Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

- To check your credit history and past record

- To see whether you are capable of repaying debts

- To review your credit balance and understand the risk level of your profile

- To judge whether you qualify for the loan

- To decide on the loan amount to offer you and interest rate applicable

Average Credit Score By Income

According to American Express, the average credit score by income are as follows4:

- $30,000 or less per year: 590

- $30,001 to $49,999: 643

- $50,000 to $74,999: 737

The correlation between lower average credit scores and lower-income may be associated with factors like higher-income individuals being able to pay back credit card debts more easily as well as being able to maintain a lower credit utilization ratio.

Those with higher income may also have higher credit limits in comparison to those with lower income.

That being said, income is not the most accurate measurement of scores. Income is only one factor that plays a role in your score. You can still have a low income and have good credit. If you fall into a lower income bracket, dont worry. Your income doesnt determine your score.

Also Check: What Is The Connection Between Credit Report And Credit Score

What Counts Towards Your 764 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 764 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

How To Get A 764 Credit Score

Theres no one path you can follow to get an excellent credit score, but there are some key factors to be aware of while you continue to build and maintain it.

Even if youre holding steady with excellent credit, its still a good idea to understand these credit factors especially if youre in the market for a new loan or youre aiming for the highest score.

Recommended Reading: Why Would My Credit Score Drop 50 Points

How To Keep On Track With A Very Good Credit Score

Your 764 credit score means you’ve been doing a lot right. To avoid losing ground, be mindful of avoiding behaviors that can lower your credit score.

Factors that can have negative effects on Very Good credit scores include:

Utilization rate on revolving credit Utilization, or usage rate, is a measure of how close you are to “maxing out” credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts recommend keeping your utilization rates at or below 30% on individual accounts and all accounts in totalto avoid lowering your credit scores. The closer any of these rates gets to 100%, the more it hurts your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Late and missed payments matter a lot. More than one-third of your score is influenced by the presence of late or missed payments. If late or missed payments are part of your credit history, you’ll help your credit score significantly if you get into the routine of paying your bills promptly.

37% Individuals with a 764 FICO® Score have credit portfolios that include auto loan and 38% have a mortgage loan.

How To Read Your Credit Report

Your credit reports contain both personal information and financial information. Your credit reports illustrate who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. A credit report is the report card of your credit life and understanding how to read it can help you take control of your credit and be prepared for any of your future credit needs.

Recommended Reading: When Do Things Fall Off Your Credit Report

What Are The Average 764 Credit Score Car Loan Rates In 2022

For those that have excellent credit scores, they can ensure that they will qualify for just about any type of loan that they wish to take out, whether it is an auto loan or a mortgage. Personal loans are also something that are easier for them to borrow with such a high credit score. It is important to provide proof of your income when applying for any loan, though.

| FICO Credit Score |

|---|

| 3.34% |

All the calculation and examples below are just an estimation*.Individuals with a 764 FICO credit score pay a normal 3.4% interest rate for a 60-month new auto loan beginning in August 2017, while individuals with low FICO scores were charged 14.8% in interest over a similar term.

So, if a vehicle is going for $18,000, it will cost individuals with excellent credit $326 a month for a sum of $19569 for more than five years at 3.4% interest. In the meantime, somebody with a lower credit score paying 14.8% interest rate without an upfront installment will spend $426 a month and wind up burning through $25584 for a similar auto. That is in excess of a $6015 distinction.

The vast majority wont fall in the highest or lowest class, so heres a breakdown of how an extensive variety of FICO scores can influence the aggregate sum paid through the span of a five-year loan:

| FICO Range | |

|---|---|

| $7,582 | $25,584 |

What Is A Good Credit Score In Canada

Good credit scores in Canada are usually 660 or higher. Of course, there are many different types of credit scores and scoring models. This means that what one lender considers to be a good credit score will not be the same for another lender. Furthermore, the credit scores a lender sees are different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores.

Is 600 A Good Credit Score?

A 600 credit score falls under the fair credit score range. With a 600 credit score, you may be able to qualify for a loan with a bank, however, you wont get the most competitive rate. Borrowers with a 600 credit score may have better luck qualifying for a loan with alternative lenders whose lending criteria are much more lax than banks.

Is 620 A Good Credit Score?

If you have a 620 credit score, it usually means you have fair credit. While you may be considered higher risk by lenders, you can usually still qualify for loans, though it may be difficult. Moreover, youre likely to get charged much higher rates than those with good or excellent credit.

Is 750 A Good Credit Score?

A credit score of 750 is considered very good . In fact, with a credit score of 750, youre only 10 points away from excellent as credit scores that fall between 760 and 900 are considered excellent. With a 750 credit score, youll be able to qualify for loans at great rates.

Is 800 A Good Credit Score?

You May Like: How Does A Credit Rating Rank Individuals

How Your 764 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

Canadian Credit Scores And What They Mean

There is no definitive model for what certain credit scores mean to all lenders and creditors. One lender may consider credit scores of 760 to be excellent, while another may consider scores above 780 to be excellent. It all depends on what scoring model that specific lender uses and how they use it during their approval process. That being said, if youre interested in knowing what your credit scores mean, here are some general guidelines that can help.

| Range | Meaning |

| Excellent | Individuals with a rate of 760 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan. |

| Very Good | This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available. |

| Good | An individual who has credit scores that fall within this range has good credit and will typically have little to no trouble getting approved for the new credit. |

| Fair | Scores in this range indicate that the individual is a higher risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates |

| Poor | Credit scores that fall in this range may indicate that a consumer has trouble making payments on time or is in the process of building their credit history. |

Also Check: How To Raise Experian Credit Score

Percent Of Adults Who Never Check Their Scores

One study conducted by Javelin Strategy & Research and sponsored by TransUnion revealed that 54 percent of adults never check their credit scores8.

Checking your credit score is a crucial aspect of reaching your financial goals and correcting any mistakes in your credit report.

Whether you regularly use a credit card or are paying back loans like student loans, always check your score on a regular basis, whether its through a third-party application or using an established credit reporting company like Experian.

Is 800 A Good Credit Score To Buy A House

While having a credit score of 800 seems lofty, even scores in the 700’s can help home buyers get lower mortgage rates. Many loan programs have a minimum credit score requirement to get approved for a mortgage. For example, most lenders will require a credit score of 580 to get approved for an FHA loan.

Don’t Miss: How Long Can Credit Inquiries Stay On Your Report

What Is A Bad Credit Score

Having a may mean some lenders will be reluctant to give you a loan or other credit product, or, depending on the loan type and lender, they may charge you a higher interest rate compared to someone with a good credit score. This is generally because you would be seen as a higher risk and less likely to be able to repay the credit.

So how low does a credit score need to be to be considered bad? Equifax considers a score of 459 or lower to be below average, while Experian views a score below 549 as below average, and Illion considers a score of 299 or under to be a low score.

What Does A Credit Score Of 800 Mean

Youre still well above the average consumer if you have an 800 credit score. The average credit score is 704 points. If you have a credit score of 800, it means that youve spent a lot of time building your score and managing your payments well. Most lenders consider an 800 score to be in the exceptional range.

If you have a score of 800 points, you should be proud of yourself. You wont have any trouble finding a mortgage loan or opening a new credit card with a score that high. Here are some things your 800 FICO® Score says about you:

An 800 credit score isnt just good for bragging rights. Some of the benefits youll enjoy when you have a higher score include:

Don’t Miss: When Does Wells Fargo Report To Credit Bureaus

Where To Go From Here

Its important to pay down your balances and keep your credit utilization under 30%. Its also wise to have different types of credit accounts to establish a solid credit mix because it accounts for up to 10% of your FICO score. So, youll want to have both installment and revolving credit showing up on your credit report.

Of course, you also want to focus on making timely payments from here on out. Even one late payment can be very damaging to your credit.

Length of credit history also plays an essential role in your credit scores. You want to show potential creditors that you have a long, positive payment history.

Give Lexington Law a call for a free credit consultation at and get started repairing your credit today! The sooner you start, the sooner youll be on your way to having excellent credit.

Categories

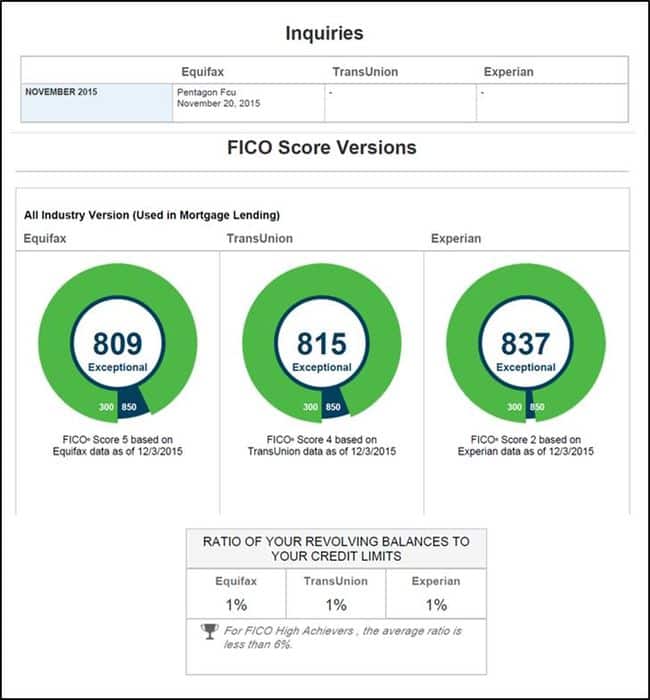

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 764 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Recommended Reading: How Does A Hard Inquiry Affect Your Credit Score

Consider Consolidating Your Debts

You can consolidate your debts by taking out a debt consolidation loan and using the loan to pay off your other debts. The primary purpose of debt consolidation is to reduce the number of payments and amount you pay each month.

With a 764 credit score, you can make the most of this approach because youll qualify for loans with low interest rates. If you have primarily revolving debt, this approach could further strengthen your credit by reducing your credit utilization and improving your credit mix. It also reduces the risk of late payments because you have fewer accounts to manage.

However, there are some potential downsides to think about. For example, if the loan term is long, then you may end up paying more overall in interest, even if your monthly payment is lower. If you do consolidate your debts, make sure to keep your old accounts open so that you dont reduce the amount of available credit you have.