How Often Do Credit Reports Update

Your credit reports are updated when lenders provide new information to the nationwide credit reporting agencies for your accounts. This usually happens once a month, or at least every 45 days. However, some lenders may update more frequently than this. So, say you paid down a credit card recently. You may not see your account balance updated on your credit report immediately. If you look at the account in your TransUnion credit report, you may see a line that reads Date Updated. This would tell you the most recent day the account information was provided to TransUnion.

Because lenders dont all provide updates on the same day, new information may be added to your reports quite frequently. You can get your credit report from each of the three nationwide credit reporting agencies weekly at annualcreditreport.com. If youd like to more tools to help you manage your credit with confidence, consider a paid subscription to TransUnion Credit Monitoring. Youll get access to daily credit report and score refreshes and alerts when there are changes to your accounts, helping you better keep track of important account changes.

What To Look For On Your Credit Report

Lenders use codes to send information to the credit bureaus about how and when you make payments.

These codes have two parts:

- a letter shows the type of credit you’re using

- a number shows when you make payments

You may see different codes on your credit report depending on how you make your payments for each account.

| Letter |

|---|

Accounts That Are Inaccurately Reported

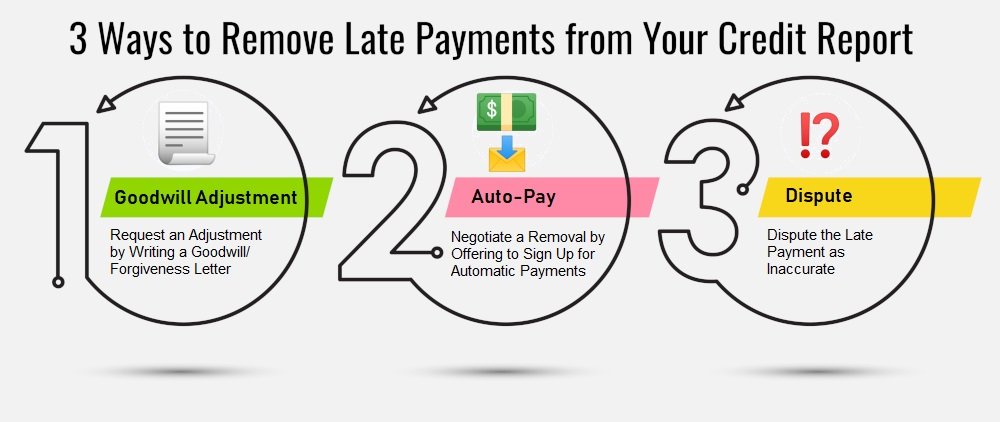

If your credit report contains negative accounts that should be positive, you can use the to have the information corrected. For example, your credit report may show that you were late on a payment that youre certain you paid on time. To correct credit report errors, you need to send a dispute letter to the credit bureaus citing the error and providing a copy of any proof that shows the information is indeed incorrect.

The bureau will investigate and revise your credit report if the investigation supports your claim. If not, you can follow up with a dispute directly with the business that reported the error.

Also Check: Does Speedy Cash Report To Credit

How A New Auto Loan Can Impact Your Credit

Does it actually matter whether your new loan shows up on your credit report? It might. If you’re building or rebuilding your credit, a new auto loan can help you out in a few ways.

First, it adds to your . A car loan is considered an installment loana loan with fixed monthly payments and a predetermined payoff periodwhich is a different type of credit than a revolving credit card account. Having a car loan appear on your report shows creditors that you have experience managing diverse types of credit. It may also boost your credit score: Credit mix accounts for 10% of your FICO® Score, the scoring system used most commonly by lenders.

Your credit score will also benefit from having timely monthly loan payments show up on your credit report. Payment history is the most heavily weighted factor in calculating your score, so you want your monthly payments to count.

What are some typical reasons your new auto loan might not appear on your credit report?

If Youre Working On Building Your Credit

If youre trying to build credit and want to make sure all your payments get reported to the three bureaus, try to determine why the payment information isnt in a report. Start by reaching out to the creditor and confirm that it reports to the bureau.

If your creditor doesnt want to report your payment information to the credit bureaus, theyre not required to. You may want to consider switching to a different creditor if you want future payments to be reported to all three bureaus.

Recommended Reading: How To Make Your Credit Score Go Up Fast

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

Services You Can Use If Your Landlord Does

-

ClearNow: This service debits your rent from your checking or savings account. Theres no cost to tenants, but your landlord must be signed up. If you opt in, payments are reported to Experian via its RentBureau.

-

PayYourRent: Fees are typically paid by management. It reports to all three credit bureaus.

You May Like: How To Clear A Repossession From Your Credit

Contact Your Mortgage Lender And Ask If They Report To Experian

If your mortgage account does not appear on your credit report, the first thing you should do is contact your mortgage company and ask them if they report to Experian. If your lender confirms that they do report to Experian, you can request that they contact their Experian representative for help in determining why the account is not appearing in your report. Ask them to review the identifying information on the account to ensure that the account is being reported under the correct name and Social Security number.

You also can contact Experian and explain the situation so that it can be researched. You can reach Experian by phone at 888-EXPERIAN, or by mail at:

Experian P.O. Box 9701 Allen, TX 75013

Simply explain that you have an account that’s not appearing on your report and that the lender has verified it is in fact being reported. Be sure to include your complete identification number, including your Social Security number, so that Experian can locate your credit information.

Unfortunately, if your lender does not report, you won’t be able to have your account added. When you apply for credit in the future, ask the lender if they report account history to one or more of the national credit reporting companies. If they don’t, you might consider applying elsewhere to ensure your positive account payments help you build a strong credit history.

What To Do If Your Loan Doesn’t Appear On Your Report

If your auto loan doesn’t show up on your credit report after 30 to 60 days, reach out to your lender. Ask them if it’s their policy to report loan activity to the credit bureaus and, if so, whether they can follow up to make sure your loan information has been reported accurately.

Short of refinancing with another lender, you have limited recourse if your lender simply doesn’t report to any of the credit bureaus. In the future, you may want to find out what your lender’s policies on credit reporting are before you submit a loan application.

In the meantime, it can still be beneficial to monitor your credit score and report periodically to check your creditand to make sure the information in your is as accurate and up to date as possible. The information in your credit report will likely be instrumental in getting your next auto loan or credit card, whether or not your current loan information is being reported.

You May Like: Syncb/ppc Account

The Goal: Eliminate Errors Ensure Fair Practices End Confusion

Fixing mistakes on a credit report can be a byzantine system of filling out forms and phone calls.

“The fact that their customers are creditors and other users of information explains the unacceptable error rates and bias against consumers who complain about errors,” Wu argued, adding that, “if consumers are not able to obtain legal redress for FCRA violations, a key means of enforcement disappears, making the broken credit reporting system much, much harder to fix. A public credit registry would replace or provide an alternative to this broken system.”

Both Wu and Waters referenced a recent Supreme Court decision, which narrowed the case brought by an Arizona man who had successfully sued Transunion for relief after a car dealership’s credit check incorrectly flagged him as being on a terrorist watchlist.

But even smaller errors can cost you over the long haul in the form of higher interest rates on mortgages and car loans or possibly getting a mortgage or rent application denied, even if you satisfy the income requirements.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Don’t Miss: How To Remove Repossession From Credit Report

Dispute Errors On Your Credit Report

If your credit report has wrong information, you can dispute the error so that it is fixed. Here is how to dispute an error:

First, write a letter to the credit reporting companies that have the wrong information to ask them to fix the information. Include all of the following:

- Your name and address

- The specific information in your credit report that is wrong

- Why that information is wrong

- Copies of any receipts, emails, or other documents that support why the information is wrong and

- Ask that the information be deleted or corrected.

You may use the Federal Trade Commissions sample dispute letter to credit reporting companies and attach a copy of your credit report with the wrong items circled. Send the letter by certified mail or priority with tracking, and keep a copy of the letter and receipt.

If you cannot get the disputed information corrected or deleted, you may ask the credit reporting companies to add a statement noting your dispute in your file and in future credit reports.

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Also Check: How To Check Your Credit Score With Itin

Stay On Top Of Your Personal Finances With Mint

Your credit score is just one metric that helps you measure your personal finances. Maintaining healthy credit along with a well-kept budget, solid debt-to-income ratio, and steadily growing savings are all aspects of your financial wellbeing that are worth keeping tabs on.

Mint allows you to do that. By aggregating your financial information including everything from investments to upcoming bills into one convenient dashboard, you can have a birds-eye view of your financial health. Knowing when rent, bill payments, credit card payments, and loan payments are due each month can help you raise your credit score and stay on top of it while also knowing how much you have leftover to budget for other areas.

Remember, theres no one magic bullet to build your credit score fast. The above credit tips are just some of the ways you might raise your credit score over time and keep it high. But remember: lasting, meaningful score increases come from showing consistently strong credit habits. In other words, dont forget the fundamentals: pay your bills on time, dont take on more debt than you can afford and be careful about applying for too many accounts over a short period of time.

Why Is It Important To Know When Credit Companies Report

Some confusion can be cleared up by knowing when credit-card companies report to the CRAs. Its usually at your statement closing date.

Dont be alarmed if you check your credit report and see a balance when you know your card is paid off in full each month. At the end of your billing cycle, theres a great fluctuation, sometimes causing as much as a 30% shift in the credit score for most consumers. But when the payment is accounted for, it shifts back into form.

Billing cycles can vary. Some credit-card companies might do it at mid-month and others at the end of the month.

Credit-card companies probably are providing a snapshot of your current balance when they report to the CRAs. If this is a concern, keep track of your spending by your statement closing date. Making a payment before your statement closing date will keep the balance lower when its reported, helping your overall credit.

This also helps your credit utilization rate, an important factor when it comes to your credit score. Your credit utilization rate is your total credit-card balance divided by your total credit-card limit. Experts advise consumers to keep that ratio under 30%. Paying down your revolving debt and carrying a lower balance is a possible way to help your credit score, although it is influenced by several factors.

The bottom line is if you pay your bills on time and you keep a low credit-card balance, your credit score will take care of itself.

All that being said, here are some tricks:

Read Also: Does Removing An Authorized User Hurt Their Credit Score

How To Self Report To Credit Bureaus

Have you noticed that your credit score is unusually low, even though youre paying all your bills and rent on time? Well, theres a reason for that, as well as a way to fix these types of omissions typically made by credit bureaus.In this article, we will explain why certain information does not get reported on its own, why you should consider self-reporting as a personal measure for credit score growth, and how to self-report to credit bureaus.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Recommended Reading: What Is Syncb Ntwk On Credit Report

More Credit Karma Services

But, besides this free service, Credit Karma has other related services, including a security monitoring service and alerts for new credit checks on you. Outside of Credit Karma, many of the best credit monitoring services provide similar alerts and services.

And, once it has your personal information, you can search for personalized offers for a credit card, a car loan, or a home loan, and your search won’t pop up in your credit report on Credit Karma or anywhere else. A standard section of credit reports is “inquiries,” which lists requests for your report from lenders you’ve applied to for a loan.

Consider Contacting A Data Furnisher

When disputing credit report errors, the FTC recommends sending a dispute letter to the data furnisher as well. A data furnisher is a financial institution, such as a lender or credit card issuer, that provides data to the credit bureaus. Each credit report that includes the error should list the furnishers name and address. If you dont see an address listed, contact the company.

Once you submit your dispute to the furnisher, it has 30 days to conduct an investigation. If it finds that the information youre disputing is inaccurate, it is required to notify each credit bureau it has reported the information. However, if the information is found to be accurate, it will remain on your credit report.

Recommended Reading: Can Lexington Law Remove Repossessions

For Your Informationcredit Records: Privacy And Other Concerns

Potential creditors, landlords, life insurance companies, and employers can access your credit record. Some businesses check a potential customer’s credit rating to decide if a deposit will be required. But not everyone has the right to access your credit report. Car dealers may pull your credit records while you are on a test drive. Cellular phone services have been known to check a potential customer’s credit ratings before the customer signs any agreements. By law, these businesses really have no right to do this unless you are actually applying for credit. To keep credit record “snooping” to a minimum:

- Never reveal your social security number unless you are actually applying for credit

- Never allow anyone to photocopy your driver’s license

Too many inquiries for your credit report can actually lower your credit rating. Multiple inquiries are viewed as a prelude to bankruptcy. Even if your credit record is clear, a flurry of inquiries over a short period of time may be detrimental to you. This is especially true for home mortgage applicants. Therefore, if you plan on buying a home or refinancing your mortgage, be careful about what else you apply for because inquiries on your credit report could act against you.

Although lenders will say “good credit leaves you nothing to fear,” if your loan application is turned down, look to the causes listed here. You may be able to plead your case with the loan officer.