Credit Score Is It Good Or Bad How To Improve Your 639 Fico Score

Before you can do anything to increase your 639 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Dispute Credit Report Errors

Its important to review your credit report on a regular basis to make sure all the information contained in it is accurate. Humans work at the credit reporting agencies and can make mistakes just like anyone else. Catching errors and getting them corrected in a timely fashion can help you change a credit score from Fair to Good.

Can I Get A Car / Auto Loan W/ A 639 Credit Score

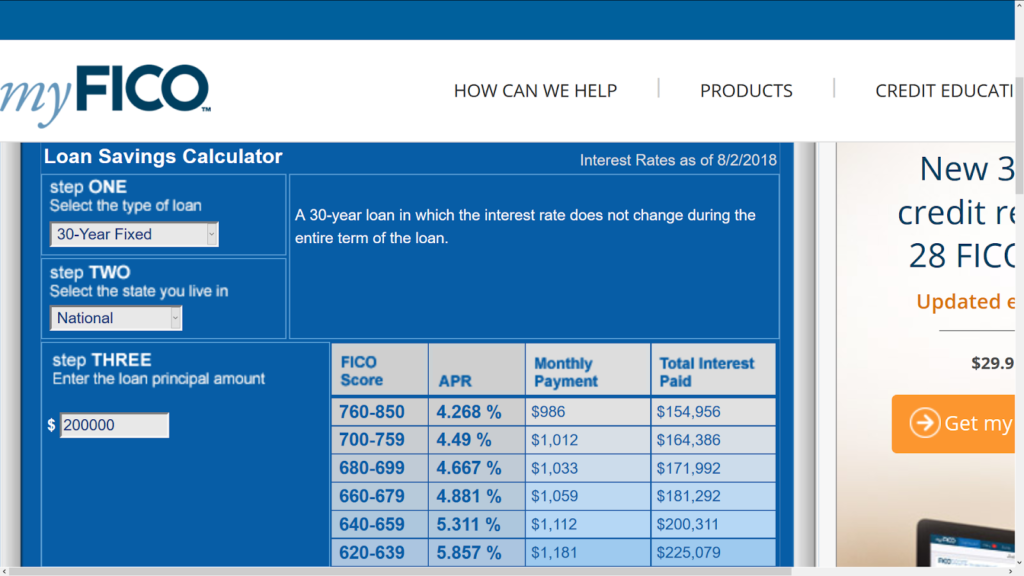

Trying to qualify for an auto loan with a 639 credit score is expensive. Thereâs too much risk for a car lender without charging very high interest rates.

Even if you could take out an auto loan with a 639 credit score, you probably don’t want to with such high interest.

There is good news though.

This is completely avoidable with a few simple steps to repair your credit.

Your best option at this stage is reaching out to a credit repair company to evaluate your score and see how they can fix it.

You May Like: Syncb/ppc Closed Account

What Else Do Auto Lenders Look At Besides My Credit Score

Auto lenders look at several factors in addition to your credit history and credit score. According to the Consumer Financial Protection Bureau , theyll also consider how much income you have, your existing debt load, the amount of the loan you are applying for, the loan term , your down payment as a percentage of the vehicle value and the type and age of the vehicle you are purchasing.

The most important things car lenders consider when you apply for a loan, however, are your credit score and credit history. You can even get a car loan when you are unemployed, provided you have a down payment and money in the bank, said Nishank Khanna, chief marketing officer at Clarify Capital, a business lending firm in New York City.

What Does A 713 Credit Score Get You

| Type of Credit |

|---|

| 31.08% |

*Based on WalletHub data as of Oct. 7, 2016

As you can see, the majority of us are in the top two tiers of the credit-score range. A lot of people dont know where they stand, though, considering that 44% of consumers havent checked their credit score in the past 12 months, according to the National Foundation for Credit Counseling. If youre one of them, you can change that by checking your credit score on WalletHub.

Don’t Miss: Credit Score Without Social Security Number

What Is A Fair Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

On commonly used credit score scales, fair credit starts around 630. Most FICO scores use a 300-850 point range, as does FICOs competitor, VantageScore.

While its tempting to hope a particular number will tell you if you’ll qualify for a loan or credit card, the reality is that lenders and card issuers set their own standards for scores required for approval.

That said, knowing what you are in can give you a good idea of what credit products youre likely to qualify for, and better credit will get you better terms.

Usda Loan With 639 Credit Score

The minimum credit score requirements for USDA loans is now a 640 for an automated approval.; Fortunately, you can still get approved for a USDA loan with a 639 credit score, but it will require a manual approval by an underwriter.; In order to get approved with a 639 credit score, expect to have strong compensating factors, such as conservative use of credit, 2 months mortgage payments in cash reserves , a low debt-to-income ratio, and/or long job history.

Other requirements for USDA loans are that you purchase a property in an eligible area.; USDA loans are only available in rural areas, as well as on the outer areas of major cities.; You can not get a USDA loan in cities or larger towns.

You also will need to show 2 years of consistent employment, and provide the necessary income documentation .

Don’t Miss: Does Klarna Build Credit

What Else Should I Know Before Buying A Car

Avoid dealerships that advertise no credit check or buy here, pay here. These dealerships specialize in sales to buyers with poor or no credit and make their own in-house loans.

According to the CFPB, you may not only pay high interest rates to places that specialize in buyers with poor credit, but you may pay thousands of dollars more for your car than you would elsewhere. If these are the only dealerships where you can get a loan, consider walking away.

If your credit score is less than 500, you may be better off getting a car you can afford to buy outright with cash, Khanna said. You can always get a nicer car when your credit improves.

While comparing car loans, remember to pay attention to the total cost of financing your car and be aware that the interest rate and the APR are different. You can expect your APR to be higher than your interest rate, because APR will include interest rate plus any fees the lender charges.

You have plenty to think about when youre shopping for a car. You shouldnt have to worry about your loan at the same time youre checking out features and searching car lots. Get a head start on financing before you go shopping, and youll have one less thing to worry about while you test drive your next car.

Moving Past A Fair Credit Score

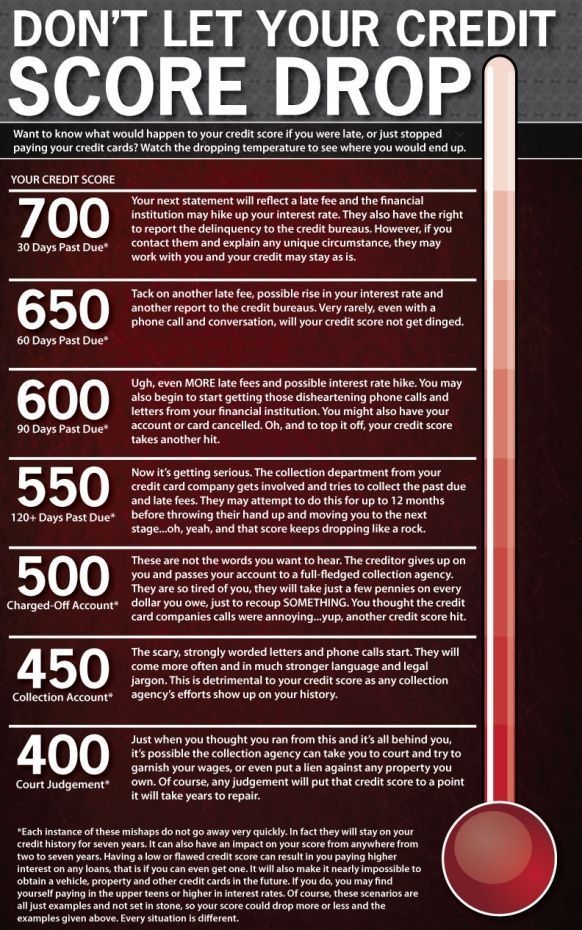

While everyone with a FICO® Score of 649 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 41% of Americans with a FICO® Score of 649 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Learn More About Your Credit Score

A 639 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and fewer fees. You can begin by getting your free credit report from Experian and checking your to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

You May Like: How To Get Credit Report Without Social Security Number

Everything You Need To Know About Your Credit Score

Every year, you can request one free copy of your credit report from each of the three major credit reporting bureausEquifax®, Experian, and TransUnion®at annualcreditreport.com.1 Your credit report is a detailed report of your credit history, including types of credit, the length of time your accounts have been open, and whether youve paid your bills on time.

How To Improve Your 649 Credit Score

The average FICO® Score is 704, somewhat higher than your score of 649, which means you’ve got a great opportunity to improve.

70% of U.S. consumers’ FICO® Scores are higher than 649.

What’s more, your score of 649 is very close to the Good credit score range of 670-739. With some work, you may be able to reach that score range, which could mean access to a greater range of credit and loans, at better interest rates.

The best approach to improving your credit score starts with a check of your FICO® Score. The report that’s delivered with the score will use details from your unique credit report to suggest ways you can increase your score. If you focus on the issues spelled out in the report and adopt habits that promote good credit scores, you may see steady score improvements, and the broader access to credit that often comes with them.

You May Like: Fingerhut Guitars

What Is Fair Credit

Fair credit is that broad range between average and poor credit. Its broad because an exact definition of what constitutes fair credit isnt as specific as we sometimes think. Fair credit;is between 580 and 669. Thats a very general range, and primarily according to the major credit bureaus.

But thats just the starting point. The actual fair credit range will depend on the industry and even a specific lender.

For example, mortgage lenders generally will not make a loan to someone whos credit score is below 620. For all intents and purposes then, a credit score of 605 is considered poor for mortgage lending purposes.

A bank or credit union that makes auto loans may set the minimum credit score at 650, below which they wont extend credit. From their standpoint, a credit score below 650 is considered poor.

This is why you dont want to spend too much time in the fair credit score range. The best way to get out is by taking new, small credit lines, then making your payments on time every month. It will enable your good payment history to gradually overcome your bad payment history.

Ways To Reduce Your Auto Loan Interest Rate

With a credit score between 630 and 639, you are going to qualify for prime loans at a higher interest rate than if you were able to increase your credit score to 780+.

Because you are so close to receiving prime credit score rates it may make sense to consider spending 30, 60, or 90 days building your credit.

The time and money spent would put you in a lower risk bracket and open the doors to much more financial freedom and better opportunities.

Another option to get a vehicle loan with a lower interest rate would be to ask a family member to co-sign on the loan.

The co-signer would become the primary borrower and you would be the secondary borrower.

They would be responsible for making the payments on the loan if you failed to do so, but you would qualify for an auto loan based on their credit score and not yours.

If you know someone with a good credit score, it may not hurt to ask them to be your co-signer. ;

Additional Auto Loan Resources

Recommended Reading: Speedy Cash Credit Check

Go Slow Applying For New Credit

Weve already touched on this factor, but its worth reminding you that lenders dont like seeing applicants applying for multiple lines credit. It could be an indication youre having budget problems, and looking to solve them by obtaining additional credit. You should apply for no more than one or two new lines of credit per year.

Can You Get A Personal Loan With A Credit Score Of 639

There are very few lenders who will approve you for a personal loan with a 639 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 639, your focus should be on building your credit and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

From Fair To Anywhere: Raising Your Credit Score

A FICO® Score in the Fair range typically reflects credit-management problems or mistakes, such as multiple instances of payments that were missed or paid 30 days late. Consumers with more significant blots on their credit reports, such as foreclosures or bankruptcies, may also see their FICO® Scores rise from the Very Poor range into the Fair range once several years have passed after those events.

The credit reports of 42% of Americans with a FICO® Score of 639 include late payments of 30 days past due.

If you examine your credit report and the report that accompanies your FICO® Score, you can probably identify the events that lowered your score. As time passes, those events’ negative impact on your credit score will diminish. If you’re patient, avoid repeating past mistakes, and take steps that can help build up your credit, your credit scores will likely begin to increase.

Don’t Miss: What Is Cbcinnovis On My Credit Report

Fha Loan With 639 Credit Score

FHA loans only require that you have a 580 credit score, so with a 639 FICO, you can definitely meet the credit score requirements.; With a 639 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs.; The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 639 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

You May Like: How Long A Repo Stay On Your Credit

Best Used Car Rates 630 To 639 Credit Score

If youre visiting this page, we know youre likely 40 years old or less, since for 21 year olds and younger is 631, while 635 is the average score for 22 to 40 year olds.

So since youre on the younger side of life, lets be wise with our money!

Grandpa always said that as soon as you buy a new car and drive it off the lot, it loses thousands of dollars in value.;

Stands to reason, that getting the best used car rates should further help save you potentially thousands of dollars by choosing to purchase a used car over a new one.

But heres the thing;

If your credit score is in the 630s, you should qualify for a non-prime APR rate,;which will be higher than someone with a 700 or 800 credit score.;;

|

Used Auto Loan Amount |

|

|---|---|

|

$642 |

$503 |

Sample Quote For Credit Scores Of 631, 632, to 636, & 637: Assumes $2,000 down payment. ;Scores sourced from Nerd Wallet site and are accurate as of 6/12/19. ;All loan payment amounts are based on a used car loan APR interest rate of 10.34% for non prime borrowers with a credit score of 600 to 660. ;The loan terms included in this chart are for 3 years , 5 years , and 7 years . However, speak to your lender about additional loan options, including mortgage loan terms that cover; 1 year , 2 years , 4 years , 6 years , 8 years , 9 years , and 10 years . This is not an offer for a loan or a loan approval. Rates and stipulations change by state, income, credit score, and a variety of other factors. For informational purposes only.

on AutoCreditExpress.com