Act Fast If You Suspect Fraud

If you suspect that someone else used your information to apply for credit, your identity may have gotten stolen. In that case, you need to act quickly to prevent them from continuing to use your identity. Some actions you can take include: putting a fraud alert on your credit reports, filing a report with the Federal Trade Commission , filing a police report, or freezing your credit.

If you see an unauthorized inquiry, make sure to keep checking your credit reports and contact the creditor to close the fraudulent account. If your credit got pulled without your permission, it could still hurt your credit until you get it removed.

Why Changes In Your Credit Make Credit Card Issuers Nervous

When times get tough financially, consumers often have to make difficult choices regarding which bills get paid and which bills are put on the back burner. Typically, credit card payments wind up at the bottom of the priority list when consumers are having money problems.

After all, if someone becomes unemployed, is battling an illness, or even becomes overextended financially, it can be a struggle just to put food on the table and keep housing expenses and utilities paid. Credit card issuers want to know immediately if a customers credit situation changes for the worse .

Knowledge regarding what is currently happening on a customers credit report allows a credit card issuer to determine if the risk of default on the customers credit card account has increased. If a customers credit report has taken a turn for the worse then it is very likely that there will be negative consequences, even if the customer has never missed a payment with the credit card issuer directly.

Possible negative consequences include:

Best Practices To Mitigate Hard Inquiries

Because the impact on your credit history is relatively small, you shouldnt worry too much about hard inquiries if you are responsibly shopping around for a new lender.

The best way to reduce the effect of hard inquiries on your credit score is to improve your overall credit history. Focus on making loan repayments on time and reducing your overall amount of debt.

The first step toward improving your credit report is to see it yourself. There are now manyfree ways to check your credit score and credit report. Many banks now offer this service free to customers.

Recommended Reading: Ashley Furniture Credit Card Score

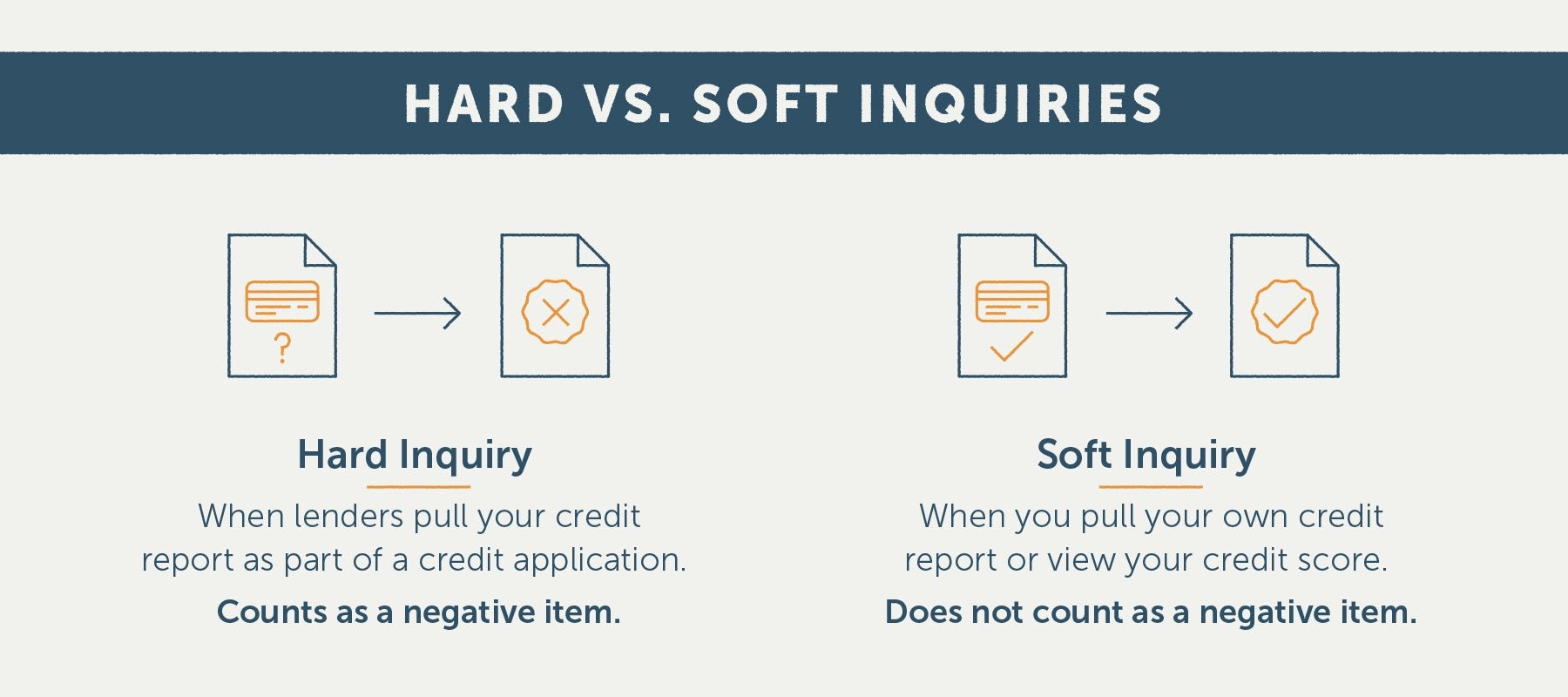

What Is A Soft Inquiry

Soft inquiries typically occur when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks your credit without your permission to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

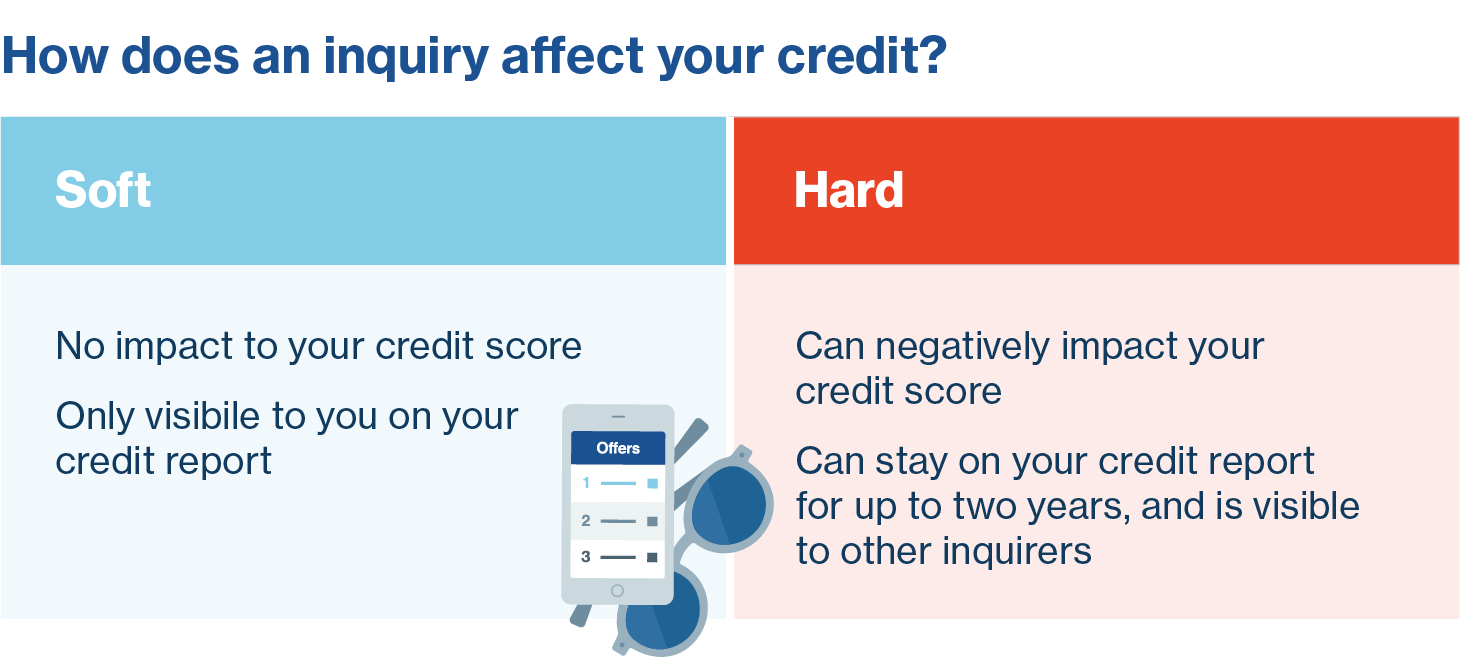

Unlike hard inquiries, soft inquiries wont affect your credit scores. Since soft inquiries arent connected to a specific application for new credit, theyre only visible to you when you view your credit reports.

Minimizing The Effects Of Hard Inquiries

The best way to minimize the effect of hard inquiries on your credit score is to wait adequate time between applications for credit, as multiple applications in quick succession might lower your credit score considerably. This is especially true when you apply for multiple credit cards or different types of credit in a short period.

If you plan to take out an auto loan or a mortgage, consider refraining from applying for any other type of credit in the next six months, as doing so can lower your credit score.

An exception to multiple hard inquiries reflecting poorly on your credit score is when shopping for a mortgage, auto loan, personal loan or student loan. Depending on the credit reporting model, all inquiries within a 15- or 45-day period are clumped together as a single inquiry. To play it safe and minimize the effect of hard inquiries on your credit scores across agencies, its best that you stick to the 15-day window.

Credit inquiries may seem scary, but dont give them too much thought. As long as you are financially responsible, the dings you receive to your credit score will smooth out quickly. Brett Holzhauer, Credit Card Journalist

Recommended Reading: How Often Does Discover Report To Credit Bureaus

Information Needed From You

There are three main ways to get rid of a hard inquiry either through mailing, faxing, or calling the creditor and credit bureaus. Typically they will need your full name, Social Security number, date of birth, current address, and your addresses from the past two years. Depending on how you submit your dispute, you may also be required to provide your email, a copy of a government-issued ID, and a copy of a utility bill, bank statement, or insurance statement.

When submitting your dispute, list out each item on your credit report that you have identified as incorrect, including the creditor details, account number, and your reasoning. If you have additional documents, such as police reports, FTC Identity Theft reports, bankruptcy schedules, canceled checks, etc., submit those as well to back up your claims.

How Many Points Does A Hard Inquiry Affect Your Credit Score

In general, hard inquiries dont have as much of an impact on your credit score as other credit factors. Credit inquiries are only responsible for 10% of your credit score while your payment history makes up 35% of your score.

For most people, according to FICO, a new hard credit inquiry will only drop your credit score between one and five points. While a hard inquiry stays on your credit report for two years, it only impacts your score for one year.

Its important to note that these inquiries can stack up. For example, if you get a new mobile phone and service plan in January and then apply for a new credit card in February, you may see a bigger hit to your credit score than just five points due to multiple hard inquiries.

However, there is a way around racking up multiple hard inquiries if youre rate shopping for a loan or mortgage. Heres how.

Recommended Reading: What Credit Score Needed For Chase Sapphire Preferred

What Is A Hard Inquiry On My Credit Report

Having a hard inquiry on your credit report can hurt your credit score. Your credit score is a number that is based on several factors, including your payment history, credit utilization, and age of accounts. The more inquiries you have on your report, the lower your score will be. Having a hard inquiry can lower your credit score, but it shouldnt deter you from applying for a loan or a mortgage.

Hard inquiries are reported when someone checks your credit, whether its a bank or a potential lender. For instance, if you apply for a credit card, the issuer will check your personal credit, even if youve never applied for one. A hard inquiry can negatively affect your score for one to two years and isnt removed from your report until two years after it was made.

If youre wondering whether or not youve ever had a hard inquiry on your credit report, you should know that these inquiries are recorded when you apply for a loan or credit card. This type of inquiry will be recorded on your report for two years. In addition, landlords may check your credit as part of the apartment application process. Any type of credit check that youve had is a hard inquiry to FICO, which means its a potential problem for your credit.

One hard inquiry will reduce your score by roughly five points. However, multiple inquiries on the same loan type will only be treated as one. The good news is that you dont need a lot of hard inquiries and they only last on your credit report for 1-2 years.

How Can I Talk To Someone About Inquiries Or Other Items That Shouldn’t Be On My Credit Report

If you see inquiries or items that shouldnt be on your credit report, begin by contacting the creditors in question by using the information you find in your credit report. This can help you determine if the hard check was warranted. If the entries seem fraudulent or incorrect, youll need to dispute them by contacting the credit reporting agency/agencies in question.

Recommended Reading: Will Eviction Show Up On Credit Report

What A Credit Card Issuer Or Lender Thinks When They See A Hard Inquiry On Your Credit Report

Hard inquiries fall under the “less influential” category when calculating credit scores using the VantageScore model, and they make up only 10% of a FICO score calculation. But they play a big part when it comes to credit card issuers and lenders assessing your potential risk.

Lenders pull your credit report to see how credit worthy you are, but finding a bunch of inquiries on your credit report will show them you may be financially stressed and a bigger risk for borrowing in the future.

According to FICO, “Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.”

But while these hard inquiries do show risk, lenders also consider other factors when making approval decisions, such as your income and payment history.

How To Avoid Triggering Too Many Hard Inquiries

Its difficult to say precisely how many hard inquiries is too many because different lenders have different standardsthere isnt a universal consensus in the lending industry.

However, your perceived risk as a borrower generally increases with each new credit inquiry. Lenders may deny you a loan or credit card if there are multiple inquiries on your credit report. While being denied a credit card wont hurt your credit directly, it will force you to apply for other lines of credit, incurring even more hard inquiries.

To minimize the number of hard pulls you receive, follow these tips:

- Only apply for credit when you need it: It generally isnt worth opening multiple credit accounts if you dont need them. Be selective about the accounts you apply for.

- Prequalify for cards: Many credit card companies offer pre-qualification tools that you can use to find out if youre eligible for a card. They only trigger soft inquiries, so you can compare several cards without receiving too many hard inquiries.

- Dispute unauthorized inquiries: You can remove hard inquiries from your credit report if they were unauthorized by filing a dispute with the credit bureau that reported the inquiry.

While its a good idea to avoid triggering unnecessary hard inquiries, having one or two really isnt something to worry too much about. In fact, FICO reported that in 2019, around 10% of people with the maximum credit score of 850 had one or more hard inquiries from the past year. 7

Article Sources

You May Like: How To Remove Repo From Credit Report

Can A Hard Credit Check Be Disputed

Yes, a hard credit check can and should be disputed in certain situations.

If you give a lender permission to make a hard pull, you cant have it removed from your credit report simply because you dont like it being listed. Youll have to wait for the inquiry to naturally fall off your credit report after two years.

On the other hand, if a hard pull that you didnt approve appears on your credit report, you should definitely contest it. This could indicate that someone stole your identify and tried to open an account fraudulently in your name.

If you do find unauthorized hard inquiries or other errors on your credit report, you need to notify the credit bureau that ran the credit report:

You should review your credit report at least once a year.

You should also contact the lender or company that requested the credit check to let them know you didnt approve it.

Once the credit bureau receives your letter detailing the inaccuracy, it has 30 days to investigate and respond.

How To Remove Inquiries From Your Credit Report

Theres no way to remove a legitimate hard inquiry from your credit report .

However, if the hard inquiry is an error that shouldnt actually be on your credit report, then you can file a dispute with the credit bureaus that are reporting it. If youre successful, theyll remove it from your report and your credit score will immediately recover.

Read Also: Zzounds Payment Plan Denied

The Effect Of Hard Inquiries On Your Credit Report

If youre like most Americans, you are probably concerned with the health of your credit report because this document continues to be very important when you are seeking mortgages, apartment leases, credit cards, bank loans, and sometimes even a new job. At the same time, the specifics of how credit reports are created and how the algorithm that determines your credit score works can seem opaque and complicated.

This is because the credit report system is fairly complicated, but with some research, you can glean a pretty complete understanding of credit reports and why your report looks like it does.

You might be aware that credit inquiries can appear on your credit report and negatively impact your credit score. When you apply for loans or credit cards, for example, a record of this can show up. However, many factors are involved with how credit inquiries can impact your credit report, and there are several ways you can mitigate the effects.

How To Dispute Hard Inquiries With Each Credit Bureau

Youll need to file a dispute with each credit bureau thats displaying the mistaken hard inquiry on your credit report.

In the table below, youll find all the information you need to file a dispute by mail, by phone, or online with Experian, Equifax, and TransUnion.

| TransUnions online dispute form |

Also Check: How To Get Credit Report Without Social Security Number

How Many Points Will A Hard Inquiry Cost You

According to FICO, one new inquiry will generally lower a credit score by less than five points. As that inquiry grows older, the impact on your score should be less until it no longer counts at all. Of course, the real credit scoring process is a bit more complicated when you break it down.

Hard credit inquiries dont count toward your credit score calculation nearly as much as other factors. With FICO scoring models, for example, credit inquiries influence 10% of your credit score. By comparison, your payment history is worth 35% of your FICO Score. Hard inquiries matter even less under VantageScore credit scoring models. VantageScore calculates just 5% of your score based on hard inquiries.

Individual credit inquiries dont have a specific point value across the board. For example, you cant say that a new hard inquiry will lower your credit score five points. Thats not how credit scoring works.

Instead, a credit scoring model considers the total number of inquiries that appear on your credit report along with the age of those inquiries. The rest of your credit information matters too. A new hard inquiry might have a bigger score impact for people with little credit history versus those with older, more established credit reports.

What Is A Soft Credit Check

A soft credit check is when your credit report is pulled but you havent applied for credit. For example: Insurance companies or potential landlords may look at your credit report to assess risk potential employers may do background checks. Credit card companies can also pull a soft copy of your credit to service and manage any existing relationships you may have with them. Soft checks do not affect your credit score or show up on your credit report.

Read Also: 766 Fico Score

Plan Before Shopping For A Loan

Before shopping for a loan, it’s always smart to proactively plan your finances.

First, learn whether the type of credit you’re applying for can have its hard inquiries treated as a single inquiry. If so, determine the applicable timeframe. Then you can plan your shopping period accordingly.

Second, you may also want to check your credit reports before getting quotes to understand what information is reported. Find out how to request a free credit report from Equifax.

If you’re worried about the effect that multiple hard inquiries may have on your credit reports, it may be tempting to accept an offer early rather than allow multiple hard inquiries on your credit. However, consider your individual situation carefully before cutting your shopping period short. In many cases, the impact hard inquiries have on your credit scores from shopping around will likely be minimal compared to the long-term benefits of finding a loan with a lower interest rate. The more informed you are about what happens when you apply for a loan, the better you can prepare for the process before you start shopping.

How Long Do Hard Credit Checks Stay On Your Credit Report

A hard credit check will remain on your credit report for two years. However, the temporary credit score drop caused by a hard inquiry should readjust in 12 months or less, provided you stay current with your payments and dont apply for more credit.

Multiple hard inquiries requested within 14 days of each other are usually treated as a single pull on your credit.

Don’t Miss: Affirm.com Walmart

What Is Considered A Hard Credit Inquiry

A hard inquiry, or a “hard pull,” occurs when you apply for a new line of credit, such as a credit card or loan. It means that a creditor has requested to look at your credit file to determine how much risk you pose as a borrower. Hard inquiries show up on your credit report and can affect your credit score.

Should You Remove Hard Inquiries

Disputing a genuine hard inquiry, such as a credit card application you submitted, will likely not be worth the effort. But if you find unauthorized inquiries, whether from reporting errors or fraud, getting those removed will be important. For example, if you believe that an identity thief has accessed and used your information to open a new line of credit under your name, you need to report that immediately.

Additionally, if you have had several hard inquires recently or other serious issues impacting your credit scores, it may become harder for you to get approved for new loans or credit cards under favorable conditions.

You May Like: Speedy Cash Change Due Date