Very Good And Excellent/exceptional: Above Mid

A lender could deny anapplication for another reason, such as having a high debt-to-income ratio, butthose with top credit scores likely wont have their applications deniedbecause of their credit scores.

People in this score range are also most likely to get offered a low interest rate and may have the most options when it comes to choosing repayment periods or other terms.

What Does A Credit Rating Tell An Investor

A short-term credit rating reflects the likelihood that a borrower will default within the year. This type of credit rating has become the norm in recent years, whereas in the past, long-term credit ratings were more heavily considered. Long-term credit ratings predict the borrowers likelihood of defaulting at any given time in the extended future. A debt instrument with a rating below BB is considered to be a speculative-grade or junk bond, which means it is more likely to default on loans.

The Fico Score Credit Score Model

Unarguably the most recognizable credit score model, the FICO® Score was introduced by the Fair Isaac Corporation in 1989 as an objective tool for evaluating borrower credit risk. The FICO models compare consumers and, essentially, rank them based on their likelihood to repay credit obligations as agreed.

The FICO Score model has changed significantly over the last quarter-century, and different industries now use models from different years as well as industry-specific models.

For instance, the home mortgage industry often uses the FICO Score 2, 4, or 5 models, whereas a credit card issuer may use FICO Score 3 or the more specific FICO Bankcard Score 2, 4, or 5. Purchasing a report from myFICO will allow you to see all of your scores, including auto, mortgage, and credit card industry-specific scores.

Watch on

Currently, the FICO Score 8 is the most commonly used credit scoring model. The newest models, the UltraFICO Score, FICO Score 10, and FICO Score 10 T have yet to truly catch on as a FICO Score 8 replacement, though some lenders have started to adopt it.

The FICO Score 8 model is more influenced by total debt than the VantageScore model, but both models are most affected by payment history.

While the industry-specific FICO Auto and FICO Bankcard Scores are judged on scales that run from 250 to 900, the base FICO Scores have a smaller range of 300 to 850. The higher numbers always indicate a lower credit risk.

Recommended Reading: What Credit Score Is Needed To Refinance A House

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

The Importance Of Credit Categories Varies By Person

Your FICO Scores are unique, just like you. They are calculated based on the five categories referenced above, but for some people, the importance of these categories can be different. For example, scores for people who have not been using credit long will be calculated differently than those with a longer credit history.

In addition, as the information in your credit report changes, so does the evaluation of these factors in determining your FICO Scores.

Your credit report and FICO Scores evolve frequently. Because of this, it’s not possible to measure the exact impact of a single factor in how your FICO Score is calculated without looking at your entire report. Even the levels of importance shown in the FICO Scores chart above are for the general population and may be different for different credit profiles.

You May Like: A Credit Score Is A Number Between

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

How Can I Check And Monitor My Credit

You can check your own credit it doesn’t hurt your score and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0.

It’s important to use the same score every time you check. Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. So, pick a score and get a game plan to monitor your credit. Changes measured by one score will likely be reflected in the others.

Remember that, like weight, scores fluctuate. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being.

You can help protect your credit by freezing your credit. You can still use credit cards, but no one can apply for credit using your personal data because access is blocked when your credit is frozen.

Recommended Reading: Does Collections Report To Credit

Significance Of Credit Rating

Now let us understand what the credit rating signifies.

A credit rating determines the probability of the company paying back its financial indebtedness within the stipulated time. The ratings could be assigned to a particular company, or could also be issue specific.

Below is the chart illustrating the credit rating scale from the global credit rating agencies S& P, Moodys, and Fitch. To be noted that Indian rating agencies ICRA, Crisil, and India rating and research are Indian subsidiaries of Moodys, S& P, and Fitch, respectively. The long term ratings are usually assigned to a company, while the short term ratings are essentially for specific loans or debt instrumentsDebt InstrumentsDebt instruments provide finance for the company’s growth, investments, and future planning and agree to repay the same within the stipulated time. Long-term instruments include debentures, bonds, GDRs from foreign investors. Short-term instruments include working capital loans, short-term loans.read more.

What Is Good Credit Anyway

Lenders want borrowers who will repay their debts, on time and as agreed upon in a loan agreement. If a lender feels they can rely on you to do that, they say you have “good credit,” or that you’re a low-risk borrower. If, based on a history of poor debt management, a lender doubts you will pay back a loan, they consider you to have “bad credit,” and to be a high-risk borrower. Most consumers fall somewhere in the middle of that spectrum, and .

Every lender has its own criteria for managing borrower risk. Some lenders avoid all but the lowest-risk borrowers, while others seek higher-risk borrowers with the understanding that they can charge them higher interest rates and fees as a trade-off.

Generally, credit scores that fluctuate by a few points up or down won’t have a big effect on your ability to get approved for a loan or credit card. This is especially the case if you’re well above a lender’s score requirement for the best credit terms . If, however, a point change drops your score below a lender’s minimum requirement, your application could get rejected.

Don’t Miss: What Is 11 Sprint On My Credit Report

Punishments In Chinas Social Credit System

As the China social credit system is still in a state of evolution, it is impossible to say with certainty what exactly the negative consequences are. That said, based on those elements that are currently in place, as well as existing regional pilots, potential negative effects of a bad score once fully implemented include:

- Travel bans

- Reports in 2019 indicated that 23 million people have been blacklisted from travelling by plane or train due to low social credit ratings maintained through Chinas National Public Credit Information Center. It is reasonable to assume that this will continue as part of Chinas social credit system.

- School bans

- The social credit score may prevent students from attending certain universities or schools if their parents have a poor social credit rating. For example, in 2018 a student was denied entry to University due to their fathers presence on a debtor blacklist.

- Reduced employment prospects

- Employers will be able to consult blacklists when making their employment decisions. In addition, it is possible that some positions, such as government jobs, will be restricted to individuals who meet a certain social credit rating.

- Increased scrutiny

- Businesses with poor scores may be subject to more audits or government inspections.

In addition, businesses of individuals need to consider the negative effects that the actions of a person or business can create for others due to a poor social credit score.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Recommended Reading: How Good Is A 700 Credit Score

Importance Of Credit Rating

Here are the benefits of credit rating for money lenders and borrowers:

For Lenders

- Better Investment Decision: No bank or money lending companies would like to give money to a risky customer. With credit rating, they get an idea about the creditworthiness of a company and the risk factor attached with them. By evaluating this, they can make a better investment decision.

- Safety Assured: High credit rating means an assurance about the safety of money and that it will be paid back with interest on time.

For Borrowers

- Easy Loan Approval: With a high credit rating, you will be seen as a low/no risk customer. Therefore, banks will approve your loan application easily.

- Competitive Rate of Interest: You must be aware of the fact that every bank offers loans in a particular range of interest rates. One of the major factors that determine the rate of interest on the loan you take is your credit history. Higher the credit rating, lower the rate of interest.

Get Free Credit Report with monthly updates. Check Now

A Multitude Of Credit Scores

The first models of credit scoring were developed by the Fair Isaac Corporation more than 50 years ago. The scores produced by the models, FICO scores, were named after the company and are well-known today. Since then, more than a hundred different models and scores have been developed for and used by lenders, insurance companies, and utility providers.

Though the three credit bureaus produce credit scores for the same purpose, the scores themselves are not the same. Differences are partially driven by the fact that the bureaus may have different information reported to them by lenders and financial companies. The differences can also trace to differences in the models used by each of the credit bureaus, which arise as the companies compete for business and try to distinguish themselves with scores that predict consumers riskiness more accurately.

Recently, the three credit bureaus joined forces and created a new company called VantageScore Solutions, LLC. Their goal was to develop credit scores for consumers that are the same across the three credit bureaus. The scores they produce, VantageScores, are not distributed by the combined company rather, each credit bureau markets and distributes them to lenders and consumers.

You May Like: What Makes Up Your Credit Score

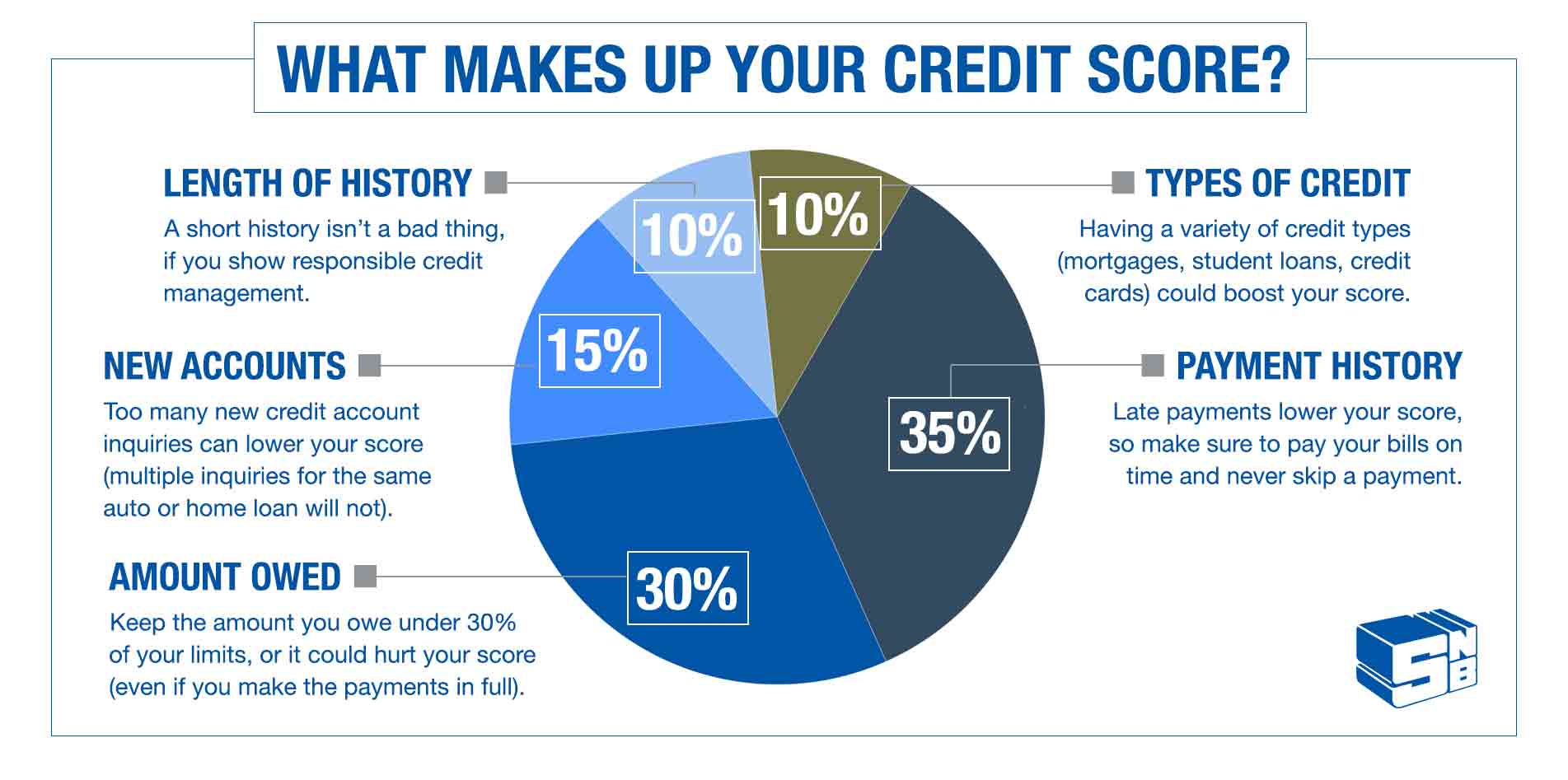

Table 1 Factors Affecting Your Fico Credit Score

| Factor affecting your FICO score | Portion of score | |

|---|---|---|

| Payment history | 35 | Payment history is the most important factor affecting your credit score. Lenders are interested in: what your payment history is on all your accounts the length of your positive credit history and how long you have gone without a negative item whether there are any severe unpaid debts like bankruptcies or foreclosures and the number and severity of delinquencies in your credit history. |

| Amount owed | 30 | The extent of indebtedness plays a large role in determining your credit score. Too many credit accounts and a high ratio of credit balances to credit limits can affect your score. Also affecting your score is the amount of debt on each account and the level of debt paid off on term accounts. Consumers can demonstrate responsibility by making scheduled payments and paying down installment loans. |

| Length of credit history | 15 | Longer credit histories result in higher scores. Important factors incorporated into credit scores are: length of credit history, length of time specific accounts have been open, and the duration of time since each account was last used. |

| How much new credit | 10 | |

| Type of credit | 10 | The type of credit you have plays an important role in determining your credit score. A healthy mix of installment loans and revolving credit from banks is considered better for your score. |

Source: , by Evan Hendricks, 2005. Privacy Times, Inc.

India Ratings And Research Pvt Ltd

India Ratings and Research, a subsidiary of the Fitch Group and the headquarters are in Mumbai. It provides timely and accurate credit opinions on Indias . Also, this rating agency provides corporate credit ratings.

The company covers financial institutions, project finance companies, structured finance companies, corporate issuers, managed funds, and urban local bodies. Also, India Ratings and Research Pvt Ltd has other branch offices in Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata, and Pune.

Read Also: What Is The Minimum Credit Score To Rent An Apartment

What Is Credit Rating

Credit rating agencies do the credit rating of various organisations and theirfinancial instruments. Few of the financial instruments that they rate are Non Convertible Debentures , company deposits, fixed deposits etc. They consider the statements of assets, liabilities, and cash flows along with previous lending and borrowing transactions to assess their ability to repay financial obligations. SEBI has the sole right to regulate and authorise rating agencies. Also, the rating system in India under the SEBI Regulations, 1999 of the SEBI Act, 1992.

The process of credit rating involves qualitative and quantitative assessment of the organisation. It shows the risk associated with investing in debt instruments. Hence this gives investors a clear picture to make clear decisions. Moreover, it also helps companies to raise money to finance their projects.

The highest rating in India is AAA. Financial instrumentswith AAA rating are the ones that have the least risk. Moreover, the companies issuing these financial instruments are less likely to default their payments. Hence the interest rate or rate of return on these instruments is low.

The lowest rating on the rating scale is D. Also, a rating of D is a very poor credit rating , and the company with such rating is more likely to default or is already in default.

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

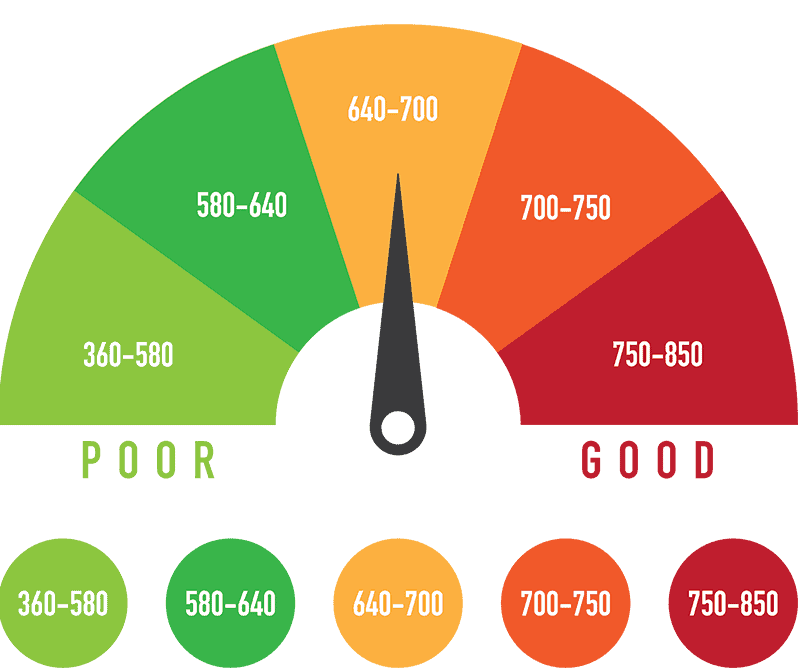

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

Recommended Reading: What Credit Score Is Needed For An Amazon Credit Card