Have Doubts About The Quality Of Your Credit History

If you believe that your file contains an error or, even worse, that youve been the victim of identity theft and that this could affect your credit rating, request a copy of your report as soon as possible. This way, if there are any errors you can have them corrected. Ask to receive your credit score by mail its free, unlike some online requests.

Good to know: If youve been the victim of identity theft, some insurersincluding CAA-Quebec home insuranceoffer a helpline for policyholders. This legal assistance can guide you in the actions you should take and help you rectify the situation.

Will A Broker Use My Credit Score

Another way to potentially escape the damaging effects of a credit check is to use an insurance broker.

This is because, in many cases, the broker acts as a middleman and a payment processor, eliminating the risk posed to the insurance agency of a customer not paying their bill.

After all, the likelihood that a low-credit customer may not pay on their policy is one of the most significant reasons why higher rates are issued.

When seeking the service of an insurance policy broker, inquire as to how they handle payments and whether or not their service will allow an exemption from standard insurance agency credit checks.

Remember to be honest and open about credit problems, as these individuals are employed to help the consumer, not the insurance agency.

If youre ready to buy no-credit-check car insurance, enter your ZIP code below to find rates in your area.

Related Topics & Resources

Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. Not all Nationwide affiliated companies are mutual companies, and not all Nationwide members are insured by a mutual company. Subject to underwriting guidelines, review and approval. Products and discounts not available to all persons in all states. Nationwide Investment Services Corporation, member FINRA. Home Office: One Nationwide Plaza, Columbus, OH. Nationwide, the Nationwide N and Eagle and other marks displayed on this page are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. ©. Nationwide Mutual Insurance Company.

Also Check: How Remove Hard Inquiries From Credit Report

What To Do If Your Car Insurance Premiums Increase

In some cases, your car insurance premiums may increase.

Re-evaluate your needs

Review your insurance needs with your insurance company. You may want to consider asking about the following options for lowering your car insurance premiums:

- raising your deductible

- dropping collision coverage if your car has a low resale value

- a package deal for insuring your home and car, or more than one car, with the same insurance company

Shop around

Shop around, get quotes and compare prices from different companies and brokers to make sure you’re getting the best deal.

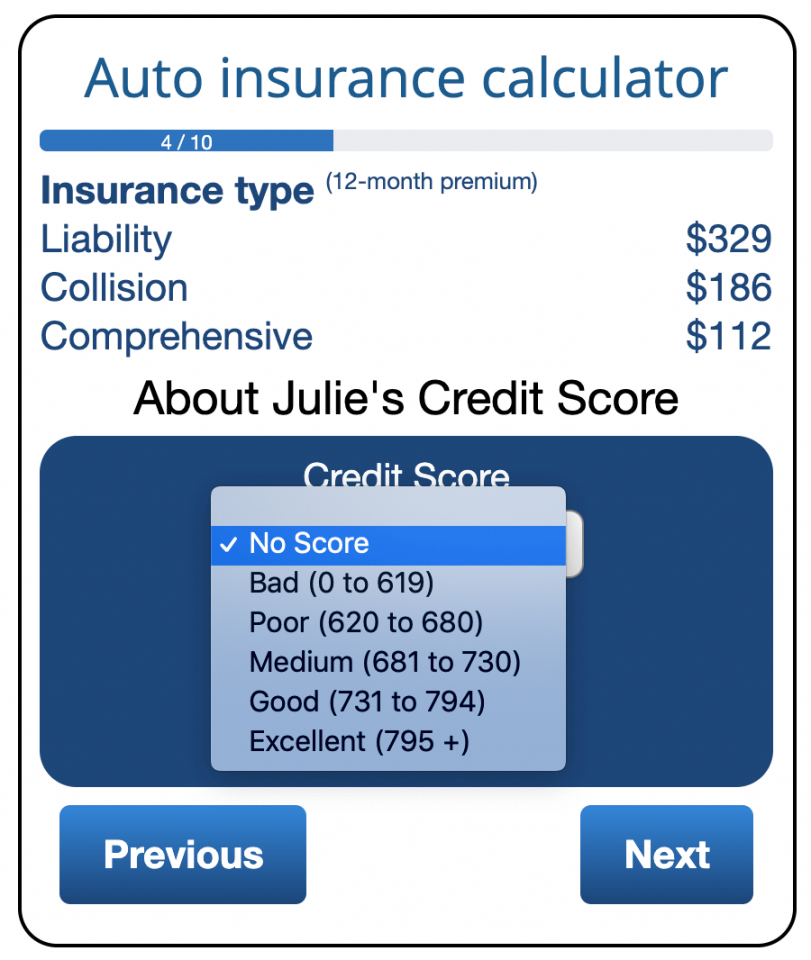

What Insurance Companies Review When Calculating Your Auto Insurance Score

Insurance companies say the most important factors for a good credit-based insurance score are a long credit history, minimal late payments or past-due accounts, and open credit accounts in good standing.

Past-due payments, collections, a high debt level, a high number of credit inquiries and a short credit history will hurt your score.

Your income, age, ethnicity, address, gender and marital status are not considered as part of the score.

The use of credit for setting premiums is controversial. Some consumer advocates say it unfairly penalizes people with low incomes or those who have job losses the people who need cheap car insurance the most.

Read Also: How To Fix A Repossession On Your Credit

What Else Do Car Insurance Companies Use In Calculating My Rates

Studies have shown that there is a distinct correlation between low credit scores and a high incidence of insurance claims. This correlation is the reasoning behind using credit scores as a car insurance rating criteria.

You may wonder which car insurance companies do not use credit scores, but the fact of the matter is that most underwriters will take this factor into account, along with information like:

- Personal demographics

- How your vehicle is used

- Type of coverage you want

The use of credit scores in setting insurance rates is somewhat controversial despite its widespread use for many years.

However, due to consumers concerns, most states now have guidelines in place regarding how insurers can use credit information in rate setting. This provides reassurance for consumers whose credit information is not being used in a standard way throughout the industry.

Why Does Credit Affect Car Insurance Rates

When you apply for car insurance, the company checks your credit rating, explains John Espenschied, owner of Insurance Brokers Group and an insurance expert with over 20 years in the industry. If your score is low or if there is an indication that you might be living beyond your means, it may affect whether you get coverage at all.

Like your driving record, your credit rating is a helpful tool for car insurance companies to use when assessing your risk as a driver. Yes, most car insurance companies use credit scores as one of many factors affecting car insurance premiums, affirms Adrian Mak, CEO of AdvisorSmith. Other factors considered include driving history, claims history, ZIP code, vehicle type and many other factors.

Analysis of car crash data shows that credit scores can accurately predict the risk that a policyholder will crash or file a claim against a policy, Mak adds. Drivers with higher credit scores tend to get into fewer crashes and file fewer claims than those with lower scores.

Therefore, the drivers who have higher credit scores are generally perceived as lower risk and are offered lower rates than drivers with lower credit scores.

Read Also: Does Rent A Center Check Your Credit

What Is An Insurance Score

An insurance score is a score calculated from information on your credit report. Credit information is very predictive of future accidents or insurance claims, which is why Progressive, and most insurers, uses this information to help develop more accurate rates. Each insurer has its own method for evaluating this credit information. At Progressive, we develop our method by analyzing the following data from people we have insured:

- Accident and insurance claim history

The results of this analysis tell us what credit information will help us predict how likely you are to have a future accident or insurance claim. We assign a value to each predictive credit factor and add the values to calculate your insurance score. The lower your score with us, the better.

Why Paying Monthly Can Improve Your Credit Score

But it’s not all bad news if you pay monthly for car insurance.

A car insurance policy paid monthly is a kind of ‘instalment loan’, and these monthly payments show up on your credit report. If you pay in full and on time every month, this can build up your credit score over time.

If you are late or miss a payment, this will bring down your credit rating. Your insurer could also cancel your policy. Setting up a direct debit payment is the best way to make sure this never happens.

Read Also: Can A Repossession Be Removed

The Effect Of Not Paying Your Car Insurance

It’s also important to remember that, while paying your car insurance doesn’t build your credit score, failing to do so will actually bring it down if your payments are turned over to a collection agency. This type of report stays on your credit report for about 7-10 years, but the effects to your report can vary depending on your overall financial picture.

If you are late with your car insurance, utility bills, or other payments, they may eventually go to collections. When that happens, it can make a negative mark on your credit score. That can affect how easily you qualify for loans, credit cards, and other credit products. It can also have an effect on your next car loan something to keep in mind if you think you might be in the market for a new car soon!

How To Improve Your Credit Score Before Applying For Car Insurance

Because credit-based insurance scores are largely based on the same underlying information that as other types of credit scores, similar actions can help you improve all your credit scores. These include:

- Pay bills on time and in full. Missing payments, having accounts sent to collections and filing for bankruptcy can all hurt your credit scores. On the flip side, making on-time payments can help your scores.

- Pay down debts. Having outstanding debts can hurt your credit scores, as can using a large portion of your available credit limit on your credit cards. Having low credit card balances and then paying your bill in full each month could help your score and save you money on interest.

Over time, your credit scores may also improve as the length of your credit history increases. You may also benefit, a little, from having experience with both revolving and installment accounts in your credit history. Additionally, be mindful of applying for new credit as the resulting hard inquiries can temporarily hurt your scores.

Read Also: Sync Ppc On Credit Report

How Much Does A Clue Report Cost

A CLUE report costs $0 for your personal report from LexisNexis. Individuals are entitled to one free copy of their LexisNexis CLUE report each year, while additional reports ordinarily cost $19.95 each. LexisNexis customer service representatives say there is no charge for customers to access additional copies of their own reports, though.

Learn more about how much a CLUE report costs.

What Are The Best No

Do all insurance companies use credit scores to determine rates? No, but most companies do.

Research has shown, numerous times, that consumers with lower credit scores or more negative items on their credit reports are more likely to be in an accident than policyholders who have sterling credit reputations.

The reasons for this are unknown, but the correlation seems to be rather hard to disprove. For this reason, a shoddy credit history will cause an insurance company to charge slightly higher rates to insurance customers who have had financial problems in the past.

Since the percentage of companies using credit scores in rate setting is so high, you may find it difficult to locate a car insurance company that does not check credit.

Also Check: Qvc Card Credit Score

Get Familiar With Your Credit

While your credit-based insurance score is different from your typical consumer credit score, what’s found in your credit report will still play a role in how it’s calculated. Getting home insurance won’t have a negative impact on your credit, but if your credit is in bad shape, you may find it difficult to get approved for coverage, or you may be charged a higher insurance premium. If you’re planning to buy a home soon and haven’t checked your credit in a while, check your credit report for free through Experian to get a sense of where you stand. If it needs some help, you can spend some time working to improve your credit before you begin the homebuying process.

What Can I Do To Improve My Credit

Things like the length of your credit history can only change with time however, you can always strive to improve your overall credit-based insurance score and credit score by paying your bills on time and maintaining a low balance on your credit cards.

But remembera credit-based insurance score is only one of many factors used to determine insurance premiums. Other things like driving safely and responsibly are also important if you’re looking for ways to reduce insurance costs.

Also Check: Affirm Delinquent Loan

Why Do Insurers Check My Credit Score

Insurance companies check your credit score in order to gauge the risk theyll take to insure you. Studies have indicated that those with lower credit scores are likely to file more claims or have more expensive insurance claims, while those with higher credit scores are less likely to do so.

If you have a low credit score, youll often pay a higher premium than if you had a high credit score. Having a higher credit score can pay off in a number of ways besides lower insurance premiums, though. And getting your is as simple as exercising good personal finance habits.

But your credit score isnt the only thing that affects your insurance premium depending on the type of insurance youre looking for, your driving history, geography, property value and claim history can all affect how much youll pay per month.

Can You Refuse A Credit

Insurers are required to ask for customers consent before checking their credit score. You should never feel obliged to grant consent in order to get a quote for a premium. You have the right to refuse. And if you do, the insurer is still required to reply to your quote request.

An insurer cannot terminate your policy on the grounds that you have not consented to having your credit score checked, and they cant refuse to renew either. This said, you may not get the best premium.

Recommended Reading: How To Get A Navy Federal Car Loan

Auto Insurance Discounts For Good Credit

Since paying your auto insurance premium is necessary for being able to maintain the required auto insurance in your state, it makes sense to try to pay as little as possible for sufficient auto insurance coverage for you.

If you are hoping to get the lowest premium possible on your auto insurance, you should ask your auto insurance directly about discounts that may be available to you.

In addition to trying to get as deep of a discount as possible, consider installing anti-theft devices on your car or signing up for driver safety courses if your auto insurance company tells you that those things could make a difference in reducing your premium.

Every auto insurance company offers discounts differently, so it is always best to check with your specific auto insurance company to see what kind of discounts you can get on your auto insurance.

Policyholders are eligible for several discounts. Some providers will give an auto insurance discount based on good credit history. Individuals with good credit are less likely involved in automobile accidents, have little to no claims, and can make timely payments to premiums.

What If My Credit Report Is Wrong Can You Tell Me What Is On My Credit Report

If there is an error on your credit report, contact the consumer reporting agency directly and notify them of any discrepancy. Once they correct their records, please contact us and we will be happy to re-evaluate your quote.

If your GEICO quote was adversely impacted by your credit-based insurance score, we will share with you the name and address of the consumer agency that provided us with the information that was used to help determine your rate. We will include contact information for the consumer reporting agency so that you can contact them for a copy of your complete credit report. To protect your privacy, our sales and service agents do not have access to your credit information.

If you’d like to review your credit report, you are entitled to one free report each year from each of the three major credit bureaus: Experian, Equifax, and TransUnion. For the most accurate understanding of your credit, you should review the reports from all three bureaus annually.

Recommended Reading: When Does An Eviction Show On Your Credit Report

But Does It Affect Your Score

But the question still remains. If car insurers pull your credit report during the application process, does that actually affect your credit? After all, . But the credit report a car insurer pulls wont actually affect your score, generally.

Why? Its because insurance companies do whats called a soft pull on your credit. There are two types of credit inquires, called a soft pull and a hard pull:

- A soft pull, also known as an involuntary inquiry, occurs when creditors want to send you pre-approved offers. That credit card solicitation you received in the mail was probably the result of a soft pull on your credit. Potential employers may check your credit as do your existing credit card accounts. Both of these are soft pulls. And if you check your own credit score, thats considered a soft pull, too. The key is that a soft pull happens when you arent actively seeking out credit. So it has no effect on your credit score.

- A hard pull, also known as a voluntary inquiry, occurs anytime you actively seek credit and fill out an application. The lender will run your credit report and determine whether to approve your credit application and under what terms. A hard pull on your credit report indicates that youre shopping for credit. So that will affect your credit score.

Heres what other major insurers disclosure about pulling credit reports:

State Farm says:

What Are Credit

Many auto insurance companies will use what is known as a to quickly and easily identify risk among policyholders. Auto insurance companies generally use this information to assess your risk and determine how likely you are to make timely payments or to file a claim.

Credit-based insurance scores are a new way of calculating premiums, comments Espenschied. The most common credit score is the FICO score, and companies such as Fair Isaac Corp. use it to help calculate premium costs based on your driving history and risk assessment.

A credit-based insurance score reviews your credit report to assess your risk in simple numerical form. This is usually a strictly credit-based identifier, so it does not include your current employment, income history or other personal details. Instead, it sticks mostly to your payment history and considers your total debt when assigning a score. An insurance company then translates that score into a metric of its own so that customer service agents cannot see your actual credit score.

Read Also: How To Get A Repossession Removed From Your Credit Report