Be Mindful Of Your Credit Utilization

Your is a measure of how much of your available credit youre using, and is calculated by dividing your total credit used by your total credit available. For instance, if you have $10,000 in available credit and have credit card balances of $4,000, your credit utilization rate is 40%.

In general, you should keep your credit utilization ratio below 30%. But if youre chasing an 850 credit score, you will want to keep it above 0% but below 10%.

The Likelihood Of Achieving An 850 Credit Score

Of those people with credit scores, the number with a perfect score is pretty slim. Though it varies from year to year, it is approximately 1.5%. For instance, in 2019, 1.2% of all FICO Scores were perfect. That number increased to 1.6% in 2021.

So, while it is possible to achieve a perfect credit score, it takes a lot of work to move from a good credit score to a perfect credit score.

What You Need To Know

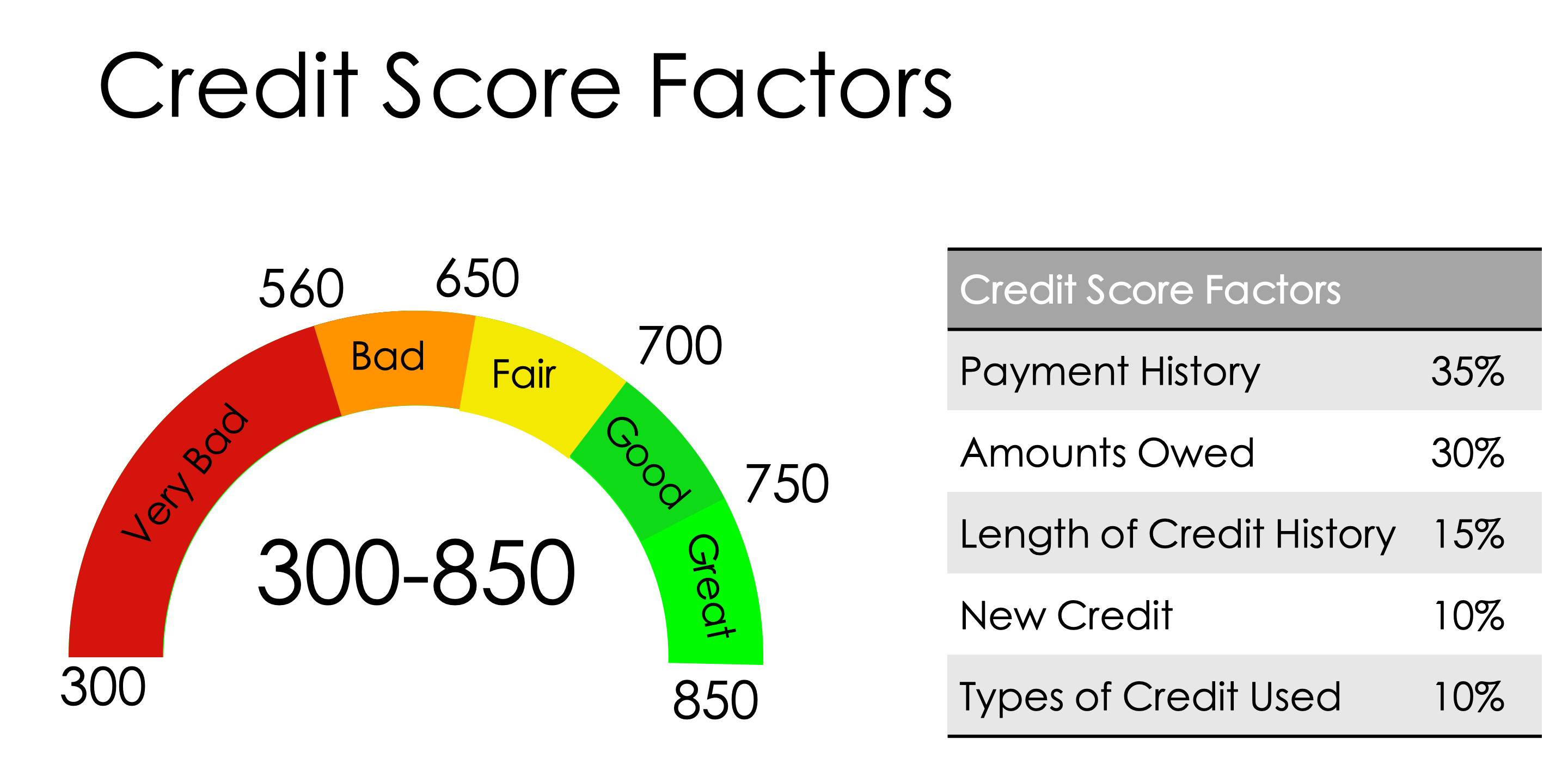

- The length of your credit history accounts for 15% of your FICO® Score

- An excellent credit score might also help you qualify for the best credit cards, lowest interest rate, and most favorable terms a lender has to offer

- Some credit card companies make credit monitoring easy by giving you free access to one of your credit scores each month

Recommended Reading: How To Unlock Credit Report

Myths Of 850 Credit Score

850 FICO scores are the rarer score to attain, there are many misconceptions surrounding it. Although none can deny that the 850 FICO score is exceptional and that it allows people to make use of all credit benefits like the easiest loan approval, the lowest interest rates, and the fewest premium amounts. Still, some myths prevail about this credit score range.

What Is An Excellent Credit Score

The definition of an excellent may be different depending on who you ask. Every credit card company and lender sets its own credit score criteria. So, the credit score thresholds you need to reach for approval, lower interest rates, and better borrowing terms can vary from one credit grantor to the next.

According to Experian, a lender might consider your credit score to be excellent or exceptional with numbers like:

- FICO® Score: 800 850

- VantageScore® Credit Score: 781 850

Recommended Reading: Does Opploans Report To Credit Bureaus

Important Credit Score Factors

Payment history

The most important part of your credit score is your payment history, which accounts for 35%. A solid track record of always paying your bills on time will go a long way toward an eventual perfect score, while just one missed payment can screw things up considerably.

The effect of a late payment on your credit score depends on the severity, when it happened and how often you pay late, according to credit reporting agency Equifax. Generally, though, the later the payment, the worse it is for your score.

Your current credit situation also plays a role. For example, if a person with a 780 FICO score and no history of late payments became 30 days late on a payment, they could experience a drop of 90 to 110 points. However, if that persons current score were 680 and theyd missed a couple of payments in the past, they could expect to lose just 60 to 80 points after another 30-day late payment.

Amounts owed

The next-most heavily weighted credit score factor is how much debt you owe in relation to the total amount of credit available to you. This is also known as your credit utilization. The more of your available credit you use, the more of a risk you are to lenders since it can seem like youre relying too much on credit to get by.

Length of credit history

The length of time youve been using credit is also important to your score. Creditors like to see that you have a history of borrowing money responsibly, so longer credit histories are viewed more favorably.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

You May Like: How To Get Credit Report With Itin Number

You May Like: Is 588 A Good Credit Score

Is 870 Credit Score Possible

An 870 credit score is excellent. Before you can do anything to increase your 870 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and don’t count towards your score.

My Credit Score Is 850 What Do I Do

Following the tips above will improve your credit over time. Your credit will improve as you get more financially responsible. Paying down debt will help, too. Remember, your payment history matters the most, so make sure to make your payments on time.

If your credit has been marred by years of financial mistakes, errors on your credit report, and bad luck, there could be helpful for you. You may benefit from credit repair.

Credit repair services like The Credit Pros help people dispute errors on their credit report, help them get bad marks on their credit removed, and give financial services to help them build their credit score.

The Credit Pros has years of experience dealing with credit bureaus and lenders and helping people repair their credit. Our credit experts will help you through any situation, and were only a phone call away. They also offer credit monitoring using their AI-powered credit management tool that you can check on your phone.

Give a call toThe Credit Pros to see how they can help repair your credit: no matter what your situation is!

Recommended Reading: What Credit Score Is Needed To Rent An Apartment 2020

Its Not Necessary To Have A Perfect Score

Ulzheimer says his FICO credit score has hit 850 off and on for the past five to seven years. That achievement became easier once his credit history passed the 20-year milestone, he says. Yet Ulzheimer notes he hasnt been striving for perfection with his credit score he just knows the right behaviors for managing his credit well.

Unlike Ulzheimer, Stevens says racking up a perfect FICO credit score of 850 has been his goal for a few decades.

As many do in their 20s, I experienced financial instability and suffered some setbacks that greatly impacted my credit scores. That credit also limited my economic flexibility, says Stevens, managing partner of a private car service in Austin.

He adds: As I grew older, I became more aware of how good credit opened opportunities for advancing and enhancing my life. So I continued to work on getting an ever-better score. After a while, it not only became a goal but a total obsession.

But Ulzheimer says obsessing over how close your FICO credit score is to 850 doesnt necessarily pay off. Why?

Ulzheimer says an 850 FICO score isnt needed to gain the best interest rates or APRs on credit cards and loans. In fact, he adds, theres not much difference in that regard between, say, 800 and 850. More than anything else, arriving at 850 merely gives you bragging rights, Ulzheimer says.

As long as your scores are above 760, you are likely going to get the best deals, Ulzheimer says.

Carry A Balance But Pay It In Full

If youre looking to build credit, you should aim to make at least your minimum monthly payments on time. But if you want to achieve a perfect credit score, youll want to pay your balances in full, but not before they hit your statement.

You should carry a small but manageable balance, keeping your credit utilization rate in the single digits. While you wont want to pay your full balance early, you may want to make a partial payment before the end of your billing cycle if your credit utilization ratio will be high that month.

It is also worth stressing that you need to make on-time payments. While it is possible to recover from a late payment or missed payment, it can take a while to do so.

Don’t Miss: Why Is My Credit Score Low

Average Credit Score By State

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Heres the average credit score in each US state and the District of Columbia, according to data from Experian.

| State |

You May Like: What Is Syncb Ntwk On Credit Report

Is It Good To Have 2 Credit Cards

Having more than one credit card may help you keep your credit line utilization ratio per card lower than the recommended 30% by spreading charges. There are potential benefits to having multiple cards, such as pairing various types of rewards cards to optimize earnings on all categories of spending.

Don’t Miss: What Credit Report Do Apartments Look At

Review Your Credit Report

Thirty-four percent of Americans have at least one error on their credit report. If youre one of them, this information could potentially be lowering your score. These errors can be the result of an innocent reporting mistake or something more serious like identity theft.

You should review your credit report for errors and inconsistencies. You can do so by requesting a report via the Annual Credit Report website. If you notice errors on your report, you can work to fix them.

How To Increase Your Credit Score

Now that you know a little bit more about credit scores, you might be motivated to increase yours. Luckily, there are many ways that you can work to improve your score. Dont be discouraged if youre unable to increase your credit score overnight. It will take some time, but it will happen with intentional steps.

Recommended Reading: What Credit Score Do You Need For Southwest Credit Card

What Do Credit Score High Achievers Have In Common And What Can We Learn From The Credit Behavioral Characteristics In These Populations

Scoring Solutions

Some of the more frequent credit score related questions people ask are around the subject of a perfect FICO® Score:

- What is the perfect FICO® Score?

- How can I get a perfect FICO® Score?

- Does anyone have a perfect FICO® Score?

- Whats the typical credit profile of someone who has a perfect FICO® Score?

FICO® Scores are a sequence of three-digit numbers ranging from 300-850*. Each lender determines the score cutoff they require to approve a request for credit and to help them set the terms of the credit being extended. Typically, most lenders do not require an individual to have the highest credit score possible to secure the best loan features. Instead, they set a high-end cutoff where those applicants scoring above that cutoff qualify as a good credit score and get these most favorable terms.

In other words, dont sweat it if you are only an 800 as most lenders are likely to treat you the same if you score in the 800-850 range because your risk of not paying as agreed is very low in these highest FICO® Score ranges.

The percent of the population with an 850 credit score is relatively small, but has been increasing. As of April 2019, about 1.6% of the U.S. scorable population had an 850 FICO® Score. That compares to 0.98% in April 2014 and 0.85% in April 2009. This slight uptick is not surprising as we have been seeing the average FICO® Score on the national population increasing as time since the great recession ages.

What Are The Credit Score Ranges

Your credit score range can fluctuate from very poor/poor to exceptional/excellent. It all depends on the information on your credit reports and the credit scoring model a lender uses to evaluate those details.

Here are the basic credit score ranges for FICO® Scores and VantageScore® credit scores.

- FICO® Score:

- Poor: 500-600

- Very Poor: 300-499

Throughout life, its common for your credit scores to rise, making it easier to obtain credit. But, they can also fall, which will make it more difficult and more expensive to qualify for financing and services.

Also Check: How Long Will Medical Bills Stay On Your Credit Report

Is Achieving An 850 Credit Score Worth It

You dont need a perfect credit score to get the white-glove service from lenders. A score in the excellent range higher than 750 is generally considered enough to get you some of the best interest rates currently available.

The incremental value of a higher score in terms of lower rates generally fades once you cross the 750 mark. Car insurance rates, car loans, mortgages and personal loan rates arent going to get any lower once youre in the top credit bracket.

So is working towards a perfect credit score worth it? If youre currently outside of the excellent credit range, the answer is a resounding yes. Building your credit to the high 700s can get you access to the best terms mainstream lenders have to offer.

Benefits Of 850 Credit Score

Easy loan approvals Maintaining the topmost level of the credit score range means that loan providers and credit card issuers will not have any second thoughts about loan approvals. Those who can maintain proper payment history can get into this best credit score range, so these account holders can easily avail of new credit accounts from any financial institution.

Low-Interest Rates This credit score has the option of securing loans with the lowest interest rates ever possible. Although good credit scorers can secure loans at 5% to 7%, excellent credit scorers have the possibility of getting loans at 3% or 4%.

Reduced Premium Amounts An 850 FICO score doesnt usually go for secured home loans or secured credit cards because their credit scores are more than enough to gain the trust of credit card issuers, so they do not have to pledge any collateral security. This makes them eligible to get loans with lower or no premium amounts.

Higher Credit Limits Credit limits are the level up to which the borrowers can borrow loans. Once the limit is reached, they pay off the amount and get the same credit limit again further. Applicants with higher credit scores have enough options to get a higher credit limit.

Read Also: Why Does My Credit Report Not Show Everything

Focus On Your Revolving Debts First

If you happen to carry a balance on your credit cards, it’s important for consumers to focus on paying off their revolving debts first.

Whether you realize it or not, FICO actually takes the types of debt you pay into account when calculating your score. These two types of debt are revolving and installment. Revolving debts typically have higher interest rates and your minimum payment is based on the amount you owe. Department store credit cards are a good example. Installment loans are fixed loans of a lengthy time period, such as a mortgage or car loan. Paying down your revolving debts first often means paying less in interest.

What Bankruptcy Will Affect While On Your Credit Score

Your payment history, on-time payments, and recent credit reporting can all affect how lenders work with you.

Once you file bankruptcy and businesses see your credit reports negative information, you may have concerns about:

- Getting a car loan

- Getting loans without a qualified co-signer

- Adding authorized users to some credit cards

- Security deposits and returns of safety deposits

You have options regarding all these concerns if you are having credit or debt issues. There are ways to address each concern by yourself or with professional help. Getting a fresh start is possible, especially after filing bankruptcy.

You May Like: What Credit Score Do You Need For Capital One

Pay Your Bills On Time

This is the most obvious solution as well as one of the easiest.

Paying your bills on time is one of the ways to achieve the best credit score, considering that payment history accounts for 35 percent of your credit score.

So late payments can keep you from obtaining the highest credit score.

In fact, late payments can be recorded as a default on your credit report.

Defaults are one of the worst things to appear on your credit report, so avoid these at all costs.

If you know you have difficulty with a bill, pay as much as you can and talk to the provided before the due date.

So, be consistent with utilities, your cable bills, phone bills and any monthly subscriptions.

Regularly Check Your Credit Report

In order to maintain the best credit score possible, you should check your free credit report regularly.

That way you can ensure that your information is correct and that all of the inquiries and listings on credit report have been made by you.

Also, criminals can steal your identity and take out credit in your name.

So, if you notice a horrible mistake on your credit report, you can correct it right away.

So, checking the accuracy of your credit report is crucial.

7. Diversify your credit.

While the more debt you have may make your situation worse, having several different types of debt can add points to your credit score.

For example, if youre looking for home loans with bad credit, then showing that youve recently been able to manage an auto loan, an overdraft, a credit card and your utility bills, will help raise your credit score.

If you follow these tips above on how to raise your credit score, chances are you might get the best credit score possible.

Recommended Reading: How To Get Credit Report Mailed