Discount Tire Store Credit Card

The Discount Tire/Americas Tire credit card provides a no-interest promo for your first purchase. The promotional no-interest timeframe can be 6 months, 9 months, or 12 months.

To qualify for 6 months of no interest, your purchase must be between $199 and $999.99. To qualify for 9 months of no interest, your purchase must be between $1,000 and $1,499.99. Finally, purchases of $1,500 or more qualify for a no-interest 12 months.

What Are Credit Reports And How Do They Work

Your credit report tells your financial story to lenders, and it allows them to make informed decisions about your creditworthiness.

Your credit report is like a report card that grades how well you manage your financial obligations, says Bruce McClary, vice president of communications for the National Foundation for Credit Counseling.

There are three credit bureaus that publish these reports: Experian, TransUnion, and Equifax. These bureaus report information from your lenders such as payment history, balanced owed, and whether youre paying on time. If you pay your bills on time and keep your balances low, youll have a higher score. Conversely, if you miss payments regularly, youll have a lower credit score.

Potential lenders use one or multiple reports to verify your information. Theyll also use this information to determine if youre eligible for financing and if you are what your terms should be. Therefore, monitoring your credit reports is an essential way to stay on top of the information presented to prospective lenders.

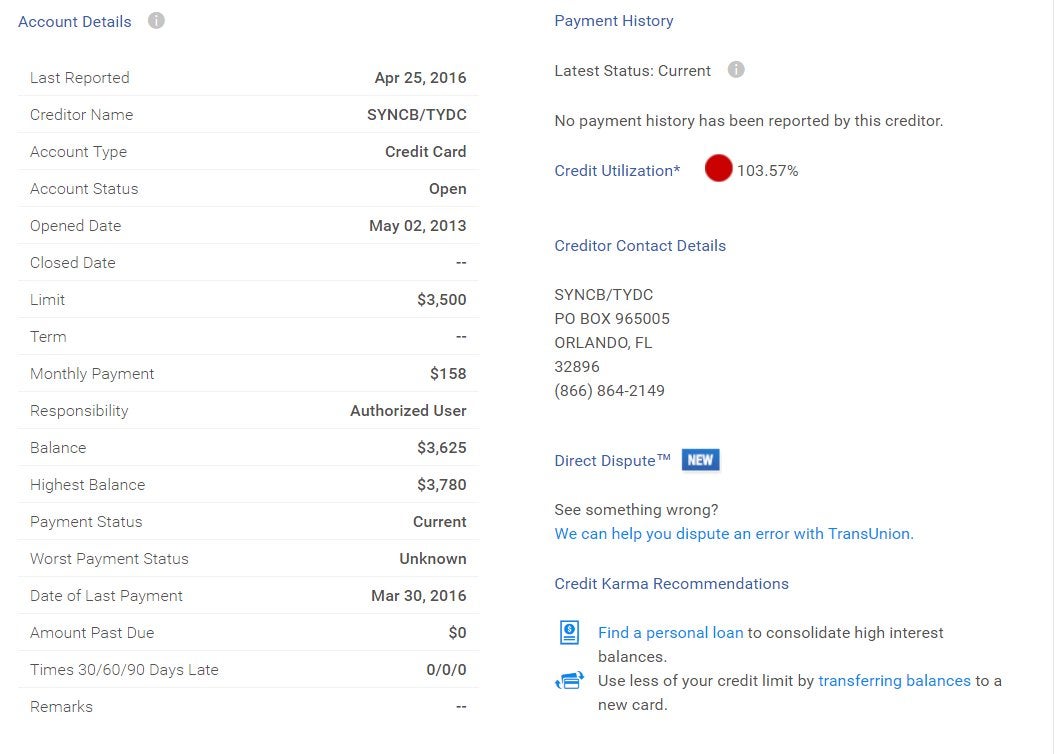

Active Or Closed Accounts

PayPal Credit accounts could also appear on your credit reports in the accounts section as either active or closed accounts.

If, at one time, you had a PayPal Bill Me Later or Credit account, the closed or active account may have been reported to the bureaus for the first time. And now that Synchrony Bank owns the accounts, it can also raise or lower credit lines and close accounts for inactivity . Both of these can affect your credit scores.

But if the account still doesnt ring any bells, you should contact Synchrony Bank. Its possible there was a mistake or that someone fraudulently used your identity to apply.

You May Like: Does Barclaycard Report To Credit Bureaus

How Long Does A Syncb Hard Inquiry Stay On Your Credit Report

One of the most frequently asked questions or FAQs, Is how long will a hard inquiry stay on my credit report?

A lot of people are unaware that applying for a retail credit card in a store can damage their score in minutes.

If youve applied for a retail card with one of the brands above, it could be the culprit of the SYNCB hard inquiry on your report.

When you apply for credit from SYNCB or any lender for that matter, the bank runs a check on your credit profile to determine whether or not to approve your application.

While checking your credit score online from a service like is considered a soft credit pull and doesnt affect your credit, a hard pull from a lender will.

In this process, the lender can request your credit report from one or all of the major credit bureaus, potentially impacting your Equifax, TransUnion, and Experian scores.

The severity of a hard inquiry lessens over time, but it will remain on your report for two years.

While one credit card application might only do minimal damage to your score, hard inquiries can add up quickly to hurt your credit.

Open And Closed Accounts

If SYNCB/PPC has suddenly appeared on your credit report as an open or closed account, then its probably affected your credit score by influencing the following factors:

To learn how your SYNCB/PPC account will affect your credit score, familiarize yourself with the factors that make up your FICO score and VantageScore.

Note that if the account used to be listed under a different company but was taken over by Synchrony Bank, then it wont have any effect on your credit score at all .

Dont rush to close your SYNCB account

Closing an account can hurt your credit score by reducing your available credit . Use the account occasionally to prevent your creditor from closing it due to inactivity and only close it if keeping it open will jeopardize your finances.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Is Synchrony A Real Bank

You wont find any brick-and-mortar Synchrony Bank locations, but Synchrony is indeed a real bank.

Aside from issuing credit cards, Synchrony provides a plethora of financial products , and more), plus special financing offers with select retailers.

Despite all the different card offers, you can use the basic to access any Synchrony card account. Or you can download the MySynchrony app for your smartphone. Youll be able to check your card details and pay bills with either method.

Synchrony cardholders can also access one of their FICO credit scores, based on their TransUnion credit reports. This is a good feature for anyone trying to establish or rebuild credit.

However, store cards also have some downsides . They typically come with low credit limits, like $500 or $1,000, and very high interest rates. You should always pay your statement balance in full and never carry a balance on a store card, because the interest you accrue will negate any rewards or benefits you got from the card . Store cards also tend to come with below-average customer support, as discussed in the section below.

Insider tip

The shopping cart trick is rumored to be a way to get approved for certain credit cards without hard inquiries on your credit reports, although it may not actually work. People usually try it with store cards issued by Comenity Bank, but some report that it works with certain Synchrony Bank credit cards as well, like the QVC card. We cant confirm this, however.

There Were Some Hard Inquiries

Typically, when you apply for a credit line with most companies, they perform a hard inquiry on your credit. Suppose you’ve applied for a PayPal Credit account or any other credit account associated with SYNCB. In that case, they always go the hard inquiry route to check your credit for its application evaluation.

Hard inquiries always show up on your credit report because they negatively impact your credit scores. They’ll also remain on your credit report for up to two years. Note that inquiries only apply to credit-related products so you will not see them for opening up a checking or savings bank account.

Don’t Miss: Syncppc

Raise Your Credit Limits

Another thing that lenders look at is the percentage of your credit limits that youre using. If youre maxing out your credit cards, lenders are likely to think youre in dire financial straits.

If youre barely using any of your available credit, you can probably handle some additional debt.

You can usually request credit limit increases on your existing credit cards through the lenders online portal.

Increasing your credit limits will reduce your credit utilization, boosting your score.

Will Ge Stock Recover

Whats more, the company expects commercial air travel will fully recover to pre-pandemic levels by 2023 or 2024. GE stock is trading for about 16 times his estimated 2024 cash flow. Thats a long way off, but Honeywell International , by comparison, trades for about 17.5 times estimated 2024 free cash flow.

You May Like: Does Opensky Report To Credit Bureaus

What Is Syncb/ppc On My Credit Report

If youve noticed an odd entry on your credit report under the name SYNCB/PPC, you may be wondering who they are.

With so many banking abbreviations appearing on credit reports these days, it can get a little confusing.

This post contains affiliate links. We may earn a commission, at no additional cost to you, if you make a purchase through a link. Please review our disclosure for more information.

Negative Codes On An Experian Credit File

For example, here are a variety of negative credit scenarios, and the Experian codes used to describe them:

-

30 Days Past Due: 30

-

60 Days Past Due: 60

-

90 Days Past Due: 90

-

120 Days Past Due: 120

-

150 Days Past Due: 150

-

180 Days Past Due: 180

-

Collection: C

-

Voluntarily surrendered: VS

Again, none of these is a flat-out credit deathblow in and of themselves.

But if your credit reports show a repeated pattern of late payments and an inability or unwillingness to pay your obligations, then banks, credit unions and other financial institutions definitely wont be beating down your door to offer you credit.

Read Also: Syncb Ntwk Card

Your Income And Expenses Matter Too

Dont forget that your income and expenses can affect your chances of getting a loan just as much as your credit.

When you apply for a credit card, Synchrony is likely to ask about your annual income and monthly housing payments.

Synchrony does this because it wants to know how much money you have left over each month to make credit card payments.

Consider this example:

If you make $1,000 per month and spend $70 on housing, its unlikely you can pay the bills on a new credit card. If you make $8,000 a month and spend $3,000 on housing, theres a much better chance you can make payments.

Why Is Syncb/ppc On My Credit Report

Before Synchrony Bank took over, PayPal Credit and Bill Me Later weren’t something that showed up on everyone’s credit reports. This is because PayPal Holdings didn’t really report to any credit reporting agencies. Now that Synchrony Bank is steering the ship, they’ve taken on the responsibility of reporting to the credit bureaus monthly.

If you’re now seeing SYNCB/PPC crop up on your credit report, here’s why:

Read Also: Does Speedy Cash Report To Credit Bureaus

Work With A Credit Repair Company To Remove The Hard Inquiry

Writing and calling creditors and credit bureaus can be quite stressful and time-consuming.

Especially if you have a more complicated credit situation.

If youd like to leave the hassle of dealing with creditors to someone else, we recommend working with a .

These companies are staffed with pros who work quickly to ensure accurate reporting, dispute your claims, and get entries removed from your report.

And if youre dealing with more than a hard inquiry, a credit repair company can be downright essential.

Hard Or Soft Inquiries

Hard inquiry: If you applied for a credit card from your bank or credit union and have a hard inquiry on your credit reports from Elan Financial Services, its possible the card actually is offered by Elan Financial Services on behalf of the bank or credit union you applied through.

In that case, Elan Financial Services would likely have done a hard pull on your reports to check your credit when evaluating your application to decide whether to lend to you. A hard inquiry can have a small negative impact on your credit scores and can show up on your credit reports for up to two years.

Soft inquiry: If you applied to prequalify for a credit card from one of the banks or credit unions that works with Elan Financial Services, you could also see a soft inquiry from the company on your reports. A soft inquiry doesnt affect your credit scores.

Unauthorized hard inquiry: If you didnt apply for a credit card provided by Elan Financial Services and you have a hard inquiry from this company on your reports, its possible that youre facing a case of identity theft. Learn more about what to do if you spot an unauthorized hard inquiry.

Read Also: Does Paypal Credit Affect Credit

Don’t Miss: How To Get Credit Report With Itin Number

How To Remove Syncb/ppc From Your Credit Report

Whether you had an open account or not, if you ever applied for a line of credit from PayPal, you probably wont be able to get it removed from your credit report.

However, if you dont recognize the name and dont recall applying for an account, you could get the hard inquiry or account deleted from your report.

Here are a few pointers.

How Often Should I Check My Credit Reports

Normally, experts advise checking your report at least once or twice a year as a good practice. Thats how often the three credit bureaus typically offer free reports. Checking your own credit is considered a soft inquiry, which means it will not hurt your credit score.

But the pandemic has created a new normal, and all three major credit bureaus are allowing people to check their credit reports on a weekly basis until April 2022. Deciding when to check your credit can be puzzling, but it ultimately comes down to how confident you are about your credit history. For some, checking it once a year is enough, while others may prefer to check it weekly following financial hardship or uncertainty during the pandemic.

At times like these, you should anticipate things perhaps falling through the cracks, Boneparth says.

Boneparth says checking your credit report every week may be a little excessive, but that it could also be a useful tool for anyone who has suspended or deferred payments to make sure lenders are marking their credit history correctly.

Banks are allowing customers to either defer or reduce payments, and the concern may be that those payments would be marked as delinquent instead of current, Boneparth says. For individuals who are taking their financial institutions up on whatever offers to do that, it could make sense to more regularly check your credit report to make sure everything is the way it should be.

Don’t Miss: How To Remove Repossession From Credit Report

How To Apply For The Carecredit Card

There are three ways to apply for a CareCredit card. You can:

- Apply over the phone Monday through Friday 9 a.m. to 9 p.m. EST with a representative or at any time using the automated phone system at 1-800-677-0718. To apply over the phone, you must be 21 or older.

- You can also apply online anytime you want. To apply online, you must be 18 or older.

- Finally, you can find an application form at most medical centers or health care provider offices. Just fill out the form and get approved on the spot.

When applying youll be asked for some basic information like:

- Name

- Net income

- Housing information

Youll also be asked about specific doctors or health care facilities that you intend to use your CareCredit card at. Its worth noting that cardholders can use their CareCredit cards anywhere they want so long as the facility accepts the card after theyve applied and been approved. So, you are not limited to the doctor or facility you put down on the application form. Its just used as a starting point.

Among the best aspects of the CareCredit card is that approval can be instant, so you dont have to wait to find out if you can get the medical treatment you need. You also dont have to have an excellent credit score to get approved for the card, something that many people whove been declined for a standard credit card will appreciate immensely.

Find Out: Business Line of Credit vs. Loan Which Is Right for Your Startup?

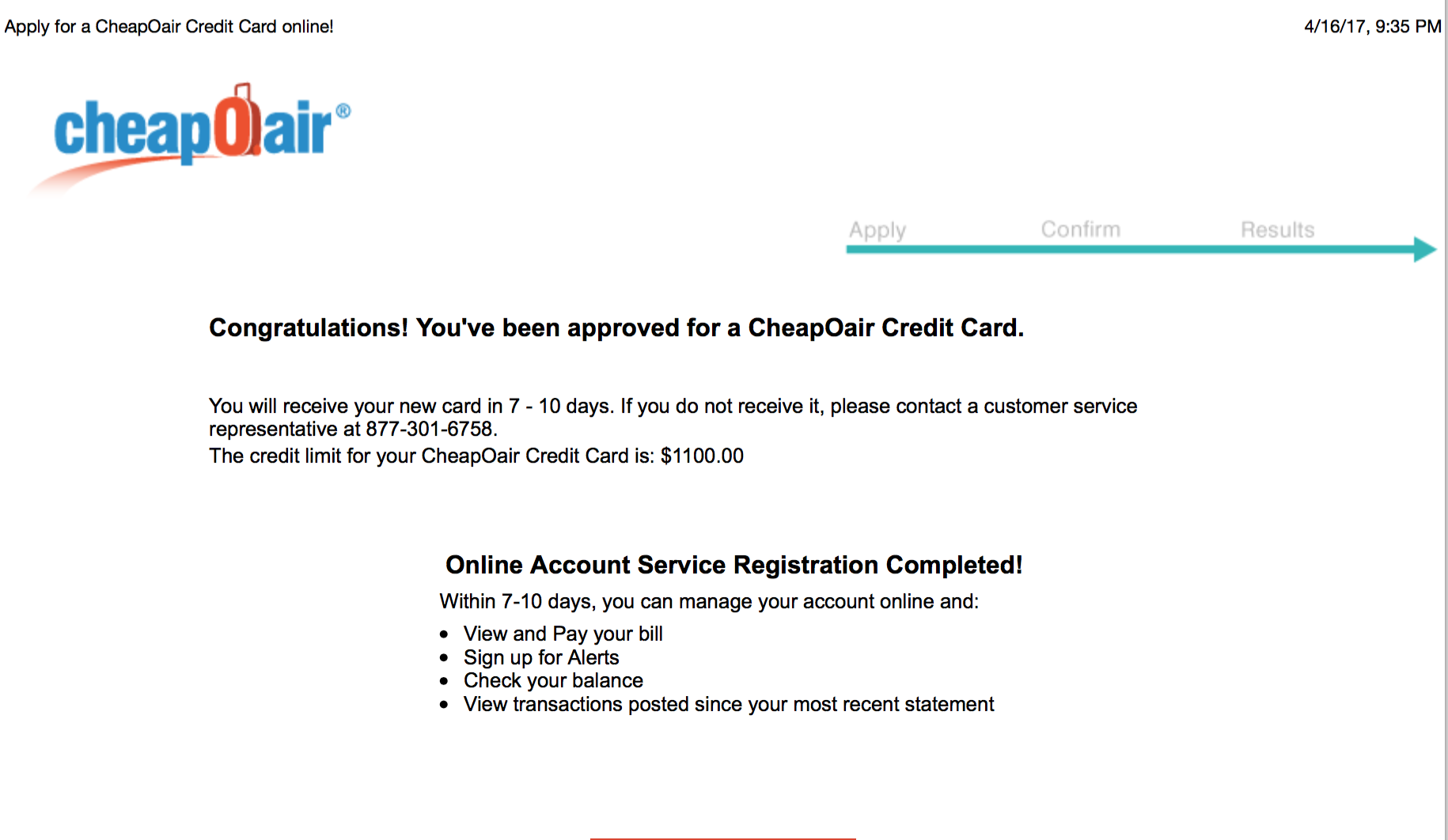

Where We Got The Data

The credit card application process isnt particularly transparent.

Generally, you fill out an application form online or in person, and wait for a response to pop out. It often seems like you dont have much control over the result.

Given how unclear the process is, its probably not a surprise that lenders dont tell us which credit bureaus they work with.

What that means is that we gathered this information from people who applied for cards from Synchrony.

Whenever you apply for a loan of any kind, the lender is likely to check your credit report. When a credit bureau receives a request for a copy of your report from a lender, the bureau takes note of that request.

These hard pulls on your credit report will stay on record for two years after the date of the inquiry. Each hard pull will also reduce your credit score by a little bit.

We used CreditBoards.com to collect the majority of the data about Synchronys use of TransUnion report.

People use the website to gauge their chances of qualifying for certain cards. After they apply for a card, users report information like their income, credit score, the bureau that the hard pull appeared on, and whether they were approved or not.

Other borrowers can compare themselves to others on the board to see if they have a good chance of getting a card.

We use just the last three years worth of data to make sure were offering the most up-to-date info we can.

Recommended Reading: Does Paypal Credit Help Credit Score

Chevron And Texaco Visa Credit Cards

The Chevron and Texaco Visa cards earn 3 cents per gallon in fuel credits on purchases with Chevron and Texaco. Additionally, you can earn 10 cents per gallon in fuel credit when you spend $300 at other merchants each month. If you spend $1,000 at other merchants in a given month, youll receive a discount of 20 cents per gallon.

These fuel credits must be redeemed at Chevron or Texaco gas stations.

What Is Syncb Ppc

SYNCB PPC stands for Synchrony Bank/PayPal Credit. You may see this on your credit report if youve applied for PayPal Credit, formally known as Bill Me Later account in the past. PayPal Credit is a line of credit that PayPal account holders can apply for.

After Synchrony Bank bought PayPal Credit from PayPal in 2018, the buy-out included any debt owed to PayPal. Now, all of those PayPal bills are owed to Synchrony instead of PayPal.

Don’t Miss: Is 626 A Good Credit Score

Whats Covered With The Carecredit Card

The CareCredit card covers a range of medical expenses including things that are covered by your more traditional medical insurance copays, elective medical procedures, doctors, dentists, surgical centers, hearing and vision care, hair restoration and even vet visits. It can also cover several other medical expenses such as purchases made at drugstores like Rite Aid. Heres a more comprehensive list of whats covered by the CareCredit card: Chiropractors

- Cosmetic surgeries and treatments

- LASIK surgery

- Primary care facilities

- Weight loss clinics and procedures such as gastric bypass, slim band, gastric sleeve and bariatric bypass

- Urgent care centers

- Veterinary services

- Vision centers

Its important to note that while the things on this list may be covered by a CareCredit card, youll have to find a healthcare professional or facility that accepts the card in order to pay for the expenses with the CareCredit card.