What Happens When You Close An Account

When you close an account, it’s no longer available for new transactions, but you’re still required to pay off any balance outstanding by paying at least the minimum owed each month by the due date.

After the account is closed, the account status on your credit report gets updated to show that the account has been closed. For accounts closed with a balance, the creditor continues to update account details with the credit bureaus each month. Your credit report will show the most recently reported balance, your last payment, and your monthly payment history.

It’s Possible To Negotiate A Pay

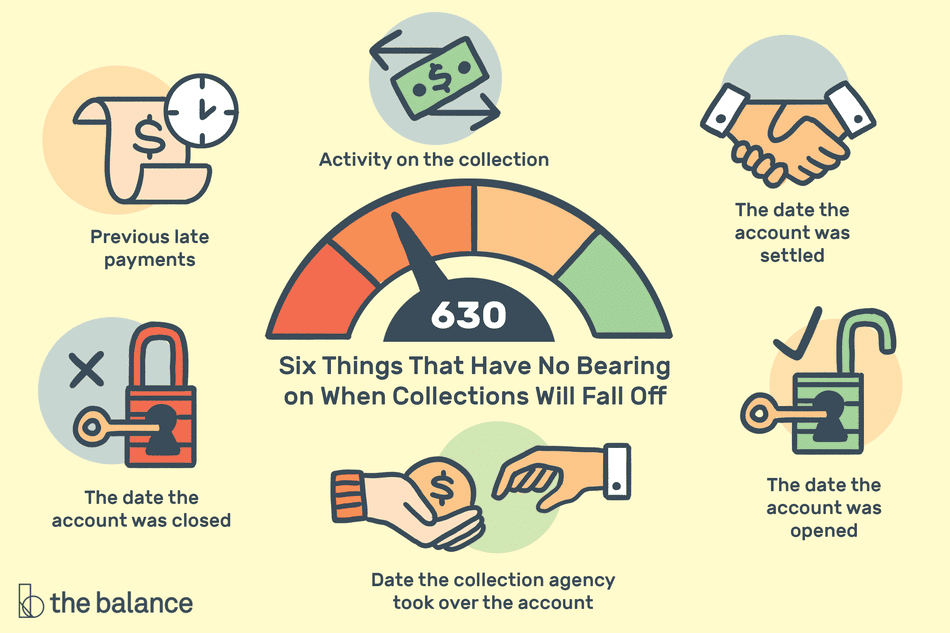

Your is important for buying a home, getting a car loan in your name, or just opening a credit card account. A significant part of your score is based on how you manage payments for loans, credit cards, and other types of credit. Having an account fall delinquent can lead to a charge-off, which can cost you major credit score points.

Negative information, including charge-offs, can remain on your credit history for up to seven years. But it may be possible to remove a charge-off from your credit sooner than that so you can begin rebuilding your credit score.

How Long Does Positive Information Stay On Your Credit Report

Positive information on credit reports includes types of loans youve held, length of a loan, amounts of loans, and repayment history. However, you must manage debt responsibly for this information to reflect as positive. Essentially any account paid as agreed, both active and closed, provide positive information.

This could show creditors you pay regularly and on time, and that you can manage many types of loans. Positive information can stay on your credit report forever. Usually, credit bureaus will stop showing positive information after 10 to 20 years.

The credit bureaus of Canada are TransUnion and Equifax. They each have unique reporting practices. They hold information for slightly different time lengths.

Read Also: Disputing Old Addresses Credit Report

When It Comes To Knowing What Is And What Is Not On Your Own Credit Report

If youre curious and want to know what is and what is not on your own credit report, get a free copy of your credit report from both Equifax and TransUnion. Take a look to ensure that all of the information is accurate. When you get your credit report, it will come with special instructions about how to correct errors, however, they must be true mistakes. Information that is not favourable, but is still accurate, will unfortunately have to stay. No one can have that removed, so avoid tempting credit repair offers from companies that tell you otherwise.

If you have question about how to deal with the debts listed on your credit report, contact us for help. Wed be happy to take a look at your situation and provide you with information and guidance about how to resolve your situation.

Worried about your credit?

Get answers from an expert.

Whether its about keeping, building, or rebuilding your credit, we can help if youre feeling overwhelmed or have questions. One of our professional credit counsellors would be happy to review your financial situation with you and help you find the right solution to overcome your financial challenges. Speaking with our certified counsellors is always free, confidential and without obligation.

Review Your Credit Reports

Regularly reviewing your from the three major consumer credit bureaus Equifax, Experian and TransUnion could help you spot something is amiss, such as a mistakenly reported late payment.

A late payment is commonly associated with a credit account. Depending on which credit bureau provides the credit report with the late payment listed, it may be highlighted in some way . And depending on the credit bureau, your reports may also indicate how late the payment was.

Because your credit reports may not be identical, its important to review your reports from all three of the major consumer credit bureaus.

Also Check: Can A Closed Collection Account Be Reopened

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

How Closed Accounts Affect Your Credit

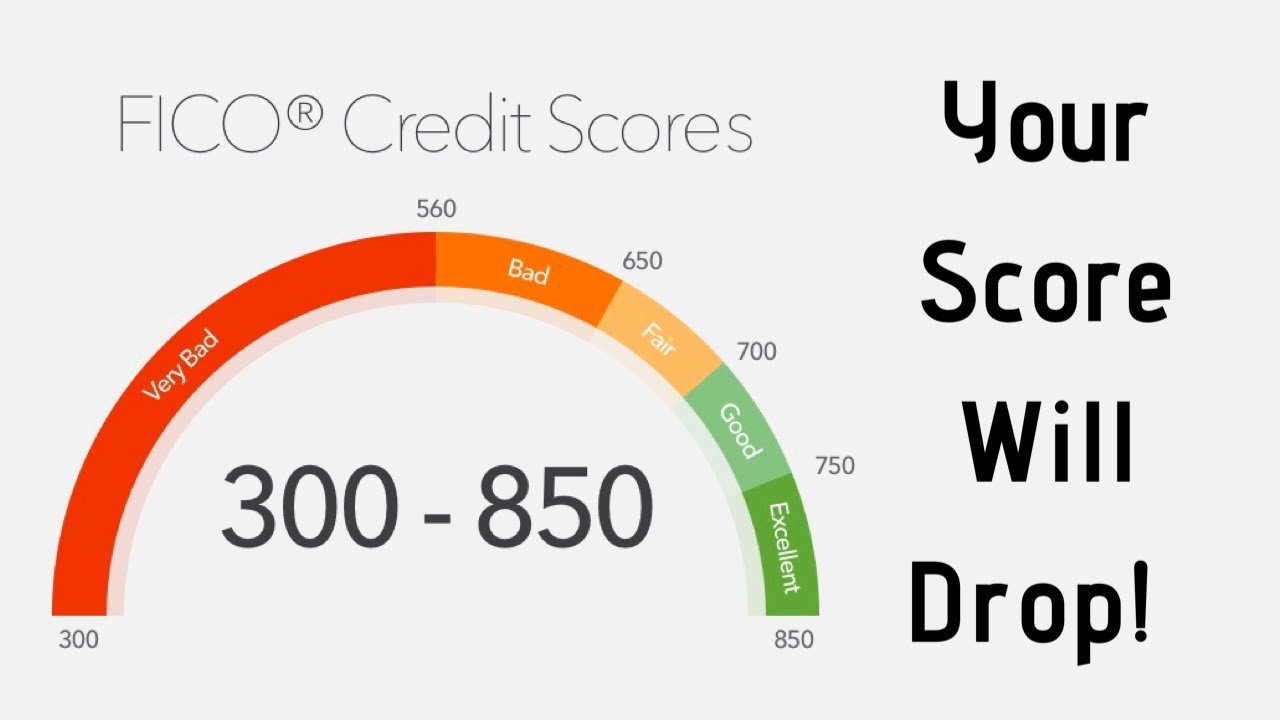

Your FICO credit score is determined by a wide range of factors including your payment history , how much debt you owe , the average length of your credit history , new credit and your credit mix . compile this information on your credit reports, which they use to determine where your score falls.

The two main areas where closed accounts can affect your credit score are the length of your credit history and the amounts you owe. Heres how:

- Certain closed accounts can increase your credit utilization rate. When you close a credit card account specifically, you are reducing the amount of open credit available to you. This can cause your credit utilization rate to increase, which could have a negative impact on your credit score. Note, however, that installment loans like personal loans do not affect your credit utilization. For this reason, a closed personal loan account would not affect your credit utilization rate.

- Closing an account can decrease the average length of your credit history. The length of your credit history is partially determined by the average age of all your credit accounts combined. As a result, closing an account can reduce the average length of your credit history, and thus impact your credit score in a negative way.

You May Like: Does Affirm Affect Credit Score

What Are Other Ways To Improve Your Credit Score

You can build healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

Your Credit Utilization May Increase

Your credit utilization rate is the portion of revolving credit youre using compared to how much you have available generally expressed as a percentage. If you close a revolving account, such as a credit card, the total amount available decreases.

When that happens, your credit utilization could increase, which may lower your credit scores. In general, most experts recommend keeping your rate below 30%.

Read Also: Does Eviction Show On Credit Report

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

What Negative Information Appears On Your Credit Report

Equifax and TransUnion are the two main credit reporting bureaus in Canada. The reports are often different between the two since not all creditors communicate with both credit bureaus, and each credit reporting agency has its own purge rules as to when information is removed from your report. Thats why it is always best to understand how each credit bureau treats negative information.

Below is a list of negative items that can appear on your report and the purge periods.

Read Also: What Credit Score Does Care Credit Use

What Type Of Credit Information Shows Up On My Credit Report

Your credit report contains all important information, the good and the bad, regarding your credit accounts. A credit account is a general term used to describe credit cards, lines of credit and loans. If you have one or all of these credit products, they will appear on your credit report with the following information:

- Payment history, both on time and late payments.

- Closed accounts because of fraud

- Bankruptcy

- Foreclosure

- Garnishment

Most lenders and creditors report directly to one of the two main in Canada, TransUnion, and Equifax. The credit reporting bureaus then create credit reports that are used by creditors and lenders to assess a potential borrowers creditworthiness.

Take a look at for a breakdown of your credit score.

How Long A Closed Account Stays On Credit Report

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Many people make the mistake of thinking that closing a credit card will remove it from their credit report. Only, it doesn’t. Your credit report provides a complete picture of your credit history and that means reporting both open and closed accounts that are accurate and timely. There may be some good news if youre hoping for a closed account to eventually disappear from your credit report.

Don’t Miss: What Is A Factual Data Credit Inquiry

How Long Do Closed Accounts Stay On My Credit Report

When you close an account, it may not be removed from your credit report immediately. This is true whether the closed account is a credit card or an installment loan. Closed accounts stay on your report for different amounts of time depending on whether they had positive or negative history. An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

When Should You Remove A Closed Account From Your Credit Report

You may be wondering, Can I have closed accounts removed from my credit report?

For the most part, it only makes sense to try to remove a closed account from your credit report if some negative information has been reported. This is especially true if the negative details reported are incorrect.

Fortunately, you do have some options when it comes to having information from your credit reports removed, or at least trying to get information removed. Heres how to remove closed accounts on your credit report.

Read Also: Does Cashnetusa Report To Credit Bureau

Pay Your Bills On Time

It may sound obvious, but theres no better thing you can do to counteract those late payments or negative items than to immediately start paying ontime. Youd be surprised how quickly ontime payments can outweigh the bad stuff. Then, its just a matter of hanging in there. The older the late incident gets, the more your scores will improve.

Late payments and negative information can hurt your credit scores, but as long as youre diligent about getting and staying current, your credit score will recover sooner than you think.

What Happens When You Close A Credit Card

When you close a credit card, it doesnt fall off your credit report right away because it’s still within the credit reporting time limit.

If you’re still making monthly payments on a credit card balance, your payment history will continue to be updated each month. Once you’ve completely paid off the balance, the credit card issuer will eventually stop sending monthly updates for that account since it becomes inactive.

Paying at least the minimum on time is important even after you’ve closed your account. Any payments late by 30 days or more will be updated on your credit report and included in your . These late payments can stay on your credit report for up to seven years. You’ll also be charged a late fee.

The account status for a closed credit card will be reported as closed, even when you’re still making payments on the balance. The status may indicate that the account was closed by you, the cardholder, or the , depending on which of you closed the account. If your account was closed with a delinquency, like a 90-day late notice or a charge-off, that will show on your credit report, too.

Also Check: What Credit Score For Care Credit

How Long Does Information Stay On Your Reports

The FCRA limits how long a credit reporting agency can report negative items in your credit report. Items that aren’t negative but are neutral or positive can be reported indefinitely. Review the rules below and then check your credit report for negative items that are too old to be reported.

No Negative Credit Reporting If You Make an Agreement Due to Coronavirus

Under the federal Coronavirus Aid, Relief, and Economic Security Act, if you make an agreement with a creditor to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or get any other assistance or relief because COVID-19 affected you, the creditor must report the account as current to the credit reporting agencies if you weren’t already delinquent.

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

You May Like: How Long To Raise Credit Score 50 Points