Get A Secured Loan Or Credit Card

Dont forget the steps you can take to build credit now, if your credit profile is thin or youve made mistakes in the past. One way to do this is applying for a secured credit card or a secured loan, both of which require collateral for you to get started.

The point of a secured credit card or loan is getting the chance to build your credit score and prove your creditworthiness as a self-employed worker, when you cant get approved for unsecured credit. After making sufficient on-time payments toward the secured card or loan, your credit score will increase, you can upgrade to an unsecured alternative and get your deposit or collateral back.

Can You Still Get A Self Cert Mortgage

Before the 2008 financial crisis, many self-employed and contractor workers used self-certification to obtain a mortgage. This allowed borrowers to declare their own income without the need for lenders to prove they could actually afford it. These were banned by the Financial Conduct Authority in 2014.

Can I Use Asset Finance When Self

Those looking for a different form of financing may want to consider asset finance as an option. This type of lending can either help you purchase high-value assets such as machinery, equipment and vehicles, or for those who already own such assets, it allows you to borrow money against their value, with the asset essentially becoming a form of security for the lender. The latter is sometimes known as asset refinancing.

At one time asset finance was only really suited to larger business because of the levels of finance involved, but with it now possible to raise sums as small as £1,000, its opened it up to smaller businesses too. As such, this kind of finance can be ideal for self-employed individuals and sole traders who are looking to expand their business, but who dont have the available cash to purchase the necessary and often expensive assets. It can be just as suitable for already established sole traders who dont have much liquid cash available, and who may want to borrow against the value of their assets to generate a cash boost for the business.

You can find out more about by reading our guide to asset finance.

Read Also: Brksb/cbna

What Affects My Credit Score

There are five different categories that go into a : on-time record of payment, the number of inquiries or applications for credit, credit utilization, credit history, and credit âdepthâ.

Dara Fahy, a mortgage broker in British Columbia, says âalthough it sounds like common sense, the most frequent reason that a personâs credit score is lower is that they missed one or two payments.â A missed payment is a missed payment, regardless if itâs a $15 minimum payment on a credit card or a $500 car payment. Few borrowers realize the effect is the same.

Also, you shouldnât be applying for credit you donât need. Store credit cards are prime culprits driving excessive credit inquiries. Is the retail discount worth it? Well, the more times your credit is under review, the lower your score.

Your credit utilization ratio â your balance divided by available credit â is also a major factor. Contrary to popular belief, itâs not based on your balance at the end of the month but your balance outstanding at any given moment in time. Fahy recommends keeping the utilization under 80%, if you want to safeguard your score.

Prove That Your Income Has Been Steady For Years

It’s far easier to qualify for financing or credit cards if you can show lenders that the income you’ve made as a self-employed worker has been steady or rising each year. If lenders see that what you made last year was similar or better to what you made the year before, they’ll be less nervous about loaning you money.

To prove that your income is consistent, you’ll have to provide lenders with at least the last two years of your income tax returns returns that should show that your income during these last two years did not swing wildly up or down.

What if you haven’t been working for yourself long enough to show at least two full years of self-employed income? Or what if your self-employment income hasn’t been consistent and has soared high and fallen low? You’ll struggle to qualify for a loan. It might be best to wait until you can show those two consistent years of income before applying.

Read Also: Credit Score Of 524

You May Have To Resort To Opening New Credit Cards

Even if youre able to open a new credit card to help pay for living expenses while youre unemployed, it may not be a good idea. Opening too many credit cards in a short amount of time can lower your FICO Score. Even the inquiries a company makes into your credit before granting you a credit card or loan can hurt your credit. Its always best to avoid opening new cards for everyday living expenses if you can avoid it.

Your Savings Account May Shrink

The amount of money you have in savings isnt factored into your credit score, but it can affect your ability to get a loan or a new credit card and the interest rate youre given. Beyond your credit score, lenders look at all your assets, including your savings account. The higher your balance and the longer youve had the account, the less of a risk theyre likely to deem you, and the more willing they may be to grant you a loan with favorable terms.

Recommended Reading: How Can I Check My Credit Score With Itin Number

How To Get A Mortgage When Youre Self

3-minute read

When youre self-employed and you want to buy a home, you fill out the same application as everyone else. Lenders also consider the same things: your , how much debt you have, your assets and your income.

So whats different? When you work for someone else, lenders go to your employer to verify the amount and history of that income, and how likely it is youll keep earning it.

What Are Affordability Rules For The Self

The biggest difference with affordability rules is that now you will have to prove your income and outgoings. This means providing evidence of your business accounts, Tax Calculation and Tax Overview and bank statements for expenses. In addition to this, to improve your chances of a successful mortgage application you will normally need a high deposit or already own a large amount of equity in your home.

Recommended Reading: Does Paypal Report To Credit Bureau

Have An Excellent Credit History

Working with any financial institution means youll need to provide traditional information, have a a , andpotentiallyhave easily-accessible money saved in a separate savings account.

In order to build a high credit score, pay your bills on time, check your credit report regularly , and try to keep your debt under 30% of your overall credit limits.

How Can I Protect My Credit When Unemployed

In the event you lose your job, its smart to take steps to protect your credit. At the top of the list is adjusting your spending habits. Try to spend within your means and do everything within your power to make on-time payments on the outstanding debts you do have.

Its also important to manage unemployment benefits. There are several benefit and aid programs to help with unemployment insurance benefits, job training, and job finding.

Finally, keep a constant eye on your credit. Federal law requires each of the three credit bureaus Equifax, Experian, and TransUnion to provide a free credit report every 12 months at your request. You can also request your free credit reports at annualcreditreport.com.

When you review your credit reports, make sure that you recognize all the information they contain, including your personal information. In addition, check that the account and payment information is accurate and complete. If you find incorrect information or information you dont think belongs to you, contact the business that issued the account or the issuing credit reporting company.,

Recommended Reading: Check Credit Score Usaa

Finding Your Perfect Self Employed Car Finance With Choosemycar

If you are self employed, then you may be wondering just how easy it is for you to get a beneficial car finance deal. The good news is that you are not alone: over the past few years the number of self employed workers in the UK has been steadily rising – and the demand for self employed car finance has grown with it. Fortunately, you have come to the right place here at ChoosemyCar because we have plenty of experience working with self employed customers coming to us to secure their ideal used car on finance.

Being self employed makes you more independent, but it won’t stop you needing to have your hands on a car in order to get around for work and family. To enjoy proper freedom, you’re going to need a car. But unfortunately, despite the huge demand for car finance from the UK’s self employed workers, a lot of lenders are still reluctant to agree upon car finance deals.

Why is this? Well, in short it is because self employed workers don’t have a guaranteed regular income and might lack three years of accounts in order to prove income. As such, a lot of lenders refuse car finance applications because they doubt your eligibility to meet your monthly payments. Securing self employed car finance is difficult depending on how easy it is to prove your monthly income and budget.

How To Improve A Poor Credit Rating

If you find your report shows that you have a poor credit score, then there are a few things you can do to start making improvements.

- Check you are on the electoral roll as evidence of where you live

- Start repaying your debt on time from this point onwards

- Consult an expert before applying for finance like a mortgage who will make sure you approach lenders correctly

- Reduce the amount of credit you have on your name for example: if you have a lot of credit cards consider closing them if you arent using them. The ability to max out credit cards makes lenders uncomfortable

- If you have not used much credit in the past, then consider taking out credit to demonstrate your ability to manage it on your credit report for example, by using a credit card.

Also Check: How To Remove Evictions From Your Credit Report

What Documents Do You Need To Provide

To start, youll need a history of uninterrupted self-employment income, usually for at least two years. Heres some examples of documents a lender might ask for.

Employment Verification

Employment verification is proof that youre self-employed. It could include emails or letters from the following:

- Current clients

- A licensed certified personal accountant

- A professional organization that can attest to your membership

- Any state or business license that you hold

- Evidence of insurance for your business

- A Doing Business As

Income Documentation

Have proof of steady, reliable income and youre one step closer to getting approved for a mortgage. Note that even if you make consistent money now, your past income will also influence your ability to get a loan. Your lender will ask for the following:

- Personal tax returns

- Profit and loss forms, which could include a Schedule C, Form 1120S or K-1, depending on your business structure

What happens if youve been self-employed for less than two years?

Great question. Ultimately, your business must be active for a minimum of 12 consecutive months and your most recent two years of employment must be verified. In this situation, your lender will likely do an in-depth look at your training and education to determine whether your business can continue a track record of stability.

Can I Get A Self

Anyone with a bad credit rating will find it difficult to get a loan, regardless of whether theyre full-time employed or work for themselves. But just because its harder, doesnt mean its impossible. You’ll find that fewer providers will be willing to lend to you, and you wont get the best rates on the market. You might also find that you are only accepted for a lesser amount than you need. Shopping around and researching before you apply will give you the best chance of getting a deal that works for you.

Read Also: Who Is Syncb Ppc

What Happens If I Cant Afford My Self

During your self-employed IVA, the income from your business could fluctuate. This in turn might affect your monthly payments as they are likely to be dependent on your business cash flow.

If you find yourself unable to make your agreed monthly payments at any point during the term of your self-employed IVA, its really important to let your supervisor know as soon as possible so they can help you. They might be able to arrange a payment break, or a reduction of up to 15% in your monthly payments.

If you cant afford your payments due to a change in circumstances, it is possible to ask your creditors to vote on a revised proposal. If your creditors accept this, then your IVA will continue on the revised terms.

You could ask your creditors to reduce your monthly payments, suspend your monthly payments for a period of time, accept a full and final settlement offer to pay off your self-employed IVA early, or even accept what you have already paid into the IVA so far in full and final settlement.

It will be up to your creditors whether they accept this revised proposal or not. The same voting rules apply to revised proposals as they do to your initial self-employed IVA proposal i.e. at least 75% of voting creditors need to vote in favour of it.

If you have any other questions about self-employed IVAs and would like to know whether this might be the right solution for you, give our team a call on 0800 280 2816.

Start Saving So You Can Offer A Higher Down Payment

If you’re working with a lender and they’re on the fence about your mortgage application, being able to put extra money down can go a long way toward allaying their concerns. Lenders are taking a risk when they originate your mortgage. A larger down payment shows you’re willing to share that risk.

Higher down payments also can help you to secure a lower mortgage interest rate, if everything else is held equal.

Read Also: Why Is There Aargon Agency On My Credit Report

You May Not Be Able To Pay Your Bills On Time

Your payment history is the most significant factor affecting your credit, accounting for 35% of your FICO Score. That means if you dont have the funds to pay your bills on time, your score could take a pretty big hit. But dont panic if youre late just a couple of times. If your credit history is strong, a few months shouldnt damage your score too much.

If your bills go to a collection agency or you have to file for bankruptcy, however, the hit could be significant.

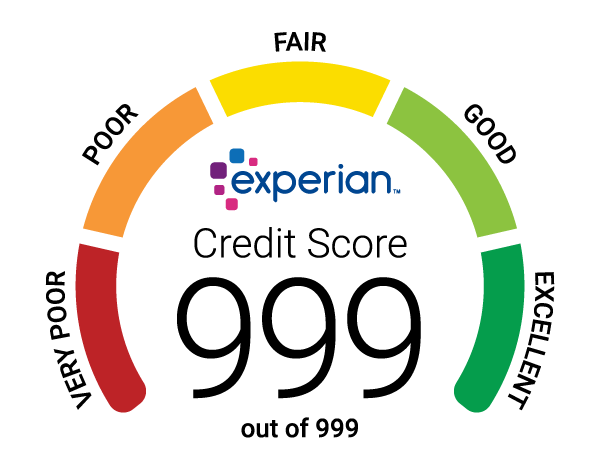

How To Check Your Credit Rating

Checking your credit rating can be nerve-racking.

But if you are ready to pluck up the courage to do it, then heres how you can do it for free.

Head Over to Check My File & Set Up An Account

Check My File offers a free 30-day trial. They also are one of the comprehensive checkers around, recommended by professionals because it shows you what lenders are seeing.

Youll need to enter a credit card, so remember to make a note to cancel the account once you have your report.

Using the Dashboard

Once logged in youll be presented with a dashboard summarising a lot of information, including:

- How major lenders like Callcredit and Equifax view you

- A summary of the current credit agreements you have

- History of searches made against your name.

If you dont want to keep the account once the trial expires, then download your credit report. I find it the easiest way to look at the information too.

Youll need to choose Download Printable Version

Review Your Credit Report

Your credit report will contain your credit score and details of all the credit agreements you have. It also shows whether you made all your payments on time dating back anything like 6 years.

Ideally, you want to see lots of green boxes that means you have paid everything on time and are managing your credit well.

Read Also: Does Klarna Financing Report To Credit Bureaus

Rejected Stop Before You Make Another Move

If you’re rejected FREEZE! Don’t automatically apply again with a different lender. Too many applications will mess up your credit score, so don’t do it. Instead, the first thing to do is to check your credit file again. Could you have missed something?

At all costs, avoid the rejection spiral. The nightmare example works like this:

This continues, until finally you check your files and get the error corrected. So…

- You apply again

- You’re rejected because of recent ‘searches’

If you’re rejected once, immediately go to the top of this guide and follow the steps we’ve set out, or you may mess up your score as more applications mean more searches, which will compound the problem.

If you haven’t missed anything and your credit file’s still looking good, it could just be that the lender you applied to had its own reason for turning you down. It’s worth asking the lender why.

It should indicate to you the main reason you were turned down and will tell you if that was your credit file.

Ready to get a mortgage?

We’ve lots more guides, tools and tips to help

- Mortgage Best Buys: Find your top mortgage deals.

- Cheap Mortgage Finding: How to pick a broker who will find the best deal for you.

- First-time buyers guide: Free PDF guide helps you take your first step onto the property ladder.

- Remortgage guide: Our free PDF guide has tips on when remortgagings right, plus how to grab top deals.

MSE weekly email