What Credit Report Information Is Included

Aside from your credit score, Chase Credit Journey also offers a credit report. This report lists out key information that affects your score, including:

- Total balances owed

- # of public records

You can view a listing of all your accounts, their balances and their monthly payments.

That listing includes open and closed accounts, as well as loan and credit card accounts. You can see all of your credit accounts here, not just the ones you have with Chase.

Now:

This report is based only on what’s in your TransUnion credit record.

If you want to see your credit report from Equifax or Experian, you can do that by heading to AnnualCreditReport.com.

This site lets you pull your credit report for free once a year from each of the three major credit bureaus. You can get all three at once or space them out over the year.

To get your report, you fill out a form with your name, address, Social Security number and date of birth. You’ll also be asked for your previous address if you haven’t lived at your current address for at least two years.

You decide which credit reports you want to receive, answer a couple of verification questions and you can see your report. AnnualCreditReport.com doesn’t, however, offer free credit scores.

A good idea:

Compare the information on your credit reports regularly.

That way, you can see what’s being reported to different bureaus and what’s not. It’s also a way to check for signs of identity theft or credit reporting errors.

How Do I Use Chase Credit Journey

To access Chase Credit Journey, youll need to log in to your Chase online account. Then scroll down until you see Your credit score on the left side. Click on Free score, updated weekly to access Chase Credit Journey.

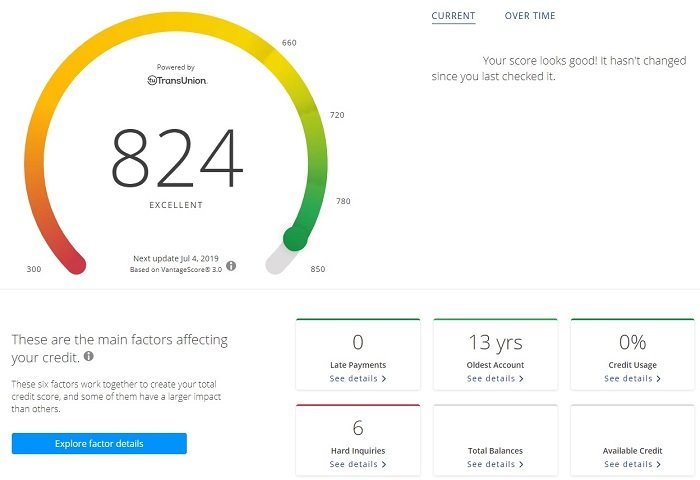

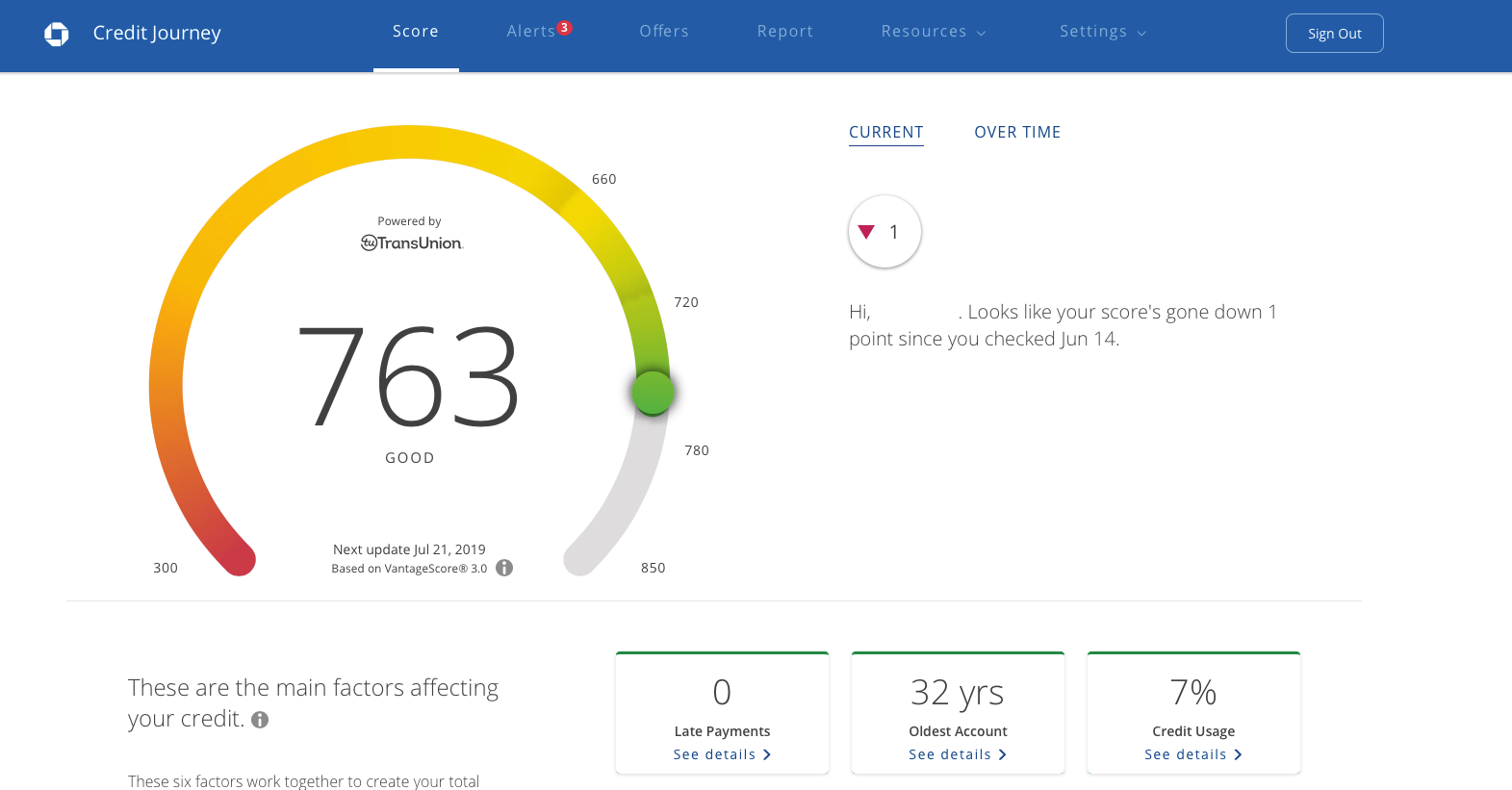

Your Chase Credit Journey home page will prominently display your credit score; the page view defaults to your current However, if you would like to see the history of your score, click on Over Time to see a graph of the previous 6 months activity.

Hot Tip: Using Chase Credit Journey will not affect your credit score.

View Your Credit Report For Free

In addition to your free credit score, you also get access to your TransUnion credit report for free. Like with your credit score, your credit report can update as often as once per week.

Keep in mind, it sometimes takes a while for an action to reflect on your credit report. CreditWise only shows what TransUnion reports to them.

Even if youve made a change, such as paying off a loan, it wont show up on your free TransUnion credit report in Credit Wise if it hasnt been reported to TransUnion yet.

While this is a great way to monitor your credit report for errors and potential fraud, you still need to check your credit reports from the other major bureaus every once in a while.

You can do this for free once per year for each major credit bureau at AnnualCreditReport.com.

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

How Quickly Does Your Credit Score Update

Unlike a lot of financial metrics, your credit score doesnt tick away silently in the background, changing without your knowledge. Instead, its recalculated each time you or a business requests it. If you request it often, itll update more frequently. Most popular free credit score websites request this information every month; that way, you get a new score update every 30 days.

It also depends on how often the companies you do business with report your information. For example, if your credit card company doesnt report your payments until the end of the month, you wont see the impact of your payments on your credit score until then, even if you pay it off at the beginning of the month.

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Read Also: Does Zzounds Report To Credit Bureau

How Much Does Chase Credit Journey Cost

With all of the services offered by the platform, you may be wondering, is Chase Credit Journey free?

The answer is yes.

While some credit monitoring services are subscription-based and offer limited functionality in their free versions, Chase offers one free comprehensive service.

You dont even have to have a Chase bank account or credit card to get started.

Anyone can access all of Chase Credit Journeys features with a free account. Well unpack all of those features below.

Getting The Most Out Of Chase Credit Journey

Signing up for credit monitoring is a positive step towards better credit.

But, the more proactive you are about using it, the more you’re likely to get from it.

There are a few things you can do to make the most of Credit Journey:

- Check your credit score and report at least once a month to see how your score is changing over time.

- Review your credit score overview to see what could be helping to add points to your score, or take them away.

- Pay attention to credit alerts you receive from Chase. If you suspect fraud, contact your card issuers and place a fraud alert on your credit file with each of the three credit bureaus.

- Use the score simulator to see how you could improve your score over time.

The more proactive you are about keeping an eye on your credit, the more results you’re likely to see in terms of positive changes to your score.

And remember, Credit Journey isn’t the only free credit tool you can use.

There are other free monitoring services you can combine with Chase’s to get a more complete picture of your credit report and score.

Don’t Miss: Open Sky Unsecured Credit Card

Free Chase Credit Journey Alerts

The Chase Credit Journey tool also provides free credit alerts to ensure that you are aware of any changes to your credit standing. This is helpful if you are concerned about identity theft. You will get alerts on the following:

- New credit inquiry

- New public records on your credit report

- Change in account status

- Notices on delinquent accounts

- Fraudulent alerts;

The Chase Credit Journey tool also suggests helpful actions to take based on the alert. This is useful amidst any type of fraud activity.;

Can I Have Negative Credit Utilization

Its smart to research ways you can use your credit cards to your advantage; this includes finding ways your accounts can help you maximize credit scores. Credit cards can definitely be powerful credit-building tools, when you manage them properly. However, some credit card strategies miss the mark.

The idea that you can boost your credit scores by overpaying your credit card account is an example of well-intentioned advice gone bad. Overpaying a credit card account wont help your credit scores. Its also not a good way to manage your money.

When you overpay your credit card, your account will reflect a negative balance. If you check your statement or account activity online, that credit might look something like this:

Account Balance: -$250.00

Overpaying isnt the only way to receive a credit or negative balance on your credit card account. Other potential reasons a negative balance might occur include the following:

- A statement credit is posted to your account, after you make a payment. .)

- You receive a refund for a purchase made on your account, after you make a payment.

- Your card issuer refunds your account as a courtesy or due to an error or fraudulent charge.

Regardless of the cause, a credit or negative balance on your credit card account will not help your credit scores.

In fact, -1% utilization will never show up on your credit reports.

Your statement might show that your balance is -$250. Your credit reports, on the other hand, would show a $0 balance.

Also Check: Aargon Agency

Chase Credit Journey Review

Basically, using Credit Journey doesnt affect your credit score one bit; rather, it updates you on all factors that could affect your credit score.

So, if you would love to get updates on your credit score weekly, Chase Credit Journey offers the best credit monitoring service you can get.

Also, it offers tips that will help you build credit through its resource page alongside notification of changes in your report.

Chase Credit Journey is safe and ideal as it alerts you of potential fraud and identity theft.

Its monitoring service has so many advantages which includes free credit monitoring. It is also very easy to use and does not mandate you bank with Chase.

However, Chase Credits use of only the Vantage Score TransUnion credit report and the inability of its Score Simulator to always function is a hitch you may wish to consider.

Chase Credit Journey offers legit credit score monitoring services and its scam free.

Chase Credit Journey Pros

- Its completely free to use.;Chase Credit Score does not cost a single cent to use. You dont have to put in any card info, and you dont even have to be a Chase bank customer to sign up for the service.

- The simulation tool is one of the best features of the service and can help you figure out what changes can maximize your score. You can change different parameters to see what effects they have on your score.

- Resource library.;Chase credit Journey also features a large, comprehensive library of useful educational resources. They have articles on pretty much every aspect of credit, including tips to increase your score, common credit myths, and in-depth explanations of how, exactly, credit reporting works.

- Recommended offers.;In addition to your credit score reports, Credit Journey will generate some recommended financial products that mesh well with your current score. To be completely honest, most people who use the service probably wont even actually apply for these offers, but they are still nice to have nonetheless.

Recommended Reading: What Credit Report Does Comenity Bank Pull

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

Also Check: Keyword

How Much Will One Credit Card Application Affect Your Score

Each bank runs a hard inquiry on your credit file when you apply for a credit card with them. One hard inquiry, on average, brings a FICO® Score down less than five points. Considering scores range from 300 to 850, five points or less isn’t much damage.

Now, that’s just the average, and the effect of a hard inquiry also depends on your credit history. If you don’t have much credit history yet, one hard inquiry could have a greater impact on your score.

Keep in mind also that when you successfully apply for a credit card, that new card will reduce your average account history age . That’s another factor that can decrease your credit score.

Read Also: Aragon Collection Agency

How Do I Access My Chase Credit Account

Chase Credit Journey is obviously one of the best credit score monitoring service. This is because you dont need to bank with Chase to enjoy this service.

Users can access Chase Credit Journey Account through their desktop or mobile app. If you dont bank with Chase, you can create an account using the three-step process.

To complete this process, you will enter your personal details, and confirm your identity.

If you are banking with Chase, you would need your Chase Credit login credentials to access Chase Credit Journey on your desktop.

Accessing Chase Credit journey on your app is easier. Simply login with your Chase Credit Journey login credentials on your app.

Scroll down to Credit Score by Credit Journey to gain access to your dashboard. tapping the Try Our Score Simulator icon on the dashboard will give you access to the Credit Journey Score Simulator.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.;

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Read Also: Is 779 A Good Credit Score

Chase Credit Journey Report

This feature displays the account holders TransUnion report. The report comes with a 7-factor comprehensive overview. This report feature displays

#Open accounts: The Credit Journey gives a report on all open accounts showing up on a clients TransUnion report. It also displays the account holders total balance and available credits.

Closed accounts: This features reports closed accounts even those closes for several years now.

Inquiries: It sends out a report whenever request on an account holders credit history is made.

Derogatory marks: This feature also reports bankruptcies, tax liens, collections and every lenders report of missed payment and delinquencies.

Collections: Reports are given on past due accounts by this feature.

Public records: this fetaures also gives updat on public records like missed child support payment and wage garnishments.

Personal information: This feature houses an account holders basic info like name, address , employment, and birthdate.

An Overview Of The Chase 5/24 Rule

To be approved for a Chase credit card, you must have fewer than five approvals for credit cards within the last 24 months. When you apply for a Chase credit card, Chase will count the card youre applying for as part of your allowed five approvals. This means that you can only have been approved for four credit cards in the preceding 24 months.

Business credit cards that do not show up on your personal credit report will not count toward your 5/24 score.

Chase published the 5/24 rule on the application page for the Chase Sapphire Reserve® in 2016, but on Sept. 1, 2016, all language referring to 5/24 was removed from the website. That remains true today, as the 5/24 rule is not published anywhere by Chase.

Because of this lack of documentation, much of whats understood about this rule comes from crowdsourced information. Starting in 2015, when the original rule seemed to have gone into effect, many applicants with self-reported excellent credit have shared on social media channels that Chase representatives communicated their denial was due to having opened too many credit cards in the last 24 months.

In fact, this happened to me in 2016 when my application was denied. I called Chase and got the same explanation.

You May Like: How To Get A Bankruptcy Off Your Credit Report

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Work With A Professional

If youre not confident in your ability to successfully dispute a late payment on your own, there are several popular credit repair companies that can help you.

have knowledgeable legal professionals on staff to help you out. They also help with other negative listings on your credit report.

Its easy to call for a free consultation to get an idea of the cost and the services theyll provide you with. Working with a pro is a great idea if youre short on time, unsure of your own abilities in disputing, and have some buffer room in your budget for this short-term expense.

Read Also: Does Speedy Cash Report To Credit Bureaus

Closing A Credit Card Improves My Credit Score

False. Closing a credit card will never improve your credit score in fact, it’s likely to ding your score and that’s one reason experts generally don’t recommend it. But there are some specific circumstances to think about before deciding whether or not to cancel your credit card.

If your card has no annual fee, then there’s really no harm in keeping it open. But if you’re losing money on the card, you can call up the card issuer and ask if you can switch to a no annual fee credit card. If you’re being charged a high interest rate, it might be beneficial to close a credit card.

The Capital One offers a simulator so you can see how taking certain actions might impact your credit score. This is a good place to start if you’re worried that closing your card might make your score go down.