How To Remove Inquiries From Your Credit Report

Because inquiries on your credit report can cause your credit score to drop a bit, you might be inclined to remove them. However, hard inquiriesthose that are made because you applied for more creditcan not be removed unless they are inaccurate or fraudulent.

Since hard inquiries have only a small effect on your credit score and they go away after two years, you shouldn’t waste your time trying to get them taken off your report. The wiser action is to limit the number of credit applications you make over a short period of time.

How To Remove Hard Inquiries From Credit Reports

Your credit reports are filled with data about your credit obligations and how you manage them. What you might not realize is that your reports contain other important details as well, like records of when others access your credit information. These records are known in the credit world as inquiries and heres how to remove hard inquiries from credit reports.

Some inquiries, called hard inquiries, have the potential to trigger a drop in your credit score. Read on for a breakdown of how inquiries work and whether its possible to remove them from your credit report.

Review Your Credit Reports For Free

Your first step in reviewing hard inquiries is to pull your own credit reports.

But dont worry, you wont be dinged for checking your credit because as a consumer you are entitled to a free report annually from each of the credit bureaus.

The three credit agencies are Equifax, Experian and TransUnion. But you can also visit MyFICO for obtaining your reports and your credit score.

Its tempting to not look at your credit too often, but trust me, knowledge is power!

Youre not only evaluating your current score, but youre confirming if the hard inquiries listed are legitimate.

Recommended Reading: Does Cancelling A Loan Affect Credit Rating

Could I Be Turned Down For Credit Because Of A Previous Occupant At My Address

When someone leaves a property, their financial details stay attached to them rather than the address. Someone else can affect your chances of getting credit but only if you have a financial association with them like a joint bank account or joint mortgage, not because you lived at the same address.

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Don’t Miss: Raise Credit Score 50 Points

What Is A Notice Of Disassociation

A notice of disassociation is a request from you to TransUnion to remove financial associates from your file. Following various checks to ensure the financial association has genuinely ended, TransUnion will then remove the financial associate from your file.

Once the association has been removed, that other persons credit rating will not be taken into account when lenders are assessing how creditworthy you are.

Having Too Many Inquiries Can Lower Your Credit Score

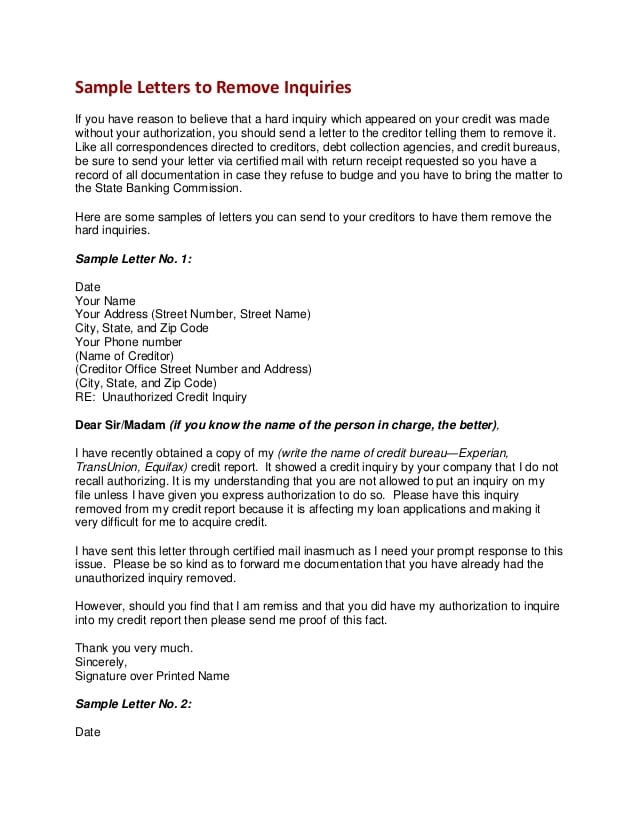

Find the tab to file a complaint through their website under the category of credit reporting. list your inquiries desired to be deleted, and include that their customer service would not help and take care of the negative inquiries reporting to your credit report. The company pulling your credit must provide documented proof, for example a document with your signature on it, that you authorized and provided consent for the hard inquiry. Upsolve is a nonprofit tool that helps you file bankruptcy for free.

Read Also: Aargon Agency Complaints

How Credit Scores Are Affected By Hard Inquiries

When a hard inquiry is reported, be aware that you may see a minor decrease in your credit score. This decrease will last for about a year.

If you are in the market for a car or house and need to shop around for favorable loan terms, you should focus on keeping your inquiries within a 30-day time frame. All inquiries during this time frame will count as one, having a minimal impact on your score.

You may see a 1 to 5-point reduction in your score. However, continuing to pay on time and maintaining your good credit will result in a bad credit score increasing into the good territory over time.

Monitoring your credit utilization and refraining from obtaining new credit are other tactics to mitigate the effects of hard inquiries on your credit score.

I have found the point reduction to be minute in comparison to the decline in my score due to an increase in my credit card balance. With an inquiry requesting information on a car refinance, I saw a drop of two points. With the credit card balance increase, there was a on my report.

What To Do If You Spot A Problem

If you cant trace the reason for a hard inquiry or you believe it was done without your consent, you can dispute it online. If the credit bureau cant confirm it as a legitimate inquiry, its required to remove it. Contact each credit bureau individually:

If you suspect fraud, you can have a fraud alert added to your credit reports, which flags applications in your name as requiring extra scrutiny. Alert any one credit reporting agency it will share information with the other two.

Or, for the best protection, simply freeze your credit with all three bureaus to stop anyone from opening new credit in your name.

Read Also: What Is Syncb Ppc

When Can You Benefit From Inquiry Removal

- When you apply for a Mortgage loan If you have a credit score above 680 and are trying to get a loan, it is prudent to get the inquiry removed from your credit report. A crucial point to note here is that there should be no negative impact on your credit history such as late payments or bankruptcies.

- When you are looking for business loan funding Out of all the different types of lenders, business credit lenders treat inquires the harshest, especially business-related inquiries and recent inquiries. They even turn down people with perfect credit scores just because they have too many inquiries. Creditors rely heavily on debt-to-income ratios to make lending decisions. Since business loans generally do not reflect on personal credit reports, a business credit lender has no way to determine how many pre-existing business loans an applicant has. Therefore, they look at business loan related inquiries to understand if the applicant has any pre-existing business loans. They are also concerned with recent inquiries, as recently opened accounts may take up to 90 days to appear on the . Usually, for business or any type of corporate credit, having several business loan inquiries may disqualify you as a debtor. Additionally, credit card companies, like those offering rewards programs, often decline applications based on excessive inquiries.

How To Dispute A Hard Inquiry On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve checked your credit reports, you may have noticed youre not the only one taking a peek.

-

Utilities use them to decide whether to charge you a deposit.

-

Companies may check your credit standing so they can market products to you.

-

Potential landlords and employers may look to see how reliable you are.

Inquiries stay on your report for two years, but not all of them affect your score. Heres what you need to know about when and how to remove a hard inquiry from your credit report.

Recommended Reading: How Long Can A Eviction Stay On Your Credit

Can Anyone Search My Report

No. We only allow access to your report in accordance with the General Data Protection Regulation and the industry rules which govern credit reference agencies. These put firm restrictions on who sees and what information we can provide from your credit report. For example, an organisation with which youve applied for credit may access your information, or on occasion, we may be required to provide information to the police or other government agencies.

Youre A Victim Of Identity Theft

If you see a SYNCB/GAP hard inquiry on your credit report but youre sure you didnt apply for a Gap credit account, it could be a sign of identity theft.

If you think that SYNCB/GAP is on your credit report because someones trying to fraudulently open accounts in your name, take these steps:

You may also want to freeze your credit .

Carefully monitor your credit reports over the next few months for further signs of fraudulent activity.

Also Check: Bby Cbna

How To Remove Hard Inquiries From Your Credit Report

Upsolve is a nonprofit tool that helps you file bankruptcy for free.Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we’ll never ask you for a credit card.Explore our free tool

In a Nutshell

A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible. This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

Navigating your credit score can be confusing, since there are many personal finance factors to deal with. One issue is âhard inquiries.â A hard inquiry is a record of every time that a creditor or lender runs your credit report to help decide what kind of credit or loan to grant you. When someone runs a credit check, it harms your credit score. Given the potential harm, you should look to remove as many hard inquiries as possible.

This article takes you through how to remove hard inquiries from your credit report. It discusses which hard inquiries are removable and the specifics of disputing them.

If You Suspect Fraud Act Quickly

But if a hard inquiry you didnt authorize is on your credit reports, it may be because

- Someone fraudulently applied for a credit account using your information

- A creditor pulled your credit even though it didnt have your permission

- The credit bureau mistakenly added the inquiry to your report

If an unauthorized hard inquiry was due to someone else applying for credit with your information, it could be an indication that your identity was stolen. You might want to take some additional steps as soon as you spot the suspicious activity to help prevent further misuse of your information, such as

- Putting a fraud alert on your credit reports

- You may even want to consider a or locking your credit

You should also continue to check your reports to see if a fraudulent account appears following an unauthorized inquiry. If a fraudulent account appears on your credit reports, youll want to contact the creditor to close the account.

If a creditor pulled your credit without your permission or a credit bureau mistakenly added an inquiry to your report, the incorrect hard inquiry could still harm your credit until you take action.

No matter how it got there, youll want to file a dispute with the credit bureau whose report shows the incorrect hard inquiry to request that the bureau remove it.

Recommended Reading: Can Overdraft Affect Credit Score

Some Of My Credit Agreements Dont Appear On My Statutory Credit Report Why Not

There are a few reasons why this may happen:

- Recently opened opened and information has not yet been shared with TU

- Information from this provider is not shared with TU at all,

- this is a really old account and at the time of signing it was not as common for users to be notified inforamtion would be shared to CRAs and in this instance the user will need to contact their lender to share their data for CRA purposes.

Although we hold millions of accounts on our database, some lenders dont contribute information about their credit agreements to TransUnion. They may supply data to all three CRAs or only to one or two agencies.

How Hard Inquiries Impact Your Credit Score

Hard inquiries may, but do not always, impact your credit scores, Ulzheimer said, noting that one of the most common misconceptions about credit inquiries is that they always have a negative effect on your credit score. If a hard credit inquiry does negatively impact your credit score, it is likely to drop by no more than 10 pointsand the damage should last no longer than a year. Hard inquiries automatically fall off your credit report after two years.

The impact, if any, will last 12 months, Ulzheimer advises. Once an inquiry becomes older than 12 months, they are not seen by either FICO or VantageScores credit scoring models.

You May Like: How To Get Rid Of Repossession On Credit Report

Carefully Plan Your Hard Inquiries

Dont start applying for credit until youre serious about it, then you can stick to this time frame.

If you are shopping around, youll start to have separate hard inquiries stack up on your credit reports when they are spread out over time. It always helps to have a financial goal with a deadline so you can plan your inquiries in advance.

If youre not applying for too many types of credit at the same time, then you probably wont have to worry about disputing inquiries you can just leave them alone.

However, if you have several different types of inquiries, you may want to consider disputing them because they can add up as lost points. And if your credit score is borderline between two scoring categories, then every few points can make a difference.

How Do I Know If I Have Too Many Credit Inquiries

Well, no one can put a concrete number on how many credit inquiries is too many. If youre concerned about the number of inquiries on your credit history, the first step is to get a free copy of your credit report. Its not so much about the number of inquiries, but more so the time between them.

For example, if youve applied for five credit cards in a period of three months and have five hard inquiries as a result, its likely to be considered as a negative detail on your report. In contrast, having five hard credit inquiries listed over a period of five years will have far less of an impact, or sometimes none at all.

I think I have too many inquiries on my credit report, what should I do?

So if you looked at your credit report and you think the number of credit inquiries listed could have a negative impact on your credit, you can start to improve your credit score in other ways:

You May Like: Does Sprint Report To Credit Bureaus

Inquiries Arent A Major Factor In Your Credit Score

Examples of soft inquiries include when a utility company considers whether they need security deposit from you, when credit card companies decide what types of credit cards to market to you and for setting premiums on insurance. Additionally, when you pull a credit check on yourself through a credit monitoring service, itâs a soft inquiry. Since these credit inquiries do not deal with lending you money, but still provide valuable information about your credit history, it would be unfair if they counted against your credit score.

According to Experian, inquiries wonât affect you unless you also have other – more serious – issues impacting your credit score. Multiple credit inquiries are ultimately a reality of life. For example, when you are looking to buy a car and want the best auto loan rates, a dealership might engage in rate shopping, where they send your information to an array of lenders. Due to this issue, all inquiries related to an auto loan that are sent within 14 days will all count as one inquiry.

Additionally, there are even credit scoring systems that will not count a credit inquiry after more than one year. As noted above, hard inquiries will not remain on your credit report for more than two years. So over time, an individual inquiry counts less.

Would You Like To Find Out How You Can Remove Most To All Of Your Inquiries From Your Transunion Credit Report

Follow these important steps for a quick do it yourself approach to removing hard and soft inquiries reporting to your TransUnion credit report.

Keep in mind this will ONLY work for TransUnion inquiries.

Step One.

You will need to pull and obtain an official copy of your credit report. In this case Credit Karma and FreeCreditReport.com

will not work for this process. I recommend using ScoreSense or to monitor and pull an accurate credit report.

Step Two.

After listing the inquiries reported on your TransUnion credit report you will need to call the TransUnion 1-800 to speak to a representative and tell them that you have been a VICTIM of their inquiry issue. Make sure to keep the list of inquiries from your credit report close, as you will need to list off the inquiries to the representative they will remove them for you.

Step Three.

Remember now, the bureaus are not here to help, rather then keep you as a victim of poor credit because they PROFIT from BAD CREDIT. You may or may not run into the conversation with the representative stating that you were NOT a victim of their faults with the misreported inquiries.

Step Four

Step Five.

Once you have completed steps 1-4 check back to your credit monitoring site in about 5 days and

VUA LAA!

You May Like: Cbna Stands For