Keep Your Financial Relationships In Good Standing

Singletary hasnt paid a bill late in the past seven years. Bird attributes her increased score to her and her husbands money management skills. They have significant savings and they pay their revolving and installment credit on time. The couple also doesnt like to carry any balances on their .

Bird still has loans she took out to fund her medical degree and she pays those down monthly without fail. She pays off the balance on her four department store credit cards every month too.

What Is A Perfect Credit Score

What does it mean to have perfect credit? If your credit score is 850, you have the highest credit score possible in both the FICO and the VantageScore credit scoring systems.

However, the FICO credit scoring system considers all credit scores over 800 to be exceptional. While trying to get a perfect credit score might be a fun game, you can get all of the advantages associated with perfect credit simply by getting your credit score over 800. Once your credit score passes 800, theres little you can do to actually make your credit score even higher, besides keeping your credit utilization low and waiting for the length of your credit history to improve.

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Don’t Miss: Does Loan Me Report To Credit Bureaus

What Factors Go Into A Credit Score

Its important to know your credit score and understand what affects it before you begin the mortgage process. Once you understand this information, you can begin to positively impact your credit score or maintain it so you can give yourself the best chance of qualifying for a mortgage.

While exact scoring models may vary by lender, some variation of the standard FICO® Score is often used as a base. FICO® takes different variables on your credit reports, such as those listed below, from the three major credit bureaus to compile your score. FICO® Scores range from 300 850.

From this information, they compile a score based on the following factors:

- Payment history

An Excellent Credit Score Is Good Enough

You don’t need a perfect credit score to get the best deals. A score of 720 or higher is generally considered excellent. And scoring 800 or above qualifies you for the best terms offered.

Thats pretty great news if you aspire to get into the group of people who have top-tier credit but you dont want to obsess over every single point in an effort to get the highest score possible.

Also Check: What Is Cbcinnovis On My Credit Report

Make Sure There Are No Negative Marks On Your Credit Report

Even if youve never missed a payment, there could be illegitimate negative marks on your credit reports. Be sure to check your Transunion and Equifax credit reports for free from Credit Karma and make sure there are no errors.

If you find incorrect marks on your reports, you can dispute them. Upon receiving a dispute, the credit-reporting companies are required to investigate and fix errors in a timely manner.

Even if you have legitimate negative marks on your credit reports, they will affect your scores less over time and should eventually fall off your reports completely.

How Is Fico Different From Vantagescore

Aside from FICO, there’s an entirely separate credit scoring model, called the VantageScore®, which the three major credit reporting agencies released together in 2006. The average VantageScore, according to recent Experian data, is 680.

There are several differences between the FICO and VantageScore models. You could have a VantageScore with just one line of credit to your name, even if it’s less than six months old, for instance. But you won’t have a FICO® Score if you don’t. Plus, a good VantageScore starts at 700, as opposed to 670 on the FICO® Score range.

The two scoring models also differ in the ways they weight certain financial behaviors. The latest VantageScore version is more similar to FICO® Score 9 than FICO® Score 8, which is still most widely used: It doesn’t factor in paid collection accounts and reduces the impact of medical collections on credit scores. VantageScore also considers your historical credit utilization, such as how frequently you pay off your balances in full, rather than capturing it only as a snapshot like a FICO® Score does.

Don’t Miss: Aargon Agency Inc Las Vegas

He Has Two Hard Inquiries

A hard inquiry, or “hard pull,” means that a lender or credit card issuer has pulled your credit report from one of the main three credit bureaus, Experian, Equifax or TransUnion. Hard inquiries may cause your credit score to fluctuate slightly, compared to a soft inquiry, which doesn’t pull your credit and has no effect on your score.

Of the two hard inquiries listed on Droske’s credit report, one is older than 12 months so it no longer calculates into his credit score. The second inquiry was three months prior to the report but didn’t affect his score at all. “Every inquiry does not automatically deduct points off of your credit report,” Droske says.

When Does An Inquiry Lower Your Credit Score

A credit inquiry shows up on your credit report every time you apply for a credit account. When you apply for credit, you authorize creditors to ask or inquire for a copy of your credit report from the major credit bureaus. Whether you are denied or approved for the credit account does not matter. But what does matter is the type of inquiry.

There are two general types of credit inquiries: soft inquiries and hard inquiries. These are also referred to as soft pulls and hard pulls .

- A soft pull, also known as an involuntary inquiry, occurs when creditors want to send you pre-approved offers. That credit card solicitation you received in the mail was probably the result of a soft pull on your credit. Other soft pulls include potential employers checking your credit report. When an existing creditor checks your report, thats also a soft pull. And if you check your own credit score, thats also considered a soft pull, too. The key here is that a soft pull does not affect your credit score in any way.

- A hard pull, also known as a voluntary inquiry, occurs anytime you actively seek credit by filling out an application. The lender will run your credit report and determine whether to approve your credit application and under what terms. A hard pull on your credit report willaffect your credit score.

Related:Will Checking Your Score More Often Actually Improve Your Credit?

Also Check: Square Capital Credit Check

Why It Is Important To Understand The Highest Credit Score

Most peoples credit score falls into the fair category or worse, with an average of less than 621. Of 30-year olds, 38% have a score below 621, with 29% achieving a score between 621 and 680, but only 2% have a score of 780 or more. This makes it very clear that people can do a lot to improve their scores.

If you understand what the max credit score is and where your score is related to it, it helps you make improvements. It cannot be emphasized enough that you need a higher score if you want lower interest rates.

Tips For Building A Perfect Credit Score

The process of perfecting your credit score is very similar to simply building a good credit score from scratch. You need positive information flowing into your credit reports on a monthly basis. And the easiest way to accomplish that is to use a credit card responsibly.

But there are a few things you can do to push your credit score into perfect territory once youve reached good or excellent credit.

For more tips and tricks, check out WalletHubs complete guide on How to Improve Your Credit Score.

Also Check: Do Lending Club Loans Go On Your Credit Report

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

So, what is a perfect credit score?

Read Also: What Credit Score Does Carmax Use

Benefits Of Knowing The Maximum Credit Score

As we mentioned before, knowing the maximum credit score is important because it gives you a framework for whats possible and it helps you understand how much improvement you need to make in order to break into that Excellent threshold.

If youre like most of the U.S. population, you have some room for improvement. Lets look at some of the ways you can improve your credit score.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

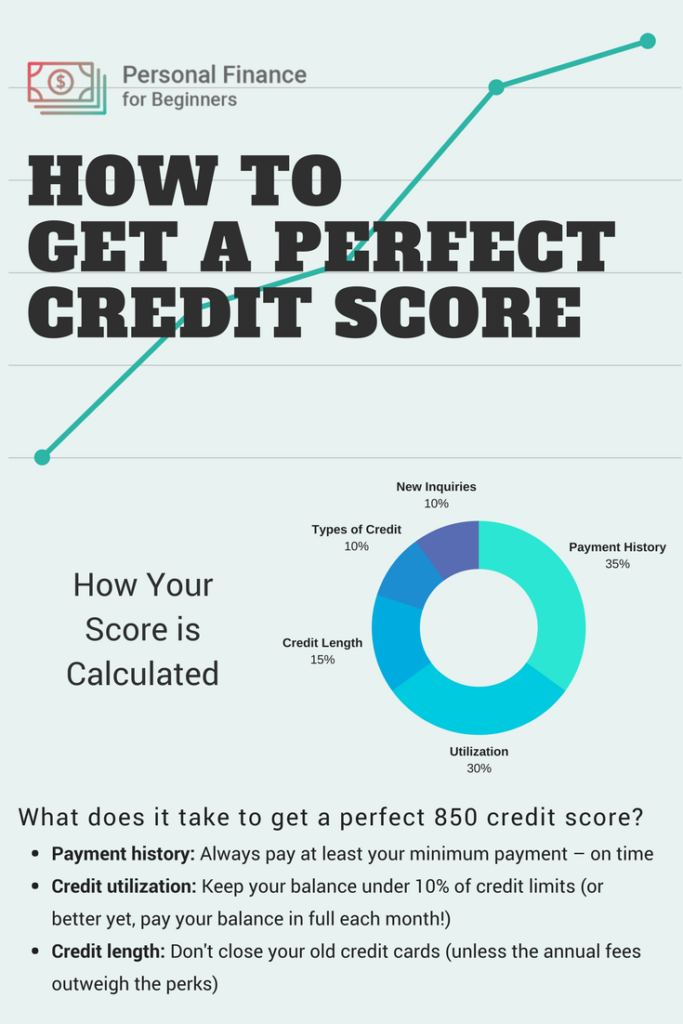

How Is Your Credit Score Broken Down

When determining your credit score, the bureaus look at four primary categories. The first is your payment history, which makes up approximately 35% of your rating. Credit utilization makes up the second-largest portion and accounts for about 30% of your overall rating.

The final three considerations include the length of time that your credit line has been opened, which accounts for approximately 15% of your overall score, while your new accounts each make up about 10% of your score.

Its important to note that the final two categories can and will vary. This may also appear on your report as new hard/soft inquires as well.

What Are The Benefits Of Having A Good Credit Score

- Get the lowest rate on a home mortgage as previously mentioned, the higher your credit score, the better loan terms you receive from a lender. Over the life of a mortgage, the additional interest you will pay with a higher interest rate will be substantial. It makes working on getting the highest credit score possible a worthwhile effort.

- Be offered lower rates on car loans like your home mortgage, the interest you are charged on a car loan will be lower when you have good credit scores. The difference in the interest rate you will be offered with the highest credit score vs. the lowest will be substantial. Believe it or not, the difference in interest rate could be over ten percent!

- Your credit cards will offer lower rates if you tend to carry a balance on your credit cards each month, the interest payments can add up. When you increase your credit scores, credit card companies will offer you a more attractive interest rate. Many credit card companies will also offer various rewards to those who have the highest credit scores.

- Some states offer better insurance rates in some locations having a good credit score will get you a better insurance rate. In some states, however, this practice has been prohibited.

Don’t Miss: Is Creditwise From Capital One Accurate

Your Payment History Needs To Be Squeaky Clean

Payment history is the #1 factor for your credit score so it shouldnt come as a surprise that youre not going to have a perfect credit score if you have late payments, bankruptcies, liens, judgments, collections, etc. on your credit profile.

According to FICO data, a 30-day delinquency could cause as much as a 90 to 110 point drop on a FICO Score of 780 for a consumer who has never missed a payment on any credit account.

So you can imagine how difficult/impossible it would be to climb up into the mid 800s with negative marks showing on your credit report.

Those negative marks do lose their affect on your credit score over time, but when it comes to obtaining a perfect credit score, youre not going to get there with a negative history.

The good news is that you can still achieve a very high credit score even with negative marks.

The key is that there needs to be some time between the present time and your negative marks. Also, if your credit report is littered with negative marks, thats a very different situation from someone with an isolated one or two hiccups.

Challenge Mistakes On Your Credit Report

There may come a time where you discover an error on your credit report. Unfortunately, reporting mistakes can take a good credit score and put it into a lower range. In fact, significant enough mistakes could cause a bad credit score. This makes it essential to check your report for errors a couple of times a year.

So if youre wondering if your credit score can be wrong, the answer is yes if the credit bureaus have faulty information.

There is also the possibility that something fraudulent could take place on your account. If you find any errors or fraud, you need to file a dispute with the credit agencies right away. Getting credit report problems corrected will help ensure you maintain a good credit score.

If you wonder why credit scores go down, it is because you dont follow the practices mentioned here for getting the best results.

Also Check: Does Barclaycard Report To Credit Bureaus

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

What Is An Excellent Credit Score Range

Excellent credit score = 740 850: Anything in the mid 700s and higher is considered excellent credit and will be greeted by easy credit approvals and the very best interest rates.Consumers with excellent credit scores have a delinquency rate of approximately 2%.

In this high-end of credit scoring, extra points dont improve your loan terms much. Most lenders would consider a credit score of 760 the same as 800. However, having a higher score can serve as a buffer if negative occurrences in your report. For example, if you max out a credit card , the resulting damage wont push you down into a lower tier.

Don’t Miss: How To Unlock My Experian Credit Report