Who Looks At Your Credit Report

When you apply for credit, youll usually be expected to give your permission to the credit provider to check your credit report.

The term credit provider doesnt only include banks and credit card companies. It also includes mail-order companies and, for example, providers of mobile phone services if you have a phone contract .

Employers and landlords can also check your credit report. However, theyll usually only see public record information such as:

- electoral register information

- County Court Judgements .

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

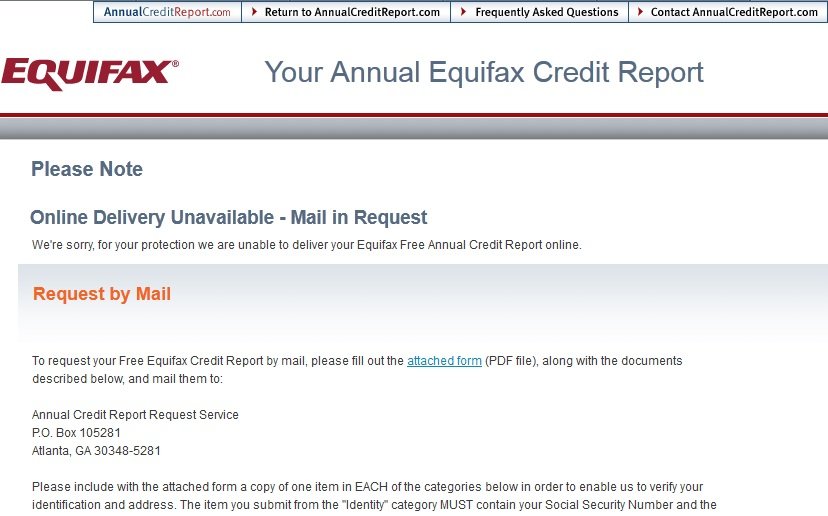

How Do I Order My Free Credit Reports

If you are getting your annual free credit reports, you can order them online through AnnualCreditReport.com.

This website will let you order all three of your free credit reports at once, with no obligations and no hidden fees. You may have to provide some personal information in order to confirm your identity before ordering, but you will not be charged if you use this site.

Please note that if you use these free credit reports to file a dispute with the credit reporting agencies, they have 45 days to investigate your dispute instead of the typical 30-day timeframe.

Don’t Miss: How To Remove Repossession From Credit Report

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

Free Annual Credit Report By Mail Or Phone

Consumers often ask where they can get a copy of their free annual credit report by mail, or where can they call to order their report over the phone.

Well, Congress made a provision in the FACT Act that covers this situation where consumers are not able to order their reports on the Internet, or maybe they just prefer not to use the Internet.

To get your free annual credit report by calling in your application, call toll free 1-877-322-8228. This is the phone number for the Central Source that Congress designated for consumers to get their free annual credit report.

For consumers who want to request their credit report by mail, you can download or print a copy of this form to send to the Central Source1:

Follow the instructions on the form and mail it to:

Annual Credit Report Request Service PO Box 105281 Atlanta, GA 30348-5281

Your report will generally be processed in fifteen days and mailed to you regular US Mail.

Also Check: Does Fingerhut Report To The Credit Bureau

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Ordering Your Credit Report

Free Annual Credit Reports

The Fair Credit Reporting Act requires each of the three nationwide credit reporting agencies to provide you with a free copy of your credit report, at your request, once every twelve months.

How do I order my free credit report?

You can order your report online at www.annualcreditreport.com by telephone at 877-322-8228 or by completing the Annual Credit Report Request Form and mailing it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

You can also obtain the request form at www.ftc.gov/credit. Do not contact the three nationwide consumer reporting companies directly.

What information do I have to provide to get my free credit report?

You will need to provide your name, address, Social Security Number, and date of birth. To verify your identity, you may be asked to provide some information only you would know, such as the name of your credit card company.

How long does it take to get my free credit report?

If you request your report online, you should be able to get it immediately. If you request your report by phone or mail, it should be mailed to you within 15 days.

Will the free credit report include my credit score?

No. However, you can purchase your credit score when you order your free report.

Does ordering my credit report lower my credit score?

No. For more information on your credit score, see .

What should I do if I ordered my free credit report, but I never received it?

Experian:

You May Like: When Do Companies Report To Credit Bureaus

Want To Feel More In Control Of Your Finances

Our free and flexible Couch to Financial Fitness plan will help you build confidence to manage your money.

Step by step we can help you cut your spending, develop core saving muscles, and create better habits for the future.

In the UK, companies called credit reference agencies compile information on how well you manage credit and make your payments.

The three main CRAs are:

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

You May Like: What Is Syncb Ntwk On Credit Report

Successfully Answer Security Questions

For each report request, youll be asked a few questions about your finances that presumably only you can answer for instance, the approximate amount of your mortgage payment or who holds your auto loan and when you took it out.

Some consumers have reported difficulty using the site, particularly answering security questions about accounts that are several years old. If you cant recall those details, you can request your reports by mail or phone this process doesnt require security questions.

Free And $1 Credit Reports

Prior to the Fair and Accurate Credit Transactions Act of 2003, there were dozens of impostor websites on the internet promising to give you a free annual credit report. These sites would request your credit card information and enroll you in a trial membership to a .

If you didn’t remember to cancel the trial, your credit card would be charged for a full period of the credit monitoring service. These gimmicks still exist, although now most of them offer your credit report for $1, rather than for free. The legitimate website for ordering your free annual credit report doesn’t require a credit card and doesn’t ask you to sign up for any trial subscription.

You May Like: Does Klarna Affect Your Credit Score

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

Whats The Difference Between A Credit Report And A Credit Score

Although they are interconnected, your credit report and credit score are separate.

Your credit report contains information about your credit accounts, including any balances you owe and your payment history. Your , on the other hand, is a three-digit number that usually ranges from 300 to 850. Credit scoring models, such as FICO, use the information listed in your credit reports to calculate your score.

Don’t Miss: What Is Syncb Ntwk On Credit Report

One Survey On Credit Reporting:

- 17 per cent of Canadian adults had checked their credit reports in the prior three years

- Of those who checked, 18 per cent found inaccuracies in their credit reports

- 10 per cent believed they were denied access to financial services because of report inaccuracies

Some credit bureau watchers estimate that there are errors in 10 to 33 per cent of credit files. Some of those mistakes can be serious enough to hurt your credit status. That hit to your credit score can result in a denied loan or a higher interest rate. Across Canada, provincial consumer agencies collectively get hundreds of complaints annually about credit bureaus.

If you find something in your file that you dispute, you can write the credit agency in question and tell them you think there’s an error. The credit reporting agency usually sends along the form you need when it sends you the credit report. Use it to spell out the details of any information you dispute. The dispute forms are online, too.

Be sure to send along any documents that support your version of the matter in dispute. The reporting agency then contacts whoever submitted the information you’re disputing.

If the file is changed, you will be sent a copy of your new report and any company that’s requested your credit file in the previous two months will also be sent the corrected file.

You can also file a complaint with your provincial consumer agency.

What’s The Deal On Free Credit Reports

The Federal Trade Commission is warning about scams in the age of coronavirus. In short, they recommend that you ignore unsolicited pitches for Covid-related items, and robocalls or emails claiming to be from the CDC or World Health Organization. Going down any of those rabbit holes could lead to fraud, identity theft, and damaging information in your credit files.

Fortunately, there’s an easy way to check ALL of your credit reports online, for free. Back in December 2003, the Fair and Accurate Credit Transactions Act was signed into law, which gives every U.S. consumer the right to receive a copy of their credit report free of charge once a year.

A credit report provides you with all of the information in your credit file, which is maintained by consumer reporting companies Equifax, Experian, Trans Union, and Innovis. This is the information that is provided by them in a consumer report requested by a third party, such as a lender, landlord or insurance company. This information includes mortgage, credit card and loan balances, along with your payment history. A credit report also includes a record of everyone who has received a consumer report about you within a certain period of time.

And that’s not the worst of it. If you have items appearing on your credit report that you do not recognize, such as consumer loans and store credit cards, it could indicate that identity theft is taking place.

Read Also: What Is Syncb Ntwk On Credit Report

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Other Situations Where You Are Eligible For A Free Credit Report

If you are a victim of identity theft, you are entitled to place a fraud alert on your file and to receive copies of your credit report from each of the three credit reporting companies free of charge, regardless whether you have previously ordered your free annual reports.

For more information on ID theft, including advice for victims and tips on prevention, review the Attorney Generals Consumer Alerts: Identity Theft Prevention and Identity Theft Recovery.

If a company takes adverse action against you, such as denying an application for credit, insurance, or employment, you are entitled to a free credit report if you ask for it within 60 days of receiving notice of the adverse action. The notice will give you the name, address, and phone number of the credit reporting company to contact.

Recommended Reading: What Is Syncb Ntwk On Credit Report

How To Get Free Credit Reports From Each Of The Three Credit Bureaus

The Fair Credit Reporting Act requires each of the three credit bureaus to provide consumers with one free credit report per year. Federal law also entitles consumers to receive free credit reports if any company has taken adverse action against them. This includes denial of credit, insurance or employment, as well as other reports from collection agencies or judgments. But consumers must request the report within 60 days from the date the adverse action occurred.

In addition, consumers who are on welfare, unemployed people who plan to look for a job within 60 days and victims of identity theft are also entitled to a free credit report from each of the credit bureaus.

How To Get Your Annual Credit Report From Experian

Starting April 20, 2020, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports for the next year through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Under federal law you are entitled to a copy of your credit report annually from all three credit reporting agencies – Experian®, Equifax® and TransUnion®– once every 12 months. Every consumer should check their credit reports from each of the 3 bureaus annually. Doing so will make sure your credit is up-to-date and accurate. Each reporting agency collects and records information in different ways and may not have the same information about your credit history.

Recommended Reading: Credit Score For Paypal Credit

What If I Find An Error In My Credit Report

Well, you won’t be the first. In millions of files and hundreds of millions of reported entries, there are bound to be mistakes. Some are minor data-entry errors. Others are damaging whoppers. For example, we’ve heard of instances where negative credit files from one person got posted to the file of someone who had a similar name .

How Long Does It Take To Get My Free Credit Report After I Order It

It depends on how you ordered your report.

Online: If you request your report at AnnualCreditReport.com, you should be able to access it immediately.

Phone: If you order your report by calling 322-8228, your report will be processed and mailed to you within 15 days.

Mail: If you use the Annual Credit Report Request Form or write a letter, your request will be processed and mailed to you within 15 days of receipt. Please allow two to three weeks for delivery.

Whether you order your report online, by phone, or by mail, it may take longer to receive your report if the nationwide credit reporting company needs more information to verify your identity.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Also Check: Credit Inquiries Fall Off