Getting Auto Loans With A 738 Credit Score

There is no credit score too low to get an auto loan, and youll be able to get one when your credit score is 738. However, if you want the best interest rates on the market, youll probably need to wait until you get your score a bit higher.

According to a 2020 quarterly report by Experian, people with credit scores of 661780 had average interest rates of 5.59% on their used car loans and 3.69% on new car loans, whereas people with credit scores of 781850 received average rates of 3.80% and 2.65%. 8 Although this is a relatively small difference, waiting until your score improves could still potentially save you hundreds of dollars on a car loan.

If youre set on getting an auto loan right now, then pay as large of a down payment as you can afford and consider getting prequalified or applying for a preapproval from your bank or credit union to increase your bargaining power.

Learn More About Your Credit Score

A 738 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Tip : Maintain A Low Credit Utilization Rate

“If your balances increase over time, your credit scores will suffer. Your is the second most important factor in scores, behind your payment history,” Griffin explains.

To calculate your utilization rate, add up the total balances on all your credit cards and divide by the total of your credit limit across all cards.

Let’s say you have two credit cards:

- Card A: $1,000 balance and $3,000 credit limit

- Card B: $3,000 balance and $5,000 credit limit

Your total balance would be $4,000 and total credit limit $8,000. That makes your utilization 50%, which is high. You should aim for a low utilization rate around 30% to improve your credit score.

If you find it hard to keep track of the percentage of credit you use, take advantage of various alerts card issuers set, such as when your balance exceeds a certain amount or when you’re approaching your credit limit. If you have no problem paying your balance in full each month, you can also call your card issuer and ask them to increase your credit limit.

You May Like: How Long Do Repo Stay On Your Credit

Credit Score Mortgage Loan Options

A conventional mortgage usually requires a minimum credit score of 620. This means that with a score of 738, you have a high probability of being approved for a mortgage loan. But lenders wont be offering you the best interest rates out theresome experts suggest that you need score of 760 to get those.

Its important to note that having a score of 738 doesnt guarantee youll be approved for a mortgage. People who have insufficient income or a history of filing for bankruptcy can still be denied loans, mortgages or credit cards even with a good score.

If youve been denied a mortgage with a 738 score, you can check if you qualify for a USDA loan or a VA loan. Otherwise, youll have to improve your credit score, increase your down payment or speak to your lender on how you can work toward a mortgage approval.

How To Improve Your 738 Credit Score

A FICO® Score of 738 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 738 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

53% of consumers have FICO® Scores lower than 738.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Recommended Reading: Carmax Financing Rates

What Can You Do With A 738 Credit Score

A Good credit score of 738 can help borrowers secure financial opportunities like property and personal loans, reasonable car insurance premiums, apartment rentals, even the best rewards-based credit cards.

While you may not be in line for the most affordable interest rates or the lowest fees, a 738 credit score still allows you to secure the funding you need, when you need it.

Reference the below details for even more information on the opportunities youve earned through a 738 credit score.

- Personal loans help borrowers fund personal projects, anything from a destination honeymoon to a surprise medical bill.

- A credit score of 738 is sufficiently high to secure a personal loan, and may even be enough to land an industry-leading interest rate, depending on your lender.

The Biggest Credit Score Myths

Like any industry, credit and lending is always changing. As the economy fluctuates up and down and federal regulations change to provide new guidelines and protections for consumers, it’s no surprise that credit card issuers change the qualifications for their financial services and products. You’ve probably heard a lot of credit card myths from people who’ve been in the game for a long time. But the truth is you shouldn’t always listen to them.

Below, we outline some of the most persistent credit card myths and explain exactly what’s true for today’s credit card user.

- Myth 1: You should never close your oldest credit card

- Myth 2: You need a perfect credit score

- Myth 3: Carrying a balance helps your credit score

- Myth 4: Checking your credit score will lower it

You May Like: How Do I Get A Repossession Off My Credit

How To Fix A 738 Credit Score

In summary your credit score determines your ability to borrow. Its important that you manage it. If you have 738 credit score then your focus should be on driving it higher. To do this follow these simple tips:

- Pay down your debt If you have debts but also have savings then you need to ask yourself do you need all that cash in the short term? Could it be used better if it was spent on paying down debt? This would be an excellent use of your funds in a low interest rate environment and would have the beneficial affect of moving your 738 credit score even higher.

- Get a credit report Like everything else in life mistakes can happen in any area and that includes the record of your debt repayments. Its possible to get a credit report to see if all the information that lenders have on you is correct. If it is not and there are records which indicate that you missed a payment which you never missed, or you applied for finance at an institution you have never even heard of then you need to correct that. Correcting those errors will also drive that score towards excellent.

- Avoid short term debt Before you take on short term debt do a simple mental exercise. Consider an item you wish to buy, look at the price, now ask yourself what the real price is if you use short term finance given the high interest rates that can apply. In some cases, this can mean that the item will cost you twice as much as the list price. At that price is it still something that you wish to buy?

When Did Credit Scores Start

1. A Brief History of Credit Scores OppLoans The current FICO score system premiered in 1989 and has become the industry standard. It is a number between 300 and 850 determined by the HistoryEdit credit bureaus. During the late 1950s, banks started using computerized credit scoring to redefine

Read Also: Does Applying For Paypal Credit Affect Credit Score

How Your 738 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

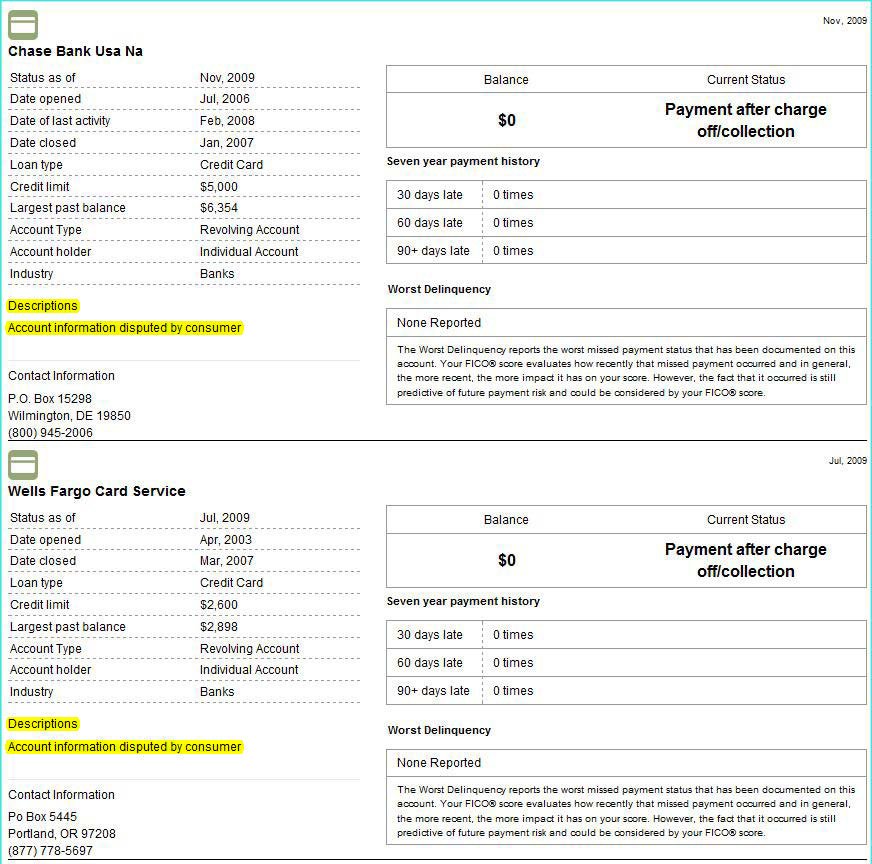

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

To maintain your good credit score, follow these tips:

How A 738 Credit Score Can Benefit Your Finances

Having a good credit score means that youll pay less for loans and other types of credit than you would if you had a bad credit score. This is because you can take advantage of the low interest rates and the other financial benefits of a good credit score.

Loans and Credit You Can Get with a 738 Credit Score

| Installment loans | Mortgage | Eligible for all types of mortgages, including FHA-backed mortgages with a 3.5% down payment, conventional mortgages, VA loans, USDA loans, and jumbo mortgages |

| Car loan | Eligible, but youll have to pay a higher interest rate | |

| Private student loan | Usually eligible without a cosigner | |

| Personal loan | ||

| Eligible, though you might not get the best interest rates | ||

| Secured credit card | ||

| Usually eligible without a deposit | ||

| Utilities | Eligible, but you may need to pay a deposit if youve previously had any late payments | |

| Charge cards | Sometimes eligible |

In addition to helping you qualify for better credit card and loan terms, having good credit can help you snag your dream job or apartment. This is because many landlords and employers run credit checks. A high score can also save you money on services like insurance.

However, if you want the very best rates and terms on your loans and credit cards, then there are still some things you can do to further improve your credit score. This is easy to do once you understand how credit scores work and how theyre calculated.

Also Check: Ccb Ppc Credit Inquiry

Frequent Credit Card Use Is Required To Take Full Advantage Of Rewards

Depending on the rewards offered, earning them can be a bit complicated. It may be easy in the first year, due to a generous sign-on bonus. But the ongoing rewards arent always so easy.

Take travel rewards, for example. If a travel rewards card offers two points for every $1 you spend, youll have to spend $1,000 per month to earn 2,000 points. In one years time, you can earn 24,000 points spending at that level, equal to $240 in travel purchases.

But the critical connection is being able to spend at that level every month. If you dont normally use a credit card, you may not accumulate a meaningful number of points.

Myth : Carrying A Balance Helps Your Credit Score

Carrying a balance on your credit card doesn’t help your credit score, it only has the potential to hurt it and it will end up becoming expensive over time paying interest. Not to mention, it’s a waste of money to pay interest on your balance if you can afford to pay off your credit card bill in full each month.

If you do have a credit card balance that you need to pay off over time, consider transferring it to a card with temporary 0% APR. It won’t necessarily change your credit score, but a 0% APR card can save you on interest and help you pay off your balance faster, which ultimately helps out both your score and your budget.

Here is our pick for the best balance transfer credit card with the longest intro period:

Also Check: Get Inquiries Removed

Dont Apply For Multiple Credit Cards

This is standard advice any time you apply for credit of any type . If you put in multiple applications, you can actually hurt your chance of being approved and even catapult your score back to the bad credit range.

Each lender will have access to your credit report, which will show that youve applied elsewhere. Those applications will show up as credit inquiries. Too many inquiries can actually drop your credit score. Maybe it wont be by a lot, but it could be enough to put you into a bad credit score range.

Pick the card you want most, and apply for it. If youre turned down, or you dont like the terms, only then should you apply for another card.

How To Find The Best Credit Cards If Your Fico Score Is 700 To 749

If youre in this credit score range, the best credit cards arent hard to find. Nearly all types of cards will be available to you.

At this credit score range, it will be less a matter of finding cards you qualify for, and more about selecting the ones you like best.

Whats more, traditional factors, like annual fee and interest rate become less important. Credit cards in the 700 to 749 range offer the kinds of perks that can actually enable you to come out ahead in using the card. That is, the rewards and benefits will be higher than the annual fee, and even the interest expense if you make a habit of not carrying an outstanding balance.

This guide will offer nine different credit cards if your FICO Score is 700 to 749. You can simply choose the card that offer the best combination of rewards and benefits for you.

Don’t Miss: Primary Cardholder’s Ssn (last 4) Wells Fargo

Vantagescore Vs Fico Credit Score Calculation Methods

VantageScore and FICO take the same factors into account to produce your score, but they weigh them slightly differently . Here are just a couple of the differences between FICO and VantageScore: 3

- VantageScore groups the length of your credit history and your credit mix into one category called Depth of Credit.

- In addition to your credit utilization , VantageScore also looks at your current balances and your remaining available credit .

The tables below show how the models weigh your financial decisions to produce your score:

| -78 | 688 |

Given time, you can get your credit score into the top ranges. This can mean developing your credit profile if you dont have much of a credit history or recovering from negative marks that brought your score down.

Regardless of your circumstances, there are steps that you can take immediately to increase your credit score.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be a reason peopleâs credit scores tend to increase as they get older. Their accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just your age.

Don’t Miss: Does Klarna Hurt Your Credit Score

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Credit Score: Is It Good Or Bad

A FICO® Score of 738 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 711, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO® Scores “acceptable” borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

21% of U.S. consumers’ FICO® Scores are in the Good range.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

You May Like: Credit Report Without Ssn