How A Credit Limit Increase Could Reduce Your Credit Score

If you are looking at your utilization ratios and decide to request a credit limit increase, your credit card company may check your credit score and pull your report from one or more credit bureaus.

This creates a hard pull on your credit file and can lower your credit score slightly for about a year. For most people, a will reduce your credit score by just a few points.

However, if you request multiple credit limit increases or open several accounts within the span of a few months, lenders could interpret this as a sign of increased spending or financial difficulties, which could make it harder to obtain additional credit at the best interest rates.

On the other hand, if your credit card company offers you a credit limit increase based on your past behavior of making on-time payments and keeping your credit utilization below 30%, accept it.

When a creditor issues a credit limit increase unsolicited, they arent permitted to do a hard pull on your file. Instead, this is a soft pull. You will be able to see an inquiry was made on your credit report, but it doesnt affect your credit score. This is a good time to make sure to check your credit report for errors that could further damage your credit score or prevent you from getting a credit limit increase.

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Ask Yourself Why You Want A Credit Limit Increase

If youre thinking about asking for a credit limit increase on your credit card, the first step is to assess your current financial situation. Consider the pros and cons of a credit limit increase.

On the plus side, a higher credit limit may lower your credit utilization rate if you keep your balance under control, says Bruce McClary, vice president of public relations and communications at the National Foundation for Credit Counseling.

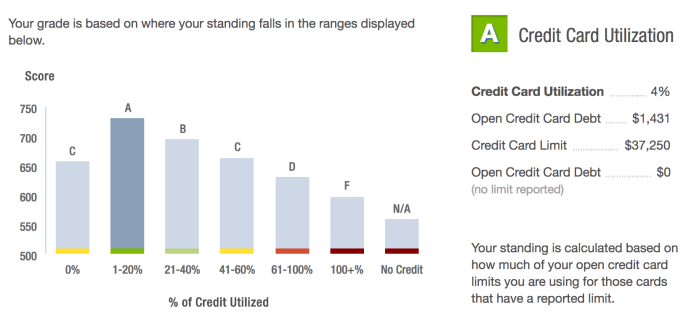

You can figure out your credit utilization rate by dividing your total credit card balances by your total credit card limits. Having a higher credit limit on one or several card accounts can help keep your utilization rate below 30%.

Then again, a higher credit limit could also lead to trouble. A higher limit may lead some to feel that there is that much more room to spend, warns McClary. Too much of a good thing can be bad, especially if you start opening more accounts with high credit limits.

As is usually the case, its best to spend responsibly and within your means. Just because a higher credit limit may allow you to charge an expensive electronic device or pay for a vacation doesnt mean that asking for a higher limit is the right option for you.

Read Also: Does Affirm Help Credit Score

Why Should You Ask For A Credit Limit Increase

A bigger credit line can be helpful when paying for unexpected emergencies, larger purchases over time, or smaller, day to day expenses.

Getting a higher credit limit improves your credit utilization ratio if you keep your spending the same. Generally speaking, a credit balance that is a low percentage of your total available credit is considered responsible credit use and may help your credit score.

That credit score is important for a variety of reasons. If you want to buy a house or a car, the better your credit score, the more likely you are to land that loan. You may also have a lower interest rate, because the higher your credit score, the less you seem like a risk to the bank.

Employers may also conduct a background check before bringing you on board, and they may want to understand your handling of credit, especially if your new job will entail handling money or finances.

How Do You Ask For A Discover Credit Limit Increase

To reach a customer service rep who can help you request a credit line increase on your Discover Card, call the phone number on your credit card. You can also select Card Services and then Credit Line Increase in the online Discover Account Center or Services and Credit Line Increase in the Discover Mobile App.

Don’t Miss: Navy Credit Union Auto Loan

Helps You Avoid Credit Score Dings

One way to get access to more credit is to get another credit card, but increasing your limit on an existing card might be a better option. According to FICO, opening a new credit card can ding your score. When you open a new account, it shortens the length of your , and a long history often means an improved score. The age of your oldest account, the age of your newest account, and the average age of all your accounts are factored into the length of your credit history. This metric affects around 15% of your score.

Is 750 Credit Score Good Or Bad 2022 Guide

If youre thinking about applying for a loan, such as a mortgage, personal or car loan and you have got a credit score of 750, then you have come to the right place.

Lets talk about the 750 credit score and how it will impact you.

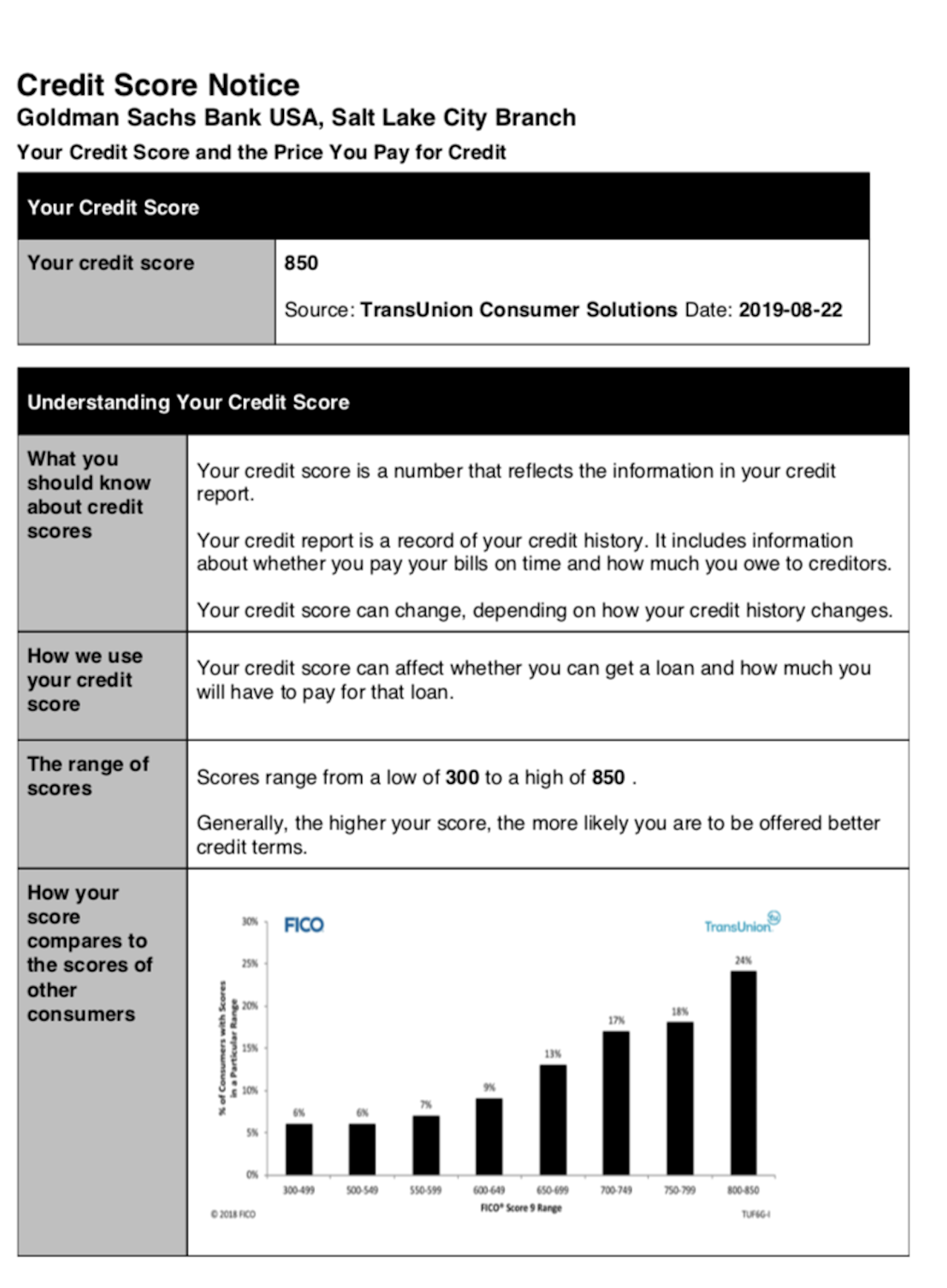

Those who want to borrow money generally have their lenders check their credit score. If your credit score is around 750, then it is considered a very good credit score.

The higher your credit score, the less risk your lender has that you will default on the loan. So, should you care if your credit score is low or high? Its important to understand what those things mean and the impact they may have on your future financial plans, but does it really matter?

Here is an overview of what happens when your credit score is 750 and how much this will cost you in fees, interest rates, and penalties.

PS: If you are looking for a loan with a 750 credit score then should contact loan providers such as ZippyLoans and OppLoans.

According to the FICO score, 750 credit is below average and is considered a low credit score. So, how can you get a personal loan with a 750 credit score?

If you have a credit score below 579 that means that you dont have a tidy credit history and that you are not making your payments on time, which ultimately reflects on the credit score range.

| From 300 to 579 |

Recommended Reading: How Do Mortgage Loan Officers Make Money

Recommended Reading: Credit Report Serious Delinquency

Benefits Of An Increased Credit Limit

One of the benefits of increasing your credit limit is being able to improve your credit utilization ratio. If you raise the amount of credit you can access but keep your spending at the same level or less, you will lower your credit utilization ratio, which could help your credit score. With a higher credit score, you may be able to access lower interest rates and better terms on future loans, such as a mortgage.

A credit card limit increase allows you to make larger purchases more easily. It can ensure your access to credit in case of emergency, like unexpected car or home repairs.

Is It A Hard Inquiry Or A Soft Inquiry

Depending on the card issuer, making a request for a higher credit limit can incur either a hard inquiry, a soft inquiry or both types of credit checks into your credit report, explains Rossman.

A hard inquiry occurs when a lender pulls your credit report this action typically causes your credit score to decrease between five and 10 points. Note that while a hard inquiry will only affect your credit score for up to one year, it will stay on your credit report for two years.

In contrast, a soft credit check doesn’t have any effect on your credit score. For example, Capital One would not perform a hard inquiry if they were to request an increased credit limit for one of their Capital One credit cards.

Keep in mind that most card issuers don’t publicly reveal which type of credit check they’ll perform on consumers requesting a higher credit limit, so you’ll want to call ahead and ask to be sure.

You can quickly request a credit limit increase for Citi credit cards, like the Citi® Double Cash Card, through the bank’s app with just a few taps. And reports indicate that Citibank will almost always only use a soft pull when making this request, however if you want a higher credit limit than what Citi initially offers you, they’ll then perform a hard pull. Citi also offers automatic credit limit increases which don’t result in a hard pull.

Terms apply.

Don’t Miss: Usaa Credit Check And Id Monitor

How Your Credit Score Is Computed

The calculation of your , be it FICO or VantageScore, takes the same factors into account, and each aspect is assigned a percentage. While both scores fall between 300 and 850, the percentages assigned to different factors vary slightly with both models. With the FICO model, new credit accounts for 10%, the amounts owed for 30%, your payment history for 35%, the length of your credit history for 15% and your credit mix for 10%.

When you request a credit limit increase, your lender might conduct a hard inquiry or a soft inquiry on your credit report. In case of a hard pull, it is regarded as an application for new credit and brings your credit score down by a few points temporarily. If you have good or excellent credit and keep your finances on track, the impact will wear off within a few months.

Pros Of Getting A Credit Limit Increase

Generally speaking, there are three main reasons why someone would want to increase the credit limit on their credit card:

Your Life Situation Has Changed: Many people start with a reasonable credit limit, often between $1,000-5,000. Depending on your life situation, it may originally have been a good amount, but sometimes you may need more spending power.

You’re Planning on Making More Purchases: For example, if you’re planning a big trip due to a special occasion like a honeymoon or anniversary, you may need to charge all your expenses to your credit card, which could be more than your current limit. You may also have a large purchase coming up, such as a laptop or tuition, where having the ability to pay with your card could help you manage the expense.

Avoid Overlimit Fees: A credit limit increase could come in handy if you carry a balance and tend to exceed your limit often. Check to see if your credit card charges overlimit fees.

Recommended Reading: Letter To Remove Repossession From Credit Report

When You Might Want A Credit Limit Increase

An increased credit limit can have a positive impact on your credit score, thanks to something known as credit utilization, which is basically the percentage of available credit youâre using. For example, if you have a credit limit of $10,000 with a balance is $3,000, your credit utilization would be 30 percent. But if your credit limit was bumped up to $15,000 and you kept the same balance, your credit utilization would drop to 20 percent. Many credit scoring formulas look at credit utilization as a significant factor that affects your credit score, and a lower utilization is better.

Having a higher credit limit gives you more ability to spend, which can translate into greater rewards. So if youâre financially stable and use credit cards for the convenience and the perks, having a higher credit limit can be particularly attractive, according to Bruce McClary of the National Foundation for Credit Counseling .

âYou may have reached a point where your credit history and financial behavior have earned you a top credit score, which qualifies you for credit cards that might reward you for your spending,â he says. So if you have a post-COVID trip or a big home renovation in mind, as long as you can pay your bill in full and on time, using a card with a larger credit limit can help you earn extra cash back or rewards points.

Increasing Your Credit Limit Has Upsides But Only If You Don’t Overspend

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Increasing your is merely an opportunity to spend beyond your means, right? Not necessarily. In fact, increasing your credit limit can have a number of upsides if you manage your credit wisely. For example, it can help you repair your credit, make large purchases efficiently, or use credit to handle a sudden emergency. A higher credit limit can even boost your .

There are at least six key benefits of increasing your credit limit.

You May Like: How Long Does Car Repo Stay On Credit

Things To Consider When Seeking A Higher Credit Limit

-

How this can affect your credit scores. Sometimes, requesting a credit limit increase may result in a hard inquiry on your credit report, which can temporarily lower your credit scores by a few points. If youre planning to initiate that conversation with your credit card issuer, find out the issuer’s policy first, and time your request carefully so it doesnt affect other loan or credit card applications.

-

How a higher limit might affect your spending habits. If you keep your spending at the same level as before, a credit limit increase can work in your favor. Thats because your credit utilization the amount of your total credit that you’re using will decrease. Credit utilization is a major factor in your credit scores, so keeping that figure low can help your scores over time. On the other hand, a higher limit can make it tempting to spend more, making it easier to get into credit card debt if you charge more than you can afford to pay back.

Pay Your Bills On Time

This is the easiest way to increase your credit card limit. Every six months or so, credit card companies review your credit and decide if your limit should be higher based on how youre handling your money. If you pay on time and pay off the balance every month they should offer to raise your credit limit.

Recommended Reading: Is Opensky Safe

Advantages Of A Higher Limit

Reduced Credit Utilization. When you accept a credit limit increase, as long you use it responsibly and forgo increasing your spending, it will reduce your credit utilization. Why does that matter? Credit utilization is one of the key criteria credit reporting agencies like Equifax and TransUnion use to calculate your .

Financial Emergencies. Credit doesnt just grow on trees. Credit can be hard to come by, especially when you need it most. If you run into an emergency, youll be glad you have the financial cushion. Although its almost always a good idea to have an emergency fund of three to six months living expenses set aside, there are some times when you may need to rely on credit.

For example, if youre a snowbird travelling to the U.S. and you run into an emergency, your credit card can help you out of a financial jam. Youll be thankful you have this extra credit at your disposal.

Reward Points on Major Purchases. If used responsibly, a higher credit limit can mean more of your daily spending can be moved to the credit card, and it turn earn more reward points. You can rack up a lot of rewards points by making major purchases on your plastic, instead of writing checks or using your debit card. Paying the taxman with your credit card and paying for major renovations are also great ways to accumulate a lot of points.

How Often Can You Request A Credit Line Increase

Theres usually no set timeframe to wait after requesting a credit line increase, and every issuer will have their own criteria for how frequently they will approve credit line increase requests for those in good standing. If you were approved for a higher credit line and your credit score has continued to improve, you may be approved for additional credit, but potentially not for months after your last request. After a denial, youll likely want to wait longer before submitting an addition credit line increase request and instead focus on good credit habits that can help improve your credit score .

Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

Read Also: How Do I Unlock My Transunion Credit Report

How Is A Credit Limit Increase Approved

When you ask for a credit limit increase, the credit card company may make a credit inquiry and look at factors like the following:

- Time since last additional credit request

- Annual income

- Employment status

- Payment history

Be realistic when looking at your financial situation and understand your creditworthiness in order to increase your chance of approval.

Another Way To Lower Your Credit Utilization

If you want to see your and you’re already doing a good job of paying your bills on time, then it pays to focus on your credit utilization ratio. But that doesn’t necessarily mean getting a credit limit increase. You can also bring that ratio down by paying off a chunk of your existing credit card debt.

Doing so won’t just help your credit score — it could also save you a lot of money by sparing you from more accrued interest. While there’s nothing wrong with attempting to raise your credit score by increasing your credit limit, it’s also important to whittle down the existing balances you have as quickly as you can.

Read Also: Raising Credit Score By 50 Points