How To Check Your Credit Score For Free Before Applying For Apple Card

For more on Apple Card, check out our hands-on and how-to coverage below:

Apple Card On Iphone Ipad Apple Watch And Mac

The Apple Card offers deep integration with the Wallet app on the iPhone, but it can also be used on the iPad, Apple Watch, and the Mac for making purchases and viewing some credit card information.

Adding the Apple Card to iPad can be done via the Wallet & Apple Pay section in the Settings app and the Wallet & Apple Pay section of the My Watch tab in the Apple Watch app on iPhone.

On Mac, you can add Apple Card by going to System Preferences, selecting Wallet & Apple Pay, and clicking the “+” button to add the Apple Card. Adding an Apple Card to Wallet on Mac requires a Mac with Touch ID.

On Macs without Touch ID, you can turn on the “Allow Payments” feature that will let you complete purchases on your Mac using authentication via an eligible iPhone or Apple Watch.

A Smarter Cardfor Smarter Decisions

Apple Card eliminates fees, provides innovative tools for managing your spending and reducing your interest, and as an Apple product, is designed to set a higher bar for privacy and security. All in the name of helping you and your Apple Card Family live a more financially healthy life.

Transactions appear in real time, so you always have your most up-to-date account activity at your fingertips. Your purchases, balance, payments, and interest are clearly and simply displayed for you in the Wallet app. In the case of Apple Card Family, CoOwners can both access and manage the account, and set limits and controls to manage spending by Participants. And Daily Cash can be automatically added to each card users Apple Cash card every day on their own purchases.

When you make a payment, you clearly see how much interest you could owe and how it would change based on the amount you pay. We also built in payment suggestions to help you decide what amount is right for you. If youre using the Apple Card Family feature and have a CoOwner, both of you are responsible for and can make payments on the account. And if you ever need to contact us, just call or text were available 24/7.

You May Like: How To Get Credit Report Without Social Security Number

How Do You Apply For Apple Card

At the moment, Apple is slowly rolling out Apple Card availability to a select group of customers who initially filled out the “Notify Me” form on the Apple Card webpage, and is presumably gearing up for a wider release.

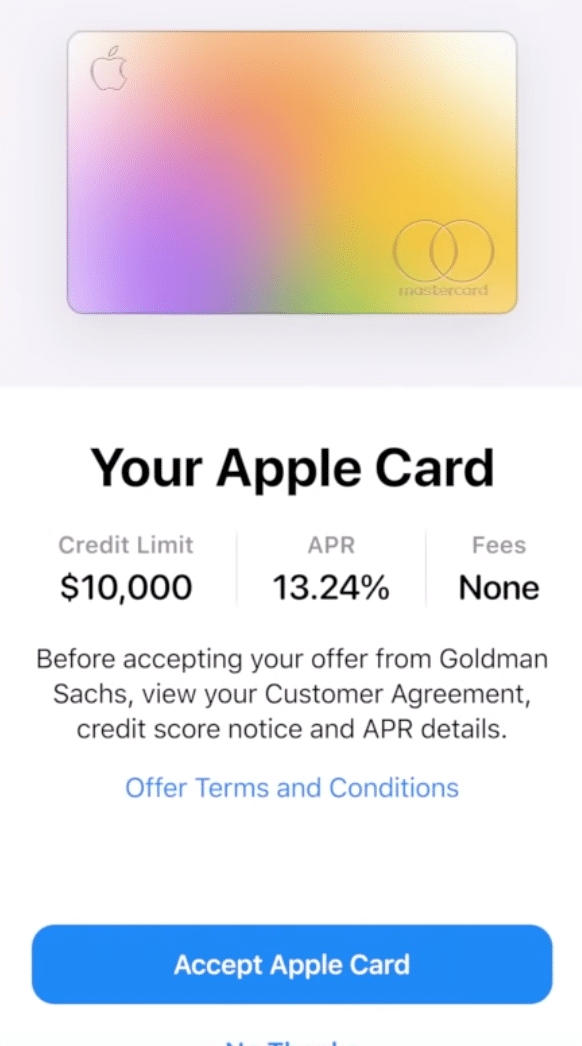

Before you try to sign up, though, you’ll want to make sure you’ve installed the latest iOS update . Once you’ve done that, open the Wallet app, tap the + button, and select the new Apple Card option . You’ll be prompted to enter some personal details, which will be used to appraise your credit status . If accepted, you’ll see an “Accept Apple Card” button pop up, and you’ll be free to start using it in your Wallet app on your phone immediately. You’ll later receive the physical card in the mail. Also, it’s important to note that in order to apply you need to be a legal US resident over 18.

How Would You Discover Your Credit Score

There are different ways you can find your credit score, and a lot of them are free. For a long time, people were basically prepared to check their credit score once every year to no end and would have to pay a cost every additional time. That has since changed, and there are as of now countless organizations that grant you to track and check your credit score. Anyway, numerous events as you would need without paying anything. A couple of these organizations, like. Credit Karma, give your credit score to free similarly as a huge group of various things. These include free government forms, unclaimed cash, and help with inquiries on your credit. A huge load of credit cards has started to give free credit scores to their cardholders too. So check with your card providers to check whether its anything but an included benefit with your card.

You May Like: Does Paypal Report To Credit Bureaus

If Your Application Is Declined

Make sure that you’re eligible to apply for Apple Card. You can also see which conditions might cause your application to be declined, and learn what you can do if your application is approved with insufficient credit to purchase a particular Apple device.

If you need help applying for Apple Card, contact Apple Support.

Apple Juice Runs Through Your Veins

Siri is your spirit guide. Every device in your home, car and office comes from the Apple store . Getting 3% cash back on your numerous Apple purchases would be a big boon, and for all other purchases, you’re already well accustomed to waving your phone over the point-of-sale device at checkout. Here’s a quick look at the current Apple Card rewards categories:

|

Rewards |

|---|

» MORE:

Recommended Reading: Les Schwab Credit Score Requirement

What Is A Credit Score

A credit score is a three-digit number that decides how credit-worthy you are as a person. It is utilized by moneylenders to appraise that you are so prone to return their cash on a schedule if that they give you a credit. To profit from loans effectively and at low-interest rates, its fundamental that you keep a high credit score. A low credit score seriously restricts your buying power.

Additionally, Credit scores are determined utilizing data in your credit reports, including your payment history, the measure of debt you have, and the length of your credit history. Higher scores mean you have shown capable credit conduct before, which may make possible loan specialists and creditors more sure while assessing a request for credit.

A Past Bankruptcy Likely Spells Years Of Apple Card Rejection

The President of the United States has had at least six business bankruptcies, and as the COVID-19 pandemic amply demonstrated, circumstances outside of individual control an unexpected medical condition or a macroeconomic crisis can force even an otherwise thriving business or individual into bankruptcy. To the extent that bankruptcy was once stigmatized, national meltdowns and all-too-frequent personal tragedies have largely eroded that stigma. Moreover, it wasnt that long ago that Goldman Sachs itself took a $10 billion bailout from U.S. taxpayers to resolve its own financial crisis, an ask considerably larger than even the most serious personal bankruptcy filing.

But Goldmans Apple Card algorithm appears to instantly reject an applicant with a past bankruptcy filing, regardless of their other indicators of creditworthiness. Apples Financial Health page says Goldman considers multiple conditions before an Apple Card decision is made, with negative public records only one of those factors, which sounds reasonable on the surface. But the companies werent as transparent about the role a past bankruptcy will play in nixing an Apple Card application until I pointed out that rejection letters were dancing around the issue.

Recommended Reading: Paypal Credit Now Reporting To Credit Bureaus

Earn The Highest Cash

Odds are you’re a fan of Apple’s products if you apply for the Apple Card, and with this card you can earn 3% cash back on goods or services purchased directly from Apple. There is no other card on the market that offers more unlimited cash back on Apple purchases.

Apple products cost a pretty penny, so earning a generous amount of cash back is a great way to offset the cost of purchasing AirPods or an iPhone. I’m looking to purchase a new Macbook Air later this year, which starts at $1,099, and I would earn at least $33 cash back if I buy through the Apple store, which is more than I’d earn from any other rewards card.

Update: Since launch, Apple continues to add new merchants that offer 3% cash back when you use your Apple Card via Apple Pay. New additions include: Uber and UberEats, Walgreens and Duane Reade stores, on the Walgreens app and on walgreens.com and at T-Mobile stores.

A Wider Window For Approval

FICO scores may be the industrys standard for credit decisions, but they dont always tell the whole story of your financial fitness. To get a better picture of your creditworthiness, Goldman Sachs draws from a wide variety of data, including:

TransUnion bureau data, which gives a record of your credit performance on past and current debt obligations.

Where applicable, your available payment history with utilities such as telecom, gas, and electricity.

The annual income you report on your Apple Card application.

The disposable income left after your monthly debt obligations.

Your history of paying down debts based on your past credit activities.

Read Also: Does Paypal Credit Report To Credit Bureaus

Where Is Your Apple Card Credit Card Number Located

The titanium Apple Card features a minimalist, security-focused design that doesnt include a credit card number. To look up your Apple card number, open your Wallet app, locate your Apple Card, tap the three dots in the upper-right-hand corner of the screen and select Card Information. Complete the authentication step to prove that its really you, and the Wallet app will reveal your credit card number.

How Do You Earn Rewards With The Apple Card

When you make certain types of purchases with your Apple Card, you earn Daily Cash. These cash back rewards are applied to your account every day, and you can decide whether to use your Daily Cash to make purchases, send money to friends or family or make a one-time payment toward your Apple Card balance.

Heres how the reward structure works:

- Earn 3 percent cash back when you buy Apple products using Apple Pay.

- Earn 3 percent cash back when you make purchases with select retailers, including Duane Reade, Exxon, Mobil, Nike, T-Mobile, Uber, Uber Eats and Walgreens, using Apple Pay.

- Earn 2 percent cash back when you use Apple Pay to make purchases elsewhere.

- Earn 1 percent cash back on all other purchases.

Cardholders who apply through Jan. 31, 2021, can earn $50 bonus Daily Cash by opening an account and spending $50 or more in purchases within your first 30 days at Exxon or Mobil gas stations or convenience stores via your Apple Card in the Apple Pay app . Apple often gives new cardholders the opportunity to earn $50 bonus Daily Cash, so make sure you take advantage of it.

Read Also: What Is Syncb Ntwk On Credit Report

Requirements To Get Apple Card

To get Apple Card, you must meet these requirements:

- Be 18 years or older, depending on where you live.

- Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that isn’t a P.O. Box. You can also use a military address.

- with your Apple ID.3

- If you have a freeze on your credit report, you need to temporarily lift the freeze before you apply for Apple Card. Learn how to lift your credit freeze with TransUnion.

- You might need to verify your identity with a Driver license or State-issued Photo ID.

When Tech Meets Credit

Tech in finance has been rapidly rising over the past few years. Seeing such a large tech company involve itself in the world of credit and finance is an important step in this.

Apple has stepped into the world of credit cards to deliver its product, bringing with it some pretty cool features you don’t get anywhere else.

Image credits: Apple

Also Check: Does Speedy Cash Report To Credit Bureaus

How To Apply For The Apple Card In 3 Steps

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The Apple Card is designed to work digitally. To start, you apply through the Apple Wallet app, though you can also apply for the Apple Card online after logging in with your Apple ID. If you get the card, you use the same app to make payments, track spending and manage your cash-back rewards. The physical card attractively designed and made of titanium is somewhat of an afterthought. You wont receive it automatically youll have to specifically request one when you apply for the Apple Card instead. The physical card will earn a lower cash-back rate compared with using the digital card through Apple Pay, the company’s payment system.

The Apple Cards current rewards categories include:

Apply For Apple Card On Your Iphone

After you accept your offer, Apple Card is added to the Wallet app and you can request a titanium Apple Card.

To apply on your iPad, open the Settings app, scroll down and tap Wallet & Apple Pay, tap Add Card, then select Apple Card.

You May Like: How To Get Credit Report Without Social Security Number

See If You’re Eligible

- To be eligible to apply for Apple Card, you must be 18 years old or older, depending on where you live.

- You must be a U.S. citizen or a lawful resident with a valid, physical U.S. address that’s not a P.O. Box. You can also use a military address.

- Your device must be compatible with Apple Pay. See which devices are compatible with Apple Pay. Make sure that your device has the latest version of iOS, watchOS, or macOS.

- You must sign in on your device with your Apple ID and use two-factor authentication.

- If you have a freeze on your credit report, you need to temporarily lift the freeze to apply for Apple Card. Learn how to lift your credit freeze.

- You might need to verify your identity with a Driver License or State-issued photo ID.5

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Why Is There Aargon Agency On My Credit Report

Even Big Tech Is Big Stupid At Handling Big Data

Part of me wonders if this would have been a nonstory if Google had just announced this in advance. was a sad attempt to retcon that announcement into existence. Even if you give Google the benefit of the doubt on its intentions and its data policies , its still, as I just said, dumb dumb dumb.

Plus as Mary Beth points out Google is already facing a lawsuit about inappropriately accessing medical data. Cant help but wonder if the FTC is going to take a much more skeptical view of the proposed Fitbit acquisition, and I wouldnt blame them if they did.

+ SMS provider said 168,000 Valentines texts were delayed now it says the number is higher

I know this isnt much of a silver lining, but I am happy that this event pierced the veil of carrier interconnects. Getting your texts and your phone calls routed between carriers is hella complicated and companies like Syniverse are a big part of it. You may know that I have been tracking RCS the successor to SMS for some time. Part of that story is the complicated way that RCS servers are supposed to work together. It is all very complicated to explain and kind of a snoozer, but I think the RCS system is more elegant than whats happening with SMS right now, from a routing perspective. too bad we wont know for sure for years, given the pace of adoption.

What Does Apple Card Offer

Apple offers quite a few features on its credit card. When compared to other cards, Apple Card is a serious competitor.

There are absolutely no fees on Apple Card. Not only does this mean that there is no annual fee , but also that there are no late or over-limit fees either. These are instead charged in extra interest. Handily, there are also no international fees, which is a big plus for travelers.

With Apple Card, you can start using the card right away through Apple Pay. As soon as you get accepted for the product, Apple lets you add the card to Apple Pay from the Wallet app. You don’t need to wait for the card to arrive in the mail.

Unlike most credit card providers, Apple claims that it want you to pay as little interest as possible. To encourage this, the app estimates the interest you might need to pay on your balance when making a payment. Apple hopes by showing you how much interest you might pay, you can make a larger payment to avoid it.

Another big feature offered is unlimited daily cashback. Apple Card lets you earn cashback on all purchases, which gets paid out every day.

Purchases through Apple Pay get two percent cashback, while purchases from Apple earn three percent cashback. Apple purchases include everything from in-store products to Apple subscriptions and in-app purchases from the App Store. Finally, all physical card purchases get one percent cashback.

Don’t Miss: What Is Syncb Ntwk On Credit Report