Guide To Choosing The Best Credit Repair Company

When choosing the best credit repair company, the most important things to consider are how much its going to cost, what services youll receive, and the reputation of the provider. Make sure the credit repair company offers a free consultation. You can expect to pay a one-time setup fee plus a monthly fee with most providers. The best credit repair companies offer some type of credit monitoring, comprehensive dispute options, and personalized service.

Percentage Of Credit Used

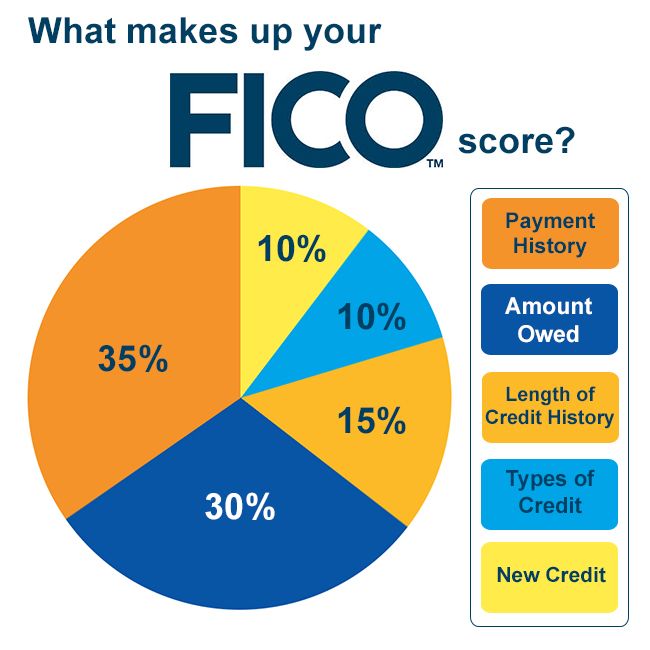

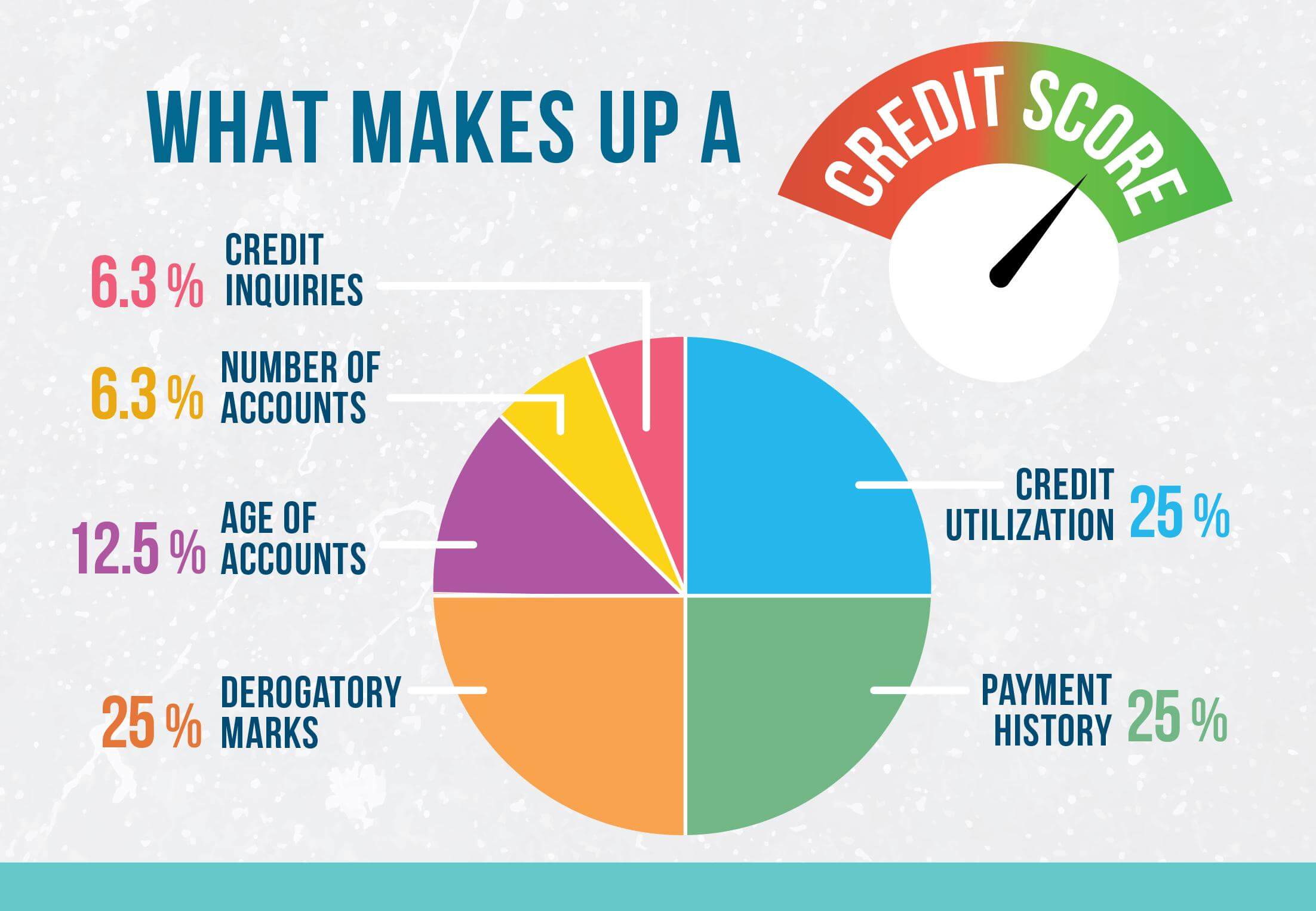

The amount of credit you usealso known as your credit utilizationis another very important factor in calculating your credit. Remember: just because your credit card has a $10,000 limit doesn’t mean you should use all of it. VantageScore recommends keeping your balances under 30 percent of your total credit limit.

What Factors Affect Your Credit Scores

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you’ve used credit. Understanding what factors affect credit scores helps you plan the most effective way to build your credit or protect it.

Credit scoring companies calculate your scores from data in your credit reports. While they wont reveal their exact formulas, they share the basic ingredients they use to calculate scores.

Why do you care? Because your : whether you can get a credit card or car loan, and at what interest rate whether you can buy a house or rent the apartment you want even how much you pay on car insurance and utility deposits.

Don’t Miss: Is Opensky Reliable

Length Of Credit History: 15%

Your credit score also takes into account how long you have been using credit. For how many years have you had obligations? How old is your oldest account and what is the average age of all your accounts?

Long is helpful , but a short history can be fine too as long as you’ve made your payments on time and don’t owe too much.

This is why personal finance experts always recommend leaving credit card accounts open, even if you dont use them anymore. The accounts age by itself will help boost your score. Close your oldest account and you could see your overall score decline.

Dun & Bradstreet Paydex

The Dun & Bradstreet PAYDEX model primarily focuses on payment history for accounts youve opened with suppliers and vendors. In addition to on-time payment history, the PAYDEX scoring model considers overdue accounts and accounts that have gone to collection.

Based on its 1-100 scale, D& B groups businesses into three risk levels for late payments:

| D& B PAYDEX Score |

| Low |

Simply put, the earlier your businesss bills are paid, the better the PAYDEX score.

As a free way to view and track your score, you can sign up for D& Bs CreditSignal, a monthly service similar to the free credit monitoring services you can use to monitor personal credit.

Viewing your credit file and further understanding your score requires filing for a DUNS number on the D& B website and signing up for its Credit Evaluator Plus product, which costs $61.99 per month.

Recommended Reading: Paypal Credit Score

The Purpose Of A Credit Score

Before we dive deep into the factors that shape your credit score, it helps to understand why companies care about credit scores in the first place. Spoiler alert: Its all about the money.

The FICO Score, used by 90% of top lenders in the United States, analyzes the information on your credit report. Then, it predicts how likely you are to pay a bill 90 days late within the next 24 months.

FICO scoring models rank-order credit reports on a scale of 300 to 850. If your score falls on the higher end of that range, you have a good credit score. That higher score tells lenders youre less likely to fall seriously behind on credit obligations. If your score is low, the lender knows that the risk of you paying late is greater.

Related: How To Improve Your Credit Score

What Won’t Be Included In Your Credit Score

Your credit score is based on financial factors that tell lenders whether you would be a good credit risk. Things that donât affect your score include:

â Your age

â Ethnicity, race, or country of origin

â How much you make

â Whether you receive public assistance

â Location

â Your work history

â Family composition and responsibilities

â Participation in credit counseling

The bank or credit company may ask questions about how much you earn, for example, to decide if you earn enough to make minimum monthly payments on a mortgage. While some factors do matter in getting approved, they aren’t tied in any way to your actual FICO credit score.

Read Also: Does Carmax Work With Poor Credit

What Affects Your Credit Scores

Do you feel like you need an advanced degree to figure out what is affecting your credit score? Good news is you don’tit can actually be rather simple.

Behind the number itself , there are five main factors used to calculate credit scores. Lenders use those scores to figure out how likely you are to pay back your debtthus those scores are often the deciding factor in whether you will get a new loan.

As your financial profile changes, so does your score, so knowing what factors and types of accounts affect your credit score gives you the opportunity to improve it over time.

Don’t ‘spend’ Your Applications Too Often

Every time you apply for a credit product , it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you’re desperate for credit. Therefore, space out applications if you can and don’t do them frivolously.

In fact it’s almost worth thinking about applications as ‘spending’. Is it really worth spending an application on what you’re doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you’re just about to apply for a mortgage, wait until after you’ve done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don’t get the credit limit you need, don’t automatically apply for another one. Read the Low Credit Limit guide for more information.

Read Also: Can You Use Affirm In Store At Walmart

Avoid Closing A Credit Card Account

Try to avoid closing credit card accounts before you apply for a mortgage because multiple cancellations can negatively affect your credit score. You may also affect your credit score if you close the credit card you’ve had the longest, because that will shorten the length of your credit history.

Consider keeping your credit cards open but place them in a locked drawer or other designated “safe spot” so you’re not tempted to use them.

How To Check Your Credit Score

Checking your credit score helps you predict how borrowers will view your applications for credit cards or loans. If you see that your credit score is lower than you want, you have an opportunity to improve your score before you take major financial steps, such as applying for a mortgage.

Avoid sites that claim to provide a free credit score if they mention a trial subscription or ask for your credit card information. You may be charged within a few days if you don’t take some action to stop the trial.

You can check your own credit score, and you should, through any of a variety of services. There are online sites that offer free credit scores. If you have a checking account, many banks will also offer customers a chance to monitor their credit scores through their online accounts.

Read Also: How To Get A Repossession Off Your Credit Report

Open A Store Credit Account

Many stores offer credit accounts. Most are reported as revolving credit, the same as a credit card. Home Depot offers project loans. Many local home improvement stores also offer credit accounts, and some are available with the payment of a deposit in lieu of good credit. Staples office supply store has several credit products, including a personal credit account administered by Citibank. Before applying for store credit, be sure the vendor reports to the credit bureaus.

Also, keep in mind that some are better than others for people with poor credit scores, while others can help individuals recover from poor credit.

What Lenders Really Know About You

It’s important to be aware of exactly what lenders know when you apply, so you can present yourself in the best light. Importantly, it’s more than just what’s on your credit file.

The application form. In many ways this is the most important part. Here, lenders obtain the key details: your postcode, salary, family size, reason for the loan and whether you’re a home owner.

Make sure you fill in the forms carefully. One slight slip, such as a “£2,000” salary rather than a “£20,000” one, can kibosh any application.

Be consistent too, fraud-scoring firms filter applications and if there are many inconsistencies such as changing your job title or different phone numbers, it can cause a problem that you may not be told about.

Past dealings you’ve had with the lender. Companies use any data on previous dealings they’ve had with you to feed into the credit score. This means those with limited credit history may find their own bank more likely to lend to them than others.

Of course, those who’ve had problems with a lender in the past may find it more difficult to get accepted there too.

Equifax, Experian and TransUnion credit files. The three UK credit reference agencies compile information, allowing them to send data on any UK individual to prospective lenders. All lenders use at least one agency. This data comes from four main sources:

– Electoral roll information. This is publicly available and contains details of addresses and who lives at them.

Don’t Miss: Reporting Death To Credit Bureaus

Dont Waste Your Money

Many debt relief companies make big promises. But you should be wary. The CFPB issued a consumer advisory warning people about paid . The fees these companies charge are often high, and you can accomplish the same results on your own. If someone promises a quick fix, go somewhere else because theres no such thing as a quick fix, advises Griffin.

Despite what some companies might claim, accurate negative information cant be removed from your credit reports, says Griffin. So you could end up paying your hard-earned money for nothing. Instead, focus on keeping up with your payments, keeping your credit card balances low, and avoiding new credit lines to improve your credit.

Why Having A Good Credit Score Is Important

In general, having good credit can make achieving your financial and personal goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you’ll have to pay in interest or fees if you’re approved.

For example, the difference between taking out a 30-year, fixed-rate $250,000 mortgage with a 670 FICO® Score and a 720 FICO® Score could be $72 a month. That’s extra money you could be putting toward your savings or other financial goals. Over the lifetime of the loan, having a good score could save you $26,071 in interest payments.

Additionally, credit scores can impact non-lending decisions, such as whether a landlord will agree to rent you an apartment.

Your credit reports can also impact you in other ways. Some employers may review your credit reports before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance.

Don’t Miss: Credit Score Of 611

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Don’t Panic If Your Credit Score Drops Slightly With One Of The Agencies It’s Actually What’s On Your Credit Report That Matters

The idea that getting accepted for credit is all based on a simple score given to you by one of the credit reference agencies is false. At best, it’s a guide to roughly how good or bad a risk you are. As we say above, lenders will judge you on three main criteria when you apply for credit:

Yet the first two aren’t factored in to your credit score so it’s based on incomplete information. Plus, different lenders are looking for different things. When you apply, they assess you based on their own ‘ideal customer’ scorecard and each lender is different. Just because one lender rejects you doesn’t mean another will do the same. So bear in mind:

- Rather than thinking “I have a great credit score so I’ll get any credit I apply for”, it’s actually best to check how you stand with different lenders before you apply. A way of doing this is to use our . That way, you’ll have a better indication of which lenders are likely to accept you .

- If you get lots of high percentages then you’re doing reasonably well but NO ONE is ever likely to be accepted for every card or loan. If our calculator shows you’re not likely to be accepted for many cards or loans, see our tips to boost your creditworthiness.

The impact of a slight credit score drop is near meaningless

Also Check: Affirm Credit Score Needed For Approval

Your Credit Report Dictates The Product And Rate You’ll Get

In the past 10 years the credit landscape has almost completely shifted towards ‘rate for risk’. This means almost every credit provider on the market uses your credit file to not only dictate whether they’ll provide you with credit, but also what interest rate you’ll get.

The most obvious way this manifests itself is in representative rates on loans.

Here, only a minimum of 51% of accepted customers must get the rate advertised. They might be advertising a 6% rate . But you could be accepted and offered a 40% interest rate instead, because of a poor credit score.

It applies to other products too. Some 0% credit cards give you a shorter 0% period if you’ve got a poor credit history , others will simply offer you a different product to the one you’ve applied for. This is why it’s so important to manage your creditworthiness.

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Read Also: What Credit Score Do You Need To Get Care Credit

Debt Burden Or Accounts Owed

The other major component category of your credit score is the break up of your existing debt burden including how much you owe in total, what types of loans you have and any other quantitative indicators about your overall debt/credit profile. As an indicator of your creditworthiness how much you owe and how it’s broken up across the different types of loans acts as a signal about your capacity to manage your existing debt.

When it comes to how this plays into your credit score, it’s probably not worthwhile to think of it was higher/lower = better. In all likelihood, the FICO calculation doesn’t evaluate your debt burden in isolation but considers it in relation to things like your payment history. For instance, let’s consider a credit profile of someone who has large amounts of debt but a long and spotless payment history. This might indicate that the person is financially well off and the debt burden is a signal that any additional loans might be obligations they can easily handle.

Take the same level of debt on a profile with a recent history of payment problems, and the higher quantitative factors should be a major red flag. This consumer may be having difficulties making ends meet and even a small amount of additional credit might be a risky proposition.