Average Credit Score By Age

The average credit score looks very different between age groups. As credit scores are calculated on credit and borrowing history, older people have higher credit scores on average due to a more extensive borrowing history. Here’s how it breaks down by age group, according to data from Experian:

| Generation | Average credit score in 2019 |

| Gen Z | |

| 736 |

The Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 702 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Use Your Credit Card But Never Max It Out

Im not the type of person who buys everything on my credit card. I do use one of my credit cards a lot, however.

Ive found I need to use the credit card a lot to get the highest FICO score possible. The caveat is that you should never max out the card. In fact, I recommend you pay it down every month and never get even close to the credit limit.

As a general rule, you should try to keep your . In other words, if you have a credit card with a total credit limit of $1,000, never rack up more than $250 worth of charges on the card.

This is why its also important to have a credit card with a high limit. For example, my main credit card has a credit limit of $30,000, and I never get even close to 25% utilization.

If you dont have a card with a high enough limit to keep you comfortably under 25% utilization, give the creditor a call and request that they up the credit limit.

Don’t Miss: When Do Things Fall Off Your Credit Report

Should You Try To Raise Your Credit Score Before Buying A House

Having a great credit score can save you thousands of dollars even tens of thousands in the long run.

As we mentioned above, 700 is in the good range for FICO scores. So lenders arent likely to ding you for it.

But a 700 FICO score might not give you much of an edge when shopping for mortgage rates, either. In fact, mortgage data firm Ellie Mae estimates that more 70% of conventional home buyers have FICO scores over 750.

If you want the lowest rate possible, it might be worth trying to raise your score by at least a few points before applying.

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

Read Also: Does Klarna Report To Credit

Dont Apply For Multiple Credit Cards

This is standard advice any time you apply for credit of any type . If you put in multiple applications, you can actually hurt your chance of being approved.

Each lender will have access to your credit report, which will show that youve applied elsewhere. Those applications will show up as inquiries. Too many inquiries can actually drop your credit score. Maybe it wont be by a lot, but it could be enough to put you into a lower credit score range.

Pick the card you want most, and apply for it. If youre turned down, or you dont like the terms, only then should you apply for another card.

S To Improve Your 702 Credit Score

Improving your 702 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

Recommended Reading: What Credit Score Does Carmax Use

Rewards Should Match Your Spending Patterns

If youre not a frequent traveler, it will make little sense to get a card that provides generous travel rewards. As you probably wont take advantage of them, itll be just another credit card.

Also, look very carefully at any qualifications for the rewards. Many credit cards in this credit range make their most generous rewards offers on select categories. If you use those categories normally, it will make sense to take the card. But if you dont, you wont earn the rewards.

Dealing With Negative Information Which Impacts Your 702 Credit Score

If your credit score is a negative in your life, then there are several things you can do if you want to improve it.

Firstly, you can enhance your 702 credit score by simply paying all your bills on time. Making late payments, partial payments or trying to negotiate with lenders all work to drive your score lower. To make sure you can pay your bills on time you should ensure that you have a monthly budget. Stick to it, pay your bills first and your credit score will improve over time.

In addition to paying your debts on time, taking on as little debt as possible in the first place will keep your credit score in good health. Lenders can only lend you so much. If you have a lot of debt your repayment capacity will decrease and your credit score will follow. Again, budget so you do not need to borrow.

If you do need to borrow then make sure you pay off the debt as quickly as possible. Dont just make the minimum repayment, this again will aid an increase in your credit score.

Another aspect of your 702 FICO score is one not many people know about. Every time you apply for credit that application is logged.

The more applications you make the more it looks like you cannot manage your finances and always need a constant stream of loans to meet your day to day obligations. So again, if you do need credit, only apply when your going to draw it down and make as few applications as possible.

Read Also: Does Opensky Report To Credit Bureaus

Inaccurate Credit Histories Are Common

Many people in this situation discover they have a few negative entries on their credit reports that are not accurate.

When you discover inaccurate credit information on your credit report, youll want to get that negative entry removed as soon as possible so your credit score can be all that it can be.

Unfortunately, when you apply for credit, credit card issuers and other lenders wont care whether your credit score doesnt really reflect your actual credit risk. No matter how well you explain things, the lender will rely on what myfico says.

The terms of your new car loan or personal loan will reflect this reported credit risk. In other words, youll pay higher interest rates because of your inaccurately low score.

When you have worked hard to establish a long history of on-time payments and responsible credit utilization, these kinds of lending decisions are beyond frustrating!

So removing inaccurate credit information from your credit history is a must. Doing this should restore your credit history within a couple months.

There are a couple ways to go about it:

- Do It Yourself Credit Repair: You can call the lender who reported incorrect credit information and ask that they correct the inaccurate data. I always recommend handling this in writing.

- Professional Credit Repair: If youre the type of person who would rather pay a professional handle it and just be done with the whole thing, I suggest you check out Lexington Law.

Average Credit Score By Year

Americans actually have better credit than ever. The average score has increased about 10 points the past seven years. Here’s how it’s risen, according to FICO data from October of each year:

| Year | |

| 2018 | 705 |

Americans have more consumer debt than ever before, holding a total of $14.3 trillion in debt in the first quarter of 2020. But at the same time, credit scores are rising. The period spanning from June 2009 until early 2020 became America’s longest-running period of economic expansion, and brought low unemployment rates. This could have contributed to America’s rising credit scores, with more people borrowing money and paying bills on time.

Read Also: What Credit Score Do You Need For Amazon Prime Visa

Correct Any Errors On Your Credit Report

Some credit report errors can be as simple as a misspelled name or incorrect address, while others may involve outdated information . Disputing errors on your credit report involves two steps:

Uncertain about what to say? Dont worry. The Federal Trade Commission has sample letters for contacting and information providers.

Youll need to provide documentation to address the errors, such as balance statements, receipts, etc. Be sure to send copies of your documents, not the originals.

How To Get A 706 Credit Score

While theres no sure-fire way to achieve an exact credit score, theres plenty you can do to build and maintain your credit within a range. Most importantly, youll want to practice healthy credit habits.

Even with so many different credit scores out there thanks to different scoring models and different credit bureau data some general principles apply. Most credit scores take into account at least five main credit factors.

Heres a breakdown of each factor and how it can affect your overall credit.

You May Like: Is Chase Credit Score Accurate

How Much Deposit Do I Need To Get A Mortgage With A Poor Credit Score

It may be the case that to access your chosen lenders rates and meet their terms, you have to deposit a higher percentage of the properties market value. That being said, the amount of deposit you need to get a mortgage will vary depending on a whole host of factors including your age and the type of property you want to buy.

There isnt a typical deposit size, but some lenders ask applicants to deposit as much as 30% for a mortgage if they have a poor credit score or low affordability.

For a home valued at £200,000 that would equate to a £60,000 deposit. Large deposits arent a viable option for a lot of borrowers and thankfully there are a handful of lenders that appreciate this and may be more willing to lend under more flexible terms.

Who Has Given You The Score

There are two big credit reference agencies and both will give you a score as an indication of how good they think your credit history is. They each have their own scoring systems and your score with one will be much different than your score with the other.

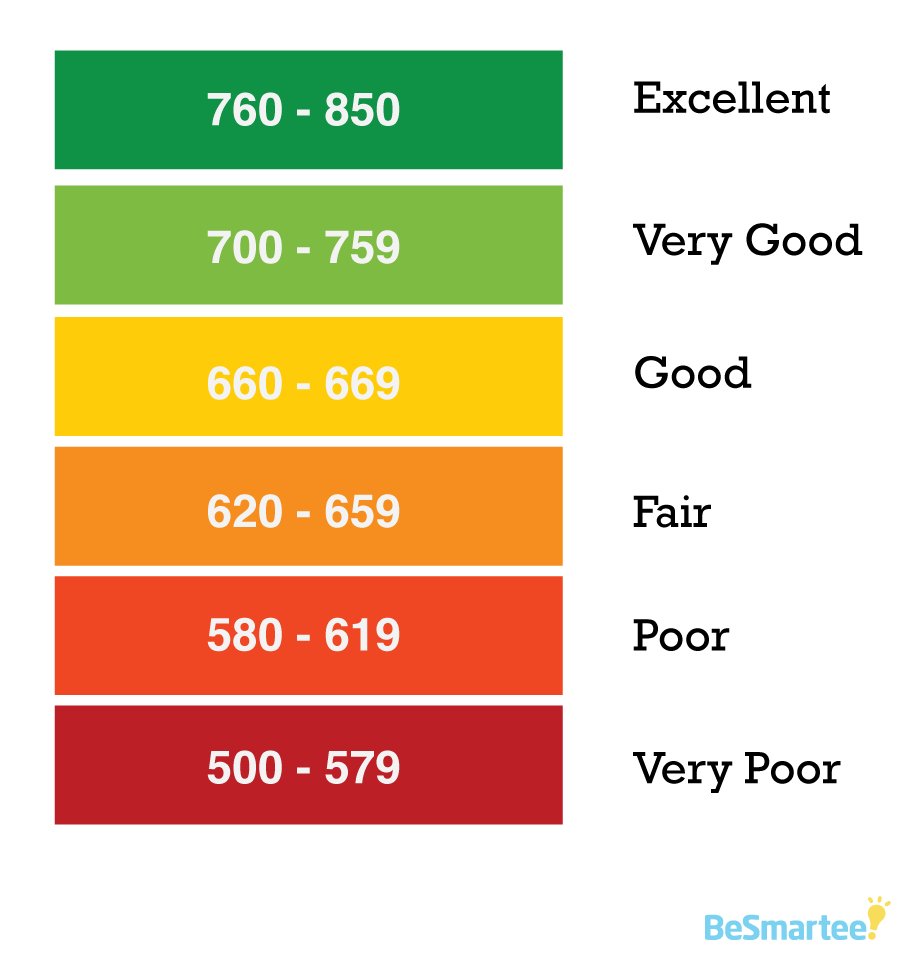

With Experian, a credit score of 702 is considered poor, but is almost within the fair category. On the other hand, with Equifax a score of 702 is well within the excellent category. If you got your score of 702 from Equifax then it will almost certainly be good enough for any form of credit you may want . On the other hand, if your Experian credit score is 702, it may or may not be good enough to get credit.

You May Like: How To Report A Death To Credit Bureaus

If I Meet A Minimum Credit Score Will I Be Accepted For A Mortgage

Not necessarily as lenders take lots of factors regarding your affordability into consideration. You are more likely to be accepted if you meet a minimum score as this suggests that youre a careful borrower.

However, its also important to prepare for your application for a mortgage by organising your:

-

Pay slips and proof of bonuses/commission and tax paid or self-assessment tax accounts if youre applying for a self-employed mortgage

-

Passport, birth certificate and drivers license

-

Proof of deposit

-

Proof of address

-

Gift letter If you’re receiving help with your deposit, the lender will need a letter from the person providing the gift explaining that they are gifting the deposit and understand that they in no way own any share of the property being mortgaged or expect the money to be paid back.

Lenders work across a lot of different criteria, and your credit score is just one part, so even if you do not meet the minimum levels, you should speak to one of our specialist mortgage advisors to see how we can help.

What Is A Good Credit Score In New Zealand

Your credit score, which is sometimes referred to as your credit rating, can range from 0 to either 1,000 or 1,200 depending on the credit bureau calculating it. In all cases, the higher the score, the better.

To make it easier to visualise, weve provided the table below to help you understand what constitutes a good credit rating in New Zealand bureau by bureau.

If you want to see how your score stacks up to the scores below, simply to see your illion credit score for free forever!

Don’t Miss: What Credit Score Does Carmax Use

Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

Cash Back Vs Rewards Points Or Miles

Rewards come in three flavors: cashback, points, and miles.

Points and miles are typically associated with travel rewards. Once again, if youre a frequent traveler, this type of rewards package will be attractive. Understand that its typical with travel rewards that theyre primarily earned through travel purchases, and redeemed in the same category.

If youre not a frequent traveler, cash back rewards are definitely the way to go. You can generally earn them through regular purchase activity, and redeem them for cash, or a statement credit .

Recommended Reading: How Long Does It Take For Opensky To Report

Average Credit Score By State

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Here’s the average credit score in each US state and the District of Columbia, according to data from Experian.

| State | Average credit score in October 2020 |

| Alabama | |

| 719 |

What Does Not Count Towards Your 702 Credit Score

There are many things that people assume go into their 702 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

Don’t Miss: What Is Cbcinnovis On My Credit Report