Get Added As An Authorized User

One easy option that can make a big difference to your score is being added as an authorized user on someone elses credit card. It shows that someone else trusts you with their credit, and can help lower your credit utilization, improve your payment history, and increase the average age of your accounts.

However, you should only ask someone to add you as an authorized user if they are responsible with their credit. If youre an authorized user on the account of someone who regularly carries a high balance and misses payments, this can negatively impact your score .

On the note of authorized users, weve gone into detail about the benefits of being added as an .

How Do Charge Cards Affect Your Credit Score

This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. For an explanation of our Advertising Policy, visit this page.

Update: Some offers mentioned below are no longer available. View the current offers here.

Reader Questions are answered twice a week by TPG Senior Points & Miles Contributor Ethan Steinberg.

With all the hype surrounding the Platinum Card® from American Express and the recently refreshed American Express® Gold Card, its easy to forget that these arent actually credit cards but charge cards. TPG reader Nodisha wants to know how using an Amex charge card will affect her credit score

I just got approved for the new rose gold Amex. I understand that this is a charge card how does that appear on your credit report?

TPG reader Nodisha

Nodisha is spot-on with this question. Its important to understand the factors that affect your credit score so you can avoid violating the ten commandments of travel rewards and damaging your credit.

About 30% of your is calculated based on your utilization, which is simply your total balances divided by your total credit. The lower your utilization, the higher your score.

How Does Closing My American Express Card Affect My Credit Score

American Express, a multinational financial service, is a popular choice among consumers. Owning a credit card such as an American Express credit card is a great way to achieve a high credit score. This is important because having a positive credit score is needed to encourage lenders to issue credit to you.

You may need to close your American Express card for various reasons. It’s helpful to be aware of the ways this will affect your credit score. If you have any questions about closing your American Express card and the effect that it will have on your credit score, reach out to American Express.

Read Also: How Long Does A Repossession Stay On Your Credit Report

Blue From American Express Vs The American Express Green Card

Similar to the Blue from American Express® card, the American Express® Green Card is another humble legacy card thats been around for years, but doesnt get as much attention as other American Express cards. But unlike the Blue from American Express® card, the recently revamped American Express® Green Card charges a hefty $150 annual fee.

The American Express® Green Card also differs from the Blue from American Express® card with its comparatively lucrative rewards program. For example, it offers a hearty welcome bonus and generous rewards bonuses on restaurant meals , travel and transit purchases. If you eat out often enough or purchase a lot of travel or public transit fare, youll rack up enough points with the American Express® Green Card to justify the annual fee.

Does Amex Gold Have A Spending Limit

No, the Amex Gold doesnt have a preset spending limit. No Preset Spending Limit means your spending limit is flexible. Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

As a result, the Amex Gold Card doesnt have a credit utilization rate on credit reports like many rewards credit cards. But, cardholders will need to pay their balance in full each month to keep their account in good standing and potentially improve their credit score.

For more expensive months, cardholders may want to call American Express to pre-authorize large purchases that may trigger a card fraud alert.

Learn more: Johnny Jet Recommended Credit Cards

You May Like: Syncb Ppc

Why Does Gethuman Write How

GetHuman has been working for over 10 years on sourcing information about big organizations like American Express in order to help customers resolve customer service issues faster. We started with contact information and fastest ways to reach a human at big companies. Particularly ones with slow or complicated IVR or phone menu systems. Or companies that have self-serve help forums instead of a customer service department. From there, we realized that consumers still needed more detailed help solving the most common problems, so we expanded to this set of guides, which grows every day. And if you spot any issues with our How Does Closing My American Express Card Affect My Credit Score? guide, please let us know by sending us feedback. We want to be as helpful as possible. If you appreciated this guide, please share it with your favorite people. Our free information and tools is powered by you, the customer. The more people that use it, the better it gets.

American Express

Easy Approvals From Renters

In European and Western countries, landlords have many screening process to identify good, trustworthy tenants. The most common one involves looking into your payment history, so they know that you will pay the rent on time. This is mostly done based on your credit score. A bad credit score can create a hassle while finding a good apartment. Moreover, landlords ask for a higher security deposit amount if you have a low credit score.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Does Blue From American Express Charge Foreign Transaction Fees

Yes, it charges a 2.7% of each transaction after conversion to US dollars. Thats lower than some cards charge. But this is still not a great card to use on foreign transactions since even the fee can quickly add up. Cards without foreign transaction fees, by contrast, are relatively plentiful even for cardholders with lower scores. So if you plan to make a lot of foreign purchases, youre better off using a different entry-level card. For example, Capital One offers a number of cards for borrowers with good or fair credit and none of them charge a foreign transaction fee.

Welcome Bonus For The Amex Platinum

New The Platinum Card® from American Express cardmembers can earn 100,000 Membership Rewards® Points after spending $6,000 on purchases on the Card in the first 6 months of Card Membership. New cardholders also earn 10x points on eligible purchases on the Card at restaurants worldwide and when you Shop Small in the U.S., on up to $25,000 in combined purchases, during your first 6 months of Card Membership. Terms apply.

Learn more: Johnny Jet Recommended Credit Cards

This bonus can be worth $1000 in reward flights and easily offsets the $695 annual fee. Plus, you also get to accumulate points from your purchases to meet the bonus requirements.

Keep in mind that if you have received a bonus offer for the Amex Platinum in the past, you will not qualify for future offers. But, you can qualify for welcome offers from other American Express credit cards.

You May Like: How To Unlock My Experian Credit Report

Is Blue From American Express Worth It

Overall, the Blue from American Express® card is a modest but solid option for cardholders who dont yet have a high enough credit score to qualify for a more lucrative point rewards or travel card. Its an especially good pick for consumers who want access to the Membership Rewards program from American Express and for frequent travelers who are enrolled in an airline or hotel loyalty program that partners with American Express. There are multiple airlines and hotel groups to choose from, but some of the domestic Amex travel partners include:

- Delta

Cardholders with higher scores are better off choosing a more lucrative American Express card, though, such as the Blue Cash Everyday® Card from American Express or even the American Express® Green Card.

Similarly, cardholders who dont plan to travel may also want to look at other cards. The Capital One QuicksilverOne Cash Rewards Credit Card, for example, offers a higher redemption value for everyday purchases. Capital One also offers more robust options for cardholders who want to use their cards abroad or just want a simpler way to redeem points for travel.

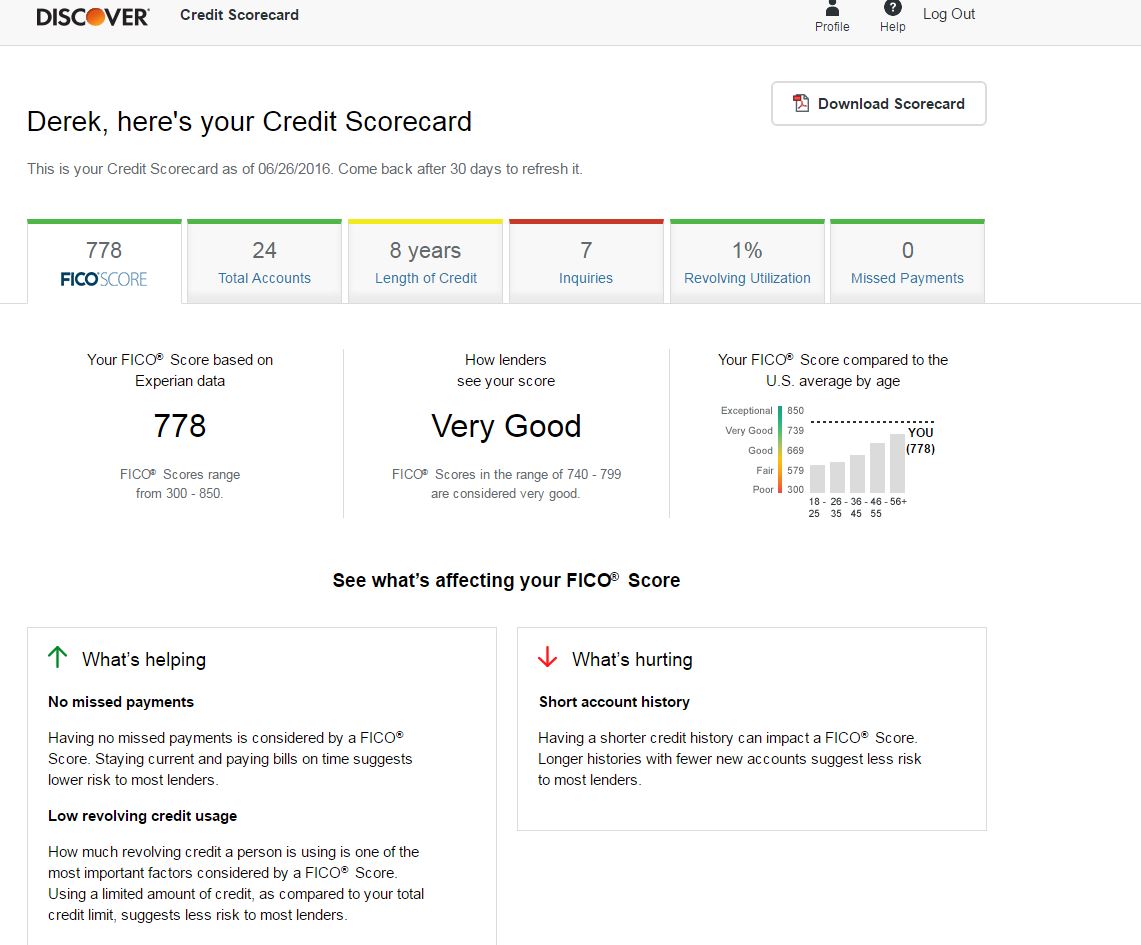

Continue To Monitor Your Credit After Approval

After you’ve gotten approved for a new credit card, avoid the urge to ignore your credit until the next time you want to apply for a credit card or loan. You can get a free credit report annually from all three credit bureaus through AnnualCreditReport.com. Though April 2021, reports are available once weekly, which can help you keep a close eye on any changes.

Additionally, you can use Experian’s to stay on top of your credit. Experian provides free access to your FICO® Score powered by Experian data and access to your Experian credit report. You’ll also get real-time alerts when new information is added to your report, including inquiries, accounts, personal information and suspicious activity.

Finally, if you notice something is amiss on your Experian credit report, you can file and track disputes directly through the Experian platform.

Fortunately, monitoring your credit doesn’t take as much work as actively working to improve your credit score, so it’s a good idea to keep an eye on where you stand, so you can address potential problems as they arise and help ensure you’re credit-ready the next time you want to apply.

Recommended Reading: When Does Capital One Report To Credit

Avoid Loan Application Rejections

With the loan marketing increasing and becoming more accessible, there are more options when you want credit. There are more and more new financial institutions that are offering loans. But that does not mean you should take loans every time an emergency arises, in an impromptu manner. When applying for a loan, make sure you are applying for one that is most eligible for you. Doing so will maximize your chance for approval , as loan rejections can lower your credit score.

What Credit Score Is Needed For The Amex Platinum Card And Amex Business Platinum Card

Our recommendation for the Amex Platinum card and the Amex Business Platinum card is a

If youre applying for the Amex Business Platinum card using an EIN, then we recommend that your business credit score be 75 orhigher. It might be the case that this score is lower than you were expecting, but the truth is you dont need an 800+ credit score in order to get approved for premium credit cards!

Keep in mind that, while this is a general recommendation, there is no minimum requirement for the card. Likewise, there is no score that will guarantee your approval either. Applicants have been approved for both the Amex Platinum card and the Amex Business Platinum card with scores in the 600s and denied with scores in the 800s.

Your credit score is just a single factor that will be considered before Amex will approve you for the Amex Platinum card or the Amex Business Platinum card. So what else matters when banks are determining whether or not to approve you?

Hot Tip:Not sure what your credit score is considered? Learn what is a good and low credit score, plus 5 ways to boost your score.

Don’t Miss: What Is Syncb Ntwk On Credit Report

How A Card Switch Affects Your Credit Score

- Copy Link URLCopied!

Dear Liz: I have one American Express card and two Visa cards, all of which I have held for many years. I received notice that my American Express card was being converted to a Visa card. I do not want a third Visa card but have no choice. For credit score purposes, will this conversion appear to be a closing of my old card and an application for a new one? Obviously, closing a long-held credit card and applying for a new one will affect my excellent credit score, which is 830. If I decided to apply for a new American Express card, how would that impact my score?

Answer: Conversions from one issuer to another can have a temporary negative impact on your credit scores as one account is closed and another opened. The effect should be minor as long as you have other open, active accounts.

Within a month or two, the new account should show the same history as the old one, and your scores should recover.

The type of card usually matters less than the benefits associated with the card. If those benefits are useful to you and are enough to offset any annual fee, consider keeping the card. Its long history and credit limit are likely helping your scores.

That doesnt mean you have to keep a card you really dont want. The fewer cards you have, though, the more careful you probably need to be about closing one.

A South L.A. woman was told the limit on a credit card shes held for 36 years was reduced because she didnt use it enough during the pandemic.

Is There A Minimum Score Needed For An American Express Card

Credit score requirements can vary depending on the credit card and its issuer. In addition to being a card issuer, American Express is a , which means other companies are able to issue Amex cards as well. As a result, it might be possible to qualify for American Express credit cards whether your credit is stellar or less so.

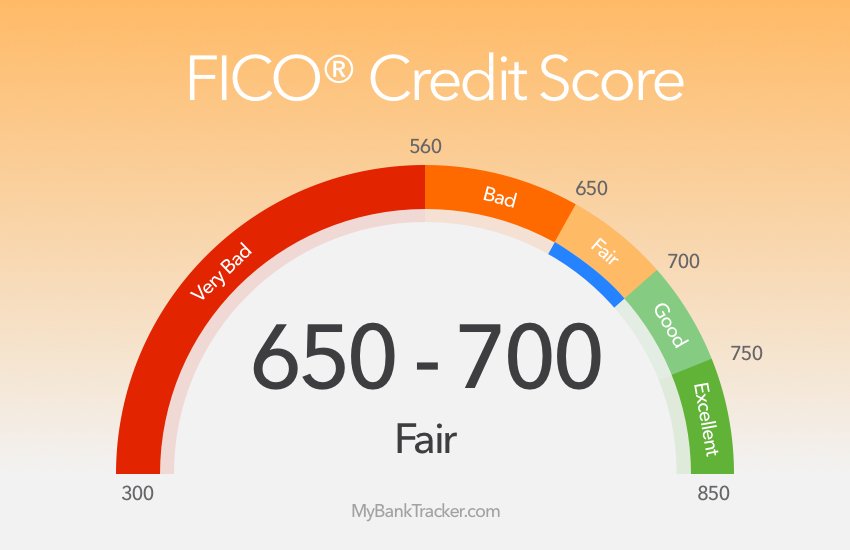

While each card issuer has its own way of categorizing credit scores, here are the general ranges, according to FICO:

- Exceptional: 800 to 850

- Fair: 580 to 669

- Very poor: 300 to 579

If you’re getting a credit card directly from American Express, you’ll generally need good credit to qualify. If you have fair credit, though, you may be able to get an Amex card from a different credit card issuer, such as the .

Also Check: What Is Syncb Ntwk On Credit Report

Average Credit Score By Year

Americans actually have better credit than ever. The average score has increased about 10 points the past seven years. Here’s how it’s risen, according to FICO data from October of each year:

| Year | |

| 2018 | 705 |

Americans have more consumer debt than ever before, holding a total of $14.3 trillion in debt in the first quarter of 2020. But at the same time, credit scores are rising. The period spanning from June 2009 until early 2020 became America’s longest-running period of economic expansion, and brought low unemployment rates. This could have contributed to America’s rising credit scores, with more people borrowing money and paying bills on time.

Is A Charge Card Better For Your Credit

Using a charge card can be great for your credit if you are responsible. Remember that payment history is the most important factor in your FICO credit score and moderately influential to your VantageScore. Paying your bill on time, every time will help your score. And unlike most rent payments, utility, cable and cell phone bills , charge cards are regularly reported to the credit bureaus and your good payment history will show up. So paying your bill on time will help your score whether you use a charge card or a credit card.

Read Also: Credit Score Of 672

Average Credit Score By State

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Here’s the average credit score in each US state and the District of Columbia, according to data from Experian.

| State | Average credit score in October 2020 |

| Alabama | |

| 719 |

How To Choose A Credit Card For Bad Credit

When it comes to choosing a credit card for bad credit, many of our typical recommendations dont really apply. Usually we would suggest that you think about things like what kind of rewards youd like to earn, such as cash back or travel rewards what kind of benefits would suit you most, like 0% intro APR and balance transfer offers whether or not you are willing to pay an annual fee and the like. Unfortunately though, with credit cards for bad credit, the questions youll need to think about when doing your research arent as exciting.

Its not quite time to start thinking about reward cards just yet, though some of the cards above do offer some minor rewards, such as an unlimited cash back match and 2% cash back earned at gas stations and restaurants and 1% on all other purchases with the Discover it® Secured Credit Card. This is a good offer for a secured credit card, but remember, the point of secured credit cards are to build your credit score so you can work towards even better things.

Instead, for now, if youre shopping for a credit card for bad credit, its important to think about things like security deposits, annual fees, credit limits, and APRs. Sure, not as fun, but if you think smartly about these things now, itll help to set you up for a better financial future so that perhaps later you can think about things like welcome bonuses and more lucrative benefits.

Also Check: Does Paypal Credit Report To Credit Bureaus