Why Your Credit Score Impacts Your Mortgage Rate

Your credit score reflects your past credit usage, which lenders use to measure how responsible you are with credit. It speaks to your past payment and debt management habits, and it gives lenders an idea of what they can expect if they loan you money to buy a home.

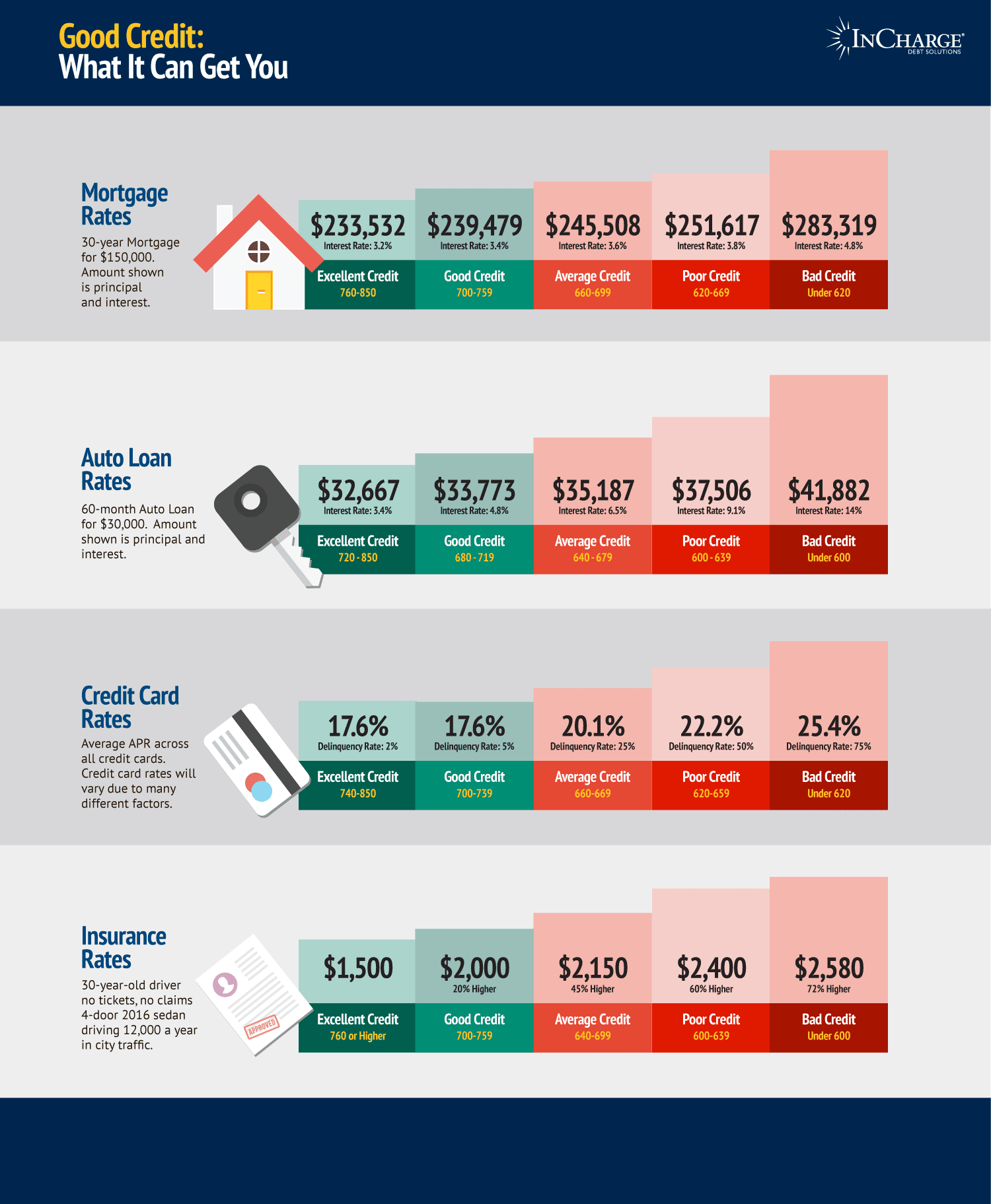

As such, credit scores directly influence what mortgage rate a lender offers you. Higher credit scores will usually mean a lower interest rate , while lower scores will usually receive higher rates.

Learn More: Comparing Credit Score Ranges

Re: How To Increase My Mortgage Fico Score

Scores are the RESULT of a robust credit profile. Focus on your profile … how many tradesline you have? how old are they? are the all in good standing? do you have any baddies on your report? Are your reports 100% accurate?

I can’t give useful recommendation of raising scores other than the above.

Don’t Incur Any New Debt

Taking on new debt can make a mortgage lender suspicious of your financial stabilityeven if your debt-to-income ratio stays low. Its best to stay away from any new credit-based transactions until after youve got your mortgage secured.That includes applying for credit cards, especially since credit inquiries affect your credit score. It also includes auto loans and personal loans, to be safe.

Once you’ve locked in your mortgage and closed on the house, then you might wish to explore other new debt.

Read Also: How Can You Get A Repo Off Your Credit

How To Raise Your Credit Score Fast

In this article:

There are three reliable ways to raise credit score fast when you want to buy a home:

Improving Your Mortgage Score

Despite having a lower-than-expected mortgage score, Atlanta resident Moore managed to improve it and buy a home.

First, she paid down an outstanding debt to help raise her score. Then she did intensive shopping for a loan, talking to several banks and credit unions before finally securing a mortgage that was aimed at first-time home buyers.

I found that if you get approved by a bank, you may be able to get a lower rate or better offer from another bank, says Moore, who closed on her house in December.

To help improve your mortgage score, here are four guidelines.

Don’t Miss: What Is Syncb Ntwk On Credit Report

How To Increase My Mortgage Fico Score

My husband and I are getting ready to do a new construction loan and I have been working diligently and increasing my credit scores. While my FICO credit scores are increasing, my mortgage scores have not moved at all. What is the best way to increase these scores? Or is there a lag in the system and it doesn’t update as frequently as the regular FICO scores? If this has already been covered, I apolgozie. I couldn’t find the information in my search. Thank you.

What Is A Credit Score

Your credit score is a statistical number that essentially shows others how likely you are to repay your debts. So having a good credit score makes a lender more willing to lend you money.

Check out our Glossary to read up on mortgage terms you need to know before you buy a home

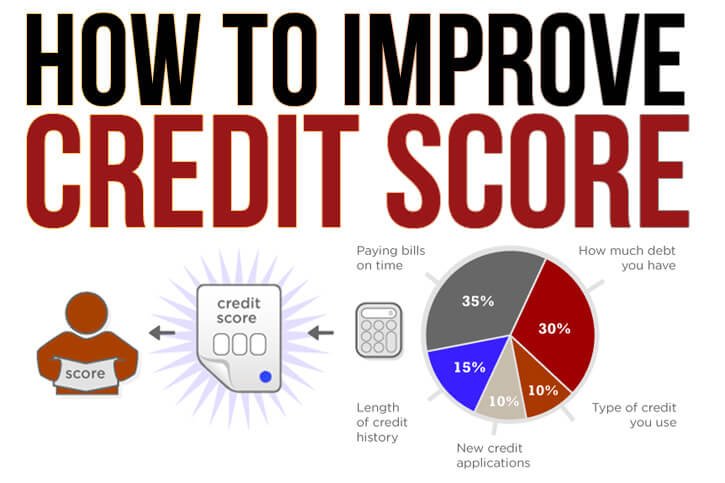

FICO is by far the most popular scoring model. Their scores range from 300 to 850 and are made up of the following factors:

- Payment history: The ability to pay bills on time.

- Amounts owed: Also called utilization. How much is borrowed divided by credit limit. The lower, the better.

- Length of credit history: The average age of active credit lines longer is better.

- New credit: Requesting new lines of credit will temporarily hurt a score.

FICO scores can differ between the different bureaus because not all creditors report information to all of them.

Those first two items are most important they make up two-thirds of a total score. So, paying all your bills on time and not carrying large balances can result in a good score. But remember, the minimum credit score to secure a mortgage varies depending on the type of loan:

- Conventional Loan: 620+

You May Like: Annual Credit Report Itin

How Your Credit Score Affects Your Mortgage

While most homebuyers and homeowners know that their credit score impacts their chances of receiving a loan, many dont know how their credit score shapes the loan itself. Many lenders have a credit score minimum threshold youll need to cross before your application will be accepted , but borrowers between 620 and a perfect score of 850 may see very different rates and terms due to their score and history.

Your Debt Load Totals

The total amount of debt should not be more than forty percent of your income . This is your total debt service ratio.

In addition to your housing costs, it includes debts such as:

- Car insurance, car payments and tax debts.

- Student loans, child support and any spousal support.

- Life insurance, medical insurance costs, utilities and any other debts or bills.

You May Like: How To Dispute Repossession On Credit Report

Impact Of Short Sale And Deed In Lieu On Your Credit Scores

A recent short sale or deed in lieu of foreclosure can easily drop scores any deficiency credit scores by more than 80 points. However, as the short sale and deed in lieu of foreclosure ages, the consumer credit scores will eventually increase. A bankruptcy on a credit report can drop credit scores by 150 to 200 points. Again, as the bankruptcy ages and time passes, consumer credit scores will go back up.

Improving Your Credit Score

Your credit score includes a lot of important factors like your payment history, types of credit accounts and total debts. When the banks run your credit report they want to see how consistent you pay bills. And importantly, how responsible you are with debts. But, lets say you had a temporary job loss. This doesnt always work against you. You can explain to your lender if special circumstances caused you to briefly fall behind on payments.

Read Also: How To Remove Repossession From Credit Report

Quick Ways To Raise Your Credit Score Before Applying For A Mortgage

Though you can buy a house with bad credit, the process is a whole lot easier when your is in good shape. And if youre teetering between fair and good credit, it could mean a difference of thousands of dollars in interest over the life of your loan.

So before you start your mortgage application, its a good idea to boost your score as much as possible. Fortunately, there are several ways to improve your credit score in a matter of weeks.

Reduce Credit Card Debt

If avoiding new debt helps burnish your credit, it’s probably no surprise to learn that lowering existing debt can also help your credit standing. Paying down credit card balances is a great way to address this. Paying them off altogether is an ideal goal, but that isn’t always feasible within the span of a year or less. In that case, it’s wise to be strategic about which balances to tackle when paying off your credit cards.

One of the biggest influences on your credit scores is the percentage of your credit card borrowing limits represented by your outstanding balances. Understanding how credit utilization affects your credit scores can help you determine the smartest approach to paying down your current balances.

Your overall credit utilization ratio is calculated by adding all your credit card balances and dividing the sum by your total credit limit. For example, if you have a $2,000 balance on Credit Card A, which has a $5,000 borrowing limit, and balances of $1,000 each on cards B and C, with respective borrowing limits of of $7,500 and $10,000, your total your utilization ratio is:

Also Check: How To Remove Repossession From Credit Report

Get One Well Ran Bank Account

View top bank account comparison tables here

If you have multiple sources of income, and accounts all over the place, not only is it harder to manage for you, but it may be prudent in the eyes of a lender to have everything ran through one main account, so try moving your income/ direct debits/ standing orders etc into one account.

The idea here is to develop one good account profile with a particular bank, and make sure there are no excesses, and that all bills are paid on time. If you have credits paid into an account, your profile with that bank automatically improves. The higher your account turnover the better, so a history of good figures coming in and everything going out on time, can really help. Most clearing banks update their customers profiles once a month, so this may take a few weeks/months to improve things.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

You May Like: Does Paypal Credit Report To Credit Bureaus

How Long Does It Take To Rebuild A Credit Score

There’s no set timeline for rebuilding your credit. How long it takes to increase your credit scores depends on what’s hurting your credit and the steps you’re taking to rebuild it.

For instance, if your score takes a hit after a single missed payment, it might not take too long to rebuild it by bringing your account current and continuing to make on-time payments. However, if you miss payments on multiple accounts and you fall over 90 days behind before catching up, it will likely take longer to recover. This effect can be even more exaggerated if your late payments result in repossession or foreclosure.

In either case, the impact of negative marks will diminish over time. Most negative marks will also fall off your credit reports after seven years and stop impacting your scores at that point if not sooner. Chapter 7 bankruptcies can stay for up to 10 years, however.

In addition to letting time help you rebuild your scores, you can follow the steps above to proactively add positive information to your credit reports.

How A Mortgage Affects Your Credit

Know the fundamentals. Your measures your ability to pay back debts. You only earn so much money so keeping your amount of debt in good proportion to your income is essential. This is called your debt-to-income ratio.

Keeping it no higher than 36% is considered optimum with no more than 28% going to your mortgage. If you know you will purchase a home in the near future, dont take on other debt obligations. Keep your debt-to-income ratio low.

However, do continue to build your . A little credit is better than no credit as far as your credit score is concerned. And of course, paying your mortgage on time is good for your credit history.

Read Also: Sync/ppc On Credit Report

Leave Old Debts That Are In Good Standing On Your Report

Sometimes people think that having an old debt show up on your credit report is a bad thing or that is will hurt their credit score. This is actually wrong and basically the opposite of what you should be doing. Credit history is the most important contributing factor to your credit score. This means that the longer youve had credit accounts open, the better. And the longer the history you have of using credit responsibly, the better. An old debt that was paid off as agreed is great for your credit score.

Take Advantage Of Self

The number and average age of accounts on your credit report can help lenders determine how well you handled debt in the past. So, those with a limited credit history can find themselves at a disadvantage. Aside from becoming an authorized user on a loved ones credit card , you may be able to add information to your credit report by self-reporting.

Experian Boost and UltraFICO are two free programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and give the credit bureau permission to add telecommunications and utility payment history to your report. UltraFICO Score allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your Experian-based UltraFICO Score.

Aside from these two free programs, there are some fee-based services that may allow you to add certain types of information to your credit reports as well. These include:

You may only want to self-report accounts with positive payment history to the credit bureaus. While Experian Boost will only add positive accounts to your Experian report, the same isnt true of all self-reporting credit services.

You May Like: What Is Syncb/ppc

How To Increase Your Credit Score

June 30, 2016 By Justin McHood

If there is one thing that can ruin your chances at getting approved for a mortgage, it is a poor credit score. Every program has different requirements regarding how low your credit score can go, but for the most part, lenders want to see a score that is at least within the good range of the credit score tier. This means a credit score no lower than 700. Because not everyone has a score that high, it pays to know how to increase your credit score to get as close as possible to this score in order to have the ability to obtain the best terms on a new mortgage.

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history, and help lenders assess your financial health. Home buyers with lower credit scores are typically assigned a higher interest rate.

Don’t Miss: Ccb Mprcc

Can You Get A Mortgage With Bad Credit

Maybe. You can still be approved for a mortgage to buy a property if you have a poor credit score. However, someone with a poor credit score will probably have a higher interest rate than someone whose credit score is good. Buyers with a low credit score may also need to pay a bigger deposit.

There is no minimum for the credit score that you have to have in order to be approved for a mortgage. When you apply for credit, mortgage lenders will instead make their decision based on their companys lending criteria.

The better your credit score is, the more likely you will be approved for a mortgage loan. This is because there is less risk involved with giving you credit when you have a high credit score.

Here is a short video on this subject.

You can see the original video here.

Get A Secured Credit Card

If your credit score is hindering you from being able to get approved for a new credit card, consider getting a secured credit card instead. Then use the secured card to pay for your weekly or monthly necessities like groceries and gas. Pay off the balance in full every month on time.

for more information about the benefits of secured credit cards.

Also Check: Does Paypal Credit Report

Make Sure Your Monthly Payments Are Made On Time

Do this as long as possible to create a good track record. If your history shows regular late payments and recent defaults, its going to really affect your score. Having 6-12 months up to date payments and well ran accounts can be the difference to a scoring system and to a mortgage underwriter deciding whether or not youve changed your ways since being in any trouble.

The Effect On Other Lines Of Credit

As your score takes this short-lived dip, you want to be wary of how it will affect interest rates on other loans you might be seeking, such as an auto loan. Thats because even though reliably paying off your mortgage month after month proves youre a responsible borrower, that positive activity wont yet be showing up and factored into any money moves you make now.

Therefore, you might want to wait until your credit score has time to recover before seeking another new loan. And by then, it might even rise, given the strength of a mortgage, potentially opening the door to even better rates than you might have qualified for before.

Read Also: How To Unlock Experian Account

Where Does My Credit Score Come From

Your credit score is a combination of data from the three credit reporting bureaus. Each bureau may give you a slightly different score depending on which lenders, collection agencies and court records report to them, but your scores should all be similar. The following is a rough breakdown of how credit bureaus calculate :

- Payment history: 35%. Your payment history includes factors like how often you make or miss payments, how many days on average your late payments are overdue and how quickly you repay an overdue payment. Each time you miss a payment, you hurt your credit score.

- Current loan and credit card debt: 30%. Your current debt comprises factors like how much you owe, how many and the types of cards that you have and how much credit you have available. Maxed-out credit cards and high loan balances hurt your score, while low balances raise your score assuming you pay them off, of course.

- Length of your credit history: 15%. The longer your credit history, the higher the probability that youll follow the same credit patterns. A long history of on-time payments improves your score.

- Account diversification: 10%. Creditors like lending to borrowers who have a mix of account types, including home loans, credit cards and installment loans.