How Do Collections Accounts Affect Your Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Having a collections account can be a drag on your credit score. Heres what to know about collections accounts on your credit report, including when collections accounts are reported to credit bureaus and the impact on your credit.

Why Should You Pay Off Your Collections Account

Yes, you should. Youll stave off ongoing penalties and show future lenders that you have the ability to make good on your financial obligations. Be advised, though: Your credit score wont increase by doing so. Overdue debts wont be removed from your credit report, just show up as paid vs. unpaid. Debt collections dont go away immediately because a borrower has to wait until debt collections reach the statute of limitations before theyre removed from their credit report.

How Collection Agencies Acquire Your Debts

Its important to note that debt collectors buy debt for pennies on the dollar. When an original credit account is very delinquent, its viewed as unlikely to ever be paid. This type of debt is typically sold to a collection agent at a steep discount.

For example, say a debt buyer pays just $0.04 for every dollar of a debts face value. If that debt was $5,000, a debt collector would pay around $200 for it.

Because the debt collector paid so little to buy someones debt in this scenario, there would be significant room to negotiate a settlement. Its not uncommon for a $1,000 collections account to be settled for $300 or so, for example.

Read Also: How To Report A Death To Credit Bureaus

Don’t Miss: How To Put A Freeze On Your Credit Report

If You Dont Find Any Errors Ask The Agency To Validate The Debt

In many circumstances, debts can get shuffled around from one third-party debt collector to another, sometimes several times over. Its not uncommon for inaccuracies to get transmitted to the debt collection agency. Also, documents verifying the original debt can get lost, too.

Once a debt ends up in collections, and you start to get communications about owing the debt, its totally acceptable to ask the debt collector to verify that the debt is valid and actually belongs to you.

Heres the information you should include in your request to validate the debt:

- Information about the original creditor and the original account

- Amount and age of the debt

- Supporting documentation like an original invoice, bill, promissory note or similar document to prove the debts validity

- Why the agency believes you owe the debt

- Whether or not they are licensed to collect debt in your state

Note, once you send the debt collector a written dispute or a written request to validate the debt within 30 days, they have to pause collecting the debt until they respond to your dispute or answer your request.

If the personal information attached to the debt, like your name, aliases, phone number, address, etc., cannot be accurately matched with the debt, it must be removed from your credit report. Also, if they cannot provide any proof the debt is valid, it must also be removed from your credit report.

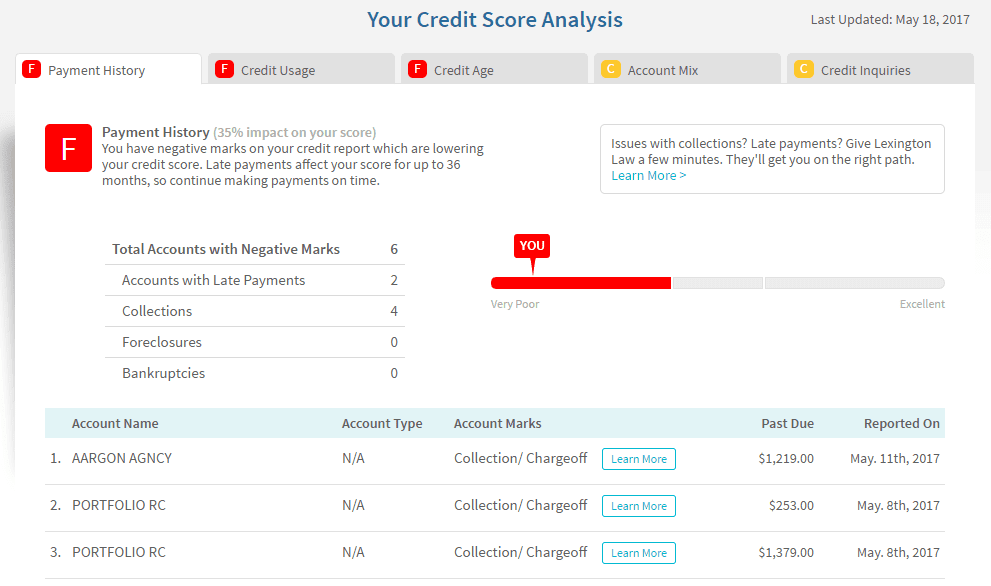

How Do Collections Affect Your Credit Score

Collections have a negative effect on your credit score.

The most recent two years are the most important where your credit score is concerned. The older a collection is, the less it hurts you.

Collections remain on your credit report for seven years past the date of delinquency.

In the newest versions of FICO® and VantageScore®, paid collections dont hurt your score but unpaid collections do.

When an account goes into collections, the number of points your score drops depends on dozens of factors unique to you.

The higher your score, the more it can fall. A 90-day late account may swipe 50 points from someone with excellent credit but only 10 points from someone who was already in the lowest tier.

Don’t Miss: What Is The Highest Credit Score You Can Get

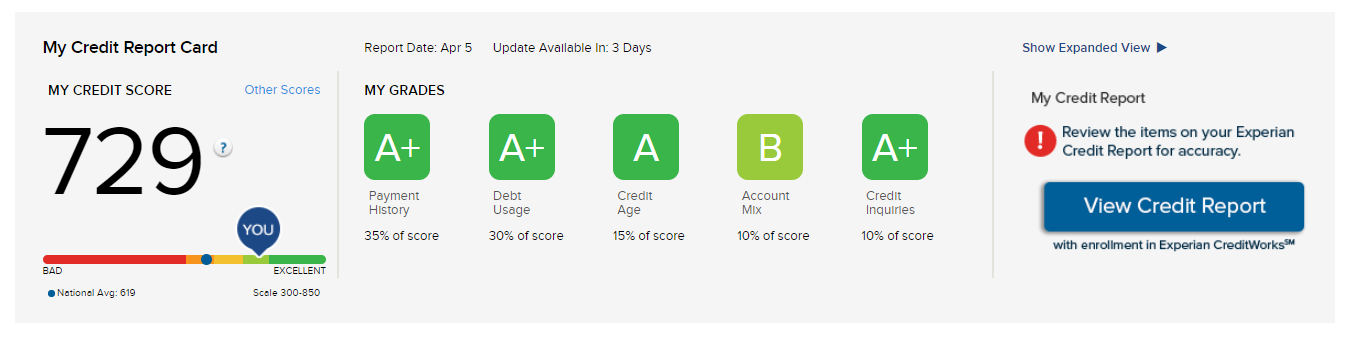

How Will These Changes Impact My Credit Score

Having a debt go to collections can drop your credit score significantly — and it gets worse the longer it hasn’t been paid. For instance, your credit score is likely to drop more if a bill has gone unpaid for 150 days versus 30 days.

Once a collection has been removed from your reports, you could see a positive change in your credit scores. The impact on your credit score will depend on how many collection accounts you have. If your only collections account is removed from your report, your score could rise as much as 150 points, according to credit repair company .

What Is A Collections Agency

A collection agency is a company that is hired by lenders, creditors, medical providers and federal and local governments to get you to pay or make arrangements to pay what you owe them, Eweka tells CNBC Select.

The most common types of debt that go to collections are credit card balances and medical bills, but there are many other reasons why people go into debt. Rent, student loans and tax debts are other examples of what can get passed on to a collections agency.

According to Debt.org, there are three phases to debt collection:

Don’t Miss: When Does Kohls Report To Credit Bureau

How To Handle A Collections Account On Your Credit Report

Since collections can drag down your credit score, youll want to do what you can to boost it in other ways.

For example, you can commit to the following credit habits going forward:

- Making all of your other debt payments on time

- Maintaining low credit card balances

- Avoiding unnecessary credit applications

When Do Collections Get Reported To The Credit Bureaus

Missed payments are first recorded on your credit report as late payments, and you will usually have the opportunity to bring your account back into good standing by catching up on your missed payments, as well as paying any penalties imposed by your lender.

Many creditors do not consider a payment to be missed until 30 days beyond the due date.

Watch out, though. You may be subject to a late fee on the first day after the due date.

Each late payment is recorded on your credit report and immediately hurts your credit score.

If you cant bring your account back into good standing, it will eventually be sent to your lenders internal collections department or sold to an outside collections agency.

At that point, its recorded on your credit report as a collection.

Don’t Miss: Does Apartment Lease Show On Credit Report

How To Check If You Have Collections Hurting Your Credit

If youre getting calls from debt collectors and youre worried that collections are bringing your credit score down, theres one surefire way to find out.

Go to AnnualCreditReport.com to claim your free copies of your Experian, TransUnion, and Equifax credit reports, and check each report for new collection accounts. You can do this once per year .

Its worth noting that most of the time, your on your credit report. However, to see the effect that collections are having on your score, you can check your credit scores by signing up for a service or getting your score directly from FICOs website.

How Long Does Info Stay On The Record

How long adverse information remains on your credit report depends on what is being reported. Positive information can stay on your report indefinitely. Negative information must be removed in accordance with limits set by the Fair Credit Reporting Act.

According to Experian, adverse information for business credit reports can remain on your report for as little as 36 months, or as long as nine years and nine months. Trade, bank, government and leasing data can remain for up to 36 months. Uniform Commercial Code filings stay for five years. Judgments, tax liens and collections remain for six years and nine months. Bankruptcies remain on your business credit report the longestup to nine years and nine months.

Adverse information generally remains on individual consumer credit reports for seven to 10 years. Bankruptcies remain the longest: up to 10 years from the order date or date of adjudication. If you defaulted on a government-backed student loan, the reporting period can be longer.

Civil suits, civil judgments and records of arrest can remain on your credit report for up to seven years or until the statute of limitations has expired, which ever is longer. Tax liens remain until they are paid, and then remain for seven years thereafter.

Recommended Reading: Do Student Loans Fall Off Your Credit

Read Also: What Is Syncb On My Credit Report

Facts You Should Know About Debt In The United States

Fewer COVID-19 restrictions have led to Americans getting out of their homes, which is a great thing. However, as they start venturing out more, so do their credit cards. Coupled with that, the price of housing and new vehicles hit record highs yet again in 2022. But even with skyrocketing prices, people are still buying homes and brand new vehicles.

The Statute Of Limitations Has Passed

Dont confuse the credit reporting time limit with the statute of limitations on debt, which is the period of time that a debt is legally enforceable. The two arent related, except with court judgments in states where the statute of limitations for a judgment is longer than the credit reporting time limit.

Recommended Reading: How To Have 800 Credit Score

How To Dispute A Collection On Your Credit Report

If a collection on your credit report is inaccurate or a duplicate collection account, you can dispute the collection account on your credit report. This doesnt necessarily guarantee that the collection will be removed from your credit report, though, because the account could be updated with the correct information rather than removed.

The Federal Trade Commission provides a guide to disputing errors on credit reports as well as a sample FCRA dispute letter. Alternatively, some consumers may prefer to hire a to assist with disputing inaccurate information.

Decide What You Want To Do

If you know the debt is yours, you do have the opportunity to negotiate a settlement. The CFPB recommends creating a realistic repayment proposal that is based on how much you can afford in payments each month, after accounting for bills, other debt payments and emergency costs. If the debt doesnt belong to you, you can dispute it.

Keep in mind that debt falls under a statute of limitations in each state. This means a collector cannot sue you for a debt that is older than a certain number of years, which the CFPB says ranges from three to six years, depending on the state. If the debt is close to the end of the limitations, the collector might be more willing to negotiate with you. If you are unsure of whether the statute of limitations has passed, the CFPB recommends contacting an attorney in your state.

Recommended Reading: Is 784 A Good Credit Score

Can Debt Collections Less Than $100 Be Reported To The Credit Bureau

Debts that make it to the collection stage can lower your credit score significantly, especially if you have a good to excellent credit score. However, collections under $100 do not factor into your credit score most of the time. In 2009, Fair Isaac Corporation, the maker of the software that major credit bureaus use to create credit scores, removed collections accounts less than $100 from the credit scoring calculations in most cases. This is a victory for consumers since unpaid library fines and small medical co-pays that slipped through the cracks should no longer impact your credit score.

Tips

-

In 2009, Fair Isaac Corporation removed collections accounts less than $100 from the credit scoring calculations in most cases. This is a victory for consumers since unpaid library fines and small medical co-pays that slipped through the cracks should no longer impact your credit score.

You May Like: Syncb Ppc Card

What Are Your Rights

Debt collection calls are the cause of more complaints to the Federal Trade Commission than any other industry. Collectors in bad-faith have been known to harass consumers with phone calls and demand larger payments than what is legal, among other deceptive practices. Under a federal law known as the Fair Debt Collection Practices Act , this behavior is illegal.

The FDCPA gives consumers rights and protections when it comes to how an agency can conduct debt collection. The act protects consumers from abusive, deceptive and unfair debt collection practices such as limiting debt collection calls before evening hours, not allowing incessant calling or communication via postcard and prohibiting the use of violence or intimidating language from the debt collector.

Changes to the law are coming. In May 2019, CFPB Director Kathy Kraninger announced a proposal to change certain restrictions under the FDCPA, ranging from how collectors can contact consumers, when and how many times. In the future, collectors may be able to communicate via email and text messages, and would be limited to seven attempts of calls per week .

The proposal is described as an overhaul by industry experts with many different changes. Its expected to pass by the end of the year, so consumers should pay attention to the final changes.

Read Also: When Does Usaa Report To Credit Bureaus

How To Get A Collections Stain Off Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent.

But you may want them off sooner than that unpaid collections can make you look bad to potential creditors. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

Here are steps to remove a collections account from your credit report:

Do your homework

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

Don’t Miss: What Are The Credit Rating Levels

What Is Debt Collection

Debt collection is the process of unpaid debts getting assigned to a collections agency. These agencies then take responsibility for collecting the debt on behalf of the original company or, sometimes, the agency buys the debt and then collects it on behalf of itself.

According to Experian, lenders can collect debt in four ways:

- Contacting you on their own,

- Hiring a collection agency to collect,

- Selling revolving debt to a collection agency who then when work to collect it, or

- Repossessing items associated with installment loans , selling the item at an auction and then selling the remaining debt to a collection agency.

Who The Legislation Does Not Apply To

The legislation does not apply to businesses or people collecting debts for which they are the original creditor or owner of the debt, a lawyer who is collecting a debt for a client, a civil enforcement bailiff or agency while seizing security or people working in the regular course of their employment while licensed under the Insurance Act.

Dont Miss: Is 611 A Good Credit Score

Don’t Miss: Why Did My Credit Score Drop 30 Points

Paying Won’t Take A Collections Account Off Your Credit Reports

Many people believe paying off an account in collections will remove the negative mark from their . This isnt true if you pay an account in collections in full, it will show up on your credit report as paid, but it wont disappear. In fact, you should expect it to remain on your report for seven years.

This means that it could affect your credit score, the three-digit number used to judge your creditworthiness, for that length of time. The sharpest drop to your scores will happen when the account is first reported to the credit bureaus as in collections and then the damage lessens over time.