Dispute Credit Report Errors

Its important to review your credit report on a regular basis to make sure all the information contained in it is accurate. Humans work at the credit reporting agencies and can make mistakes just like anyone else. Catching errors and getting them corrected in a timely fashion can help you change a credit score from Fair to Good.

Learn More About Credit Cards For Fair Credit

When used responsibly, credit cards could be one way to build credit. By making on-time payments and keeping your balance low, you may help boost your credit scores over time.

You can see a few options by checking out Capital Oneâs . If any interest you, you can also see whether youâre pre-approved, without affecting your credit score.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

We hope you found this helpful. Our content is not intended to provide legal, investment or financial advice or to indicate that a particular Capital One product or service is available or right for you. For specific advice about your unique circumstances, consider talking with a qualified professional.

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Recommended Reading: What Is Cbcinnovis On My Credit Report

My Credit Rating Is Fair What Does This Mean

10th Jan 2017

thinkmoney

When you come to apply for credit, you might decide to check your credit report first. Your credit report shows how youâve managed credit in the past and if youâve had any problems with borrowing. It should also help you see whether youâre likely to get any more credit.

But if you get a credit rating of fair â or credit score, if you live in the UK â what does this actually mean? Will you still be able to borrow any money? It depends on what youâre applying for â letâs take a look at how your credit score can affect you.

Personal Loans For Poor Credit

If youre shopping around the for the best unsecured loans for bad credit, heres a closer look at three of the lenders most likely to give you the green light.

- 9.95-35.99%

Avant: Avant requires a minimum credit score, however, that score is a very attainable 580. For qualified borrowers, Avant offers loans ranging from $2,000 to $35,000 with interest rates starting as low as 9.95% and going up to 35.99%. Theres also an administration fee to keep in mind, which ranges from 1.50% to 4.75%. On the other hand, there are no prepayment fees with Avant, which many borrowers appreciate.

LendingPoint: If your credit score has been dragged down by derogatory marks, LendingPoint is more likely to approve you than many other lenders. Even if youve , you can still qualify for a loan with LendingPoint. Unlike Avant, LendingPoint never charges any late fees, nor will you get hit with an insufficient-balance fee in case youre ever overdrawn. That said, LendingPoints interest fees are significantly higher than Avants, starting at 15.49% compared to 9.95%. Another drawback is that LendingPoints origination fee can be as much as 6%, while Avants will never exceed 4.75%.

Lenders that Offer Secured Loans

Tips to Get a Personal Loan with a Credit Score of 550 or Less

How to Get a Personal Loan With Bad Credit

Don’t Miss: How To Check Credit Score Without Social Security Number

Benefits Of An Excellent Credit Score

Excellent credit makes life easier and less expensive. Here are the biggest benefits of having an excellent credit score:

- You can qualify for the best credit cards. These cards tend to have more perks than credit cards for consumers with lower credit scores. Your credit score doesn’t guarantee an approval, but it’s one of the most important factors credit card companies look at during the application process.

- You can get lower interest rates and potentially be approved for larger amounts on loans. This includes all types of loans, including personal loans, auto loans, and mortgages.

- You have a better chance of passing a credit check with a rental company, which helps when looking for a house or apartment to lease.

- In most states, car insurance companies can use your credit when determining your premiums. Excellent credit can get you lower car insurance rates.

- Utilities companies are less likely to require a security deposit to set up service with them.

Your credit score is almost certainly going to play a major role in your life. That’s why a high credit score is a smart financial goal.

What Lenders Really Know About You

It’s important to be aware of exactly what lenders know when you apply, so you can present yourself in the best light. Importantly, it’s more than just what’s on your credit file.

The application form

In many ways this is the most important part. Here, lenders obtain the key details: your postcode, salary, family size, reason for the loan and whether you’re a home owner.

Make sure you fill in the forms carefully. One slight slip, such as a “£2,000” salary rather than a “£20,000” one, can kibosh any application.

Be consistent too, fraud-scoring firms filter applications and if there are many inconsistencies such as changing your job title or different phone numbers, it can cause a problem that you may not be told about.

Past dealings you’ve had with the lender

Companies use any data on previous dealings they’ve had with you to feed into the credit score. This means those with limited credit history may find their own bank more likely to lend to them than others.

Of course, those who’ve had problems with a lender in the past may find it more difficult to get accepted there too.

Equifax, Experian and TransUnion credit files

The three UK credit reference agencies compile information, allowing them to send data on any UK individual to prospective lenders. All lenders use at least one agency. This data comes from four main sources:

– Electoral roll information. This is publicly available and contains details of addresses and who lives at them.

Fraud data

Also Check: Does Speedy Cash Report To Credit Bureaus

But Her Journey To Good Credit Didn’t Happen Overnight

Stevens’ credit score didn’t change overnight in fact, she estimates it took about seven years to become excellent but she quickly read up on credit once she came to the realization of its importance.

Stevens remembers visiting the library and reading “Girl, Get Your Money Straight!” by Glinda Bridgforth as well as other books on credit responsibility.

“That book helped me really understand that there are books out there about personal finance specifically catered to women,” Stevens says.

She credits books to helping her understand the relationship between good money behavior and a successful future. Stevens says she also learned about the power of credit and credit scores, which was what motivated her to check her score for the first time ever and realize it was in the low 600’s.

“That’s when I first started to think about money management and the indicators that demonstrate financial health,” Stevens says. This was her realization that a good credit score matters.

An even better cash-back card for people with fair or average credit is the Capital One® QuicksilverOne® Cash Rewards Credit Card, which offers a competitive 1.5% cash back on all purchases, with no limit on the amount of cash back you can earn. And cash back can be redeemed at any amount, without the typical $25 minimum some other cards set.

What Is An Excellent Credit Score

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

An excellent credit score is a FICO® Score of 800 to 850 or a VantageScore of 781 to 850.

To clarify what these different scores mean, FICO is the credit scoring system that’s most widely used by lenders. VantageScore isn’t as popular, but it’s often the score provided by free credit score tools.

Having a credit score in this range is great for your personal finances. With excellent credit, you’re likely to qualify for the top credit cards and the lowest interest rate on loans. Whether you have excellent credit and you want to take advantage of it or you’re trying to get there, here’s everything you need to know.

You May Like: Kroll Factual Data Credit Report

Know What To Negotiate

Auto loans and car prices aren’t one size fits all, and they aren’t set in stone in most cases . Several things can typically be bargained on in the buying process, so make sure you know where you stand before you start trying to stare down a dealer.

You can negotiate loan terms with an auto lender, too. Know what your credit score is, and what the average interest rate is for someone in a similar situation this way you have a leg to stand on.

Know that you can usually negotiate with a dealer: your vehicle selling price, your down payment amount, dealer add-ons, and dealer doc fees. Things that can’t be changed are your tax, title, and license fees. Be prepared to battle for a fair price, and know you can always walk away from a deal that doesn’t meet your needs.

How Fico Scores Are Determined

FICO credit scores seem to be more popular than VantageScores and their credit scoring factors are more widely known. Its important to realize that FICO has a wide variety of credit scoring models.

Each model weights different factors to develop a credit score that fits a lenders particular needs. For example, the elements used to determine your likelihood of paying your car payment on time are different from those used to determine if youll pay your credit card bill.

That said, FICO provides some general guidance of the weighting of their credit scoring factors overall. This information can help you determine why your credit score is what it is and how to improve it. Here are FICOs credit scoring factors.

Payment history

The most significant part of your FICO credit score is your payment history. In a way, this is nice. If you simply make all of your payments on time, youll max out this portion of your credit score.

People that dont make all of their payments on time should make them as quickly as possible. The length of time a payment is overdue is factored into this scoring factor. The amount due that is late matters, too.

If you have late payments, work to establish an on-time payment history as soon as possible. The time that has passed since your more recent delinquency factors into this part of your score.

Amounts owed

What it does factor is:

Length of credit history

New credit

Read Also: Opensky Billing Cycle

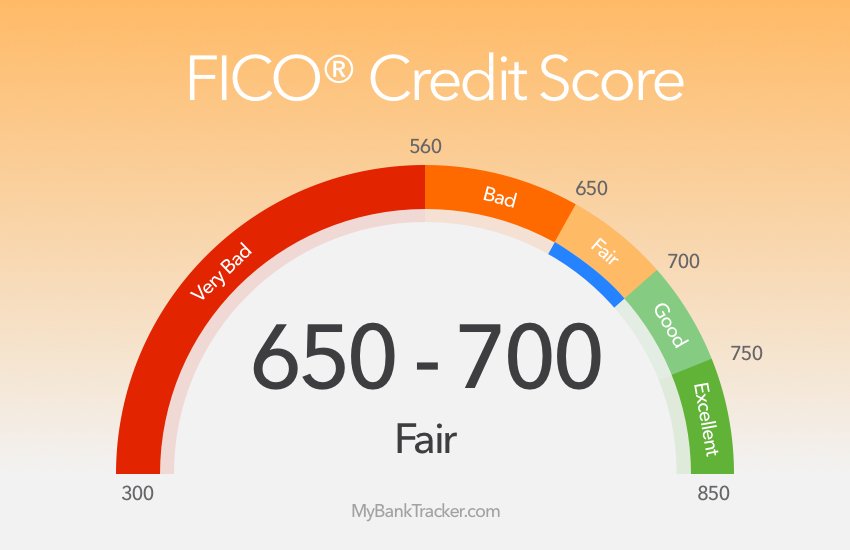

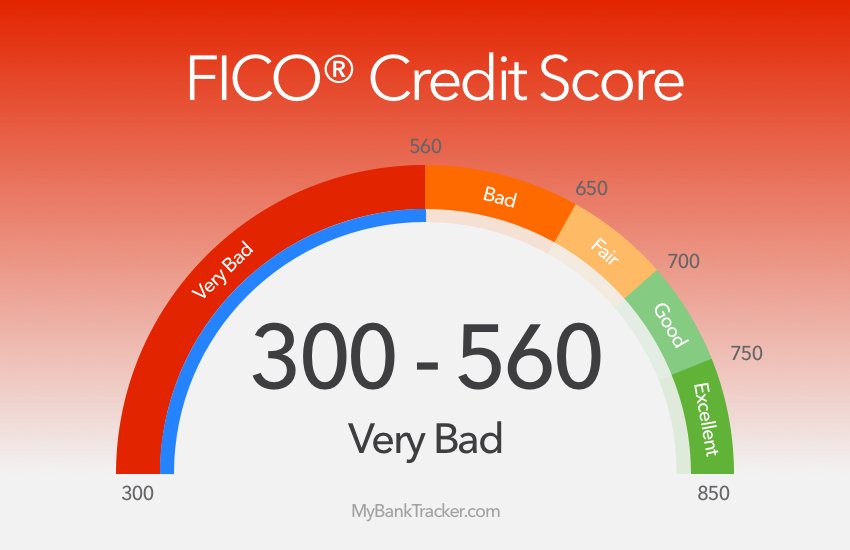

What Is The Range Of Credit Scores

Every FICO credit score falls within one of five ranges: Excellent , Very Good, Good, Fair and Poor. If you have a fair credit score, your credit score ranges between 580 and 669 points. You dont have bad credit, but you dont have great credit either.

Heres how the FICO credit scoring system ranks credit scores:

- Exceptional: 800-850

- Poor: 300-579

Check For And Report Errors On Your Credit Reports

Breaches are a top reason for checking those credit reports, and for good reason. We found in our recent data breach poll that Americans are more worried about identity theft than home burglaries. Some 46% said having their identity stolen would be worse, while 27% said a home break-in would be worse. And as consumers age, the spread is greater, with a 6-point difference for millennials and a 32-point difference for Baby Boomers.

But for all that fear, consumers are not protecting their data: Some 92% of U.S. adults have been guilty of at least one risky data security behavior within the past year.

What should you do? Besides varying your passwords , regularly check your credit files for mistakes. Notify the credit bureaus of any errors you find, no matter how small, because even a little one can be a sign that youre a victim of fraud, and that can ultimately impact your score.

Read Also: Jefferson Capital Systems Verizon

Dealing With Negative Information On Your Credit Report

Its no secret that negative information can have a huge impact on your credit score and your credit report not to mention moving forward, your ability to get new credit with favorable terms. Negative marks do not last forever. There are several things that can have a negative impact on your credit score:

- Chapter 7 bankruptcy stays on your credit report for 10 years.

- Late payments or past due accounts stay on your credit report for 7 years.

- Accounts that are sent to collections stay on your credit report for 7 years.

- Chapter 13 bankruptcy stays on your credit report for 7 years.

- Hard inquiries stay on your credit report for 2 years.

Research has shown that many US consumers find that their credit reports contain errors. Over time that number has shown a decrease, but with just under 17 percent of Credit Sesame members still finding errors, it is wise to be vigilant.

Percentage of members and non members who found inaccuracies on their credit report from 2014-2018

| Found Inaccuracies on Credit Report | Members |

|---|---|

| 16.5% | 35% |

The first step to improving your credit is to make sure that all the information on your current credit report is accurate. Next:

| Inaccuracies and resolution timeline |

|---|

Donât Miss: Remove Syncb/ppc From Credit Report

Lendingclub: Best For Availability In Most States

Overview: LendingClub offers personal loans of $1,000 to $40,000 for three- or five-year terms.

Why LendingClub is the best for availability in most states: While some lenders only operate in a limited number of states, LendingClub accepts applications from borrowers in every part of the United States.

Perks: You may qualify for a loan if you have a credit score of at least 600. The lender also allows a 15-day grace period on late monthly payments.

What to watch out for: It can take 48-hours from loan approval to funding. Youll also be subject to an origination fee of up to 6 percent.

| Lender |

|---|

You May Like: Speedy Cash Extension

How To Qualify For A Loan With Fair Credit

To improve your chances of obtaining a personal loan with fair credit, try taking the following steps before you apply:

- Use a co-signer: While a co-signer adopts some responsibility for your loan and therefore some risk they may also make it easier for you to qualify. Choosing a co-signer with good credit will improve your overall creditworthiness.

- Prequalify: If you’re unsure if you’ll qualify for a loan with a particular lender, see if it offers prequalification. That way, you’ll avoid harming your credit score even further before applying.

- Pay down debt: Many lenders consider your debt-to-income ratio in addition to your credit score. By paying down credit card debt before applying for a loan, you’ll look better to potential lenders.

- Use a local bank or credit union: Your existing bank or a local credit union may be more lenient when it comes to your credit score, especially if you have a history of timely payments on your accounts.

Always Check Your Credit Files After Rejection

There’s a nightmare scenario you need to avoid called the rejection spiral. It works like this:

This continues, until finally you check your files and get the error corrected. So…

You apply again. You’re rejected, not due to the error, but because of recent ‘searches’.

If you’re rejected once, check your files are correct immediately. Otherwise you may mess up your score for an age, as more applications mean more searches, compounding the problem. You’ll be told by the lender which credit reference agency it used to assess your info, so focus on that one.

After an error, it’s possible to get successive searches wiped, but it involves negotiating both with the agency and the lender, and it isn’t easy.

The rejection spiral also applies when you apply for credit normally reserved for those with an excellent score when you, say, only have a good score .

If you’re thinking of applying for a new card, check our best buy credit card guides. Our eligibility calculator gives an indication of which loans and cards are likely to accept you, plus those likely to turn you down.

Also Check: When Do Companies Report To Credit Bureaus