How Often Is My Credit Report Updated

Erika Rasure, is the Founder of Crypto Goddess, the first learning community curated for women to learn how to invest their moneyand themselvesin crypto, blockchain, and the future of finance and digital assets. She is a financial therapist and is globally-recognized as a leading personal finance and cryptocurrency subject matter expert and educator.

If youre working to improve your credit or watching for a specific change to your , you probably want to know how often your credit report updates. Being able to predict how your credit reportand ultimately your credit scorewill change is a concern for anyone who knows the importance of having good credit or anyone who hopes to be approved for a major loan soon.

The timing of credit report updates largely depends on when lenders, credit card issuers, and other companies you have credit accounts with send your account information to credit bureaus. If you have multiple accounts with several businesses, your credit report could update daily.

Also Check: Is 706 A Good Credit Score

Does The Apple Card Help You Build Credit

If you use your Apple Card responsibly, it can help you build your credit over time. To improve your credit score with the Apple Card, focus on making regular, on-time payments and try to keep your credit card balance as low as possible. As of this writing, the Apple Card reports credit activity to TransUnion and Equifax two of the three major credit bureaus and Apple may expand reporting to Experian in the future.

You May Like: 676 Credit Score Good Or Bad

How To Check Your Credit Reports

Its wise to periodically check your credit reports to make sure theyre accurate. Consumers have free weekly access to their reports from all three bureaus through the end of 2022 request them by using AnnualCreditReport.com.

While waiting for improvement can seem like watching paint dry, there are habits aside from checking credit that will help you build good credit and maintain it.

-

Pay on time every time.

You May Like: Is 667 A Good Credit Score

Read Also: Why Is My Credit Score So Low

If Your Application Is Declined Because Your Identification Information Couldnt Be Verified

Make sure your name, address and other information provided on your Apple Card application is correct. If you find inaccurate information, re-enter the information as needed.

If you are asked to verify with an ID, follow these steps:

After you complete these steps, submit your application again. If your application is declined again for the same reason, contact Apple Support.

Your credit score wont be impacted if youre declined, or dont accept your offer. Your credit score might be impacted if your application is approved and you accept your offer.

You can apply for Apple Card again, but you might receive the same decision.

If you want to receive a different decision on your application when you apply again, you should review your credit report to see if you have conditions that might result in a declined application and then check for these common errors in your credit report.

*If the information on your ID doesnt match the information you entered for your Apple Card application, try to apply again after you update your ID.

How New Credit Can Increase Fico Scores

If the new line of credit helps diversify the types of accounts you currently have, this can increase the “credit mix” factor of your credit score. It shows lenders you can obtain and manage different kinds of credit, which can lower their risk of lending you money.

Let’s say you open a new credit card account and then don’t use that card for any new purchases. Over time, this can lower your credit utilization which could mean an increase in your credit score.

If you have a bad “payment history” and are starting from scratch to create a positive one, then opening new credit can help with that. If you can prove to lenders that you can pay your bills on time, this will help increase your score in the long run.

You should carefully consider if you need a new credit account. In the next section, you can learn about how to improve your FICO Score.

Don’t Miss: How Much Will Paying Off Collections Raise Credit Score

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, co-president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.

Your Interest Rates And Any Penalties Incurred Are Private Information

Your credit report names your accounts, such as credit cards, lines of credit, and instalment payments such as car loans. They include when the account was opened, its status with the lender, the highest amount owing, the currently reported balance, and the number of payment periods past due. It will also state the date of last activity, such as when you made a payment or used the account .

It doesnt, however, list any caveats tied to these accounts, such as steep interest rates and penalties incurred because of missed payments. These are details that are shared between you and your creditor.

Read Also: How To Get A 720 Credit Score In 6 Months

Request A Change To Your Credit Report

If you believe there is inaccurate, incomplete or out-of-date information inyour credit report, you can apply to amend the information held on the CentralCredit Register.

If you believe you have been impersonated by another person, you have theright to place a notice of suspected impersonation on your report.

Add a statement to your credit report

It is possible to add a personal statement to your credit record to clarifyit. This is known as an explanatory statement.

For example, if you have had significant expenses due to relationshipbreakdown, bereavement, illness or another cause, you may add these details toyour record.

The statement must be factual, relevant to the information in the creditreport, and under 200 words. It should not contain information that couldidentify another individual .

You can get more information in the factsheet Placingan explanatory statement on my credit report .

The statement is added to your credit report and it can be viewed when yourdata is accessed. However, lenders do not have to take your statement intoaccount when assessing you for a loan.

Your Credit Scores Can Update Whenever The Information In Your Credit Reports Changes

Your credit scores are based on the information in your credit reports. And your credit scoresâlike your reportsâcan change over time. But how often do they change?

The short answer: It depends. Read on to learn about when your credit scores might change and to get tips for improving your scores and monitoring your credit.

You May Like: How To Clear Inquiries From Your Credit Report

When It Comes To Knowing What Is And What Is Not On Your Own Credit Report

If youre curious and want to know what is and what is not on your own credit report, get a free copy of your credit report from both Equifax and TransUnion. Take a look to ensure that all of the information is accurate. When you get your credit report, it will come with special instructions about how to correct errors, however, they must be true mistakes. Information that is not favourable, but is still accurate, will unfortunately have to stay. No one can have that removed, so avoid tempting credit repair offers from companies that tell you otherwise.

If you have question about how to deal with the debts listed on your credit report, contact us for help. Wed be happy to take a look at your situation and provide you with information and guidance about how to resolve your situation.

Worried about your credit?

Get answers from an expert.

Whether its about keeping, building, or rebuilding your credit, we can help if youre feeling overwhelmed or have questions. One of our professional credit counsellors would be happy to review your financial situation with you and help you find the right solution to overcome your financial challenges. Speaking with our certified counsellors is always free, confidential and without obligation.

Best First Credit Cards

If you dont qualify for a traditional unsecured credit card, you may be eligible for a student credit card, which typically has looser credit requirements, or a secured credit card, which requires an upfront deposit. Even some unsecured cards are designed for people with no credit history to begin building credit, and can help you work toward a great credit score. Choose the best option available to you in terms of rates, fees, credit limit, perks, and rewards. Here are a few of our top picks.

Read Also: How Do You Get Your Credit Report

The Problem With Credit Reporting

Looking to establish your credit history or boost your credit scores before buying a house or making a large purchase? Youll want to make sure your positive credit history is reported.

But heres the thing: Not all lenders report your activity to credit bureaus. If they do, they might not report to all three of the major credit bureaus, either. Credit reporting is a voluntary practice, and credit card companies dont always reveal which credit bureaus they report to. Some companies, like Capital One, explicitly state that they report your credit standing to the three major credit bureaus. Others may not reveal that information so openly.

All in all, its best to keep your credit in good standing across the board. You can do this by making on-time payments in full and keeping your balances low.

Why Could Your New Account Take Longer To Appear

We already offered some insight on when does a new credit card show up on your credit report. But why may it take longer to appear? Apart from the delay caused by the standard payment cycle of the card issuer, there may be other causes at play. Here is what may have gone down with your credit card account:

Also Check: What Is A Delinquent Account On Credit Report

How Credit Is Reported If You’re An Individual Apple Card Account Owner

Your Apple Card account information, such as payment history and credit utilization, will be reported to credit bureaus and shown in credit reports as your individual Apple Card account.

If you choose to add a participant to your Apple Card account

- There is no direct negative impact to the account owners credit report when adding or removing a participant.

- Participants are reported as Authorized Users to the bureaus, which means they are not liable for making payments on that account.

- Adding one or more participants to your Apple Card account may lead to higher credit utilization, because multiple people can now spend on the same account. Higher credit utilization may negatively impact your credit score.

If you want to close your Apple Card account

- Account owners can close the account at any time, which may negatively impact their credit score.2

- Closing your Apple Card account will remove any participants from the account, and it will show up as closed on both the owner and participants credit reports.3

How Often Do Credit Scores And Credit Reports Update

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

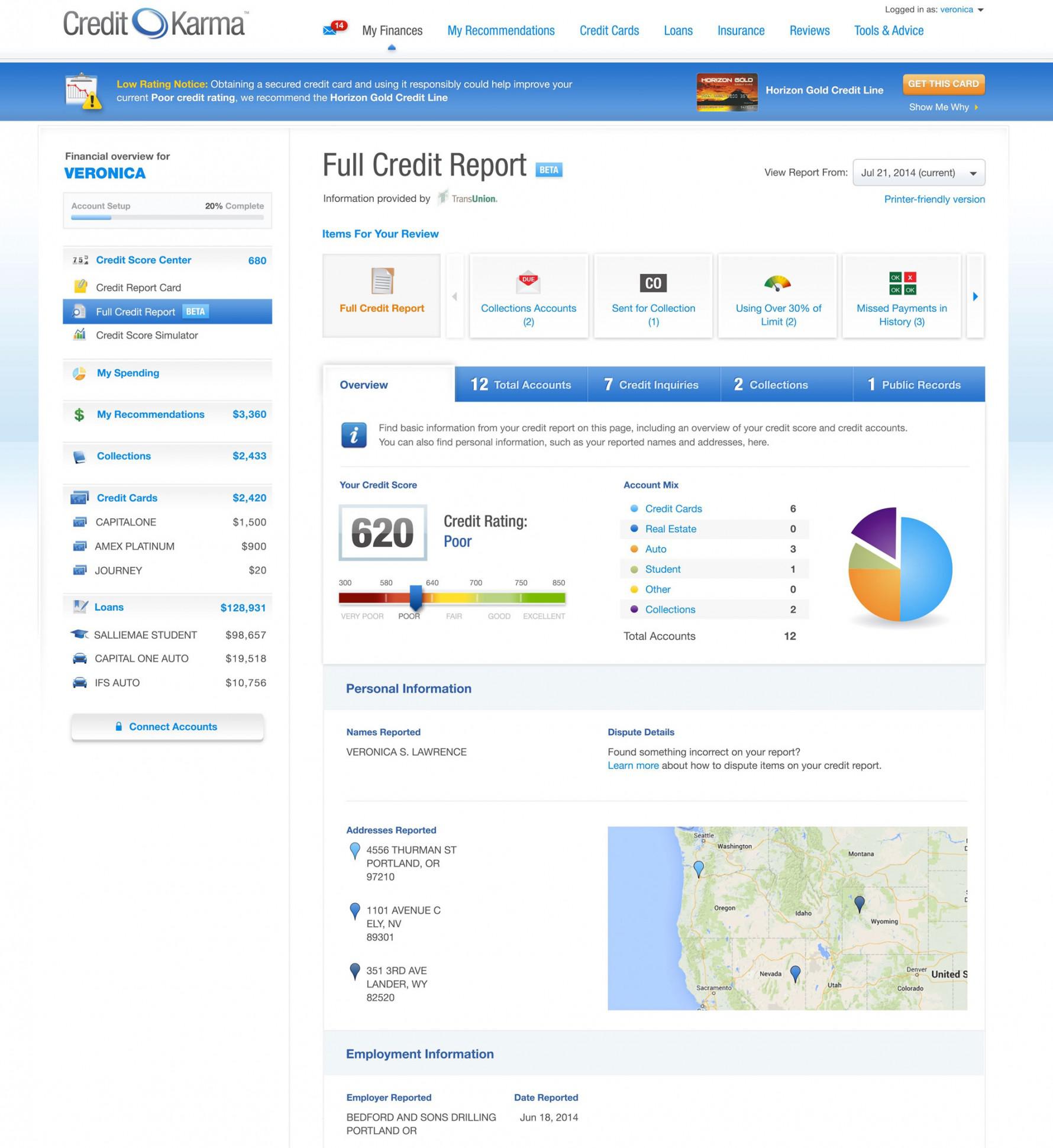

Working to improve poor credit is largely a waiting game. You may be disappointed at how slowly improvement seems to occur and impatient about seeing results.

To understand how often and why credit scores change, it helps to know how often credit reports, the source of the data that is used to calculate scores, are updated with fresh information.

Don’t Miss: Is 811 A Good Credit Score

Where To Access Your Free Credit Reports

Thanks to the Fair Credit Reporting Act, you can access a free credit report from Experian, TransUnion and Equifax once every 12 months. Free reports are available at AnnualCreditReport.com.

You may be entitled to additional free reports under any of the following circumstances as well:

- Youre unemployed and plan to apply for a job within 60 days.

- A company denies your application or offers you worse terms based on your credit when you apply for credit, insurance or employment. .

- You receive public assistance income.

- Youre a victim of identity theft or fraud.

Soft Pull Business Credit Cards

There are many business credit cards that allow you to do a soft pull, which means that you can check your creditworthiness without affecting your credit score. This is a great way to see if you qualify for a particular card without having to worry about a hard inquiry impacting your score. Some of the best soft pull business credit cards include the Capital One Spark Cash for Business, the Chase Ink Business Cash Credit Card, and the American Express Blue Business Cash Card.

Soft pull credit cards allow you to check for pre-approval before requesting a credit limit increase. Most soft pull cards require you to answer a series of questions before you can open a new account. There are a few secured credit cards that allow you to pull a soft pull, but it is not a viable option for all. Soft pull credit cards are not accepted by any other credit card company. They require applicants to be at least 18 years old and have a U.S. mailing address and Social Security number. WalletHubs editors selected several of their favorite credit cards from issuers that offer pre-approval and a soft pull. Certain types of general-use credit cards do not require a credit check.

Read Also: Does Simm Associates Report To Credit Bureaus

Is Hulu Part Of Experian Boost

*Experian Boost previously added Netflix® to its list of eligible bill payments, and now HBO, Hulu and Disney+ join the growing list of qualifying streaming payments. If you’re looking to improve your credit score, Experian Boost is a free feature that lets you get credit for paying monthly bills on time.

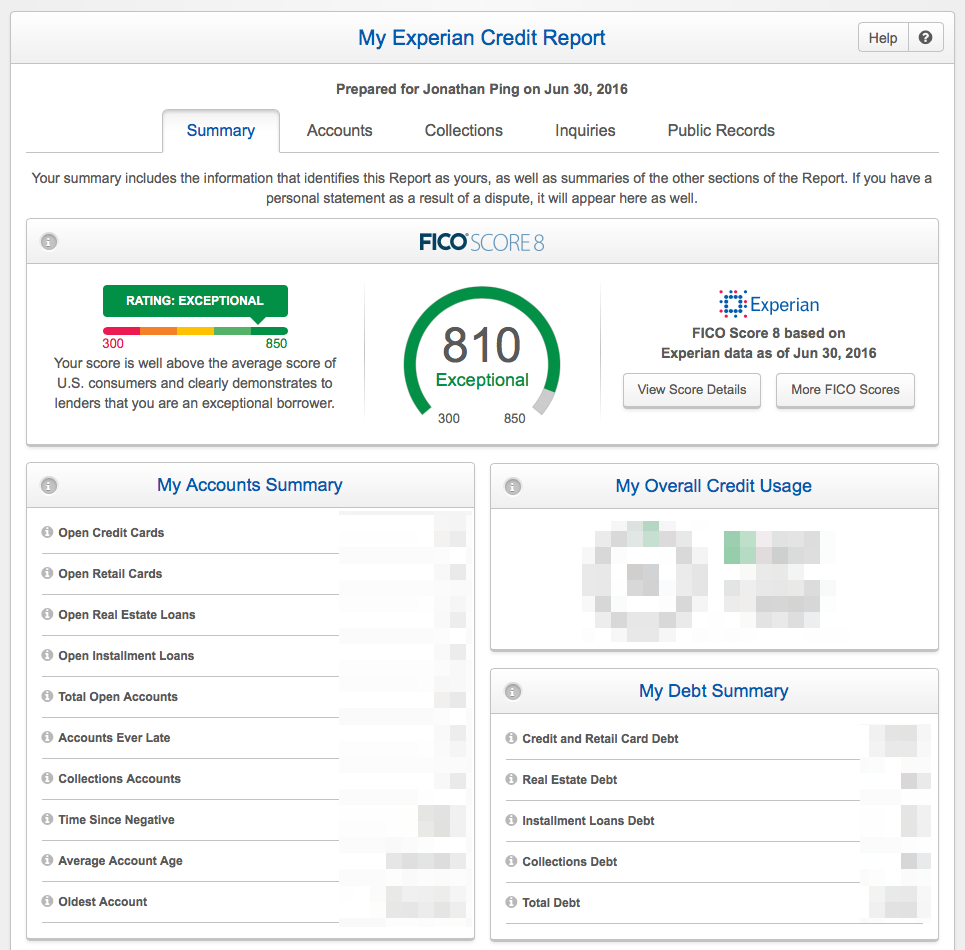

How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Recommended Reading: How To Improve Credit Rating Nz

Whats In Your Credit Report

Your credit report typically holds the following information:

- A list of your credit accounts. This includes bank and credit card accounts as well as other credit arrangements such as outstanding loan agreements or utility company payment records. Theyll show whether youve made repayments on time and in full. Items such as missed or late payments or defaults will stay on your credit report for at least six years.

- Details of any people who are financially linked to you for example, because you’ve taken out a joint loan with your partner.

- Public record information such as County Court Judgments , home repossessions, bankruptcies, Debt Relief Orders and individual voluntary arrangements. These stay on your report for at least six years.

- Your current account provider, but only details of overdraft information from your current account.

- Whether youre on the electoral register.

- Your name and date of birth.

- Your current and previous addresses.

- If youve committed fraud, or if someone has stolen your identity and committed fraud, this will be held on your file under the Cifas section.

Your credit report doesnt carry other personal information such as your salary, religion or any criminal record.