The Relationship Between My Credit Score And My Auto Loan

When it comes to your credit score and your auto loan, it is a consistent flow of gives and takes. For instance, if your credit score is Deep Subprime and you get a loan, you will have a higher interest rate than a loan candidate with a non-prime, prime, or super-prime credit score.

However, suppose you continuously pay your bill on time and remain in good standing with your auto loan. In that case, it will play a more significant role in helping your credit score than if you were already an established prime or super-prime credit score holder.

Ironically, having a diverse portfolio of loans in good standing will help your credit much more than if you never took out a credit line.

Whether your credit score is good or needs improvement, it pairs well with obtaining a car loan. Not only is a credit score necessary to get a car loan, but it also works in tandem with your car loan to help get your credit to an acceptable level.

Once you have achieved this level, and you use your auto loan to control your credit score, getting a car is only the first step into a world of possibilities.

How To Improve Bad Credit

There is not a simple answer to this question because every person’s situation is unique. But under most circumstances, if your scores are low but you start to take some positive action, you can see results in about two to three months. Here are some ways to improve your credit scores:

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

Recommended Reading: Is 524 A Good Credit Score

What Is A Fair Credit Score Range

Fair credit score = 620- 679:;Individuals;with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers;arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Read Also: What Is Cbcinnovis On My Credit Report

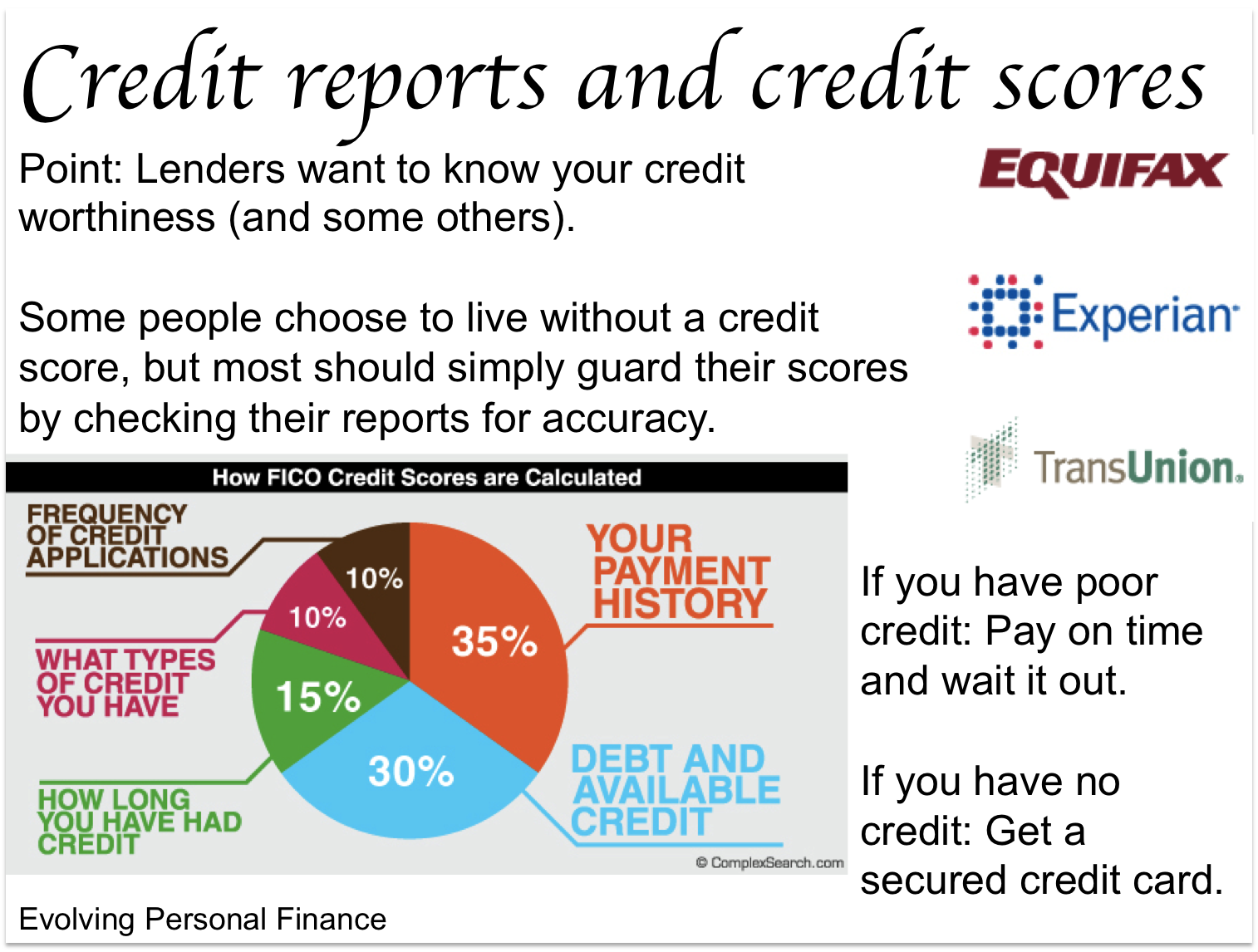

What Is A Fico Score

A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. This, in turn, affects how much you can borrow, how many months you have to repay, and how much it will cost .

When you apply for credit, lenders need a fast and consistent way to decide whether or not to loan you money. In most cases, they’ll look at your FICO Scores.

You can think of a FICO Score as a summary of your credit report. It measures how long you’ve had credit, how much credit you have, how much of your available credit is being used and if you’ve paid on time.

Not only does a FICO Score help lenders make smarter, quicker decisions about who they loan money to, it also helps people like you get fair and fast access to credit when you need it. Because FICO Scores are calculated based on your credit information, you have the ability to influence your score by paying bills on time, not carrying too much debt and making smart credit choices.

Thirty years ago, the Fair Isaac Corporation debuted FICO Scores to provide an industry-standard for scoring creditworthiness that was fair to both lenders and consumers. Before the first FICO Score, there were many different scores, all with different ways of being calculated .

Debt Burden Or Accounts Owed

The other major component category of your credit score is the break up of your existing debt burden including how much you owe in total, what types of loans you have and any other quantitative indicators about your overall debt/credit profile. As an indicator of your creditworthiness how much you owe and how it’s broken up across the different types of loans acts as a signal about your capacity to manage your existing debt.

When it comes to how this plays into your credit score, it’s probably not worthwhile to think of it was higher/lower = better. In all likelihood, the FICO calculation doesn’t evaluate your debt burden in isolation but considers it in relation to things like your payment history. For instance, let’s consider a credit profile of someone who has large amounts of debt but a long and spotless payment history. This might indicate that the person is financially well off and the debt burden is a signal that any additional loans might be obligations they can easily handle.

Take the same level of debt on a profile with a recent history of payment problems, and the higher quantitative factors should be a major red flag. This consumer may be having difficulties making ends meet and even a small amount of additional credit might be a risky proposition.

Read Also: Does Speedy Cash Report To Credit Bureaus

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- ;;;;;Cleaning up your credit report

- ;;;;;Paying down your balance

- ;;;; Negotiating outstanding balance

- ;;;; Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

You May Like: Does Paypal Credit Report To Credit Bureaus

There Are Few Numbers In Life That Matter As Much To Your Financial Well

Whether youre applying for a credit card or buying a home, these three-digit numbers can go a long way in determining whether a lender will do business with you.

The problem is, there are so many out there. How can you keep track of them all?

And what should you do if your scores differ between credit-reporting agencies ?

First things first: Its perfectly normal for scores to differ slightly between agencies. Its up to lenders to decide which information they report to the major credit agencies and which agencies they report to in the first place. Since your FICO Scores depend on the data listed on your credit reports, you might not see the exact same score from every credit-reporting agency. Of course, there may be other reasons for any discrepancies in your scores; more on that later.

The good news? Many agencies look at similar factors when calculating your credit scores. So long as you make payments on time, keep your credit card balances low and dont go wild opening new credit card accounts when you dont need them, you should be in good all-around shape.

Here at Credit Karma, we want to help you develop the healthy financial habits that credit-reporting agencies look for when they crunch your credit scores.

So, listen up .

What Is Good Credit Anyway

Lenders want borrowers who will repay their debts, on time and as agreed upon in a loan agreement. If a lender feels they can rely on you to do that, they say you have “good credit,” or that you’re a low-risk borrower. If, based on a history of poor debt management, a lender doubts you will pay back a loan, they consider you to have “bad credit,” and to be a high-risk borrower. Most consumers fall somewhere in the middle of that spectrum, and .

Every lender has its own criteria for managing borrower risk. Some lenders avoid all but the lowest-risk borrowers, while others seek higher-risk borrowers with the understanding that they can charge them higher interest rates and fees as a trade-off.

Generally, credit scores that fluctuate by a few points up or down won’t have a big effect on your ability to get approved for a loan or credit card. This is especially the case if you’re well above a lender’s score requirement for the best credit terms . If, however, a point change drops your score below a lender’s minimum requirement, your application could get rejected.

Read Also: Why Is There Aargon Agency On My Credit Report

Keep Balances Low On Credit Cards

Thirty percent of your total credit score is based on your credit utilization that is, the percentage of available credit that has been borrowed. Since FICO views borrowers who habitually max out credit cards as people who cannot handle debt responsibility, you should maintain low credit card balances. Keep debt at least 30% below your credit card limit to keep your debt-to-income levels manageable. Use your cards for items you can pay off at the end of the month, and make payments on time. Also, if you pay off a credit card, dont close the card as this rarely helps your credit score. In fact, closing a card is more likely to hurt your credit score.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Read Also: How Long A Repo Stay On Your Credit

How Useful Are Free Credit Scores When Applying For A Mortgage

To bring the conversation around to mortgage borrowing, the only credit score that matters is the one your lender sees when your application is submitted. And its almost certainly NOT a score you have seen for yourself from all the score providers out there.

These days, prospective mortgage clients are often excited to tell me what their credit score is. I bite my tongue, and instead applaud them for caring and for monitoring their credit, while explaining that, no, a screenshot of their Borrowell credit score is not sufficient for our mortgage lenders.

We actually need their signed consent to access a comprehensive credit report.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Recommended Reading: Aargon Collection Agency Reviews

What About The Average Credit Score By Province

The average Canadian credit score does fluctuate by province. The province or territory with the highest number of people with credit scores above 750 is Quebec. The province or territory with the highest number of people with credit scores below 520 is Nunavut.

Since the health of your credit is tied to the overall health of your finances, it makes sense that there is at the very least a small correlation between the province you live in and your credit score. Certain provinces or territories offer Canadians more financial opportunities or more financial hurdles, all of which can have an effect on your credit score. Some of these opportunities or hurdles could be:

- Job opportunities

- Cost of housing

- Insolvency

Based on a study by Borrowell , weve compiled the average credit score of some of the major cities by province.

| Ontario; | |

| Yukon; | Whitehorse 619 |

Moreover, of the eight cities, two belonged to Quebec, two belonged to British Columbia, three belonged to Ontario and one belonged to Newfoundland and Labrador. The other 12 cities all fell within the fair credit score range. Overall, the city credit scores averaged around the average Canadian score of 650 which reinforces the fact that the provinces average credit score has a small correlation to your credit score and can be an indicator of the financial hurdles you face in one province over another.

Debt Levels Could Also Affect Credit Scores

| Province |