What If The Credit Bureau Finds It To Be An Error

Take a moment to celebrate.

Then spread the news that the errors on your credit reports have been corrected.

Make sure your lender notifies all three credit bureaus, so they can adjust their records.

As an added safeguard, ask the credit bureaus to notify any lender that pulled your credit within the last six months, as well as any employer that pulled your credit during the last two years.

Determine Which Entries Can Be Disputed

Once youve spotted the items that are bringing down your score youll need to decide which items to dispute. You should focus on inaccurate items. Check your credit report against your own records to see what entries you should challenge. You should also look for duplicate entries and inaccurate information regarding your employers, addresses, names, and more.

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

Also Check: Does Getting Married Affect Your Credit Score

How To Actually Win Your Dispute

The Fair Credit Reporting Act requires the credit bureaus to conduct a reasonable investigation when a consumer files a dispute, although this rarely happens.

Unfortunately, the credit bureaus often rely too much on debt collectors and lenders that originally gave the incorrect information to investigate the dispute. If they verify the errors as correct, those mistakes will be stuck on your credit report, no many how many times you dispute.

There are steps you can take to get your dispute properly investigated, though. Heres what you need to do.

1. Look for even small mistakes

While youre probably quick to notice the big mistakes, like a court judgment that isnt yours, look for small mistakes that may be missed, like an incorrect address or your name misspelled. This may indicate a mixed file or even identity theft. This may also cause wrong information to get into your reports when lenders pull it, as they may get different information than you see on your personal file.

2. Highlight mistakes

Print off your credit report and photocopy the first page and the page with the mistake. Highlight any errors, even if its minor. For multiple errors, put a number next to each one, which makes it easy to refer to them during your dispute. Make a few copies of the marked up report one for your personal records and a few for your dispute letters.

3. Write your own dispute letter

4. Separate your disputes into multiple letters

5. Keep things simple

How To Dispute Errors On Your Credit Reports With Credit Karma Direct Dispute

If youre ready to take control of your finances, youve come to the right place.

While Credit Karma doesnt fix errors on your credit reports, Credit Karmas Direct Dispute tool can help you through the process of disputing an error on your TransUnion credit report in just a few clicks.

Since 2015, through Credit Karmas Direct Dispute tool, more than $10.2 billion in erroneous debt has been removed from TransUnion credit reports.

Now, lets walk through some common questions about Credit Karmas Direct Dispute feature, so youll know what to do the next time you spot an error on your credit reports.

Don’t Miss: What Credit Score Is Needed To Buy A Car At Carmax

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

How To Look Out For Credit Report Errors

As noted above, checking your credit reports is crucial to finding mistakes. The credit bureaus deal with millions of pieces of data on a daily basis, and mistakes are bound to happen. It is generally up to you to find and correct those mistakes when they happen. Checking your reports on a regular basis is the best way to do that. I like the idea of pulling at least one report every three months or so to check for errors. If you have access to credit reports through a credit card, you can check them even more often at no cost to you.

Also Check: What Credit Report Does Comenity Bank Pull

What Cant You Dispute On Your Credit Report

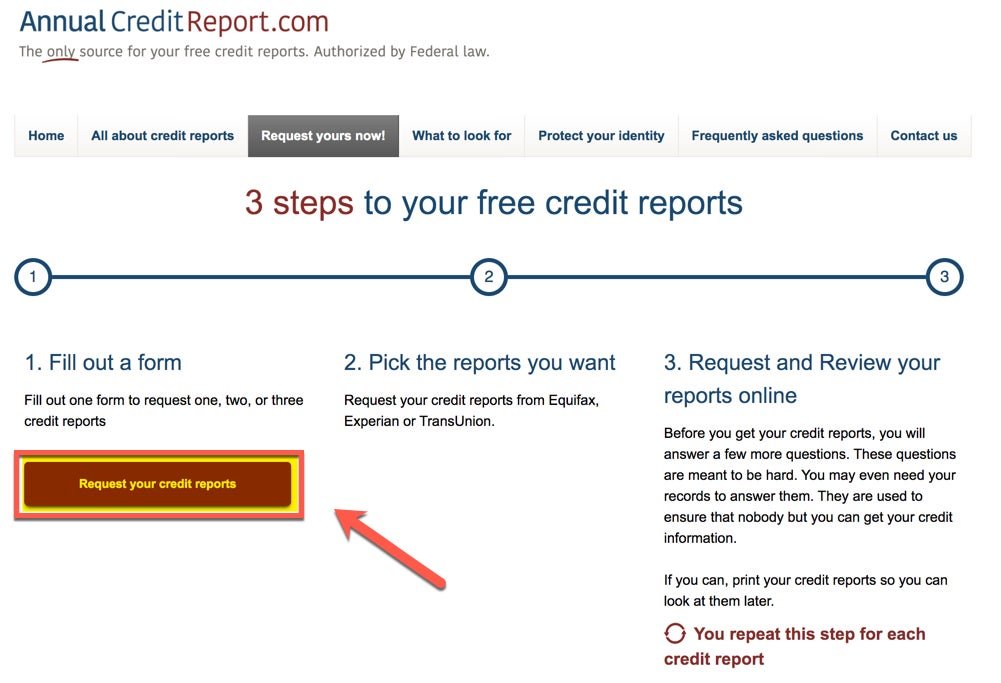

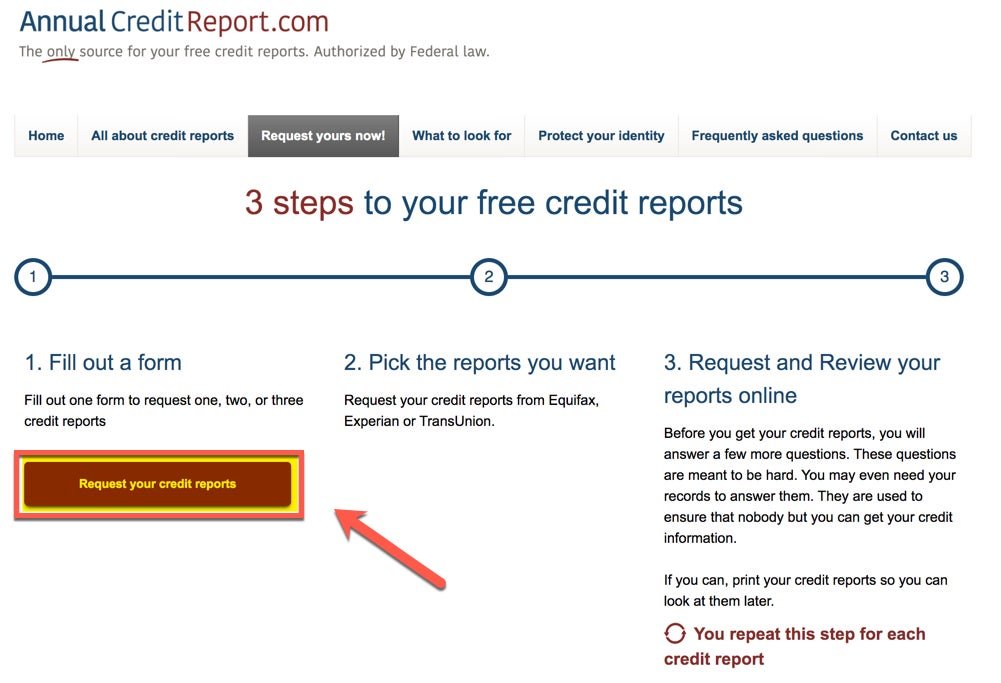

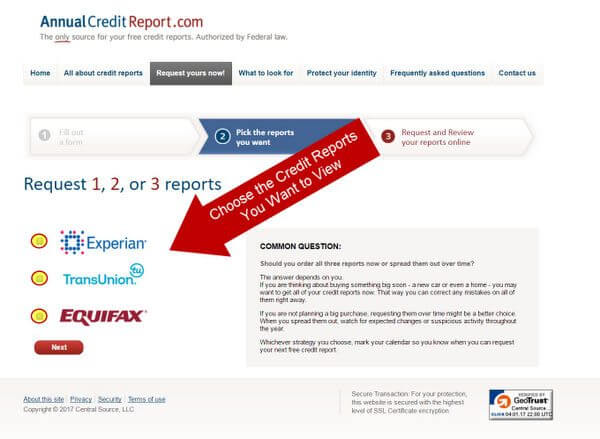

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

The three main consumer credit reporting agencies in the United StatesExperian, TransUnion and Equifaxeach maintain nearly 220 million credit files on U.S. consumers. These files contain a wealth of information about you and your credit management practices.

From time to time, you may find information on your credit reports with which you disagree. You have the right under the Fair Credit Reporting Act to dispute information on your credit reports, and have that information corrected or removed if it’s found to be inaccurate. There are, however, certain items on your credit reports which are more a matter of record and are not generally disputable.

What To Expect After Your Dispute Is Filed

Once your dispute is received, TransUnion must complete its investigation within 30 days and issue a response regarding the outcome. During that time, they will submit your information to the party that furnished the information and await a reply to confirm or deny your claim.

In most instances, youll be able to track the status of your dispute directly from TransUnions website.

If the outcome is successful, your TransUnion report will be updated to reflect the correct information. TransUnion will also send you an updated copy for your records.

If the outcome is unsuccessful, the information will remain on your credit report. And at this point, you may need to provide supporting documentation to the creditor or open another dispute and include this information to substantiate your claim.

Recommended Reading: Is 698 A Good Credit Score

What’s In Your Credit Reports

A credit report may include basic information about a consumer’s debts, creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The data in the reports from the different credit reporting agencies can vary to some degree, depending on which company produces the report.

The Best Way To Make A Dispute

There are actually four ways you can make your initial dispute. All 3 bureaus allow you to make a dispute online, although the Federal Trade Commission states that its best to prepare the dispute in writing and mail it to the credit bureau by certified mail with return receipt requested.

This way, you may send a copy of your credit report with the mistakes highlighted, along with any documentation supporting your claim.

You will also have proof that they received your letter. A sample dispute letter is included below.

Option 1. Dispute by Mail Highly Recommended

This may be your best option, although many people report great success with the online dispute process. Heres how to dispute by mail:

- Experian: Mail your dispute to Experian Disputes, PO Box 9701, Allen, Texas 75013.

- TransUnion: Go here and click on Dispute, then Mail and print out the request for investigation form and mail it to the address on the form. TransUnion doesnt require a formal letter, just their own form.

- Equifax: You dont need a confirmation number and you can easily mail a letter regarding the dispute, including the company name of the disputed item, to Equifax Information Services, PO Box 740256, Atlanta, GA, 30374.

Option 2. Dispute Online

Option 3. Dispute by Phone

Option 4. Dispute through Small Claims

This isnt often included in a list of ways to dispute a negative item on your credit report, although it can be very effective.

You May Like: How To Report To A Credit Bureau Landlord

Sue For An Unsettled Experian Dispute

When you file a dispute by mail, online or over the phone, Experian has a 30-day window to verify that the disputed information is incorrect and fix the error.

If your Experian disputes are ignored after 30 days and errors are not corrected, the attorneys at Francis Mailman Soumilas, P.C. are here to help you sue Experian. Fill out the online form to start your free case review or call us now at 1-877-735-8600.

Responsibility For Someone Else’s Debt

You are generally not legally responsible for paying another person’s debts unless you have agreed to be a co-borrower or guarantor for a loan. If you are considering becoming a co-borrower or guarantor, think carefully if the person defaults on their repayments, you could be legally responsible for the full amount of the debt.

Get advice if you think you were pressured into agreeing to be a co-borrower or guarantor, didnt understand the commitment you were making or felt threatened in any way.

Also Check: 580 Credit Score Personal Loan

Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

Don’t Miss: Does Afterpay Affect Credit

Statute Of Limitations On Debt Collectors

The first thing consumers should do is verify that the debt even exists. In addition to the validation notice that debt collectors must send, there is a statute of limitations on most debts. The statute of limitations varies from state-to-state, from as little as three years to as many as 15. Most states fall in the range of 4-to-6 years.

If the statute of limitations on your debt has passed, it means the collection agency cant get a court judgment against you. It does not mean they cant still try to collect, though if you refuse to pay, they have no legal recourse against you. However, the unpaid debt remains on your credit report for seven years from the last time you made a payment on it.

Many of the problems start with the fact that debt collection agencies often buy debts from several sources and either collect the money or sell the debt a second, third, maybe even fourth time. Along the way, the original contract gets lost and specifics of how much was originally borrowed, at what interest rate, what late payment penalties are involved and how much is still owed, are lost with it.

Consumers need to keep accurate records of all transactions involved with their debt, especially the original contract, record of payments and any receipts. That information is used when filing a dispute letter with the collection agency.

The Credit Bureaus And The Dispute Process

first

What are the mailing addresses for the 3 credit bureaus?

Equifax:

Experians National Consumer Assistance Center, PO Box 2002, Allen, TX 75013

How to write a credit dispute letter?

How to file a dispute with the credit bureau?

How long does a credit dispute take?

Who do I call to dispute my credit report?

Do online credit disputes work?

Yes. Unfortunately, it not yet as sophisticated as the traditional way. Thats why along with your online dispute, you are still encouraged to send a copy of your letter by mail. Follow these links to do an Equifax dispute, Experian dispute, or Transunion dispute online.

How often can you dispute something on your credit report?

How to cancel a dispute on credit report?

Read Also: Synchrony Bank Ntwk

Contact The Credit Reporting Agency

Once youve spotted and confirmed the inaccuracy, you can start a dispute request with the credit reporting agency. TransUnion offers a free online credit dispute service that is the quickest and easiest way to get started. We also have an extensive online FAQ section there to answer your dispute-related questions.

To get started with your dispute online, click Start Dispute and set up an account if you dont already have one. This way you can login later to check your dispute status or view your investigation results. If youve requested an online dispute, freeze, or fraud alert before with TransUnion, you should already have a username and password you can use. If youve forgotten your username or password, the login page will provide steps to recover your account information.

Once your account is set up and youve logged in, select New Investigation and choose the item you want to dispute. Remember, if you need to dispute multiple items, you should select each item before submitting your request.

After making your selections, youll have the option to upload relevant supporting documents. Examples include court or lender documents that provide specific evidence to prove your claims. Currently, we dont support document uploads for updates to personal information like your Social Security number, date of birth, name or address. If you need to update this type of personal information, please use our phone or mail dispute services.

What Can Be Disputed On A Credit Report

Essentially anything in the bankruptcy public records and accounts sections of your credit report can be disputed. For example, if you have a bankruptcy, a third-party collection account or an account with a lender on your credit report you feel is incorrect in any way, you can file a dispute with the credit reporting agency on whose report the information appears.

You can also dispute inaccurate PII, such as a name misspelling or an address with which you are unfamiliar.

If, after submitting a dispute, the data furnisher discovers that they are reporting incorrect information to the credit reporting agencies, they must correct it with all three of them. While the lender should update the information automatically, if changes are made, it can be a good idea to check the other credit bureaus just to be sure.

It is often beneficial to file a dispute directly with the company reporting the information, also known as the data furnisher, prior to contacting the credit reporting agencies. This is sometimes referred to as a “direct” dispute because you are filing your dispute directly with the lender or other business that reports the information to the credit bureaus. Notifying the lender that you believe an account is being reported inaccurately can help you get the information corrected more quickly.

Also Check: Does Qvc Report To Credit Bureaus

A Valuable Consumer Protection

The ability to dispute charges is great protection for consumers, and it’s also one of many reasons why credit cards are such a smart way to pay.

This isn’t a protection you should misuse, though. Before you dispute a charge, make sure that you have a legitimate reason. If it’s a problem with a product or service, contact the merchant and do your best to handle it yourself first.

If you need to dispute a charge, have your evidence ready and be as thorough as possible when you file the dispute with the card issuer. Respond promptly if the card issuer requests any additional information. Assuming you have a valid reason for your dispute, the odds are that you won’t need to pay the charge.

Removing Late Payments From Credit Reports

Successfully removing late payments from credit reports involves a direct strategy because the data furnisher is the original lender. However, disputing something does not mean the negative information will come off or your file or stay off.

You need to prioritize which erroneous delinquencies to dispute and adopt unique tactics for items before and after the 7-year expiration.

The number of points your score will go up once these derogatory items disappear varies. Deleting hard inquiries rarely makes a lasting or meaningful difference. Therefore, prioritize the most recent and severe late payments for removal.

Recommended Reading: Does Klarna Financing Report To Credit Bureaus