How To Remove Negative Items From Your Credit Report

Its smart to know how to remove negative items from your credit report, especially if you are soon to be applying for a mortgage or car loan.

In fact, you can remove something from your credit history before seven years pass.

Whatever youre dealing with, late payments, collections, charge offs, or foreclosures, the following techniques can clean up your credit quickly.

How To Delete A Credit Account From Equifax

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.There are 10 references cited in this article, which can be found at the bottom of the page. This article has been viewed 53,337 times.

In the United States, Equifax is one of the three major credit reporting agencies . You can remove a credit account from your Equifax report if the account is not yours or if the account was closed. You can easily request that an account be removed by contacting Equifax, either online or by letter. If Equifax wont remove the account, then you can file a statement of dispute. You can also ask the creditor who reported the account to remove the information.

Something Fell Off Your Credit Report

Thankfully, missed payments and derogatory marks wont stay on your credit report forever. The greater the age of those marks on your credit score, the less impact they have, so you may see your score recover over time while your behavior is kept consistent.

Late payments over 30 days will remain on your credit report for seven years, while derogatory marks like bankruptcy can remain on your report for up to 10 years. Over time your score will recover, and once these marks fall off your credit report, you may see an instant boost in score.

Don’t Miss: How To Get Car Repossession Off Credit Report

Identify Any Credit Report Errors

Review your credit reports periodically for inaccurate or incomplete information. You can get one free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion once a year at annualcreditreport.com. You can also subscribe, usually at a cost, to a credit monitoring service and review your report monthly.

Some common credit report errors you might spot include:

- Identity mistakes such as an incorrect name, phone number or address.

- A so-called mixed file that contains account information belonging to another consumer. This may occur when you and another consumer have the same or similar names.

- An account incorrectly attributed to you due to identity theft.

- A closed account thats still being reported as open.

- An incorrect reporting of you as an account owner, when you are just an authorized user on an account.

- A remedied delinquency such as a collections account that you paid off yet still shows as unpaid.

- An account thats incorrectly labelled as late or delinquent, which could include outdated information such as a late payment thats over 7 years old or an incorrect date regarding your last payment.

- The same debt listed more than once.

- An account listed more than once with different creditors.

- Incorrect account balances.

- Inaccurate credit limits.

Late Payments And Defaults

Late payments can be notified to a credit agency when they are more than thirty days in default. Most late payments notified to the credit agencies are from either the credit card companies or the utility providers.

Not all utility companies report payments to credit reference agencies but the number that do is increasing. More and more lenders are starting to pass their data onto these agencies and you may soon see all your personal and household bill payments recorded on your credit file.

Open accounts stay on your report indefinitely and settled or closed accounts can remain on your credit file and available for future lenders to see for six years.

Read Also: Report A Death To Credit Bureaus

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

You May Like: Does Removing An Authorized User Hurt Their Credit Score

How To Get Rid Of Closed Accounts On Your Credit Report

If your credit card has been closed, you can try calling your credit card issuer to ask if the account can be reopened, but dont wait too long.

If a closed account on your credit report is reporting inaccurately, then you can dispute it and have the update the account with the correct information or remove it.

Contact each credit bureau or check their websites for instructions on how to dispute accounts on your credit report.

Can You Ask Creditors To Report Paid Debts

Positive information on your credit reports can remain there indefinitely, but it will likely be removed at some point. For example, a mortgage lender may remove a mortgage that was paid as agreed 10 years after the date of last activity.

Its up to the lender to decide whether it reports your account information to the three credit bureaus. That includes your debt thats been paid as agreed. You can call the lender and ask it to report the information, but it might say no. However, you can add positive information to your credit reports by using your existing credit responsibly, like paying off credit card balances each month.

Don’t Miss: How To Take A Repo Off Your Credit

How To Remove Items From Your Credit Report In 2021

Weve outlined how to remove negative items from your credit report, the paid services you can opt to use, and additional information to have on hand. It is important to clarify that only incorrect items can be removed. If youve done this already, but your credit score is still low, you will need to repair bad credit over time. Although accurate items cannot be removed by you or anyone else, there are still many credit report errors that can damage your score, and these are worth looking out for.

What To Do If You Find A Closed Account On Your Credit Report

If you have a closed account on your credit report, what you need to do next depends on whether you know why it was closed and if the information is correct.

- No action required. If you asked the creditor to close the account or you paid off a loan, theres nothing necessary for you to do.

- Contact your lender. If you dont know why the account shows as closed, the creditor might be able to tell you. If your creditor closed it, you can ask if itll reopen the account, but its not required to. Either way, you know it wasnt a credit bureau error.

- File a dispute. If the lender didnt close the account or you dont agree with what its reporting, you can file a dispute with the credit bureaus. Youll need to explain in writing whats wrong, provide documentation that shows why you believe the information is inaccurate, and mail it to the credit bureau or bureaus. The Federal Trade Commission has detailed instructions on how to file a dispute.

You May Like: Klarna Credit Approval Odds

Having A Creditor Remove The Account

How To Request Pay For Delete

To ask for pay for delete, youll need to send a written letter to the creditor or debt collection agency. A pay for delete letter should include:

- Your name and address

- The creditors or collection agencys name and address

- The name and account number youre referencing

- A written statement saying how much you agree to pay and what you expect in return with regard to the creditor removing negative information

Youre essentially asking the creditor to take back any negative remarks that it may have added to your credit file in connection with late or missed payments or a collection account. By paying some or all of the outstanding balance, youre hoping that the creditor will show goodwill and remove negative information from your credit report for that account.

Read Also: How To Get Credit Report Without Social Security Number

You Have Defaulted On An Account

An account is in default when the borrower has missed payments and the account is then closed by the lender. There is no set number of missed payments that result in a default being recorded. This is down to the individual lender, but when they believe a debt can no longer be recovered they record a default.

If a debt cannot be recovered many lenders sell the account to a debt collection agency. This will show negatively on your credit file and will remain on it for a period of six years from the default date, regardless of any settlement. After this time it is removed from your report automatically even if the full amount has not been settled.

Although a default will be removed from your report after 6 years the lender may still pursue you for the debt, unless the debt is statute barred. A statute barred debt is a debt which is seen as unenforceable as the creditor has not chased it in the period allowed. If you have not been chased for payment, have not made payment or signed any acknowledgement of a debt in writing for 6 years in England and Wales and 5 years in Scotland then it could be statute barred.

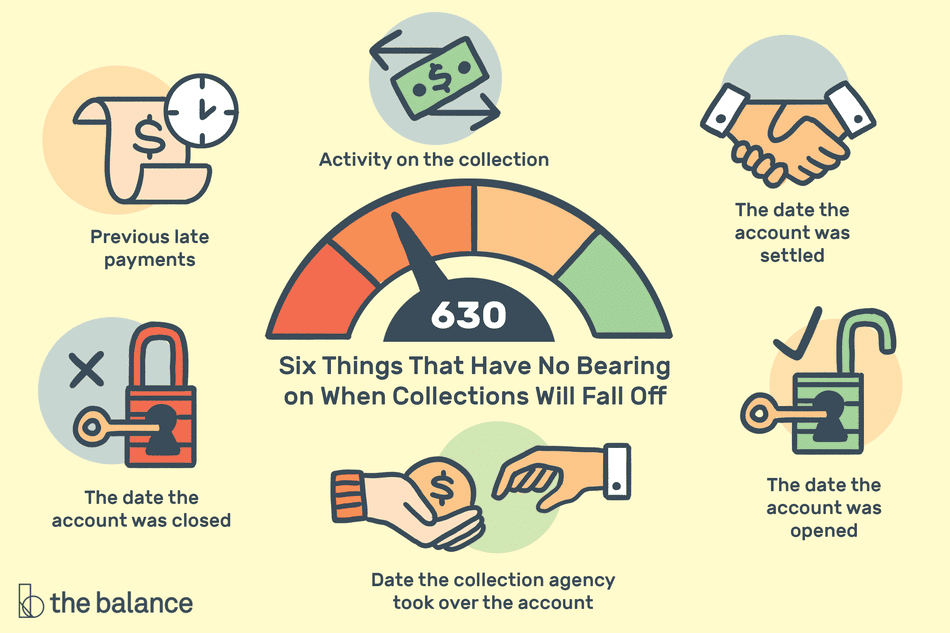

Review Your Credit Report For Answers

If you’re wondering when a specific collection account will fall off your credit report, pull a copy to review. You can get a free one from AnnualCreditReport.com once a year. Review the history for the original account to check the date of delinquency and add seven years to that date. That’s about when you can expect the collection account to drop off.

Read Also: Does Carvana Report To Credit Bureaus

Write A Goodwill Letter

A goodwill letter is a formal request to a creditor asking for a negative item to be removed.

Although creditors are not required to remove negative items upon request, they may be willing to do so if you have a long history with them or if there were special hardships that led to the negative item.

However, goodwill letters are generally useful only for late or missed payments rather than collections, repossessions or other more significant negative items.

In addition to goodwill letters, you can also request that an account is removed using a pay for delete letter. These letters can lead to an agreement with a collection agency to remove an account in exchange for a set payment. That said, the collection agency may decide not to remove the account, and the original account that went to collections may remain on your report.

An Account Has Closed

When you pay off a loan, your credit score could be negatively affected. This is because your credit history is shortened, and roughly 10% of your score is based on how old your accounts are. If youve paid off a loan in the past few months, you may just now be seeing your score go down.

Your score could be negatively impacted by a closed credit card, too. Not only is your credit history shortened, but your credit limit would also decrease and your credit utilization ratio would be impacted.

Often youll be the one authorizing a credit card to close, but card companies can close them without your knowledge. The Equal Credit Opportunity Act allows creditors to close a card due to inactivity, delinquency or default with no notice. If they close an account for any other reason, they only have to give you 30 days notice after closing the account, so you could have a closed credit card that you dont know even know about.

Also Check: How To Make Your Credit Score Go Up Fast

Re: Remove Old Closed Accounts And Transferred Student Loans

Every year or so I would use the sample from this forum. I never use the electronic submission and stated the payments relected were incorrect and listed the late payments dates. Alot of times the credit cards will not verify and they have to be removed if not verified within 30 days. I did just use the online submission and chase removed an old providian late payment.

Only good thing with the banking crisis is they may not have the records handy to verify your late payments. If they come back verified, then next step is Good Will letter to the company asking them to remove the mark.

How Long Does Credit Information Stay On Your Credit Report

Categories

Your credit report is essentially your credit history. It compiles all the information concerning your credit habits and creates a tool that can be used by lenders and creditors to assess your creditworthiness. While your credit report does represent a good portion of your credit history, the information is not saved for the total duration of your credit using life. Your credit information is eventually removed from your to make room for newer information.

Of course, the question on everyones mind is, how long does this credit information stay on my credit report for? This is what were going to take a closer look at so you can know exactly how long specific credit information will affect your credit report.

Don’t Miss: Is Creditwise Good

Removing Closed Accounts From Your Credit Report

In some cases, a closed account can be harmful to your credit score. This is especially true if the account was closed with a delinquency, like a late payment or, worse, a charge-off.

Payment history is 35% of your credit score, and any late payments can cause your credit score to drop, even if the payments were late after the account was closed.

Removing the account from your credit score could potentially lead to a credit score increase.

Removing a closed account from your credit report isn’t always easy, and is only possible in certain situations.

If the account on your credit report is actually open but incorrectly reported as closed, you can use the to have it listed as an open account. Providing proof of your account status will help your position.

Having a credit account reported as closed could be hurting your credit score, especially if the credit card has a balance. You can dispute any other inaccurate information regarding the closed account, like payments that were reported as late that were actually paid on time.

What Can I Do To Minimize The Impact Of A Late Payment

First things first: If your bills are past due, the sooner you can pay them off, the better. As we noted above, the damaging effects of a late payment on your credit scores can increase if you let the delinquency drag on.

But say you want to go a step further and try to actually remove a late payment from your credit reports. There are several ways you might try to go about this, and they differ depending on the particular situation.

Credit Karma offers free credit reports from two of the major credit bureaus, TransUnion® and Equifax®. You can dispute an erroneous late payment on your TransUnion credit report using . To start, simply click on the account with the error and look for Direct Dispute in the details of the account.

Also Check: Can I Get A Credit Report With An Itin Number