The 5 Best Credit Monitoring Apps Of 2021 According To Experts

Our editors independently selected these items because we think you will enjoy them and might like them at these prices. If you purchase something through our links, we may earn a commission. Pricing and availability are accurate as of publish time. Learn more about Shop TODAY.

Continuously monitoring your credit now can save you a lot of headaches in the future, especially if youre suddenly plagued by fraudulent abuses of your personal information. In 2020, the Federal Trade Commission received more than 1.4 million reports of identity theft in the U.S., double the previous year, with the top three reports listed as credit card fraud, government documents or benefits fraud and loan or lease fraud.

While credit monitoring services dont prevent fraud from showing up on your credit report or affecting your credit score, experts say they can help detect major changes to inform necessary action. But credit monitoring sites and apps vary when it comes to cost and services understanding what they do and whats best for you are important before investing in a specific plan. To figure out the best approach to finding the best credit monitoring apps, we consulted financial experts.

Is Experian Better Than Credit Karma

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Think of it this way Credit Karma is like a newspaper that writes about the credit scores other companies give you. But we have no influence over your scores.

Other Places To Check Your Credit Score

Although other scores arent used as often by lenders, they are still useful for tracking changes to your credit and are offered for free.

If you dont have a credit card or other product that provides free access to your score, it doesnt hurt to track one of the other scores, even though it isnt a FICO score.

You can also use these scores to check if you are making progress on your credit, and if there is a major decline or suspicious activity on your credit report, you can catch it right away. Then, you can at least investigate the activity and fix any issues.

Some of the other credit scores you might want to keep an eye on include the following:

Read Also: Aargon Debt Collector

Which Credit Score Do Lenders Actually Use

Consumer Financial Protection Bureau Director Richard Cordray speaks during a a hearing in Denver… where he discussed his agency’s proposal on arbitration, in Denver, Colo., on Oct. 7, 2015.

There was some big news in the world of credit scores this week. The Consumer Financial Protection Bureau;ordered TransUnion and Equifax to pay more than $23 million in fines and restitutions “for deceiving consumers about the usefulness and actual cost of credit scores they sold to consumers.” I’ve used these and the other credit scoring services described below extensively, and these services are advertisers on my personal finance blog, so I was particularly interested in the CFPB’s orders.

The orders explained that the credit score models most often used by lenders are those developed by Fair Isaac Corporation. You may know these scores by their common name, FICO scores. In contrast, the scores offered by TransUnion and Equifax used proprietary scoring models, sometimes referred to as “educational credit scores.” The name comes from the idea that these scores help educate consumers about their credit scores generally.

The problem, according to the CFPB, was that TransUnion and Equifax misled consumers by suggesting that the educational credit scores;they offered were the same scores lenders used to make credit decisions. According to the CFPB, however, these scores were “rarely used by lenders to make credit decisions.”

Many Credit Scores

- Equifax Beacon 5.0

Wallethub: Best For Credit Alerts

WalletHub provides you with credit reports from TransUnion and the TransUnion VantageScore. To register, you’ll need to provide your personal details and the last four digits of your Social Security number , and you’ll have to answer a few questions to verify your identity. The site also asks other questions, such as your annual income, monthly expenses, and credit card debt to complete the registration.

The dashboard shows all of your credit accounts and balances while the credit alert section gives you a report card-style letter grade on the factors that influence your score. For example, the site warns you if your debt load is too high relative to your income or if;your is too high and hurting your score.

Drop-down menus provide additional details, such as your credit;utilization ratio. An easy-to-read version of your credit report shows all of your current and closed accounts, and any negative items, like collection accounts.

A menu bar across the top of the page provides information about financial products and services, such as checking accounts and car loans. WalletHub earns money from some of these companies, which advertise and pay for premium placements on the site.

You May Like: Is 739 A Good Credit Score

Practice Good Credit Habits

Remember: Your credit score is never set in stone. Even if you have a good credit score, make sure to continue practicing good credit habits like always paying off your balance on time and in full and keeping a low .;

If you have no credit history or bad credit history, checking your credit report and score is the first step to improving your credit. You need to have a full picture of where you stand now in order to understand what you should be doing differently and spot opportunities for improvement.

Helpful Features Of Equifax Complete Premier

-

Lost Wallet Assistance

Losing your wallet is a headache. We make it a less painful ordeal by helping you cancel and reissue your credit and ID cards.

-

Auto Fraud Alerts;3

If you believe youre a victim of fraud, you can activate automatic fraud alerts and we’ll place an initial alert on your credit report. This alert encourages lenders to take extra steps to verify your identity before extending credit. On an annual basis, we’ll automatically renew your fraud alert, so you don’t have to.

-

Social Security Number Monitoring;4

Your personal information shouldn’t be on the dark web. We scan suspected fraudulent websites and alert you if we find your Social Security, credit card, banking and medical ID numbers.

-

Youll know if key changes occur to your 1bureau VantageScore credit score, because well be monitoring it and notifying you with custom alerts.

-

ID Restoration

Recovering from identity theft on your own can be time consuming. Let us help make it less of a pain. Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft.

-

Identity Theft Insurance;5

If youre a victim of ID theft, we have your back. We provide up to $1 million in coverage for certain out-of-pocket expenses you may face as a result of having your identity stolen.

2 Credit monitoring from Experian and TransUnion will take several days to begin.

Read Also: How To Remove Items From Credit Report After 7 Years

Understanding Fico Vs Non

When you check your credit score, youll see a number between 300 and 850. This is the number that lenders use to determine how big of a credit risk you are. The lower the number, the bigger the risk. The higher the number, the more likely it is youll be extended credit on good terms.

Somewhere around that number, you should see language that tells you whether that score is a FICO scoreor a VantageScore, which is a non-FICO score. While both types of scores operate on that 300-850 range, there are some big differences between them.

There is one source and one source only for your true credit score: the Fair Isaac Corporation, Clark says. That would be your FICO score, the one that most lenders will use when theyre deciding to loan you money or not.

You have a FICO score with each of the three major credit bureaus Equifax, Experian and TransUnion but they all should be fairly similar.

However, youll find that the most popular places people are getting their free credit scores these days are showing a VantageScore instead.

The three main bureaus hate that FICO dominates the credit score market, so they started selling their own impostor score called a VantageScore, Clark says.

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

Also Check: Removing Hard Inquiries From Your Credit Report

Why Does My Credit Score Show Different On Sites

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders arent required to report to all or any of the three bureaus.

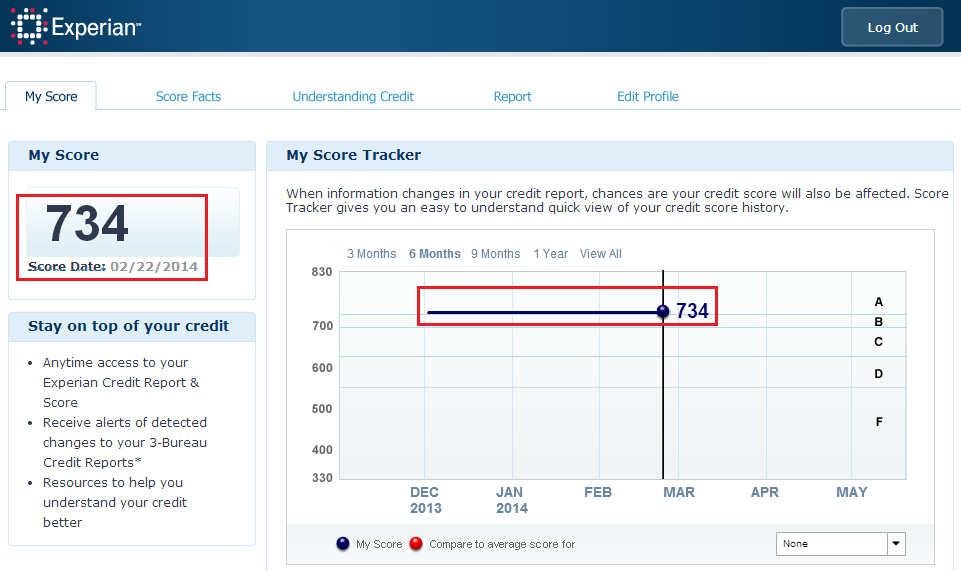

How Can You Get Your Experian Credit Scores

If youd still like to access your Experian credit score, you can find it for free in several places.

Experians free CreditWorks Basic service updates your credit score every 30 days. Experian also operates freecreditscore.com, another place where you get your free Experian FICO score once a month.;

Some banks and credit card issuers, like Discover, also offer complimentary Experian-based FICO® credit scores.

And if youre willing to pay, Experian and FICO both offer premium services through which you can access your credit scores on a more regular basis. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support. But we believe strongly that you should never have to pay to access your credit scores or credit reports.

Read Also: How Bad Is A 524 Credit Score

Whats The Difference Between A Credit Score And A Credit Report

Your credit report is a record detailing all of your credit history, while your credit score is a numerical score that is calculated based on the information in your credit report. To use an analogy, if your credit report is a report card detailing all your past assignments, your credit score is your final grade in a class.

One important thing to know is that you can dispute information on your credit report, but you cant dispute your credit score. If you notice any errors or inconsistencies on your credit report, you should report them to the credit bureaus immediately to avoid any negative effects on your credit score. Conversely, if you notice a sudden drop in your credit score, you should check your credit report to discover why and report any potential mistakes.;

Another thing to remember is that youre legally entitled to a free copy of your credit report annually, but theres no such law regarding your credit score. Most credit card companies and banks provide credit score updates for free.;

How Many Different Credit Scores Are There

Thats a loaded question! Since we have already said that FICO and VantageScore are the ones most widely accepted as being accurate, we will focus on those two. But as I mentioned above, there are hundreds variations of scores used in scenarios as varied as approving casino credit to pricing your auto insurance policy.

Where this all gets very confusing is when we start talking about the versions of each score. FICO in particular can be hard to nail down since your score depends on only one credit report. This means you have a different FICO score from each of the three bureaus in every version. FICO also has industry-specific versions, making it all the more confusing. And dont forget those four versions of VantageScore.

See related: Best credit cards for excellent credit

Recommended Reading: Mprcc On Credit Report

Understanding The Scoring Models

FICO and VantageScore arent the only scoring models on the market. Lenders use a multitude of scoring methods to determine your creditworthiness and make decisions about whether or not to give you credit. Despite the numerous options, FICO scores and VantageScores are likely the only scores youll ever see yourself.

Heres what FICO uses to determine your credit score:

- Payment history. Whether or not you pay your bills in a timely manner is critical, as this factor makes up around 35% of your score.

- . How much of your open credit you have usedwhich is called credit utilizationaccounts for 30% of your score. Keeping your utilization below 30% can help you keep your credits core healthy.

- Length of credit. The average age of your creditand how long youve had your oldest accountis a factor. Credit age accounts for around 15% of your score.

- Types of credit. Your credit mix, which refers to having multiple types of accounts, makes up around 10% of your score.

- Recent inquiries. How many entities have hit your credit history with a hard inquiry for the purpose of evaluating you for credit is a factor for your score. It accounts for about 10% of your credit score.

VantageScore uses the same factors, but weighs them a little differently. Your VantageScore 4.0 will be most influenced by your credit usage, followed by your credit mix. Payment history is only moderately influential, while credit age and recent inquiries are less influential.

Re: What Is The Most Accurate Credit Score Website

The cap1 score is completely useless. That is a TU new account score. Literally NO ONE will ever use that score. CK offers Vantage 3.0 scores, which may be used by a very select number of credit companies. FICO scores are still the king, 90 percent of lenders will use some version of a fico score.

Recommended Reading: Why Is There Aargon Agency On My Credit Report

Identityiq Vs Our Competitors

When comparing similar-priced plans, IdentityIQ benefits go beyond with our tools and features.

All trademarks and tradenames used in price comparisons are acknowledged to be the copyright of their respective owners. IdentityIQ services are not affiliated with the Symantec corporation or any of its brands, including LifeLock. Price comparison and features for LifeLock are shown on this site as presented at www.lifelock.com and may change.

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

You May Like: Aargon Agency Inc Phone Number

Fico Vs Vantagescore: Is One More Accurate Than The Other

Essential reads, delivered weekly

Your credit cards journey is officially underway.

Keep an eye on your inboxwell be sending over your first message soon.

Why? Because in addition to the large number of scores that potentially could be used , it is far from the only criteria. ;Your payment history may be an important factor to both your score and loan underwriting, but other factors like income, job stability and more are critical to decision making in the loan underwriting process. None of those factors are considered in your credit score.

And if that doesnt complicate matters enough, lenders in different industries will tend to interpret the data on your credit report differently. For example, a car dealer may put more emphasis on how youve paid your car loan in the past while a mortgage lender may focus more on your mortgage and home equity loan experience.

While there are hundreds of industry-specific and proprietary scores out there, VantageScore and FICO are the two that are widely accepted as being accurate. FICO is up to 10 and VantageScore is up to 4.0.

See related: Which credit score matters most?

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Don’t Miss: How To Remove Inquiries Off Credit