What Is The Key To A Favorable Credit Inquiry

Understanding the role of credit is important if you plan to buy a home. Share your concerns with your lender and remember your credit report is only one of many factors lenders consider when reviewing your mortgage application. When you’re ready to apply for a mortgage, talk to a Home Lending Advisor about your options.

Credit inquiries play an important role for buyers and lenders alike, and they can make all the difference regardless of if you’re a first-time homebuyer or an experienced property owner.

The key to a successful credit inquiry is understanding how they work and how they impact your credit score. Below are answers to some of the most common questions about credit inquiries and how you can help make your next inquiry a favorable one.

Missing Accounts On Your Credit Report

Your credit file may not reflect all your credit accounts. Although most national department store and all-purpose bank credit card accounts will be included in your file, not all creditors voluntarily supply information to the credit bureaus: Some travel, entertainment, gasoline card companies, local retailers, student loan lenders and credit unions are among this group of non-reporting creditors.

If you’ve been told you were denied credit because of an “insufficient credit file” or “no credit file” and you have accounts with creditors that don’t appear in your credit file, you might consider asking your creditors to begin reporting your credit information to credit bureaus. It won’t hurt to ask, but keep in mind that creditors are not required to report consumer credit information to credit bureaus. Another possible option is to move your account to a different creditor who does report regularly to credit bureaus.

Next Steps: What To Do If Theres An Inquiry Or Account You Dont Recognize On Your Credit Reports

Monitoring your credit is an important part of managing your personal finances. Its always smart to double check credit inquiries on your credit reports.

In some cases, names that you dont recognize, like Factual Credit, may appear on your credit reports because a bank or lender that youre working with hired the company to perform the credit check on its behalf. So when you notice an inquiry from an unfamiliar company, do a little extra research before you dispute it as a credit report error.

Heres an extra bit of good news: Credit Karma offers free tools and services to help you protect your credit.

- Free credit monitoring This service can alert you to important changes on your credit reports. Along with checking your credit scores regularly, this feature can send you alerts so you can check any suspicious activity and report any instances of identity theft.

- Free identity monitoring This service notifies you when Credit Karma learns theres been a data breach involving another company in which your information may have been compromised. Well also give you tips on how to lock your credit with the three major consumer credit bureaus.

Also Check: Does Barclaycard Report To Credit Bureaus

Worried About Credit Inquiries Affecting Your Credit Score

If youre having trouble managing your hard credit inquiries or youre trying to reverse the negative impact caused by identity fraud, stay calm and follow the preventive measures above. While it might take a bit of time to fix the situation completely, its always possible to bounce back from credit score damage if you have the right help! ;

Combining Multiple Inquiries For Auto Mortgage And Student Loans

When you shop around for a mortgage, auto, or student loan, you may end up with multiple hard inquiries. However, youre not looking to take out 10 loans. Youre rate shopping for the best deal on one loan.

For this reason, credit scoring models are designed to include special rules for these certain types of loans in an effort to prevent your scores from being penalized for multiple inquiries for the same loan.

With FICO scoring models, all auto, mortgage and student loan inquiries that are fewer than 30 days old are completely ignored. After 30 days, the model breaks those three types of inquiries into a 45 day de-dupe period. Multiple inquiries during a 45 day period are grouped together and counted as one inquiry. This process is called collapsing.

You May Like: How To Get Credit Report Without Social Security Number

Keep An Eye On Your Credit Inquiries

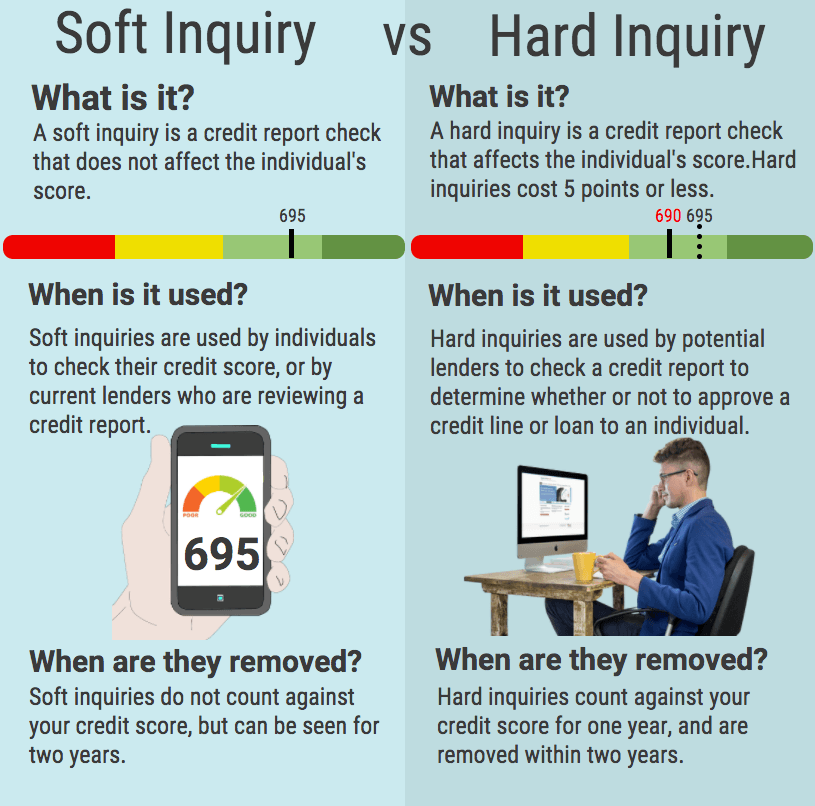

Remember: Checking your own credit scores is an example of a soft inquiry. And soft inquiries donât impact your credit scores.

Hard inquiries, on the other hand, happen when a lender checks your credit report after you apply for credit. And since hard inquiries do affect your scores, youâll want to control how many âhardâ hits your credit takes.

Monitoring your credit can help you keep an eye on where you stand.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the;Centers for Disease Control and Prevention.;

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

Why Does A Hard Inquiry Hurt Your Credit

Too many hard inquiries may raise red flags for lenders because they signal a high volume of new accounts in a short period of time, according to credit-reporting company Experian, which “may mean you’re having trouble paying bills or are at risk of overspending.”

Lenders may make an exception, however, if the inquiries are for the same product, like a mortgage, and it’s clear you’re shopping for the best rate, Experian explains.;

Soft inquiries, by contrast, aren’t linked to a specific credit or loan application they’re usually made by employers, landlords, and banks for pre-approved offers.

Soft inquiries are only visible to you, with a few exceptions insurance companies can see inquiries made by other insurance companies, and your current creditors may be able to view inquiries made by debt settlement companies, according to Experian. Soft inquiries have no affect on your credit score.

Recommended Reading: What Is Cbcinnovis On My Credit Report

Who Is Actually Able To See Soft Inquiries On Your Credit Reports

Soft inquiries will only show up when you personally check your own credit reports . The credit reporting agencies do not disclose information regarding soft inquiries on reports sold to third parties. If a lender, insurance provider, or employer checks your credit report, your soft inquiries will not be displayed.

How Inquiries Affect Your Score

Inquiries on your credit report are one of the ways credit scoring companies gauge the risk that you’ll default on new credit obligations. Too many inquiries, especially in the past few months, might mean that youre taking on too much debt or that youre in some kind of financial trouble and are looking for credit to help you out. Several inquiries can lower your credit score.

Depending on how much information you have on your credit report, an additional inquiry might not affect your credit score at all. On the other hand, if you have a short credit history with only a few accounts, an additional inquiry could cause your score to drop by a few points.

Recommended Reading: How Long Does A Repossession Stay On Your Credit Report

Home > Credit Reports > What Is A Hard Inquiry Creditcom

Aug 14, 2020 Hard inquiries specifically refer to instances when a lender accesses your credit report for the purpose of evaluating you as a borrower. In;

Sep 4, 2020 This inquiry becomes part of your credit report, meaning anyone who pulls your credit can see it. A hard inquiry will remain on your credit;

Jun 23, 2021 That means people may have more than one score out there. Rate Shopping Can Minimize the Impact of Hard Inquiries. Sometimes when you apply for;

A credit inquiry is a formal request to see your credit report. Also known as a credit check, a credit inquiry is usually made by a financial institution such;

Apr 16, 2020 Does applying for a new credit card hurt your credit? Learn more about credit inquiries and how they impact your credit scores here.

When A Lender Or Creditor Requests Your Credit File This Is Recorded As A Credit Inquiry

While a single hard inquiry, sometimes called a hard pull, is unlikely to influence your eligibility for new credit products such as a new credit card, it may have a long-lasting effect on your credit ratings for up to two years.

When checking your credit reports for hard inquiries, you want to ensure that they are genuine. What does this imply exactly? Did you allow the creditor or lender to pull your credit for each hard inquiry line item? If you did, there is no need to take any more action.

However, when checking your credit reports, it is likely that you may notice instances of illegal hard queries. If you discover one of these, you should contact the credit bureau that produced the report and request that the bureau deletes the illegal inquiry.

Heres how to challenge inaccuracies on your credit reports about hard inquiries

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Checking Your Own Credit Score Wont Lower It But Other Credit Checks Might Have An Effect On Your Score

Ever wonder if checking your own credit scores will lower them? Great question! The short answer is noâchecking your credit scores yourself wonât hurt them. However, other types of credit checks could cause your scores to dropâthough the drop could just be temporary and only by a few points.

Read on to learn more about the two kinds of credit checksâsoft checks and hard checksâand how only hard checks can lower your scores.

Whats A Soft Credit Inquiry

According to the Consumer Financial Protection Bureau , a soft checkâalso known as a soft inquiryâis a review of your credit file and existing accounts. Soft inquiries donât impact your credit scores.;

Examples of Soft Credit Inquiries

- Viewing your own credit reports and scores.

- Opening a bank account.

- Pre-qualified or pre-approved credit card offers.

Don’t Miss: Zzounds Financing Review

How To Write A Letter To Request The Removal Of A Credit Inquiry

Companies and people may make difficult questions that you did not approve of. In such situations, there is a method to eliminate the hard inquiry and, as a consequence, enhance your credit. A credit inquiry removal letter or a credit inquiry dispute letter is what it is.

Even if a hard credit query is questionable, and you are unsure whether you made it or not, you may contest it since the credit agencies and your creditors bear the burden of evidence.

We have created an example letter to submit to the credit agencies in order to seek an investigation into an illegal query on your credit report.

Impact On Credit Score

Soft inquiries do not affect your . While soft inquiries do appear on your credit report, only you can see them.

Hard inquiries lower your credit score by a few points, though that shouldnt be a big deal in the long run. However, too many hard inquiries in a short period of time may give lenders the impression that youre a high-risk customer.

Read Also: Credit Score 524

How To Get Inquiries Off Your Credit Report If They Are Inaccurate

Credit inquiries are records of when credit lenders or creditors request to see your credit file. A single hard inquiry, also called a hard pull, isnt likely to impact your eligibility for a new line of credit, such as a . However, it can affect your credit score for around two years.

When you review the challenging inquiries that show up on your credit report, you want to make sure theyre correct. What does this mean? For every hard inquiry on your credit report, you need to decide if you gave that credit lender or creditor permission to pull your credit report. If you gave permission, then you dont have to do anything.

But its not unlikely that when you monitor your credit report that youll find an inaccurate hard inquiry. If you find one of these, you might ask yourself, How to get inquiries off your credit report?

Because of the Fair Credit Reporting Act , credit bureaus are required to inform consumers when creditors or other business entities perform hard inquiries on their credit reports. The way that credit bureaus do this is by noting the hard inquiry on your credit report.

To get the inquiry off your credit report, youll want to file a dispute with the major credit bureau that created the report and ask them to remove that inaccurate inquiry. Below well go into more detail about how to find inaccurate inquiries on your credit report and the process of filing a dispute claim.

How Do Credit Inquiries Affect Your Fico Score

What are credit inquiries? Learn about credit inquiries, when they appear on your credit report, and how these credit checks affect your FICO Scores.

Dec 27, 2019 A record of a request for your credit report is called a credit inquiry. Youll see an inquiry on your credit report anytime someone pulls;

Shopping for a loan involves many steps and, potentially, multiple credit checks. Understand how hard inquiries are generated on your credit.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Do Credit Inquiries Affect Your Credit

Be careful when applying for any product, service or job position that could appear on your credit report. This is a particularly important rule when it comes to hard credit inquiries, which have a direct impact on the overall health of your credit.;

In fact, new credit inquiries are one of the five top factors that can influence your three-digit credit score, which normally ranges from 300 to 900 .

What Percentage of Your Credit Score do Credit Inquiries Make up?

Basically, the number of inquiries you have on your credit report goes into the calculation of your credit score. When factored in, new credit inquiries make up about 10% of your total score. They also stay on your credit report for several years. Remember, only hard inquiries affect your credit score in a negative way.

Here are the other factors that go into the calculation of your credit score:

- Payment History = 35%

- Types of Accounts = 10%;

Found an error on your credit report? Learn how to dispute an error on your credit report.;

How Do Credit Inquiries Work

When deciding whether to extend you creditand if so, how much and at what interest ratelenders typically obtain your from one or more of the three national consumer credit bureaus . Your credit report offers a summary of your debts and payment history on those debts.

As part of their evaluation process, creditors often also obtain one or more : three-digit numbers derived from statistical analysis of your credit report’s contents. A higher score indicates lower likelihood you’ll fail to repay your debts. When you apply for credit or services such as a cellphone account, your application usually indicates that you are giving the lender permission to do a credit check. When lenders run those credit checks, hard inquiries appear on your credit report.

Certain companies are also legally allowed to access your credit information for reasons other than an application you made, such as when your current lenders periodically check your reports or when a potential lender sends you a preapproved offer.

Employers may also check your credit history with your written permission, although they will not receive a credit score. In addition, you may check your own credit reports and credit scores, and it’s wise to do so regularlythese checks have no effect on your credit rating. Credit checks such as these, which are not related to credit applications, generate soft inquiries on your credit report.

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Understanding Hard Inquiries On Your Credit Report

Reading time: 3 minutes

Highlights:

- When a lender or company requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry

- Hard inquiries usually impact credit scores

- Multiple hard inquiries within a certain time period for a home or auto loan are generally counted as one inquiry

Some consumers are reluctant to check their credit reports because they are concerned that doing so may impact their credit scores. While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is in your credit reportand checking your credit may help you get in the habit of monitoring your financial accounts.

One of the ways to establish smart credit behavior is to understand how inquiries work and what counts as a hard inquiry on your credit report.

What is a hard inquiry?

When a lender or company requests to review your credit report as part of the loan application process, that request is recorded on your credit report as a hard inquiry, and it usually will impact your credit score. This is different from a soft inquiry, which can result when you check your own credit or when a promotional credit card offer is generated. Soft inquiries do not impact your credit score.

Recent hard inquiries on your credit report tell a lender that you are currently shopping for new credit. This may be meaningful to a potential lender when assessing your creditworthiness.