Breaking Down Fico And Vantagescore

When most people think about their credit score, whether they know it or not, they are thinking about FICO. The Fair Isaac Corporation introduced FICO credit scores for consumers back in 1989, and since then the company has worked diligently to keep up with consumer behaviors and how those impact the FICO scoring calculations. Up until a decade ago, FICO was the only consumer credit score used by the three major credit reporting agencies, as well as the only score used by lenders and financial institutions.

In recent years, VantageScore has taken on the challenge of competing with FICO for its place at the top of the consumer credit scoring chain. By partnering with the three credit bureaus, VantageScore is able to use similar information and scoring models as FICO to generate individual credit scores. However, there are differences between FICO and VantageScore that consumers should be aware of.

First, it is important to understand that both the FICO and VantageScore methods draw from the same consumer information: payment history, credit usage, recent inquiries, length of credit, and type of credit. However, these details are gathered in different ways.

Negative Knocks On Your Credit

If you have made a change to your credit that should be reflected on your credit score but isnt, theres a chance your positive efforts have been canceled out by something negative.

Often, this is because of something called hard inquiries. Anytime you apply for a loan or a credit card, your potential lender or creditor will want to check out your credit. A Hard credit inquiry occurs anytime a lender does this pull on your credit score and credit report.

A hard inquiry can drop your score 5-10 points. If you have multiple inquiries at once, your score can drop fairly quickly as a result.

If you made a positive change to your credit score that is not being reflected in your score, there is a chance that hard credit inquiries have caused your score to drop by the same amount it increased from your positive changes.

What Is The Vantagescore Model

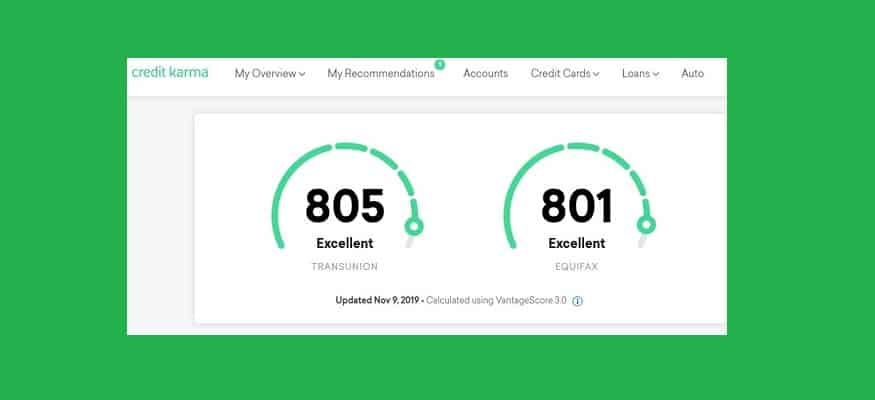

The VantageScore Model was originally developed in 2006 and the VantageScore Model 3.0 debuted back in 2013. There is currently a 4.0 model as well but it has not been as widely adopted as it has only been out since 2017. VantageScore Model 3.0 is used for other credit services like , Chase Journey, etc.

The VantageScore Model Credit Karma uses is pretty similar to the FICO model but it has some key differences. It uses the same FICO range of 300 to 850 for the score and stresses many of the same factors as FICO it just gives them different weight and has some slightly different criteria for calculating them.

Here are the 3.0 factors according to :

- Payment history

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

Final Thoughts On Credit Karma

One of the key questions I ask is, how is this company going to make money? As best I can tell, their model seems to be similar to Mints show you offers from advertisers and collect a commission on them.

Another question I ask is, how does this change the marketplace? I think it has potential to be a huge changer for the big credit bureaus. It reminds of when Zecco came out with free stock trades. In my eyes, E*Trade and Ameritrade have to innovate to show that they bring more value for the dollar. Im not convinced theyve done that. In the same way, Credit Karma should force the big credit bureaus to give consumers more value for the dollar spent on a credit score. If they cant adapt Credit Karma will start slowly eating their lunch. In both cases , consumers stand to win big.

So get out there start improving your credit score. Sign up for today!

Be Smart With Passowords

But even though Credit Karma has top-notch security practices, it doesn’t mean someone couldn’t get access to your account. That’s why you should ensure you are using a secure password and setting answers to your security questions that people can’t guess the answers to.

If you look at the Credit Karma IOS app, you’ll notice they have 130,000 reviews with an average of 5/5 stars. I’m not the only one who loves Credit Karma!

Just like any other site or service, Credit Karma could come under attack and have their systems compromised, but it’s clear to me that they are very proactive in doing everything they can to avoid that.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Tip #: Keep Your Credit Utilization Below 35 Percent

The Financial Consumer Agency of Canada recommends keeping your credit utilization at less than 35 percent of your total available credit. Generally, having high credit utilization may hurt your score as your lender may view you as more likely to default.

For example, if you have two credit cards with a $6,000 total limit, try to keep your combined balances below $2,100 .

How Does My Credit Utilisation Impact My Credit Scores

There are many different credit scoring models, so its difficult to calculate exactly how credit utilisation will impact your credit scores.

With that said, theres a strong correlation between a consumers credit utilisation rate and their credit scores. Though individual cases may vary, those who keep their utilisation percentage low generally have higher scores than those who habitually max out their credit cards.

If you dont want your credit utilisation to negatively impact your credit scores, its important to consider your spending habits. Factors such as your credit history and the number of cards in your wallet matter, too.

High utilisation on a single credit card could especially hurt your credit scores if you have a short credit history and only one card. On the other hand, you may feel the effects less if you have a long and excellent credit history and spread your utilisation across multiple cards.

Although its an important factor in calculating your credit scores, try not to focus just on this one aspect. Keep the big picture in mind.

You May Like: Opensky Billing Cycle

Should You Worry About Changes In Your Credit Score

Changes in your credit score are completely normal, so theres no need to worry about small fluctuations! That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening for example, if you have unauthorized accounts opened in your name, or youve been a victim of identity theft.

Whats In A Credit Report

Your credit report shows details of how you have used debt over time. In addition to your credit score, a lender also looks at what is on your credit report. Some of what credit bureaus record on your credit report include:

- Personal information

- Consumer statements

In Canada, credit bureaus are obligated to provide you with one free copy of your credit report per year if you request it.

Companies like Credit Karma and Borrowell provide free monthly or weekly credit report updates when you sign up with them.

Don’t Miss: Which Credit Score Matters The Most

Forgetting To Pay Your Bills On Time

If you think paying your credit card bill late every once in a while isnt a big deal, youre definitely wrong. Believe it or not, but your payment history is the most important factor that makes up your FICO score, making an impact of 35%. This means a single late payment could cause serious damage to your score, but it also means multiple late payments could harm it even more.

The best thing you can do for your credit is always pay your bills early or at least on time every single month. If you dont take bills seriously and you simply pay them when you get around to it, youll likely regret it.

Does Checking Your Credit Score Lower It

You’ve probably thought about checking your credit score every now and then. You may be pulling your report occasionally from the credit bureaus or you may have active credit monitoring in place . Either way, this question may have crossed your mind does checking your credit score lower it?

We’ll discuss this in detail but first a quick overview of your credit score.

Basically, your available to you. Some factors that determine your score include how much credit you use, how quickly you pay off that balance, how long youve been using credit, and if you have any dings against your record .

These are all things you want to keep in mind as you consider your credit score.

This brings us back to the big question: does checking your credit score lower it? The short answer is, yes and no. A key factor to this is any inquiries made on your credit. Hard inquiries can affect your score while soft inquiries dont.

Let’s go over how these credit inquiries work.

You May Like: What Credit Score Do You Need For Affirm

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

Does Checking Credit Karma Hurt Your Score

Checking your credit information on Credit Karma will not directly hurt your credit score, so you are free to check your credit information as you wish.

Again, Credit Karma uses Experian and TransUnion to get your credit information. To get this information, they need to pull the information from your account, just like lenders do.

However, anytime a lender does a pull on your credit account, it will likely cause a hard inquiry, and your score will drop as a result. Credit Karma on the other hand, does something called a soft inquiry, which is basically a hard inquiry that does not affect your score at all.

Soft inquiries show up on your credit report but do not affect your credit score. You can freely use Credit Karma knowing your score will not take a hit.

Also Check: Is 517 A Good Credit Score

Tip #: Dont Make Late Payments

If possible, aim to always make your credit payments in full by the due date.

If your cash flow is tight, try to at least pay the minimum payment to keep your credit account in good standing.

If youre unable to make the minimum payment, let your lender know immediately to see if a special arrangement can be made, such as spreading your payment over a longer period of time or negotiating a lower interest rate.

To make sure you never miss a payment, I recommend setting calendar reminders to log in and make payments to your credit accounts twice per month. This could help ensure that youll never be late for a payment and give you ample opportunity to review your statements and recent transactions for inaccuracies and fraudulent charges, says Stephen Weyman, personal finance blogger at HowToSaveMoney.ca.

Hard Inquiries Vs Soft Inquiries

Hard inquiries occur when people apply for a mortgage, auto, student, business, or personal loan, or for a credit card. They also occur when someone requests a credit limit increase. While one or two hard inquiries a year may hardly dent credit scores, six or more hard inquiries at once can cause harm.

Soft inquiries, on the other hand, pivot around investigations, such as credit checks made by businesses who offer goods or services, employer background checks, getting pre-approved for offers, and checking personal credit scores. Soft inquiries can also be inquiries made by businesses with whom people already have accounts. Most of these inquiries are not lending decisions. Theyre considered promotional and conditional, and therefore, wont affect the person’s score. Soft inquiries can be done without the persons permission and may, or may not, be reported on the credit report, depending on the credit bureau.

Other activities, such as applying to rent an apartment or car, getting a cable or internet account, having your identity verified by a financial institution, such as a credit union or stock brokerage, or opening a checking account may result in a hard or soft inquirythis depends on the credit card bureau or type of institution that instigates the inquiry. Credit Karma requests the information on its members behalf, so it is a soft inquiry and therefore does not lower the member’s credit score.

Don’t Miss: How To Get Credit Report Without Social Security Number

Maximizing Your Credit Score

Now that you no longer have to wonder if checking your credit score lowers it, you can stay more informed of your credit status. As you work your way toward that perfect score, remember that you do have some say in how your report looks.

Avoid any credit missteps youre able to control. Your score may drop with late and missed payments or when you allow your credit debt balances to grow. Closing an old account can also cause a dip in your score, as well as any bad marks on your credit report. Lastly, avoid too many hard credit inquiries whenever youre able.

While your credit score doesnt give a full picture of your financial health, its a key piece to your overall money puzzle and creating a financial plan.

Having a higher score can mean better terms on new loans, mortgages, and credit cards. These things on their own dont add much value to your life, but theyre tools you can leverage to reach your goals.

Ashlee Sang

How Can I Lower My Credit Utilisation

Here are three tips that may help you lower your credit utilisation .

- Make credit card payments more than once a month. This way, your balance never gets too high. Your credit card provider will typically report your credit activity to the credit reference agencies once a month. So, if you pay off a portion or even all of your credit card bill before that date, you can lower your credit utilisation.

- Spread your charges across multiple cards each month. Using multiple cards will result in multiple accounts of low credit utilisation rather than one account with high utilisation. Keep in mind, however, that certain credit scoring models will look at your overall credit utilisation and/or the utilisation on individual credit cards, so this technique may not always work.

- Increase your available credit. If your income has increased, youve maintained an amazing credit history, or you have little debt, it doesnt hurt to ask for a credit limit increase. Just remember that this can sometimes result in a hard credit search on your credit file.

Recommended Reading: Klarna And Credit Score

What Is Credit Karma Tax

When most people think of Credit Karma, it is because of their credit score monitoring and improvement tools. Many people have never heard of Credit Karma tax until they get in and start using the site.

Like their credit scoring tools, Credit Karma tax is free to use. Like you would expect, the service is used to help you to prepare your taxes.

As you might expect, preparing a Credit Karma tax return probably would not be the best for folks who have complicated taxes. Their tax review would be more appropriate for those who have a fairly straightforward tax situation.

With any free software, its not going to be best for everyone, but the tax software can satisfy a significant number of people.

One thing worth noting is that their tax program cannot be used everywhere. There are forty states as well as DC that allow their service.

How Does My Credit Card Utilization Affect My Credit Scores

There are many different credit-scoring models, so its difficult to calculate exactly how credit utilization will affect your credit scores.

With that said, theres a strong correlation between a consumers credit card utilization rate and their credit scores. Though individual cases may vary, those who keep their utilization percentage low generally have higher scores than those who habitually max out their credit cards.

If you dont want your credit utilization to negatively affect your credit scores, consider your spending habits. Factors such as your credit history and the number of cards in your wallet matter, too.

High utilization on a single credit card could especially hurt your credit scores if you have a short credit history and only one card. On the other hand, you may feel the effects less if you have a long and excellent credit history and spread your utilization across multiple cards.

Though its an important factor in calculating your credit scores, try not to focus just on this one aspect. Keep the big picture in mind.

Read Also: Does Qvc Report To Credit Bureaus

Fastest Ways To Raise Your Credit Score

It takes time to improve your credit score, especially if you have lots of negative items on your credit report. Fortunately, there are a few things you can do to raise your credit score quickly. Paying down a large credit card balance or getting a credit limit increase, especially before your account statement closing date, can impact your credit score relatively quickly. Both of these improves your credit utilization rate, which is 30 percent of your credit score.

Disputing a negative error from your credit report can also raise your credit score, especially if you talk to the creditor over the phone and have them remove the error from your credit report right away. To enforce your rights under the Fair Credit Reporting Act , you have to dispute credit report errors in writing. However, some creditors are willing to remove legitimate errors with just a phone call. The update can appear on your credit report and impact your credit score in just a few days if the creditor is willing to work with you.

If you’re unable to dispute an error over the phone, disputing in writing is still effective, particularly if you have proof of the error. The dispute process can take 30 to 45 days while the credit bureau investigates then updates your credit report. Once the error is removed from your credit report, it will factor into your credit score right away.