How To Get A Collection Removed From Your Credit Reports

Advertiser Disclosure

Credit Card Insider is an independent, advertising supported website. Credit Card Insider receives compensation from some credit card issuers as advertisers. Advertiser relationships do not affect card ratings or our Editors Best Card Picks. Credit Card Insider has not reviewed all available credit card offers in the marketplace. Content is not provided or commissioned by any credit card issuers. Reasonable efforts are made to maintain accurate information, though all credit card information is presented without warranty. When you click on any Apply Now button, the most up-to-date terms and conditions, rates, and fee information will be presented by the issuer. Credit Card Insider has partnered with CardRatings for our coverage of credit card products. Credit Card Insider and CardRatings may receive a commission from card issuers. A list of these issuers can be found on our Editorial Guidelines.

Determine The Accounts Legitimacy

Is the collection account legitimate a past-due debt that you actually owe? If it is, youre going to have a tough time getting it removed from your credit reports. However, if the account is actually incorrect, or should have been removed from your reports by now, then you may be able to get it removed through the dispute process.

Things A Debt Collector Will Tell You When You Ask For A Pay For Delete Agreement

Pay for Delete refers to a collection company offering to delete a collection account from someones credit report if you pay them in full. There is no formal pay for delete plan with the repositories or collection companies.

The Repositories disapprove of removing correct negative information simply because it has been paid. They will give a collection company that continuously makes this request warnings and could eventually restrict the collection companys ability to report to that repository. Some repositories agreements clearly state Paid in full collection accounts must not be deleted& Do not delete paid in full collection accounts.

Recently collection companies have been instructing debtors to pay the collection and then file a dispute with the repositories and the collection company will tell you that they will not respond to the dispute and it will be removed per the Fair Credit Reporting Act. The problem with that method is you have nothing to fall back on when someone unfamiliar with the arrangement re-verifies the debt.

So there is a lot of gray area when trying to use the Pay for Delete strategy. Although it should always be your goal when dealing with collection accounts. Whatever the conclusion get your agreement in writing, on company letterhead, signed with ink. Then you will no longer need someone at the collection company to fix your report

Transcript

1. That they either done it too many times and the repositories give him a hard time about it.

You May Like: Does Carvana Report To The Credit Bureaus

Choose Your Plan Of Action

There are a few ways to handle a collection account on your credit reports.

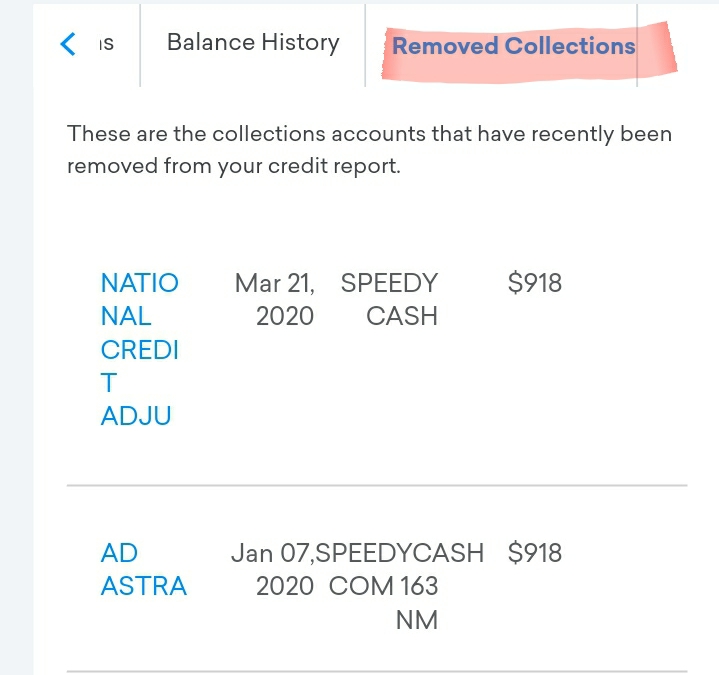

Re: Score Jumped By 71 Points After I Pfd An Account With Ad Astra

fecfec-

I did not send them a letter. I called the number that was on the letter that Ad Adstra sent to me. When I told them that I will pay off all of balance right now if they will delete it from my credit report, they didn’t hesitate to comply. The representative put me on hold for about 1 minute to talk to her supervisor. She came back and said ok. I paid off the loan with a credit card and within two weeks, the collections item was off my report and my scored jumped. I hope this helped

More info about my debt:

1 year old debt, personal loan, balance was $600

You May Like: Credit Score 575

What About A Short Sale

If the lender is willing to accept less than the amount thats still owed on a mortgage loan through the sale of the property, it is known as a short sale. Two things must occur for a short sale to occur:

Lenders will use a short sale as an option to avoid foreclosure. If you receive permission from your lender to sell your home for less than you owe, it depends on your lender how it is reported on your credit report. In most cases, a short sale is treated as a foreclosure so it stays on your credit report for seven years.

Ad Astra Recovery Services Inc Complaints

Most collection agencies have numerous complaints filed against them with the Consumer Financial Protection Bureau and the Better Business Bureau . Most complaints are about inaccurate reporting, harassment, or failure to verify a debt. If you find yourself facing any of these situations with Ad Astra Recovery Services, you should also consider filing a complaint.

You have many consumer rights under the Fair Credit Reporting Act and the Fair Debt Collection Practices Act . Lexington Law knows that you have rights, and Ad Astra Recovery Services does too.

Read Also: Does Affirm Report To Credit Bureau

Ready To Fight For Your Rights

If Ad Astra Recovery Services or any other debt collection agency is calling you to the point of harassment, using abusive or profane language, or violating the FDCPA in some other way, its time to fight back. Under the law, you may be entitled to up to $1,000. At Lemberg Law, we wont charge you a dime out of pocket, and we only get paid when you win. Call us today for a free, no-obligation, case evaluation. Well get the justice that you deserve.

Who are we? We are Lemberg Law, a Consumer Law Firm

Lemberg Law is a consumer law firm helping victims of collection harassment and abuse. We are ranked A+ by the BBB. Weve helped more than 15,000 consumers stop harassment and recover money from debt collectors. Harassed? Abused? Misled by a collector? Call our Helpline today! There is no charge unless we win.

Why Is Ad Astra Recovery Services Calling Me

Ad Astra Recovery Services could be calling for a number of reasons, all of them related to debt collection:

- They could be collecting a debt on behalf of a creditor. For example, your dentist may have hired the agency to collect on a past due dental bill.

- They may be calling about a debt incurred by someone you dont know. For example, it could be a wrong number call or your phone number could have been previously owned by the person who actually owes the debt.

- They could be calling to ask the whereabouts of someone you know. For example, they may believe that a family member of yours owes a debt and theyre trying to get a hold of his or her phone number or find out where he/she works.

- They may be trying to get you to make a small payment on a time-barred debt in order to restart the clock on the statute of limitations. For example, they could have purchased a very old bundle of uncollected cell phone bills that are legally unenforceable convincing a consumer to pay even a dollar makes the debt current again.

If youve been contacted by Ad Astra its important to know your rights under the Fair Debt Collection Practices Act. If theyve violated your rights, you can take the agency to court and sue for statutory damages of up to $1,000 along with court costs and attorney fees.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Work With A Credit Repair Company

Sometimes, improving your credit requires more than a debt validation letter or pay-for-delete agreement.

If your credit problems are more complicated, you should consider hiring a credit repair company. Especially if youre worried about questions like, Can Ad Astra sue me or garnish my wages?

They can help you recover from a range of credit-related issues, such as:

- Collections

- Identity fraud

Theyll also help to ensure that debt collectors stay within the bounds of the FDCPA.

With a credit repair company on your side, you dont have to worry about the hassle of writing debt collectors and negotiating payments.

If you think your situation calls for professional help, take a look at one of our top credit repair companies.

Is Ad Astra Recovery Services Legit Are They A Scam

Ad Astra Recovery Services, Inc. is a legitimate third-party debt collection agency based in Wichita, Kansas. Ad Astra Recovery Services, Inc.s website contains very little information about the company, its business practices, or its clients. The home page contains a statement that Ad Astra Recovery Services, Inc. combines quality employees with sophisticated technology to ensure productivity and reliability on behalf of its clients. Ad Astra Recovery, Services, Inc. boasts that it offers superb results with superior service.

Ad Astra Recovery Services, Inc. is affiliated with the International Association of Credit and Collection Professionals , a professional debt-collection association.

Also Check: Does Opensky Report To Credit Bureaus

Ad Astra Recovery Services

Ad Astra Recovery Services is a collection agency that may either call or write you about an unpaid debt.

Collection agencies either take over unpaid debts of an original creditor or purchase debts from the original creditor.

One way or another, youll need to settle the account.

That means either proving its not legitimately your account or having it removed from your credit report.

If you dont, the collection agency can bring a lawsuit against you, which will allow them to garnish your wages until the entire debt is paid.

To avoid that outcome, were providing strategies for dealing with Ad Astra Recovery Services in this article.

What Is A Foreclosure

A foreclosure is what occurs when a mortgage servicer takes over the property of a home due to the borrower no longer being able or willing to repay the loan. The lender is protecting its interest by using this legal process to end the owners right to the property. Typically the property is then sold at auction. Proceeds from the sale are used to pay back the original mortgage loan.

There were many foreclosures that occurred from the 2008 housing crisis where borrowers across the nation were unable to pay their mortgage. Eventually, lenders used the foreclosure process to take possession of these properties.

Having your home foreclosure on is a challenging event. But its not a permanent situation and its possible to come out of foreclosure and buy a new home in the future.

Also Check: What Is Syncb Ntwk On Credit Report

Torres Credit Services Inc Complaints

Most collection agencies have numerous complaints filed against them with the Consumer Financial Protection Bureau and the Better Business Bureau . Its because they often report accounts inaccurately and/or for harassment. If you are being harassed by a debt collector, you should also consider filing a complaint.

You have many consumer rights under the Fair Credit Reporting Act and the Fair Debt Collection Practices Act . Lexington Law knows that you have rights, and Torres Credit Services, Inc. does too.

What To Do If Your Settlement Letter Does Not Work

If your Delete for pay letter does not work you should offering a settlement even without a pay for delete agreement. The account will still be on your credit record, but once its paid its impact on your credit score will diminish.

More important, youll get the debt collector off your back, resolve the account, and make sure you wont face a lawsuit. Remember that collection agencies pay an average of 4 cents for every dollar of debt they buy. They can afford to settle for much less than you owe and still earn a profit. Start low, negotiate up, and make the best deal you can!

Editorial Note: The editorial content on this page is not provided or commissioned by any financial institution. Any opinions, analyses, reviews, statements, or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved, or otherwise endorsed by any of these entities prior to publication.

Also Check: Does Removing An Authorized User Hurt Credit

Demand Deletion The Debt Cannot Be Validated

A missing or incomplete debt validation letter may be your best opportunity to eliminate both the debt itself and the collection account from your credit reports.

If Ad Astra Recovery Services cant fully validate the debt, theyre required by law to drop it and correct information with the credit bureaus.

You can dispute the account with the credit bureaus, who will investigate your claim within 30 days.

If Ad Astra Recovery Services is unable to validate the debt fully with the credit bureaus, theyll delete the collection account from your credit reports.

They may still attempt to pursue you for the debt even after its been dropped from your credit reports.

If they do, you may need to get legal representation to force them to comply with federal law.

Dealing With Ad Astra Recovery Services

Before you answer one of Ad Astras phone calls, you might want to take a few moments to read up on the Fair Debt Collection Practices Act.

The FDCPA is an important law that limits the reach of debt collectors, protecting you from abuse.

Among other rights, it states:

- May only call between the hours of 8 a.m. and 9 p.m. and cannot contact you at work if you ask them not to.

- Cannot contact other individuals about your debts.

- Debt collectors cannot collect on a debt without first validating it.

If you think that AARS has acted in a way that violates the FDCPA in their interactions with you, you may want to take legal action against the agency.

You can also file a complaint with the Consumer Financial Protection Bureau or the Better Business Bureau

A lot of complaints against the agency are centered around the issues listed above.

To avoid several of these problems, you should consider only communicating with AARS in writing.

The FDCPA allows you to choose to only communicate by mail, giving you the documentation you might need to get AARS off your report.

Recommended Reading: Open Sky Unsecured

Who Is Ad Astra Recovery Services

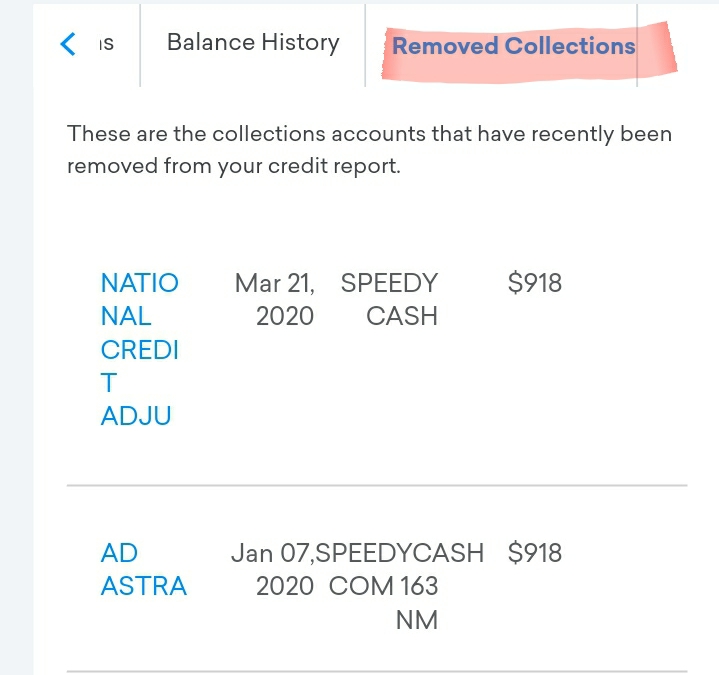

Ad Astra Recovery Services, Inc. is a third-party debt collection agency located in Wichita, Kansas. They collect for Speedy Cash payday loans and also provide check recovery services and in-house collections through litigation.

You may see Ad Astra Recovery Services listed on your credit report as a collections account. This can happen if you owe a creditor money and theyve hired Ad Astra to collect that money. Ad Astra may appear on your credit report as ad astra rec or ad astra recovery serv.

More Tips On Dealing With Ad Astra Recovery Services

Avoid the phone. NEVER talk to a debt collector on the phone. The less they know about you, the better.

Politely tell them its your policy to deal with everything in writing. Request a letter with the original debt information and then hang up. If they keep calling, send them a cease & desist letter.

Record their phone calls. If you must deal with a debt collection agency on the phone, record them. Thirty-five states and the District of Columbia allow you to record your phone conversations secretly.

In the other 15 states, you can record with the other partys permission. If you tell the debt collector you are going to record, and they keep talking, thats considered giving permission. They will usually hang up.

Dont believe what they say. Debt collectors are known to make false threats, lie, and tell you whatever they need to tell you to try to get you to pay the debt.

Dont try to hide money. Its considered fraudulent to hide money or assets from a legitimate debt collector if you owe them. However, its also best to avoid giving access to your bank account or credit card information.

Dont apply for new lines of credit. Its also considered fraudulent to apply for new lines of credit if you are unable to pay your current creditors.

Dont ignore them. You can do things on your terms, but ignoring the situation will not make Ad Astra go away. Ignoring them sets you up for a possible lawsuit.

Also Check: What Is Syncb Ntwk On Credit Report

Should I Contact Or Pay Torres Credit Services

Nothing good can come from speaking to a collection agency on the phone. And making payments on the collection account will reset the clock. So instead of helping your credit, it could make it worse.

The best way to go about handling this is to work with a professional credit repair service. They have deleted millions of negative items from companies like Torres Credit Services, Inc. for millions of clients nationwide.

And they can help you too.

What Is A Pay For Delete Letter

Its exactly what it sounds like. You offer to settle a debt. If the collection company agrees to what you proposed in your letter, then they will delete the negative collection record from your credit report upon receiving payment.

A Pay-For-Delete letter is sent to a creditor or collection company that you owe money to and has filed a negative record against your credit.

You must use specific language when making an offer on an open collection account because the letter could be used against you in a lawsuit. If the collection company accepts your offer, be sure to get an agreement in writing or email. Once you have paid the agreed-upon amount, the collection company will then delete the negative collection records.

Also Check: Is Chase Credit Journey Accurate