Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Percent Of Credit Files That Dont Qualify For A Fico Score

The Ascent reports that data released in 2019 found 11 percent of Americans dont qualify for a FICO credit score5.

In order to qualify for a FICO score, you must have:

- At least one credit account that has been open for at least six months

- At least one account that has reported to credit bureaus within the past six months

- No deceased status on your account6

If you share a credit card or other types of credit with someone who has passed, this may account for the deceased status thats preventing you from receiving a FICO score on your credit report. Watch your credit with a credit reporting agency like Experian to report this.

Does Age Impact Achieving A Perfect Fico Score

While length of credit history is one of the main factors in calculating your FICO® Score, it is still possible for people from younger generations to attain a perfect score. Baby boomers held the majority of perfect credit scores, accounting for 58% of people with an 850, according to Experian data from the fourth quarter of 2018. Generation X came next, accounting for 25% of people with perfect scores, and the silent generation trailed with 13% of the best scores.

While most of those with perfect scores were in the older generations, millennials made up 4% of those with perfect scores and Generation Y less than 1%proving that it doesn’t take a lifetime to grow to a perfect 850.

Also Check: 672 Fico Score

Percent Of Adults Who Never Check Their Scores

One study conducted by Javelin Strategy & Research and sponsored by TransUnion revealed that 54 percent of adults never check their credit scores8.

Checking your credit score is a crucial aspect of reaching your financial goals and correcting any mistakes in your credit report.

Whether you regularly use a credit card or are paying back loans like student loans, always check your score on a regular basis, whether its through a third-party application or using an established credit reporting company like Experian.

How To Build Credit After Bankruptcy

You can start rebuilding your credit score after the bankruptcy stay stops creditors from taking action. Bankruptcy will show on your record for 7-10 years, but every year you work to improve your credit, the less it will affect you and the financing you seek.

You need to wait 30 days after you receive the final discharge. This means most of your accounts will be at a zero balance, and creditors must stop calling you about debts.

To rebuild your credit score, you should:

Also Check: Affirm Virtual Card Walmart

How To Get A Perfect Credit Score

Want to know how to get a perfect credit score? Start by building good creditwhich you can do by making all of your on time and keeping your below 30 percent. Once you have established good or excellent credit, you can start taking the extra steps that may, with time, help you achieve perfect credit.

What If I Need A Loan Or Credit Card Immediately After Bankruptcy

Luckily, most mortgage companies provide FHA loans for scores of 560-600. Traditional financing options often require a score of 600 or higher.

There are options for buying high-cost necessities after filing bankruptcy claims. Secured credit cards and loans exist for those facing bankruptcy. You can look into credit builder loans or other financing options specially built for people after bankruptcy.

Recommended Reading: What Credit Score Does Carmax Use

Whats The Range For Fico Scores

Your FICO® Score will be a three-digit number, ranging from 300 to 800+.

But most lenders arent looking for one specific number, but rather an overall feeling for how you handle credit. Therefore they group them so you can look at the scale and see where you fall. While aiming for the top is important, you are likely still able to get credit with a very good score, while some lenders might even dip down into the good designation. Here is how they group the scores on a scale:

- Exceptional: 800+

What Are The Benefits Of 850 Credit Score

Everyone dreams of having an 850 credit score. Its the highest score possible under most FICO scoring formulas. Its been listed as one of the most common wishes that American adults would make. Get to know the benefits of 850 credit score?

Very few people in the United States actually have a credit score of 850, though. So we set out to answer the question: what does an 850 credit score actually get you? But first, lets break down some information about credit scores and why an 850 is so good.

Also Check: Paypal Credit Score Requirement

Why You Dont Need A Perfect Credit Score

Though its definitely possible to reach an 850 score, its nothing more than a vanity number, Alden said. Anything over 800 is just a bonus and likely wont result in better lending rates or other perks. Thats because most lenders consider anything over about 780 to 800 to be excellent, so any score over 800 puts you comfortably in the top tier.

That being said, even a high 800+ score can sometimes fail to qualify you for the best rates, Alden said. For example, say youve never had an auto loan. Even with a score of 800 or more, you might only receive the second-best lending rate on an auto loan since you dont have any track record there. Its all up to the individual lender, and your credit score is just one part of your larger financial picture that gets evaluated when you apply to borrow money.

But if youre motivated to go for a brag-worthy 850, theres no harm in trying. Just know that you might be waiting awhile, Allec said.

What Is A Good Credit Score For Credit Cards

The best credit card offers are typically reserved for consumers with excellent credit. Still, there are plenty of great credit card products that frequently accept consumers with good credit, or even fair credit. Consumers with poor credit are typically restricted to secured credit cards. These cards can help rebuild credit over time.

Read Also: Qvc Card Credit Score

Percent Of The Us Population That Has A Fico Score Below 550

Fortunately, a low percentage of the U.S. population appears to have low FICO scores. Data released by FICO in 2019 reveals that only 11.1 percent of the U.S. population has a FICO score ranging between 300 and 54913.

It also reveals a downward trend, indicating that the average FICO score is on the rise and the average credit card debt and other debts are on the decline for Americans.

The Average American Credit Score

The average FICO score in the United States is 706. But this varies based on a variety of factors. Most peoples’ . Some states have higher or lower average credit scores, too. For example, Minnesotans on average have the highest FICO credit scores in the nation at 733.

As of this report, 55% of Americans have a FICO score of 740 or higher. This has historically been the case, but the decade of steady economic growth since the Great Recession has caused Americans’ credit profiles to improve significantly. Credit scores are higher when fewer consumers have serious delinquencies weighing down their scores. The state of the economy can influence whether or not people are financially able to avoid credit score pitfalls from year to year.

You May Like: Does Klarna Report To Credit

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit report’s negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

Learn About The Average Credit Score In The Us Including By Age And State

The average FICO® credit score in the U.S. was 710 in 2020. Thatâs according to data from an annual study by Experian®.

The Experian 2020 Consumer Credit Review uses FICO scores nationwide to determine averages by age, state and more. FICO is a credit-scoring company that provides some of the most commonly used scores in America. Read on for more of the studyâs findings and see what they mean for you.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

How To Improve Your 850 Credit Score

A FICO® Score of 850 is well above the average credit score of 704. An 850 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Among consumers with FICO® credit scores of 850, the average utilization rate is 5.8%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

Because your score is extraordinarily good, none of those factors is likely to be a major influence, but you may be able to tweak them to get even closer to perfection.

Average Credit Score By State

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Here’s the average credit score in each US state and the District of Columbia, according to data from Experian.

| State | Average credit score in October 2020 |

| Alabama | |

| 719 |

You May Like: What Is Syncb Ntwk On Credit Report

Number Of Americans With No Credit History

According to the Consumer Financial Protection Bureau , approximately 26 million adults are considered to be credit invisible, meaning they have no credit history as theyre without credit cards, loans, and other lines of credit.1

Of course, if you have a credit card, that doesnt necessarily mean you will have a credit score. Around 19 million adults lack a score altogether due to credit reports with minimal credit usage or out-of-date credit history. Nows the time to open a credit card or loan to build your history.

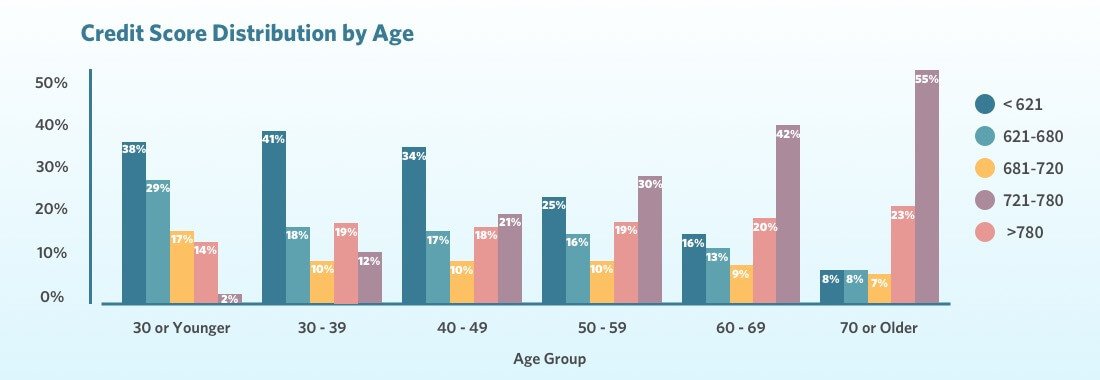

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Read Also: How To Get Credit Report With Itin Number

Monitor Your Credit Reports

Because your credit score is constantly being updated, its important to monitor your report regularly. Doing this will help ensure that all the information on your credit report is accurate. And if there are errors, you can find out about them and have them removed in a timely manner, before they do any damage.

Youre entitled to receive one free copy of your credit report from Experian, Equifax, and TransUnion every 12 months. You can order a copy of your report online at AnnualCreditReport.com.

And for ongoing monitoring of your credit, you can check your VantageScore® at Rocket HomesSM.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

You May Like: How To Get Credit Report With Itin Number

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Why You Should Be Pleased With An Exceptional Fico Score

Your 850 FICO® Score is nearly perfect and will be seen as a sign of near-flawless credit management. Your likelihood of defaulting on your bills will be considered extremely low, and you can expect lenders to offer you their best deals, including the lowest-available interest rates. Credit card issuers are also likely to offer you their most deluxe rewards cards and loyalty programs.

Late payments 30 days past due are rare among individuals with Exceptional credit scores. They appear on just 0% of the credit reports of people with FICO® Scores of 850.

An Exceptional credit score can mean opportunities to refinance older loans at more attractive interest, and excellent odds of approval for premium credit cards, auto loans and mortgages.

Don’t Miss: How Long Does Repo Stay On Credit Report

Why Is Having A High Credit Score Important

While its not necessary to have an 850 score, its important to maintain a high credit score. This will make it easier for you to buy a home, purchase a car and even get a job.

Your credit score shows your history of repaying your debts and making your monthly payments on time. If you have an excellent or even perfect credit score, the lender assumes youre not a risky investment because they assume that you will treat new credit as you have credit in the past and pay it back responsibly.

But, if your credit history shows that you dont pay your bills on time, some lenders may be hesitant to extend you a line of credit. They may be more concerned that this pattern will repeat itself, and they will be out that money.

Many workplaces are increasingly looking to hire employees with high credit scores. Thats because a good credit score demonstrates a history of financial responsibility.

How To Get A Credit Score Of 800

When you want to shoot for those upper tier credit scores, keep a few things in mind. Take a look at a few guidelines you want to pursue relentlessly in order to achieve admission to the 800 Club:

-

Keep your utilization rates at or below 30%. What does this mean? This means that even if your credit card offers you a $10,000 credit line per month, repeatedly using more than 30% of that line will affect your score.

-

Length of credit history matters. A longer credit history will result in a higher score than a shorter credit history.

-

Applying for new credit means your score can drop temporarily, but often “comes back” within a few months.

-

Debt mix makes a difference. Multiple types of credit, including revolving credit , installment loans look better on your credit score than just one type of credit.

-

Keep tabs on your credit reports and scores so you know what’s going on. Keep on top of your credit reports because it’s very possible that the credit bureaus could have made a mistake.

-

Get rid of debt with a caveat. Getting rid of revolving debt helps your score by bringing down your credit utilization rate. However, know that closing certain lines of credit can actually bring down credit score temporarily.

-

Make all of your payments on time.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus