Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO Score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO Score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, several services allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO Score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

New Electronic Alerts From Your Bank

Some banks have started sending new electronic alerts to help you manage your day-to-day finances and avoid unnecessary fees.

Your payment history is the most important factor for your credit score.

To improve your payment history:

- always make your payments on time

- make at least the minimum payment if you cant pay the full amount that you owe

- contact the lender right away if you think you’ll have trouble paying a bill

- don’t skip a payment even if a bill is in dispute

Why Is My Credit Score Low Even Though I Pay My Bills On Time

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If your credit score is lower than you thought it would be, you probably want to know why and what it will take to fix it.

It can be especially perplexing if you thought you always paid on time and expected to have a good credit score. Here are five reasons you may be in a lower credit score range than expected.

Also Check: Which Credit Score Do Apartments Use

What Is Considered A Low Credit Score

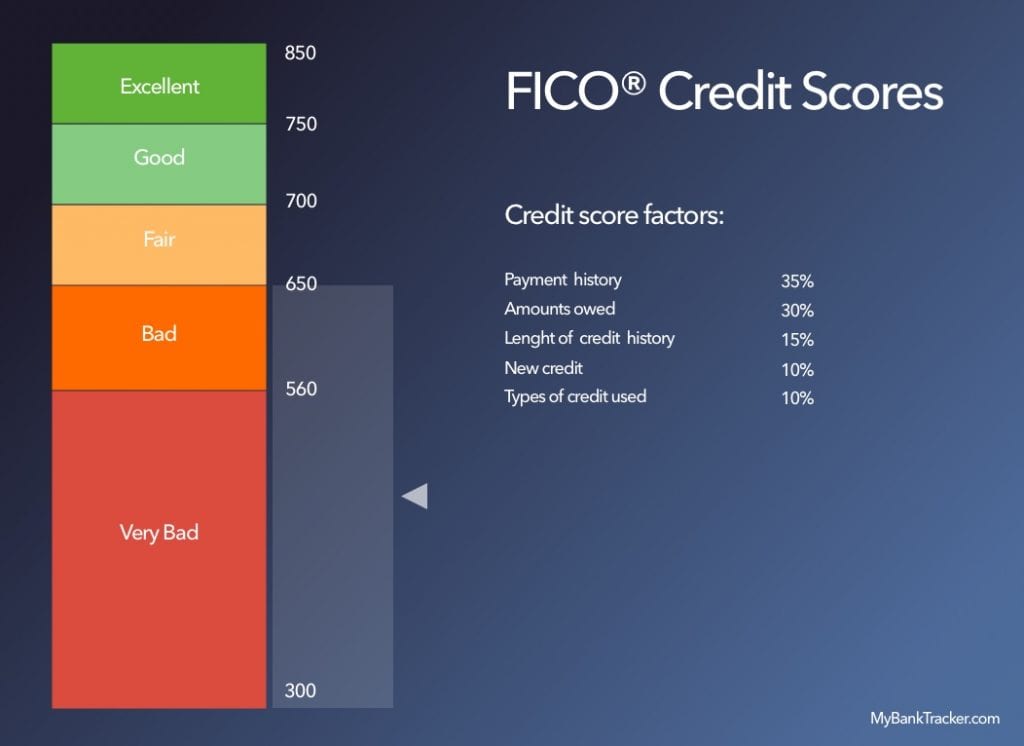

Whats considered a bad or low credit score can depend on what scoring model you or your credit bureau is using.

The VantageScore® model is based on a range of 300 850, where anything below 661 is considered bad.

The FICO® model uses a range of 280 850, with bad scores being any under 670.

For the most part, lenders will look at your FICO® Score when considering your approval for a loan.

Your Bankruptcy Fell Off Your Credit Report

When bankruptcy falls off your credit report after seven years , you’ll likely move to a new credit scorecard, similar to what happens when a collection drops off your credit score. You could see a drop in your credit score because now your credit performance is being compared to other people who haven’t filed bankruptcy.

Don’t Miss: Is 750 A Good Credit Score To Buy A House

How To Repair Your Credit And Improve Your Fico Scores

You can improve your FICO Scores by first fixing errors in your credit history and then following these guidelines to maintain a consistent and good credit history. Repairing bad credit or building credit for the first time takes patience and discipline. There is no quick way to fix a credit score. In fact, quick-fix efforts are the most likely to backfire, so beware of any advice that claims to improve your credit score fast.

The best advice for rebuilding credit is to manage it responsibly over time. If you haven’t done that, then you’ll need to repair your credit history before you see your credit score improve. The following steps will help you with that.

Its Never A Good Feeling To See That Your Credit Scores Have Dropped Since You Last Checked But Being Able To Quickly Identify The Cause Can Help You Take The Right Steps To Get Them Back On Track

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts , or applying for new credit accounts. And dont forget that credit report inaccuracies due to mistakes or identity theft can also cause a dip.

Lets look at the nine main reasons why your credit scores might have dropped, and how you can address each of them.

Recommended Reading: Is 711 A Good Credit Score

Check Your Credit Report

Your credit report contains all the information which makes up your credit score. You can check your credit report for free using:

Its worth checking with each of these, as the information they hold on you can be different as they are each based on data from different credit reference agencies.

Your credit report will give you advice about areas for improvement.

Do Not Let Bad Credit Become Bad News For You Get Low Rate Auto Loans Today

Is bad credit being a bad news for you? Don’t let bad credit score or poor credit history become a potent factor for car loan rejection. Do not lose faith because you can easily maneuver bad credit ratings and secure low rate auto financing in your city. This article is going to lead you towards affordable car loans despite your credit troubles.

Also Check: Does Refinancing Hurt Credit Score

How Errors Could Drive Your Credit Score Down

When you pull your credit report or review your credit score, take note if you find the information you dont agree with or incorrect terms.

Maybe a reason code doesnt make sense to you because it doesnt apply to your financial situation. Or you could even find evidence of accounts on your report that you didnt open.

That sounds a little weird but mistakes happen, and they often find their way into your file. In this case, you need to contact the credit bureau that issued the report and file a dispute.

Depending on the error, you may also want to follow up with your other financial institutions and check for fraud.

Accounts that you didnt open but show up on your credit report could be evidence that someone is using your information to commit credit fraud or identity theft.

Needless to say, checking your own information on a regular basis is important. Not only can you catch fraud if it happens, but you can also spot errors that might unfairly drive down your score.

You can get a copy of your credit report every year for free.

If you request copies more than once per year, youll pay up to $12 for each additional report. Again, if you find mistakes, open a claim or dispute with the credit bureaus.

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

Recommended Reading: Is 728 A Good Credit Score

Security Deposits For Utilities

Your utility providers take your credit report, and particularly your payment history, into consideration when setting up your account. If you have a poor payment history, chances are you will have to provide the utility company with a deposit in order to get service.

Although the FTC outlines that any utility companies requiring deposits must require them for all new customers or none, many providers waive deposits as long as you meet their credit criteria. This means that the poorer your credit, the more likely you are to be charged a deposit when setting up an account. Some utility providers may also accept a letter of guarantee, which is a letter from someone who has agreed to pay your bill on your behalf if you cant make the payment.

Avoid Giving Any Hint Of Risk

If individuals are looking to increase their credit score from 750 to 800, it is vital to avoid giving a hint of financial stress. Credit scoring models have been designed in a special way to identify early signs indicating financial pressure. Paying an amount lower than the overall amount due is one of the common signals of financial stress.

Also Check: Is 757 A Good Credit Score

Why Is My Experian Score So Low

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

Which Of The 3 Credit Scores Is Usually The Highest

For both the VantageScore and base FICO® score models, the lowest score is 300 and the highest credit score is 850. But even if you have pretty good credit habits, don’t be surprised if you check your scores and find that you’re below 850. Perfect credit scores can seem to be inexplicably out of reach.

Recommended Reading: How To Get Annual Free Credit Report

Is This Negative Credit Score Hit Permanent

Fortunately, negative marks are generally not permanent in the FICO scoring model. Even something as serious as bankruptcy will drop off your credit report after about 7 years. So, this negative hit from getting a new card will be a temporary thing.

First, the FICO scoring model only looks at hard credit inquiries over the last 12 months, so that small hit will fall off in about a year. Then, as the account ages and remains active, it’ll start helping improve your credit score via the length of credit history factor.

How Can I Clear My Bad Credit

Your credit score will naturally shift and fluctuate over time, based on how you handle your existing credit and the changing circumstances of your finances.

Sudden temporary drops in your score are often nothing to worry about and even the most serious of mistakes are repairable with time. You can start making positive changes to your score today by following these simple steps.

Read Also: Can Medical Bills Affect Your Credit Score

Why Is My Credit Score Low If I Have No Debt

It was about a year after getting my first credit card. After using the card to make small, necessary purchases , I had dutifully paid off my balances before my bill was due each month.

I never carried a balance and Id never had a cent worth of debt to my name. I was proud to build my credit and establish myself as a financially responsible, creditworthy adult, and fully expected it to reflect in my credit score.

But when I saw my credit score for the first time, I was disappointed. It was lower than I thought it would be. Why was my credit score low if I had no debt?

The most obvious answer was that my credit history was just not long enough.

This wasnt, however, the only reason my credit score was much lower than I expected.

Why Is My Credit Score A Bit Low

Purchasing a car or a house is a major decision. Deciding to go back to school is a significant life change. Sometimes, you need loans to make these major life events happen. It can be frustrating if your loan application is denied, and one of the most common reasons why applications are denied is due to a low credit score. You can check your free credit score at least once per year from all of the major credit bureaus. You should do so before you apply for a loan. Then, if your credit score is not what you thought it was, you should figure out why. What are some of the most common reasons why credit scores are a bit low?

The report is wrong

Sometimes, your credit report is not accurate. You can check your credit score at least once per year for free. You should take advantage of this. This gives you an opportunity to take a look at your report to see if there are any inaccuracies. There might be other people out there with the same name as you. Sometimes, their financial list apps can end up on your credit report. If there is something wrong with your credit report, you should reach out to the credit bureau as quickly as possible. Explain to them what happened, and they should remove the mistake. If you need help correcting your credit report, you may want to reach out to a financial professional who can assist you.

You paid your bills late

You declared bankruptcy

Improve your credit score

Don’t Miss: How To Get A Credit Report From Credit Karma

Learn The Factors That Determine How You Rate

Marcus Reeves is a writer, publisher, and journalist whose business and pop culture writings have appeared in several prominent publications, including The New York Times, The Washington Post, Rolling Stone, and the San Francisco Chronicle. He is an adjunct instructor of writing at New York University.

A credit score is a three-digit number that helps financial institutions evaluate your credit history and estimate the risk of extending credit or lending money to you. Credit scores are based on information collected by the three major , Equifax, Experian, and TransUnion. The most common credit score is the FICO score, named for the company that devised it, Fair Isaac Corporation.

Your credit score can be a deciding factor in whether or not you qualify for a loan and, if you do, the interest rate you’ll pay on it. It may also be used in setting your insurance rates and even be consulted by prospective employers and landlords. This article will explain how your FICO score is calculated, what information is not considered, and some common things that can lower your credit score or raise it.

Why Did My Credit Score Drop

Your credit score may have dropped because:

Recommended Reading: Is 621 A Good Credit Score

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

Reasons Why Credit Scores Drop

are generally calculated using information from your credit report about your finances. Factors like your payment history, the amounts you currently owe, your and how many accounts you have open can be important parts of your credit score. So when thereâs a drop in your score, itâs likely that thereâs been a change in one of these or one of the many other factors that go into credit scores.

There are many possible reasons your credit score might drop. Read on for some of the reasons and what you can do about them.

1. New Credit Applications

New credit applicationsâlike for credit cardsâcould have an impact on your credit scores. Thatâs because a new credit application generally creates a hard inquiry, which can cause your credit scores to drop by a few points and stay on your credit report for up to two years. And multiple credit applications in a short period of time could be seen as a sign your financial situation has changed negativelyâand they might cause your credit scores to drop.

2. High Credit Utilization

is a measure of how much of your available credit youâre using. Itâs sometimes called a credit utilization ratio, but itâs often expressed as a percentage. The more of your available credit you use, the more likely it is to negatively affect your credit score.

What you can do: Experts recommend keeping your credit utilization at 30% or less to help you maintain a good credit score and show lenders youâre responsible with credit.

Also Check: What Is A Fico Credit Score