Which Credit Scores Do Private Lenders Use

When calculating how various debts, like student loans, affect a credit score, most private student loan lenders use a base FICO® score, which ranges from 300 to 850, to determine whether to extend credit and at what interest rate.

Because FICO is used widely throughout the lending industry, including by mortgage, auto loan and credit card providers, it gives lenders an apples-to-apples comparison of potential borrowers.

Does Paying Student Loans Build Credit

Paying on time is the most important factor affecting your credit score. You cant get traction without it. Making regular, on-time payments on student loans will help build credit.

If you’ve used only one type of credit before, like a credit card, then having a student loan is good for your score because it helps your But that’s a smaller score factor, so it’s not worth taking out a loan you can’t afford just to have a mix of credit types.

Student loans taken out by parents, such as federal parent PLUS loans and private parent loans, affect only the credit of the person who took them out. So if a parent takes out a federal parent PLUS loan, for instance, to help you pay for school, it affects their credit. A student loan you took out and your parent co-signed, on the other hand, appears on both of your credit files and can affect scores for both of you.

Taking On Student Loan Debt

Of course, your student loan will eventually become an old account over time. If it’s the first debt you’ve applied for, it may actually help you start developing the long borrowing history lenders look for.

Borrowing a large sum to fund your education can also hurt your score because credit scoring formulas look at how much debt you owe overall.

Amounts owed is a key factor in determining your credit score. Credit card balances largely influence this component of your credit score, but installment loans like student loans play a role, too. Credit scores consider how much you owe compared to the amount you initially borrowed, so when you first take out a loan, youll have a high loan balance. But as you pay down the debt, youll show you can manage taking on debt and paying it off, which is good for your credit score.

For example, FICO found that consumers between the ages of 30 and 34 who paid off their student loans had an average credit score of 697, which is considered good. Those in the same age group with current student loan balances had an average credit score of 653, which is considered fair. FICO also found that about 7% of consumers with $50,000 or more in student loan debt had a credit score of 800 or higher, which is considered excellent. Regardless, FICO scores look at revolving credit more so than installment loans when it comes to .

Also Check: Does Carmax Have Good Financing

Are Student Loans Impacting Your Credit Score

Even if you only have a basic knowledge of how credit scores are calculated, you may be aware of the fact that taking on debt and then paying it off in a timely and consistent manner is generally considered one of the best ways to build good credit, while late and missed payments can show up as black marks on your credit history. What you might not know is that different types of debt can have different ramifications where your credit is concerned.

For example, the balances carried on credit cards are considered to be a form of revolving credit, according to Investopedia. Lines of credit also fall into this category. This type of debt includes a maximum limit and accounts are considered open-ended, which is to say, you still have access to agreed-upon funds even after youve borrowed and paid back up to the maximum.

Then there are installment credit accounts, including loans for houses, cars, and college tuition, just for example, which Investopedia characterizes as separate from revolving credit in that there are terms attached which specify the duration for payments, the number and amount of payments, and an end date for the loan. Further, once payments are made, the money cannot be borrowed again.

- What is owed on all accounts

- What is owed on different types of accounts

- The number of accounts with balances

- The percentage of revolving credit in use

- The amount still owed on installment loans

How Do Student Loans Show Up On Your Credit Report

One of the biggest questions that comes up when considering student loans is whether they appear on your credit report and can affect your credit score. The straightforward answer is yes.

Your student loans appear on your and are factored into your credit rating, just like any other loan. How you manage your student loans can make an impact, so it’s important to stay on top of the situation.

Read Also: Removing A Repossession From Credit Report

How To Get Rid Of Student Loans

As mentioned before, there is a way you can eliminate student loans legally without paying. However, none of these options are easy. For a federal student loan, you may be able to opt for forgiveness programs such as:

- Forgiveness through income-driven repayments

- Obama student loan forgiveness

- Military student loan forgiveness

If you have a private student loan you may be able to get rid of student loan debt through bankruptcy. Youll have to file for Chapters 7 and 13 bankruptcy and file an adversary proceeding lawsuit. Additionally, youll need a bankruptcy attorney, which can cost you a lot of money.

For both private and federal student loans, you can apply for total and permanent disability discharge. This is only available to students who are disabled. The student loan disability discharge credit report should state that you no longer owe the debt.

The Benefits Of Paying Off Student Loans On One’s Financial Position

When someone pays off a student loan boosts one’s overall financial stability, regardless of the immediate effect on their creditworthiness. One could decide to start by celebrating and spending the money they may have sent to the student loan office on a night of fun. However, one needs to choose carefully how they want to invest their money:

Recommended Reading: When Do Companies Report To Credit Bureaus

What Happens When I Miss Student Loan Payments

Since payment history is the biggest contributing factor from a student loan to your credit score, pay close attention to it.

Remember that a student loan is a financial contract enforceable by law. In the case of a federal student loan, your lender is the federal government. Just missing a single student loan repayment can have a negative effect on your credit score.

According to data from FICO, missing a monthly payment for 30 days may decrease:

-

17 to 37 points in a fair credit score

-

63 to 83 points in an excellent credit score

Miss several payments or let your student loan go into default, and your credit score will take an even bigger drop.

When your student loan is eligible for repayment options like forbearance or deferment, youre not required to continue making payments, and your credit score shouldnt be affected.

But, make sure to follow the requirements and necessary steps from your student loans issuer.

If the credit bureau doesnt get the right paperwork proving the forbearance or deferment, your credit score could still suffer until the error is resolved.

What Is A Credit Score

A credit score is a three-digit number that represents your creditworthiness as in how risky you are as a borrower based on how you manage credit and loans. While there are different scoring models, the one most lenders used is the FICO score, which ranges from 300 to 850.

The higher your score, the less risky you appear to lenders. In other words, youre seen as someone who is likely to pay their bills on time.

Some factors that make up your credit score are:

- Payment history

- Recent credit inquiries

You May Like: Credit Score Needed For Apple Card

Why Does The Impact Of Student Loans Matter

Your credit score is used to determine whether you are approved for future loans and to calculate the interest rate and terms you are eligible for, according to Student Loan Hero. While a single late or missed payment isnt going to tank your score, and you can always speak with lenders about removing black marks on your credit report once youve rectified a mistake, you naturally want to maintain a high score if at all possible so as to improve your odds for loan approval and the best terms down the road.

If You’ve Already Established Some Credit Student Loans Can Improve Your Credit Mix

This is why lenders like to see a variety of debts on your credit history and also why “credit mix” can help to build your score. If you have a low-limit credit card in addition to your student loan, it shows that you have both installment and revolving debt. Having different kinds of debt along with a strong credit score can help you get additional credit at a lower interest rate.

Don’t Miss: Carmax Bad Credit Finance

How Student Loans Can Help Your Credit

Yes, the loan amount and payment history do go on your credit report, but that can be a good thing. Here’s how student loans can help you out:

- Payment history. Payment history accounts for the largest part of your credit score , so in the future that good payment history might help you get approved for credit cards, auto loans, apartment leases, or even a mortgage for your first home.

- Student loans also add to your credit mix. Lenders like to see a mix of secured loans and unsecured loans .

- Low-interest borrowing. And if you have federal student loans, you’re probably borrowing at a more competitive interest rate than you’ll find with other lines of credit, which always looks better than a pile of high-interest debt.

Keep in mind, while student loans can help you build credit, you should not take out unnecessary student loans just to establish credit. If you don’t need a loan, investigate other ways to build credit that may be better for your financial situation.

The benefit of paying off your student loans outweighs the temporary drop in your credit rating.

What Student Loan Factors Affect My Credit Score

So, how exactly does a student loan affect your credit score? Well, when FICO creates your credit score, it takes loans into consideration. Not only that, it evaluates your payment patterns thus far on any loans.

That means if you fail to repay or continually pay late on your loan, your credit score will see a dip. The more you fall behind, the harder the hit to your score. If you stop paying at all, or default, then you may even face consequences.

However, student loans can also positively affect your credit score. A responsible debt owner may experience no credit changes or even see positive shifts, such as if they continually make on-time payments.

Here are the main factors to look for that could impact your credit, in either direction:

Making late payments

Failing to pay at all

Expanding your credit mix

Applying for new credit

Read Also: What Does Public Record Mean On Your Credit Report

Student Loan Cancellation And Forgiveness

There are some rare cases in which student loans are cancelled or forgiven, usually as a fringe bonus for people who sign up for volunteer or military service, or for others in specific occupations. Loans can also be forgiven in other situations of extreme financial and legal hardship.

From the credit bureaus perspective, student loan cancellation and forgiveness all looks the same: Its a debt discharge caused by non-credit factors, and loan forgiveness does not have any impact on your credit score. However, picky lenders may ask why the loans were canceled before granting a mortgage or personal loan.

How Student Loans Impact Your Debt

While its not a direct impact on your credit score, student loans can also impact your debt-to-income ratio. For some loans, lenders will look at what percentage of your income goes to debt payments each month.

This can be especially important if youre trying to buy a home. Many mortgage lenders wont approve a loan if your DTI is above 43%, and your student loan payment can contribute to that. In order to get the best possible mortgage rates, a total DTI of 36% is often required. If you have a high enough student loan payment, it can make it difficult to get approved for a mortgage or to get the best rates especially if you have other debt as well as student loans.

You May Like: How To Check Credit Score With Itin Number

Learn More About The Many Ways Student Loans Could Affect Your Credit Scoreand How You Can Monitor Your Credit

As if thereâs not enough to deal with when it comes to school and student loans, thereâs also credit to consider. Thatâs because if student loans are reported to credit bureaus, they can affect your credit in a number of ways.

If you think youâll need student loansâor you already have themâit could help to do a little homework to learn more about student loans and credit. This is especially true because of how important credit could be in the future when you try to do things like buy a house or get a job.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Qvc Shopping Cart Trick

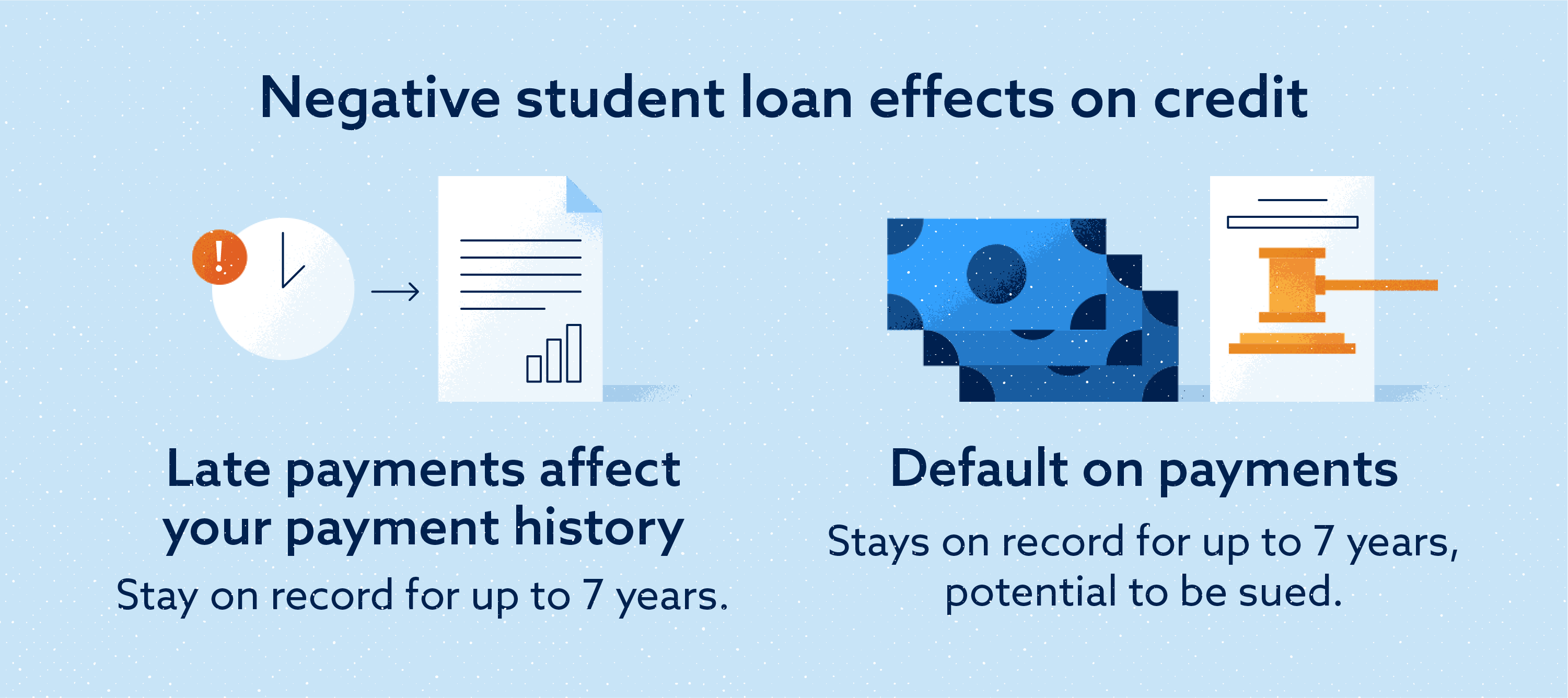

Late Payments Or Defaulting

While deferrals and forbearances do not impact a credit score, late payments and defaults have an immediate negative effect on your credit report. If a payment is more than 30 days late, it will begin to impact your credit score, knocking it down by 30 points or more.

The longer your student loan payments are late, the lower your credit score falls, until your credit score is in the poor category. Eventually, the lender will conclude that you will never pay your student loan, and report that you have defaulted on the student loan. This makes your credit score fall further. Lenders report both defaults from late payments and defaults from non-payment, and both can knock your FICO score into the poor range.

Normally, late payments and defaults remain on a credit report for seven years, after which they disappear. However, student loans are an important exception. Unlike other types of debt, student loan defaults will remain on your credit history forever, and it is impossible to discharge most student loan debt in bankruptcy. If you default, the default remains on your record until you pay back the loan.

The Benefits Of Paying Off Your Student Loans As Soon As You Can

Paying off student loan debt can affect much more than your credit score. By removing the financial and emotional weight of student loan debt, you are free to reimagine your finances. You can:

- Pay off high-interest credit cards. You’ll save money on interest and reduce your monthly debt load even further.

- Save up for a house. Funnel the money you used for monthly student loan payments into a down payment fund. Or upgrade to a nicer rental.

- Qualify for a car loan or mortgage. Not only can you save more toward a down payment, but you may also qualify for a larger loan now that you have a more favorable debt-to-income ratio . Lenders consider DTI to determine whether you can safely take on a new monthly loan payment.

- Create an emergency fund. If you haven’t already, be sure to set aside emergency-only savings so you won’t have to borrow money if you find yourself in a difficult position.

- Treat yourself. Go on vacation. Take yourself out to dinner. Buy yourself a computer. Invest in your own side hustle. As long as you’re not putting yourself into a difficult financial position, celebrate your achievement.

Eliminating student debt makes financial goals more attainable. And here’s a final note on financial health: With less debt to manage, it may be easier to manage your debtthat means making all of your monthly payments on time, keeping your credit utilization low, monitoring your credit consistently, and avoiding unnecessary applications for new credit.

You May Like: Serious Delinquency On Credit Report

What Happens When Someone Pays Off A Student Loan

When an individual pays off a student loan, their account is closed, and the account balance is zero on the relevant credit reports.

The account is going to stay on the person’s credit records for 10 years after they paid off the student loan if they did not miss any payments or the individual missed payments and decided to bring the account current before finalizing the loan. Late fees, on the other hand, are removed from the history of the account seven years after occurring.

If one falls behind on their payments and never pays off their loan, the account is going to be closed seven years following the initial missed payments, which puts the borrower in default. Regardless of the timeframe, the personâs account continues to affect credit ratings if it appears on the credit report.

Fully paying off loans improves one’s credit score because it demonstrates that they adhered to the terms of the loan. However, there may be no difference in one’s ranking when they initially pay their student loan, or there might be a minor boost when they make the last on-time payment.

If someone’s existing ongoing accounts have increased balances or no longer contain ongoing installment accounts, paying off a student loan often results in a decline in the score. This is due to the fact that having a combination of open revolving accounts and installment accounts can boost an individual’s credit score while having high balances on all of the open accounts can harm it.