Become An Authorized User

If you have a trusted family member with a good credit score, you have an opportunity to dramatically increase your credit score. You can become an authorized user of their account in order to boost your score.

However, this can be a taxing emotional burden. If you dont repay your debts, then you could hurt their credit score. Talk through the pros and cons with your family member before trying this method.

Pay Everything On Time

Yes, paying your bills on time is a painfully obvious first step. But it bears repeating in any guide to improving your credit because its by far the most important.

Your payment history accounts for 35% of your credit score, making it the most important . One missed or late payment will stay on your credit report for seven years, though your score will typically start to heal after two years.

To build payment history, your payments must be reported to the credit bureaus. Credit card, installment loan and mortgage payments are typically reported to the bureaus. But other bills, like utility and cell phone payments, generally arent reported unless youre so behind that the account gets sent to collections.

Using A Debt Settlement Company

Having an account back in good standing is obviously a good thing for your credit â but how you get there matters.

The idea of settling your debt for less than the full amount is enticing, but when dealing with a debt settlement company, you are likely to incur fees for their services.

Most importantly though, your credit score will suffer. It is a much safer bet to contact your creditors directly and aim to find a solution instead.

Also Check: When Does Kohls Report To Credit Bureau

Keep Old Accounts Open

Your average length of credit determines 15% of your score, so your score benefits from keeping old credit cards open, even if you only use them occasionally. In fact, people with credit scores above 800 tell us that keeping their oldest credit card open is one of their top tips for building excellent credit.

Keeping credit card accounts open that charges exorbitant fees may not be worth the credit score benefits. But if the fees are low, keep your credit accounts open. You can use them once a month for a small purchase youd normally make and then use cards that offer better for bigger purchases.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: How To Remove Disputes From Credit Report

Is A 700 Credit Score A Good Credit Score

Though each financial institution sets its own credit criteria, a 700 credit score is usually considered to be within the good credit range. Although a score of 700 is not considered an excellent credit score, it will qualify as a good score and well above the minimum requirements for most lenders.

Borrowers with a 700 credit score are considered prime borrowers as they fall in the good range in the score classifications. Subprime borrowers have a lower score in the fair range and very poor range.

Divisions of Credit Scores

The divisions of FICO scores are as follows:

300 to 579 = Very Poor

580 to 669 = Fair

740 to 799 = Very Good

800 to 850 = Exceptional

While you wont qualify for the same benefits as someone with very good or excellent credit, you will still be looked upon favorably by a majority of lenders.

Who Calculates Credit Scores

You have probably heard of FICO scores. When you hear about credit scores of 500, 650, 700, etc. there is a company that deals with those calculations by the name FICO. In full, FICO stands for Fair Isaac Corporation. Initially, the company was called Fair, Isaac, and Company.

The company was founded in 1956 by William R. Fair and Earl Isaac. The headquarters of the company are at San Jose, California. The company operates worldwide, and many financial institutions in the world rely on the companys credit score calculation formula.

FICO score is a measure of consumer credit risk. Data on peoples history on loan payments helps financial institutions to make informed decisions when giving loans and credit cards to their customers. It is from this data that people can get small business credit cards for bad credit or even a credit card of excellent credit card scores.

Don’t Miss: Do Utility Bills Affect Credit Score

How To Improve Your 700 Credit Score

A FICO® Score of 700 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 700 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

40% of consumers have FICO® Scores lower than 700.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Look After The Credit You Have

Adding new tradelines to your credit report can boost your credit, especially if you are new to the credit game. If you already have loans or credit cards, youll also have to manage them effectively. Heres what you need to do.

- Make every payment on time. Payment history is the most important part of your credit score.

- Keep your credit utilization low. Keep card balances below 30% of your credit limit.

- Dont close old accounts. If youre not using an old card just leave it open, unless it has a large fee. It will help the length of your credit history.

- Pay off credit card balances. Youll pay less interest and lower your credit utilization.

- Ask your card issuer to increase your limit. A higher credit limit can lower your credit utilization instantly.

- Use the authorized user strategy. If a friend or family member adds you to their card as an authorized user, your credit score can gain.

- Put your bill payments to work. You can place your bill payments on your credit report with services like eCredable Lift and Experian Boost.

- Use a rent reporting company. Rent reporting companies can put up to 2 years of rent payments on your credit report. Youll pay for this service, so youll have to decide if its worth it

Experian Boost can help you build your credit record with phone and utility payments and its absolutely free!.

Also Check: How To Correct Credit Report

How Does My Credit Score Affect How Much I Can Borrow In Loans

With a 700 score, you’ll likely be above creditors’ minimum score requirements. This means your application probably won’t be denied based on your credit score, but it won’t necessarily be possible to secure the highest loan amount or the best terms even with a good score.

For example, you can qualify for many different types of mortgages with a 700 credit score. But the myFICO mortgage comparison tool shows that the best interest rates go to borrowers who have a score of 760 or higher.

Not only that, creditors will be considering more than just your credit score when determining how much to lend you and what to charge. Other factors may include:

- Your income, your monthly debt obligations and how they compare before and after you take out a new loan

- Your credit history

- How you plan to use the loan

- The collateral’s value

- Your history with the lender

Sometimes, other factors are more important than your score. For example, even with a good score of 700or a perfect score of 850you might not get approved for a large loan if you don’t have a steady income, have a high DTI or you’ve defaulted on a previous loan from the company.

Understand The Benefits Of A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 33% of people with FICO® Scores of 700.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

Recommended Reading: What Is The Average Credit Score To Buy A House

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Increase Your Credit Limit

Increasing your credit limit isnt a viable solution for everyone, but if you already have good credit, doing this can encourage your score to rise above 700. Your credit limit is a contributing factor to the utilization ratio because it represents the amount of available credit. An increased limit can help lower the ratio, improving overall credit.

You May Like: When Do Collections Come Off Credit Report

Faq: 700 Credit Score

Is 700 a good credit score?Yes, a 700 credit score is generally considered a good score by many lenders.

What are the FICO Score ranges?FICO scores are broken up into five ratings and score ranges.

| Score |

|---|

What is considered an excellent credit score?According to FICO, an excellent credit score is 800 or higher.

What is an ideal credit score?If youre wondering, what is an ideal credit score, higher is better. However, it can take time to build credit and earn a higher score. If you have a credit score under 700, other factors like a high income and low debt-to-income ratio may work in your favor.

What are the factors that affect your FICO Score?There are five elements that make up your FICO score. These factors include:

- Payment history

- Length of credit history

- New credit

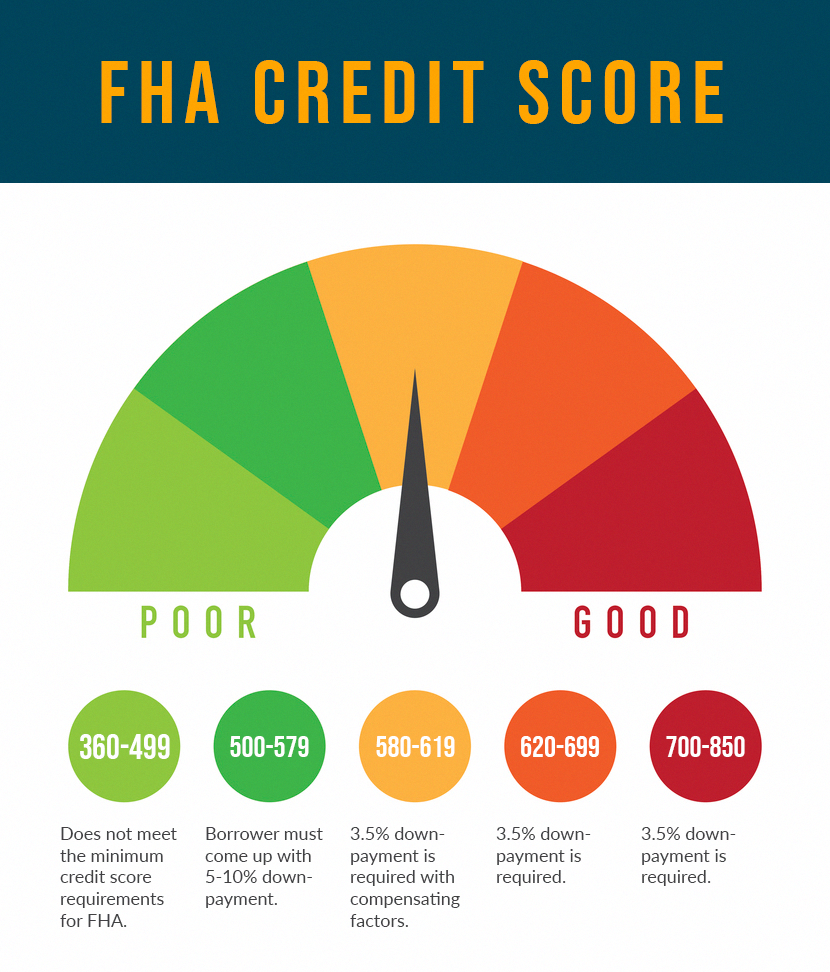

Can I buy a house with a 700 credit score?Generally, yes, you can buy a house with a 700 credit score. According to Experian, conventional loans require a score of at least 620 while FHA loans may be available to qualified borrowers with a score as low as 500 with a 10% down payment. Jumbo mortgage loans may require at least a 700 credit score.

What happens to your credit score after bankruptcy?A bankruptcy stays on your credit report for seven to 10 years, depending on the type of bankruptcy filed. During this time, your credit score is adversely affected by bankruptcy and it might be difficult to secure new lines of credit. If you are approved for a loan or credit line, expect to pay higher interest rates.

How Your Fico Score Is Calculated

Many different types of scoring models are available that calculate your score using the information on your report. However, the FICO score is the most popular and widely used scoring model. FICO scores are three-digit numbers ranging from 300 to 850 that function as an accessible summary of the credit risk a borrower might pose to a lender.

The FICO score breaks down the information on your credit report into five metrics to calculate your total score:

Payment History

Length of Credit History

Credit Mix

New Credit

All these factors have the power to give you a higher credit score or a lower credit score depending on whether you exhibit good credit habits or not.

You May Like: Will An Eviction Show Up On My Credit Report

Can I Buy A Car With A 700 Credit Score

In 2020, Experian reported that the average credit score to secure a used-car loan was 657, with 721 being the average for new-car loans. You can buy a car with a 700 credit score, but even if you are under 700, there are still ways to get financing.

Those with bad credit will need to supply additional proof of their financial history, including pay stubs, proof of residence, or other supporting documents that illustrate your ability to pay bills on time. You may also consider putting down a larger down payment or getting a cosigner or guarantor on your loan to improve your rate.

More Opportunities To Improve Your Credit History

With a 700 score, you will have more opportunities to improve your credit history. It can be challenging to find lenders who will approve you for new credit when you have a score of fair and below. This can be incredibly frustrating as new credit can be an instrumental part of improving your score. However, with your score in the good range, you will have far more opportunities to positively impact your history.

Recommended Reading: Do Direct Debits Build Credit Rating

Here Are 10 Ways To Increase Your Credit Score By 100 Points

The 9 Best Credit Cards For 700 Credit Score

What comes to your mind when you hear the phrase credit score? Maybe you have your own understanding of what a credit score is. In general, a credit score is the creditworthiness of an individual that is expressed in numerals. Each credit score range has suitable credit cards. For instance, the best credit cards for 700 credit score will give you a higher credit limit accompanied by various rewards to make your card usage exciting.

A crucial thing to note is that even people with bad credit scores can get credit cards for bad credit. Various financial institutions can give to help you improve your credit score. The only problem with bad credit cards is that they charge high-interest rates. Moreover, most bad credit cards have low limits. These are the unsecured credit cards. Secured credit cards give you a limit depending on your deposit amount.

Also Check: What Credit Score Do You Need For An Apple Card