Is Getting A No

A no-money-down home loan may sound like an attractive option for many would-be homebuyers. A whopping 68% of respondents to an Urban Institute survey reported an inability to afford a down payment as the primary reason they cant buy a house.2

Unfortunately, you may end up paying a lot more in interest and fees over the life of the loan without a down payment.

For example, suppose that you have a credit score of 750 and want to buy a $300,000 house with a 30-year loan. With that FICO score, youd qualify for a rate of 2.772%.

All else being equal, if you chose to finance all $300,000 instead of putting down a 20% payment of $60,000, youd pay an extra $28,432 in interest over the life of the loan.

In practice, if you purchase a home with a no-money-down loan, your interest rate might be slightly lower. Only a USDA loan or VA loan would let you skip the down payment, and they have lower interest rates than conventional loans.

Unfortunately, with a USDA loan, youll also owe mortgage insurance until you reach 20% equity, which can reduce or eliminate any interest savings.

Ultimately, everyones credit profile and borrowing options are going to be unique. You should always shop around with various lenders and get prequalified to make an informed decision.

How To Solve Common Credit Issues When Buying Ahouse

If your credit score orcredit history is standing in the way of your home buying plans, youll need totake steps to improve them.

Some issues like errorson your credit report can be a relatively quick fix and have an immediateimpact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally 6-12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Here are tips on solvingsome of the most common credit issues faced by home buyers.

Can I Buy A Car With 706 Credit Score

Is the 706 a good credit score? A score of 706 FICO® is considered good. Mortgage, car and personal loans are relatively easy to obtain with a credit rating of 706. Lenders like to do business with borrowers who have good creditworthiness because it is less risky.

What is an acceptable credit score to buy a car?

What is the minimum estimate required to buy a car? Generally, lenders are looking for borrowers in the best range or better, so you will need a score of 661 or higher to qualify for most regular car loans.

Is 706 considered a good credit rating?

The 706 FICO® rating is good, but by raising the rating to a range of very good, you can qualify for lower interest rates and better loan terms. A great way to get started is to get a free credit report from Experian and check your credit score to determine which factors are most affecting your score.

Is a 700 credit score good enough to buy a car?

What credit rating do I need to get a good offer for a car? If you want to get a car loan without a high interest rate, our research shows that you will want a credit rating of 700 or more on a scale of 300 to 850 points. This is the case for the first loan and lenders do not have to value a lot of risk in their interest rates.

Recommended Reading: Realpage Credit Score

The Credit Score Needed To Buy A House

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

Recommended Reading: Does Usaa Do A Hard Pull For Credit Increase

Shield Your Credit Score From Fraud

People with Very Good credit scores can be attractive targets for identity thieves, eager to hijack your hard-won credit history. To guard against this possibility, consider using credit-monitoring and identity theft-protection services that can detect unauthorized credit activity. Credit monitoring and identity theft protection services with credit lock features can alert you before criminals can take out bogus loans in your name.

Nearly 158 million Social Security numbers were exposed in 2017, an increase of more than eight times the number in 2016.

What Is Considered Good Credit

Good credit is in the 700-749 range. Loan options should still be fairly open to you in this range, although you may need to add incentives for them to lend to you. A great incentive is a more substantial down payment.

If your credit falls in the 650-699 range, it is considered to be fair. While there are still loan options available to you in this range you will have to jump through more hoops for the lender to consider you.

The 550-649 range is considered to be poor, and this is actually where the majority of people in the U.S. reside. This is a stickier range and is where you begin to scrape the bottom of the barrel in terms of getting a loan for your house.

Anything below 550 is considered bad credit. If you donât have any credit, you also reside in this area. Loan options for those in this range come more from unconventional means than your typical house loan.

If you want to know your credit score, there are several credit apps that will give you that information without dinging your credit. Some of them do charge fees, though, so be on the lookout for those.

Read Also: Will Carmax Approve You With Bad Credit

What Is A Credit Score

Your score is probably one of the biggest criteria that lenders evaluate in the mortgage application process. Your lender can actually get the whole picture of your financial situation just by looking at your credit score. In technical terms, Credit score is also referred to as FICO score that is used to determine the candidates creditworthiness. The higher the score, the candidate is more likely considered to pay his/her debts and a lower score usually indicates the opposite.

So the question is, what are the factors that make up your FICO score and determine your creditworthiness? The main factors are listed down below:

Good Credit Score Range For Auto Loans

When determining the interest rates for an auto loan, financial institutions typically rely on FICO® Auto Score 2, 4, 5, or 8. These scores range between 250 and 900. The higher the number the better the score. If youre shooting for the lowest possible APR on your auto loan your Auto credit score should be above 740.

We sampled auto loan interest rates from Unitus Community Credit Union to see how interest varied on a new car loan across a range of credit scores. The results can be seen in the table below.

New Auto Loans: Model Years 2014 and Newer

| 15.24% | N/A |

As with mortgages, the length of the loan also plays a huge impact in your rates. The longer the term on your auto loan, the higher interest you’ll pay. Having a good credit score can mitigate this negative effect.

Also Check: Check Credit Score Without Social Security Number

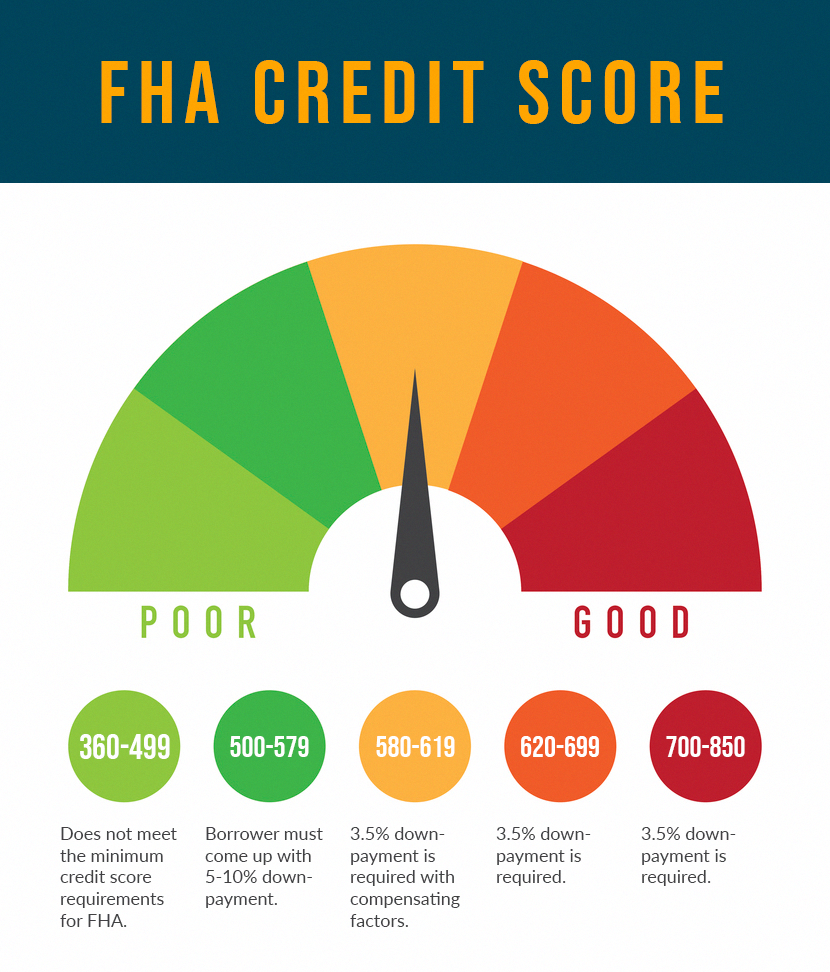

Minimum Credit Scores By Mortgageprogram

The credit score needed to buy ahouse depends on the type of loan you apply for.

Minimum credit requirements forthe five major loan options range from 580 to 680.

- Conventional loan : 620 minimum FICO score

- FHA loan: 580 minimum FICO score

- VA loan: 620 minimum score is typical

- USDA rural housing loan: 640 minimum FICO score

- Jumbo loan : 680 minimum FICO score

Note that FHA loansactually allow credit scores as low as 500. But if your score is below 580, youneed a 10% down payment to qualify. Borrowers with credit scores above 580 onlyneed 3.5% down for an FHA mortgage.

Other requirements to buy a house

Theres more to know than just credit minimums, of course .

In addition to credit scores, lenders evaluate borrowers based on:

- Down payment: Most loan programs require at least 3% down

- Income and employment history: Most lender want to see at least 2 years of steady income and employment

- Savings: Youll need cash to cover the down payment, closing costs, and often cash reserves

- Existing debts: Your debt-to-income ratio compares pre-existing debts like student loans, auto loans, and credit card minimum payments against your monthly gross income. The lower your DTI, the better

- Loan amount: If you have lower credit, your loan amount will likely need to be within FHA loan limits or conforming loan limits

If your credit scoreis weak but you have stable income, a large amount ofsavings, and a manageable debtload, youre more likely to get mortgage-approved.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Aargon Agency Debt Collector

Staying The Course With Your Very Good Credit History

Your 750 credit score means you’ve been doing a lot right. To avoid losing ground, be mindful of avoiding behaviors that can lower your credit score.

Factors that can have negative effects on Very Good credit scores include:

Utilization rate on revolving credit Utilization, or usage rate, is a measure of how close you are to “maxing out” credit card accounts. You can calculate it for each of your credit card accounts by dividing the outstanding balance by the card’s borrowing limit, and then multiplying by 100 to get a percentage. You can also figure your total utilization rate by dividing the sum of all your card balances by the sum of all their spending limits .

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts recommend keeping your utilization rates at or below 30% on individual accounts and all accounts in totalto avoid lowering your credit scores. The closer any of these rates gets to 100%, the more it hurts your credit score. Utilization rate is responsible for nearly one-third of your credit score.

Late and missed payments matter a lot. More than one-third of your score is influenced by the presence of late or missed payments. If late or missed payments are part of your credit history, you’ll help your credit score significantly if you get into the routine of paying your bills promptly.

36% Individuals with a 750 FICO® Score have credit portfolios that include auto loan and 33% have a mortgage loan.

How To Get A Good Credit Score

There is a wealth of information available to consumers wishing to improve their credit score. Though the exact calculations for what drives FICO scores are proprietary and unknown to the general public, the company has been open about the general some general influencing their model.

How to achieve an excellent score : You will need a near spotless record one with no bankruptcies, delinquent payments, tax liens, or other negative marks. Even then, you will need to maintain such a record for several years before models begin giving you a score above 800. Consumers who have a negative mark on their credit history can still reach an excellent credit score. However, it doing so will take significantly longer. For example, it takes up to seven years for a late payment to be taken off your credit history.

How to achieve a good credit scores :

To get a good credit score, there are three basic behaviors consumers should stick to. Opening at least one credit account is the most basic piece of advice everyone seeking a good credit score should follow . The length of your credit history accounts for 15% of your total FICO grade. The longer you wait to open your first credit card, personal loan, or mortgage, the longer it will take for your average age of credit to go up.

Read Also: What Does Thd Cbna Stand For

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

What Is A 755 Credit Score Considered

As long as your FICO Score is between 740 and 799, then you qualify for Very Good status. Credit scores such as 755 point to an average credit score being higher. In order to qualify for a lenders better interest rate and product offer, borrowers with a score in the Very Good range are likely to be the lenders best choice.

Read Also: Check Credit Score With Itin Number

Average Home Loan Interest Rate By Credit Score

| FICO score | |

| 4.159% | $1,460 |

. Assuming a 30-year fixed, $300,000 loan based on mortgage rates on July 15, 2021.

Of course, theres more to buying a house than having a credit history thats comparable to the average profile. The definition of a good enough score will depend on what mortgage loan type you want and your other creditworthiness factors.

Heres what you need to know about those additional considerations: how they impact the credit score you need to buy a house, and what to do if you cant qualify for a mortgage yet.

Is A 800 Credit Score Hard To Get

Your 800 FICO® score falls within the range of 800 to 850, which is categorized as outstanding. Your FICO® rating is well above the average credit rating and you are likely to receive easy approvals when you apply for a new credit. 21% of all consumers have FICO® ratings in the Exceptional range.

How long does it take to get a 800 credit score from scratch?

It will take about six months of lending activity to establish enough history for the FICO credit rating used in 90% of lending decisions. 1 FICO credit ratings range from 300 to 850, and a rating above 700 is considered a good credit rating. Ratings above 800 are considered excellent.

Is it hard to get your credit score to 800?

Depending on where you start, it can take a few years or more to create a credit score of 800. You only need to have a few years of positive payment history and a good combination of credit accounts that show you have experience managing different types of credit cards and loans.

Read Also: How To Unlock Transunion Credit

Tips To Raise Your Credit Score

Not finding an option you like in the above loans? You could always try raising your credit score! If you have taken out bankruptcy in the last few years, there is not much you can do but wait and remain current on your payments as they stand. If youhave some outstanding bills, make sure to pay them off. Check your credit statement to identify the reason for your lower credit score. If you find any bills that are still reporting as overdue even after youâve paid them, you can write a letterto the reporter and point out the error. You can often get things like that removed from your credit report altogether.

If you donât have any credit, or just need to raise your credit score without any late payments recording, it is a good idea to use the credit cards you have. As you use them, pay them off immediately. This will begin reporting a positive numbertoward your score and will work to raise it.

To avoid the hassle of hoop-jumping and fees, work to repair your credit score before you apply for a home loan. There are many financial advisors that can help you with that. When you are ready to buy, make sure you find a quality real estate agent thatcan help you find the home that fits your loan.