Factors That Affect Your Credit Scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

Does Credit Karma Offer Free Fico Scores

You may have read reviews that say the credit scores you see on Credit Karma are useless because theyre not FICO® scores. Though Credit Karma does not currently offer FICO® scores, the scores you see on Credit Karma provide valuable insight into your financial health.

Its important to keep in mind that no one credit score is the end-all, be-all. There are dozens of different FICO® scoring models alone. Even if youre confident in a specific FICO® score, it may not necessarily match the scores a lender pulls when you apply for a loan.

At Credit Karma, we believe that because you can have so many different scores, the exact number you get at a given time isnt of foremost importance. Whats more important are the changes you observe over time in a single score, and where that number puts you in relation to other consumers.

Once People See That Credit Karma Offers Access To Your Credit Scores For Free They Usually Follow Up With Questions Like Is Credit Karma Accurate Or Whats The Catch

Whether its your first time visiting Credit Karma or youve been a member for years, you might want some more insight into where Credit Karma gets your credit scores and why you should trust a company that claims to offer something for free.

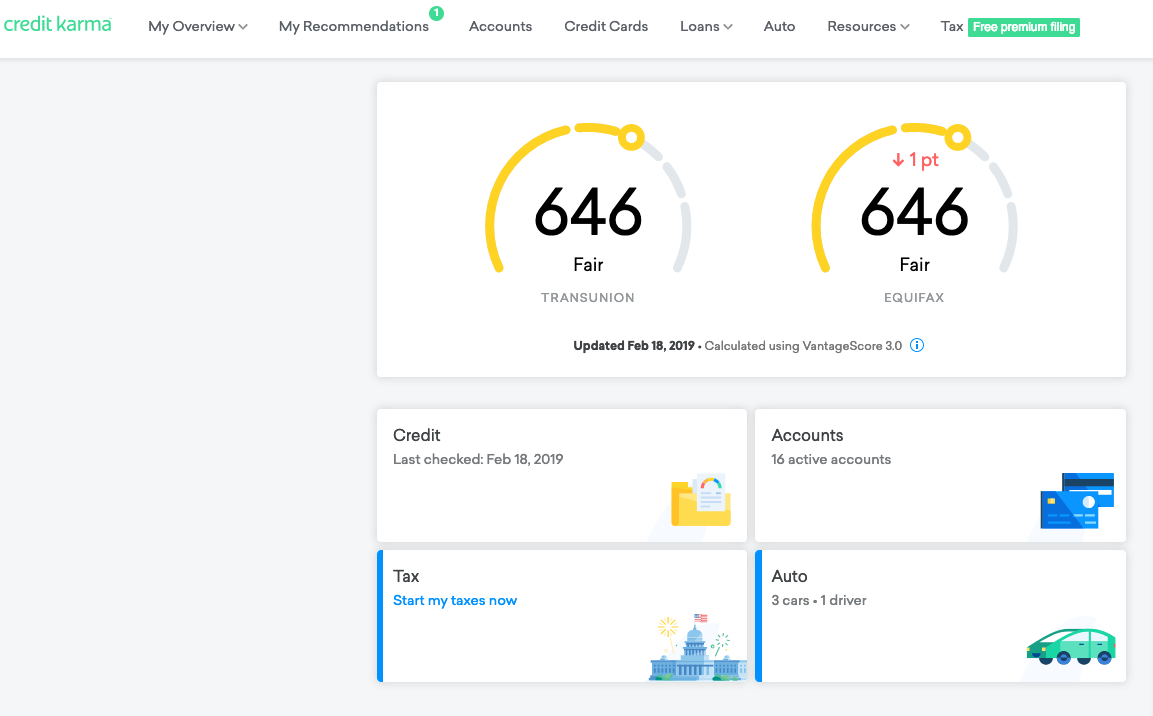

Heres the short answer: The and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

This means a couple of things:

- The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating. This, by the way, is one of the reasons why we ask for your Social Security number and other personal information in order to create a Credit Karma account so that we can match you up to what the bureaus have on file for you.

- We dont gather information from creditors, and creditors dont report information directly to Credit Karma.

Understandably, you may still have some questions about how Credit Karma gets your credit scores and why your scores from Credit Karma might look different from scores you got somewhere else.

Well dig into some of those questions below. Well also explain how Credit Karma can offer free credit reports from TransUnion and Equifax along with your free credit scores from each of those credit bureaus.

Recommended Reading: Is 672 A Good Credit Score

Borrowell Vs Credit Karma Canada: Which One Is Better

In the past few years, credit scores have been available to regular folk for free in Canada with fintech providers like Borrowell and Credit Karma. Prior to this, you would have to pay for your credit report, or be applying for a loan to be able to access your credit score. There are two major credit score companies providing this for free in Canada, and these are Borrowell and Credit Karma. Which one is better? Heres whether you should sign up to have your credit score regularly monitored with Borrowell vs Credit Karma.

Knowing your credit score is useful because if you are applying for a loan you will want a good or excellent credit score. If you dont know what your score is, you wont know if it is good or excellent unless you pay for the credit report or unless you are applying for a loan. And then it might be too late to improve your score, should you find out that your credit score is not up to snuff.

This post may contain affiliate links. Please see genymoney.cas disclaimer for more information.

How Do I Check My Credit Score For Free

You now have a legal right to access your credit report for free from any credit reference agency.

These statutory reports offer a snapshot of your credit history and dont include a credit score.

But the three main credit reference agencies all offer more comprehensive services for a monthly fee.

These provide unlimited access to your credit report, plus extra features, such as a score and alerts when major changes are made to your report.

However, it’s now possible to access both your credit report and score without having to pay for a subscription.

You May Like: How To Remove A Repo From Credit

Why Is It Important To Monitor Your Credit Score

A good credit score can make your financial life easier. Youll have easier access to large loans such as a mortgage or auto loan with better terms. These terms can save you money over the long term and allow you to work towards your other financial goals such as retirement or building a safety net before deciding to work for yourself.

On the flip side, a bad credit score can lead to difficulty obtaining large loans with favorable terms. If you are able to secure a loan with bad credit, then you will likely be paying higher rates. Your higher payments can add up and make it more difficult to save for your other financial goals.

If you have plans to make a major purchase with the help of a loan, then you will want a good credit score. Consider whether or not you see a home purchase or auto loan in your future. If you do plan on making a major purchase with the help of a lender, then you will likely need a good credit score to make that transaction flow as smoothly as possible.

With that, is incredibly important to monitor your credit score. Not only can your actions have a big impact on your , but also mistakes on your credit report can lead to a misleading score. For example, if a creditor accidentally reports a defaulted loan on your credit report, it could lead to a big drop in your credit score through no fault of your own. That could lead to problems securing a mortgage or auto loan down the line.

Why Credit Scores Can Vary

- Information may be incorrect on a credit report. If information is wrong on your credit report, it will affect your score. Fortunately, you can dispute inaccurate information using the . Getting incorrect information fixed on any credit report is vital, especially if you purchase a home shortly. You can learn how to dispute errors in a credit report in this helpful article from Norton.

- Some lenders do not report to all three major credit report companies. If a lender does not report to a credit report company, that companys score for you will be different from the score you have at a credit report company with that lenders info.

- Scoring models differ among credit reporting companies. Each credit reporting company has its own scoring model the model they use to weigh the importance of different aspects of your credit. Since they use different models, they can come up with different scores using the same information. You will notice that all credit agencies have slightly different scores.

So, hopefully, you now have a better understanding of Credit Karma accuracy.

Also Check: Does Paypal Credit Report To Credit Bureaus

Is Credit Karma Free

Its true that Credit Karma is completely free and the company claims that they will remain so indefinitely. Thats great news for users, but its still important to be cautious when browsing the website.

It might be tempting to take out a loan or get a new credit card that you might not otherwise consider when you see all the various financing offers available to you.

Perhaps that is a good thing for some people after all, everyone needs some sort of financing at some point in their lives. Or maybe your credit has improved and you are eligible to refinance a current loan at a better interest rate and save some serious cash.

Not Checking Your Credit Reports Each Year

Identity theft is fairly common these days, and statistics show that an array of hacking strategies aimed at consumers are on the rise. New account fraud that takes place when someone opens an account with your private information grew to a $16.9 billion dollar crime in 2019, according to a 2020 report from Javelin Strategy.

The best way to know if youre a victim of identity theft or fraud is to check your credit reports every year. If you fail to do so, you could easily be a victim of theft and not find out for months or even years. Fortunately, you can check your credit reports from all three credit reporting agenciesExperian, Equifax, and TransUniononce a week through April 2022, and after that once per year using the website AnnualCreditReport.com.

Recommended Reading: Check Credit Score Without Social Security Number

Why Is Your Credit Score Lower Than Credit Karma Told You

February 23, 2021 by First Residential Mortgage

Did you recently try applying for a mortgage or another loan after you looked up your credit score using the free tool provided by Credit Karma?

Perhaps you faced an unwelcome surprise. The lender might have turned you down or offered you a lower rate than youd projected.

There is a specific explanation for why this happensand you are not the only borrower to have this experience.

Lets find out why the credit score that was pulled while processing your application for a mortgage was lower than the score Credit Karma pulled up online.

As CNBC explains, Consumers tweeted about going to apply for a credit card or loan thinking they have good or excellent credit, only to soon find that the credit score that the card issuer or lender pulled was lower than what they saw on Credit Karma.

Here is what is going on here. Credit Karma pulled up your VantageScore credit score. But the lender pulled up your FICO credit score.

Most customers know they have a FICO score, but many do not know they also have a VantageScore credit score as well as other credit scores.

What To Know About Credit Karma Including Accuracy

Your credit score is one of the most critical pieces of financial information, especially when buying a home.

For a long time now, creditors and lenders have used your credit score to determine whether they would lend to you and what kind of terms they would offer.

Today, your credit score affects even more aspects of your life, possibly even your ability to get a job or successfully rent or purchase a property.

The company has over 100 million members as of 2021, all of which can get their free information from the Credit Karma site.

When buying a home for the first time, it is essential to get your financial house in order far in advance of ever putting down your earnest money with a real estate agency. Credit Karma helps you do just that.

One of the most substantial mistakes first-time homebuyers make is not preparing themselves well enough financially. Credit Karma can be your financial right-hand man in your home buying journey.

Once you are ready to get started, the Credit Karma sign-in will get you on your way. As you would expect, the Credit Karma login is at the top right of the screen.

Lets take a deep dive into what you need to know about Credit Karma and what it offers:

You May Like: What Is Syncb Ntwk On Credit Report

How To Monitor Your Credit Score

You can monitor changes in your credit scores for free by using or CreditSesame.com, which gives you free access to your non-FICO credit scores. Credit Karma updates your TransUnion and Equifax credit scores daily while Credit Sesame delivers monthly updates to your Experian credit score. If there are changes to either of those credit reports, you can see the subsequent credit score change using the free services.

Some credit card issuers give their cardholders a free FICO score on each month’s billing statement. Discover, First National Bank of Omaha, and Barclaycard all offer free FICO scores each month. Capital One offers CreditWise, which is also free. Check with your credit card issuer to find out whether they provide free access to your credit score.

Why Is Credit Karma Free

One minor complaint from some users is that the user dashboard has many ads and offers from third parties maybe too many for some.

Of course, these ads and offers are how they make money and can provide members with a totally free credit score. However, you shouldnt take out a credit card or loan that you dont need just because youre being offered what seems like a good deal.

Because Credit Karma has access to so much of your personal and financial information, they are able to make extremely targeted individualized offers to each member.

Be sure to use your judgment wisely before committing to any product youre offered. But hopefully, if youre using Credit Karma, youre already determined to use your credit responsibly so you can achieve all of your financial goals.

Read Also: What Day Does Opensky Report To Credit Bureaus

What Is A Credit Score

A credit score is a number based on the information in your . Most credit scores range from 300 to 850, and where your score falls in this range represents your perceived credit risk. In other words, it tells potential lenders how likely you are to pay back what you borrow.

Your credit scores can affect whether a lender approves you for a mortgage, auto loan, personal loan, credit card or other type of credit. And if youre approved, your credit scores can also help determine the interest rate and terms youre offered.

Easy To Login And Use The Site

Signing up to use their financial tool is straightforward and only takes a couple of minutes to get started. You will need to give them your name and address along with a couple of finance-related personal details like your social security number. The sign-in and login are super easy to use.

As you would expect, the is in the upper right-hand corner of the site, so signing in is a breeze.

Given the company will be holding your sensitive information, it offers security features that all users should consider opting into. Doing so keeps Credit Karmas users information safe from hackers. There will be much less worry about identity theft.

Recommended Reading: Does Affirm Show Up On Credit Report

Losing Points On Your Credit Score

To reiterate, hard inquiries can lower your FICO credit score anywhere from 5 to 10 points. While this seems like nothing, 5 to 10 points could end up being a deal breaker. Some companies look through thousands of loan and credit card applications every day. To make the process go by faster, they might only look at your credit score. They might have a threshold that if you are even one point under they wont lend to you. According to credit.org, a good credit score ranges from about 680-740 and the threshold of a good score usually is about 700 points and above. If youre trying to get a loan from a company that has a strict threshold of 700 points, a 5 or 10 point decrease could put you below that line and you could be denied an important loan.

While many other things lower your credit score more than hard inquiries do, they still shouldnt be ignored. Hard inquiries arent exactly avoidable though, so try to only get them once in a while. If you have had 4 inquiries over the past year your score could be down as much as 40 points until it goes away!

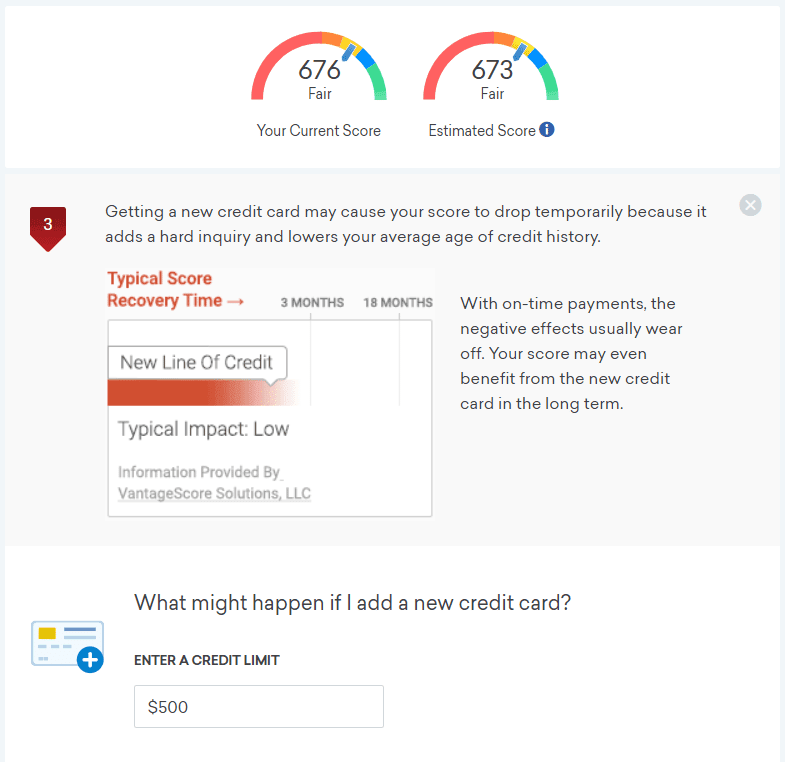

Opening New Credit Cards All The Time

Tempted by the enormous signup bonuses you can earn on rewards and travel credit cards? Theres nothing wrong with using credit to pursue rewards, but you may wind up with too much of a new thing.

New credit makes up another 10% of your credit score, mostly because each new credit application you make causes a hard inquiry on your credit report. Too much new credit can cause your score to temporarily drop, which could make it more difficult to qualify for loans with the best rates and terms in the future.

Recommended Reading: Syncb/ppc Account

Maxing Out Your Credit Cards Each Month

Lets say you pay your bills early every single month and never miss a payment, but you cant help but rack up balances that continue growing every month. This can be a huge problem for your credit since the amounts you owe in relation to your credit limits, called , make up 30% of your FICO score.

Whats the problem? According to myFICO.com, credit score formulas see borrowers who constantly max out their cards as a potential risk. Thats why its a good idea to keep low credit card balances and not overextend your credit utilization, they report.

Whats the best utilization rule? Credit reporting agency Experian says you should strive to keep your credit balances below 25% to 30% of your limits to achieve the best results. This means that, if your total credit limit across all your is $10,000, you should never owe more than $2,500 to $3,000. If you maintain balances higher than that in relation to your credit limits, you should fully expect your credit score to take a hit.