A 735 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

With good credit scores, you might be more likely to qualify for mortgages and auto loans with lower interest rates and better terms. You might also be approved for credit cards with valuable sign-up bonuses and attractive rewards programs.

Why do these three-digit numbers matter so much to your financial well-being? Well, lenders use your as a gauge of how likely you are to pay back any money they lend to you. So, a good credit score can give a lender the confidence to lend you money at terms favorable to you. It might not be enough to unlock the absolute best financial products or terms, but its a milestone indicating youre on the cusp of excellence.

People often talk about their credit score as if they have only one, so you might be surprised to learn that there are many different credit scores out there. A credit score is based on a credit-scoring model, which differs depending on the company that created it, like VantageScore or FICO. To generate your credit scores, these models can use data from different sources: Equifax, Experian or TransUnion .

Each model has its own standard for what qualifies as good. And to make matters even more confusing, its often not clear which credit score, model or bureaus data a particular lender is using and what other factors the lender may look at beyond scores.

S To Improve Your 735 Credit Score

Improving your 735 credit score can take a lot of work, but following these steps can make all the difference. It will take time, but you can see your credit score go up within a year, which could save you countless amounts on interest rates. Dedicating the effort to improving your credit is worth the investment.

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Also Check: Can Someone Check Your Credit Without Permission

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

Summary: Financing A Car With A 735 Fico Score

It is when applying for loans that the distinction between an excellent and good credit score truly comes to fore. For example, when applying for a loan that is more than how much you earn, then you will need a credit score of at least 680 and it is not different when it comes to an auto loan.

It is practically impossible to secure some loans without a very good credit score. Imagine the interest on a $200,000, 30-year, settled rate contract. If you have a credit score of 760 to 850, you will have to pay an interest rate of 3.083 percent according to FICOs interest number cruncher as of October 2012.

Read Also: Is 565 A Good Credit Score

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Can You Get A Personal Loan With A Credit Score Of 735

Most lenders will approve you for a personal loan with a 735 credit score. However, your interest rate may be somewhat higher than someone who has Very Good or Excellent credit.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

See Also:12 Best Personal Loans for Good Credit

You May Like: Does Aarons Report To Credit

Build Your Credit Mix

We generally dont recommend taking out a potentially expensive loan just to build your credit scores. But its true that having a mix of different types of credit can benefit your scores over the long term. Types of credit include revolving credit and installment credit .

But theres a wrinkle: Applying for new credit can lead to a hard inquiry on your credit reports, which can have a negative impact on your scores. While this impact is typically minor, too many hard inquiries in a short time period can be a red flag to lenders. Thats why its important to have a general sense of how likely it is that youll be approved before you apply for a credit card or loan.

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

You May Like: Aargon Collection Agency Ripoff

Pay Your Bills On Time

Your payment history is the most important credit score factorit accounts for 35% of your FICO score. Because of this, you should aim to never miss a payment. If your bills become 30 days past due, your creditors can report this to the credit bureaus. Once your credit report lists a late payment, it can cause serious damage to your credit score. To avoid paying your bills late, use a spreadsheet to keep track of your due dates or enroll in autopay.

Most people who have 800 credit scores or higher pay off their balances in full each month, according to FICO.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Also Check: Does Wells Fargo Business Secured Credit Card Report To Bureaus

Review Your Credit Score And Credit Reports

To keep track of your progress, monitor your credit score and credit reports. You can check your credit score for free by using a free credit scoring website. Some of these websites will even offer you recommendations on how to improve your credit score.

Since your credit score is based on the information listed on your credit reports, review them to ensure each one doesnt contain inaccurate negative information, such as late payments or collection accounts. Even if you pay your bills on time, a credit reporting mistake can happen. You can view all three of your reports for free weekly through April 20, 2022 by visiting AnnualCreditReport.com.

If you find an error listed on one of your reports, file a dispute with each credit bureau that has it listed to remove it.

Mortgage Rates For Good Credit

Your credit scores are just one factor to consider when youre looking to get a great mortgage rate. Having good credit can help you get a better rate, but so can factors such as

- The type of mortgage loan youre looking for

- The total cost of your home

- Your debt-to-income ratio

- The size of your down payment

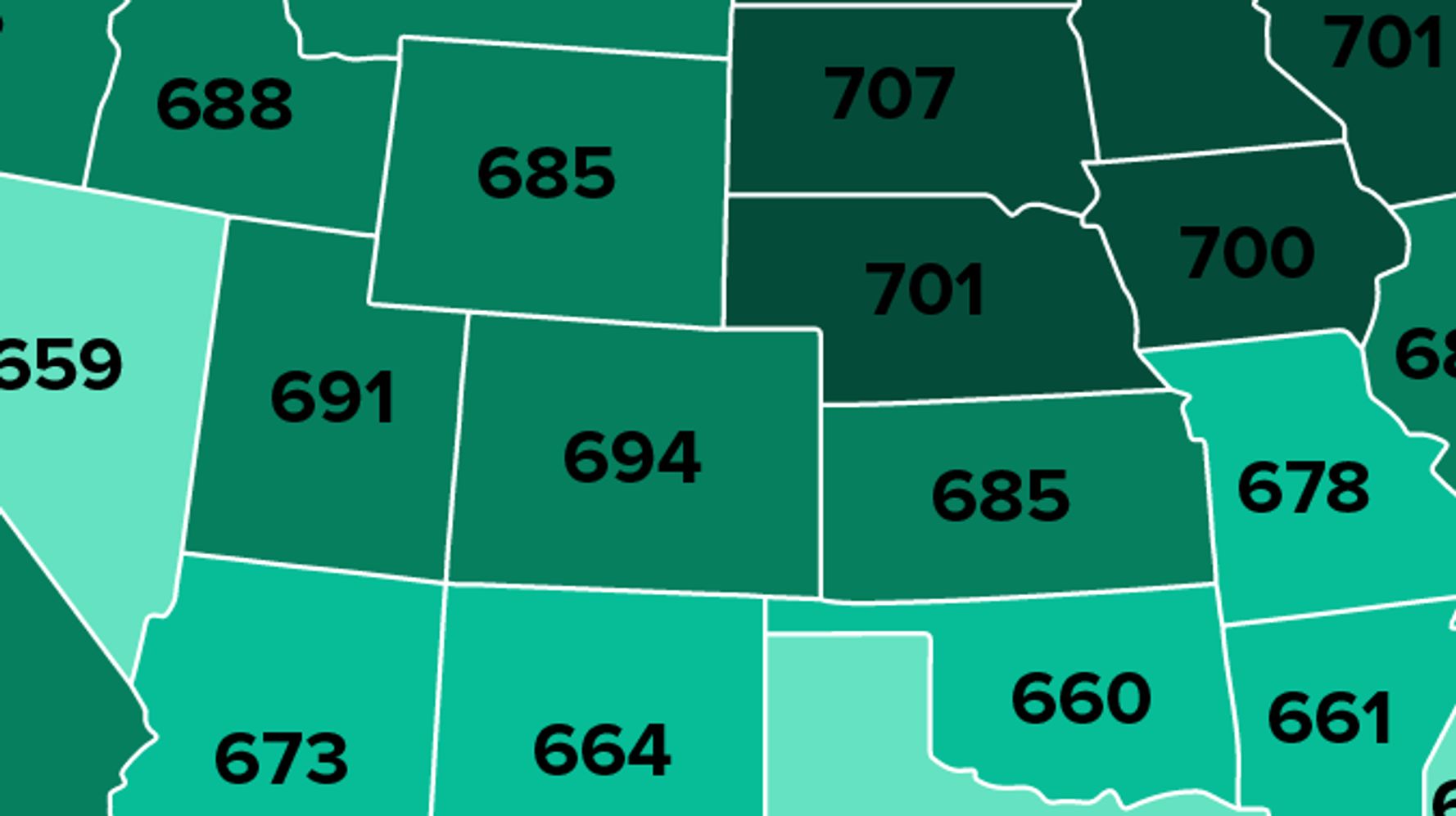

The average credit score it takes to buy a house can also vary greatly by location.

Once you have a general picture of your overall credit as well as how much house you can afford and the type of loan you want its a good idea to shop around. This can give you a better idea of what different lenders could offer you.

Compare your current mortgage rates on Credit Karma to learn more.

Read Also: How To Remove Hard Inquiries From My Credit Report

Build Or Rebuild Your Credit History

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

A is a personal loan thats designed to help you add positive payment history to your credit report. Unlike a traditional personal loan, a lender doesnt directly deposit a lump sum of money into your account. Instead, it sets aside money in a savings account or certificate of deposit account , and you gain access to the funds after repaying the loan.

Using a credit card responsibly is another way to build your credit history. If you dont qualify for or dont want to use a traditional credit card, you can apply for a secured credit card instead. When you take out a secured card, youll be required to make a cash deposit thats held in a collateral account, which is equal to your credit limit.

Upgrade Visa Card With Cash Rewards

Best for low interest and low cost

- This card is best for: People interested in an innovative financial product that combines elements of a cash back credit card and a loan, designed to help limit the cost of owning and using it.

- This card is not a great choice for: People who dont have trouble with the standard method of making monthly payments on their credit card bill and would rather use a 0% intro APR card to finance a large purchase. Unlike the Upgrade Card, a 0% intro APR card can help you temporarily avoid interest charges altogether rather than minimizing them.

- What makes this card unique? Instead of paying a monthly balance that typically fluctuates, youll pay off your card purchases in steady installments.

- Is the Upgrade Visa® Card with Cash Rewards worth it? The Upgrade Card could prove useful to a particular kind of cardholder who favors the payment plan method and the opportunity to earn cash back.

Jump back to offer details.

Also Check: What Is Syncb Ppc

Getting Mortgages With 735 Credit Score

As with personal loans, credit scores in this range tend to produce favorable terms. With 735 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point five percent. If youre in the market for house, try pushing off your search until your credit slightly improves to lock in a more ideal rate.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 735 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 735 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

What Does It Mean To Have An 800 Credit Score

When you have a credit score of 800, your score is better than a good credit score. According to the most popular VantageScore and FICO credit scoring models, its an excellent or exceptional credit score. As of April 2018, only 21.8% of Americans had a score that was at least 800, according to a FICO report.

To score this high, you must do an outstanding job of managing your credit. This means you likely have a long credit history, perfect payment history, a good credit mix and only use a small percentage of your total credit limit. Based on your excellent credit history and good credit habits, a lender will consider you less likely to default on a loan than applicants who have lower credit scores.

Recommended Reading: Capital One Remove Authorized User

Getting A Credit Account With A 735 Credit Score

As a prime borrower, youll have plenty of options when looking for a new credit card. However, you might not qualify for the top rates that card issuers reserve for people in the highest credit score range.

The types of credit cards you can get with a credit score of 735 generally fall into two categories:

- Secured credit cards: These cards require a security deposit, which your lender will use as collateral. The amount you put down will usually be your credit limit. Secured cards are a low-risk option if you want to build credit while ensuring that you dont spend beyond your means.

- Unsecured credit cards: These cards dont require a deposit. Your card issuer will set your credit limit according to how creditworthy they perceive you to be. In many cases, these cards offer cash back on certain purchases and other rewards.

Which type of credit card is best ultimately depends on your financial situation and your reason for opening a new credit account. If youre good at controlling your spending, then its a good idea to use your good credit score to take advantage of the potential rewards and higher credit limit that come with an unsecured card.

On the other hand, if your main goal is to build credit and youre worried about overspending, then a secured credit card may be your best bet.

Takeaway: 735 is a good credit score, but its not in the top scoring range.