Learn More About Your Credit Score

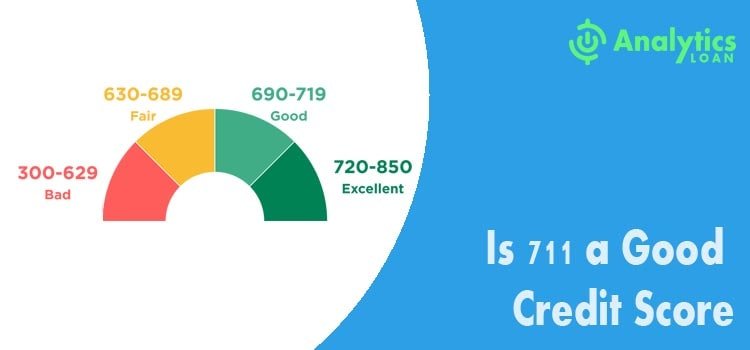

A 711 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

The Average Credit Score By Age State And Year

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective. Terms apply to offers listed on this page. Read our editorial standards.

- The average American has a credit score of 711, according to data from Experian. That’s considered ‘good’ by FICO’s score ranges.

- People over 50 have average credit scores higher than the national average. Scores in some states, including Minnesota, Wisconsin, and Vermont, tend to exceed the US average, too.

- Get your free credit score with CreditKarma »

The average credit score in the US is 711, according to credit reporting company Experian, calculated using the FICO scoring model.

Credit scores, which are like a grade for your borrowing history, fall in a range of 300 to 850. The higher your score, the better people with higher credit scores tend to get better interest rates on loans, have access to credit cards with better perks and lower interest rates, and could even pay less for insurance.

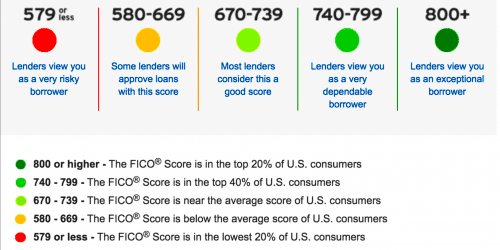

The FICO model of credit scoring puts credit scores into five categories:

- Very poor: 300-579

- Very good: 740-799

- Exceptional: 800-850

Based on this scoring system, the average American has a good credit score. But, the average credit score is different by demographic.

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. A good credit score can help you get approved and lock in better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and the type of credit youre applying for. The score you see when you obtain credit monitoring or buy a credit score along with your credit report may not be the score that the lender is using. There are also different scoring models. That said, read on to learn what a good credit score range is when you check your score with TransUnion. Plus, youll find tips on how to maintain healthy credit.

Read Also: Delete All Inquiries

Credit Score Car Loan Options

A 711 score should easily secure you a car loan. On average, your score should get you an interest rate between 3.6- 4.6 and between and 6 percent on a used car. Scores above 720 are more likely to net you the lower percentage rates.

If you are having trouble getting approved for a car loan with a 711 credit score, you have some options. You can opt for a less expensive vehicle, find a cosigner or make a bigger down payment

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

You May Like: What Is The Ideal Credit Score To Buy A House

What Is A Credit Score

Everyone has credit scores based on data gathered by the three credit reporting agencies: Experian, Equifax, and TransUnion. There are two methods of calculation, known as FICO and VantageScore. While each one uses a slightly different calculation, all scores should be similar.

Your credit score can be found for free online from sites like Credit Karma, or even from certain credit card issuers that partner with the agencies to give you one of your scores.

It’s a good idea to check your credit report regularly, too. Annualcreditreport.com, a site established by the federal government, will give you access to your report from each of the three agencies once per year. You can check them all at once, or check one every few months to keep a close eye on your credit. It’s not uncommon for a report to contain an error that then affects your score, but it’s up to you to find any such error. If you do find one, you can dispute it with the agency.

If you don’t have any credit history, it becomes very difficult to borrow, and to get the best rates, going forward. That’s why some credit card issuers provide specific credit cards meant for people to use temporarily, to build their credit in the first place. You can see our picks for the best starter credit cards here.

Fair Credit Score: 580 To 669

Borrowers with credit scores ranging from 580 to 669 are thought to be in the fair category. They may have some dings on their credit history, but there are no major delinquencies. They are still likely to be extended credit by lenders but not at very competitive rates. Even if their options are limited, borrows in need of financing can still find solid options for personal loans.

Also Check: Navy Federal Personal Loan Approval Odds

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Number Of Americans With No Credit History

According to the Consumer Financial Protection Bureau , approximately 26 million adults are considered to be credit invisible, meaning they have no credit history as theyre without credit cards, loans, and other lines of credit.1

Of course, if you have a credit card, that doesnt necessarily mean you will have a credit score. Around 19 million adults lack a score altogether due to credit reports with minimal credit usage or out-of-date credit history. Nows the time to open a credit card or loan to build your history.

Recommended Reading: How To Get Hard Inquiries Off Your Credit Report

Is 711 A Good Credit Score Instant Credit Boost

Im sure youve heard the term in the past. Its that 3 digit number that follows you & your financial life every where you go. You need it to get authorized for loans, credit cards, apartments, home mortgages & more! And since you never truly see it, its normally out of sight, out of mind however this number is something that requires to be taken severe.

None of us like it, the truth that a credit score is so crucial to almost whatever we do financially is exactly why we said it has to be taken serious. It can take years to build up a good score and only a day or two to bring the whole thing crashing down.

Fortunately, theres things you can do to safeguard and inform yourself on the topic. From tricks to provide you a near-instant boost to your score to understanding what a credit score even is from a fundamental level, were going to stroll you through this step by step. Get ready to take control of your financial freedom at last!

Pro Tip: Work With Your Lender To Raise Your Score

If are not sure how to raise your credit score or whether its even possible its still worth talking to a mortgage advisor. Lenders often have access to simulators that can help you understand your scenario and come up with an action plan to improve your score before you buy.

Read Also: Does Affirm Pull Your Credit

Very Poor Credit Score: 0 549

This score spells rookie. Clearly, youre a newbie in the credit bidness and dont have enough credit history, to begin with. Not to panic though, everybody starts somewhere. This can easily be fixed, apply for a loan and credit card and set up a repayment schedule, this will ensure a good record and aid in maintaining a future credit history. Although if your score falls to this range, you might need to take some drastic measures to bring it back up.

Perfection is overrated but aiming for it isnt. Our score doesnt be perfect to get the best terms but our effort should be to achieve an excellent credit score. But if your credit is bad, how do you get there?

Pay Down All Installment Loans

I was surprised by this one. I always assumed my credit score wouldnt be affected by the balances on my installment loans.

But I noticed that once I paid off my auto loans and student loans, my credit score jumped more than 20 points.

The key here is that you should pay off as much of the loan as possible, if not all of it. The closer the remaining balance is to zero, the more it will benefit your credit score.

For a little bit of perspective, I paid off a $30,000 auto loan, another $20,000 auto loan, and student loans totaling $11,000. Almost immediately after I did this, my credit score improved.

Read Also: Aargon Agency Complaints

How To Get Your Free Credit Report

If you want to see your most up-to-date credit score for free, you can now get a free credit report each week from TransUnion, Equifax, and Experian by visiting annualcreditreport.com.

Free weekly reports will be available through April of 2021 in response to the coronavirus pandemic. After April of 2021, youll still be eligible for one free credit report from all three major credit bureaus every year.

You can also track your credit through free credit monitoring services like Credit Karma or Credit Sesame. These wont show your actual credit score, but theyll give you a good approximation based on your payment history, credit utilization rate, and mix of accounts.

One of your credit card accounts may offer free FICO scores or free Vantagescore. Check on the app or website to find out.

| 500 |

What Is A Good Credit Score Range

Good credit score = 680 739: Credit scores around 700 are considered the threshold to good credit. Lenders are comfortable with this FICO score range, and the decision to extend credit is much easier. Borrowers in this range will almost always be approved for a loan and will be offered lower interest rates. If you have a 680 credit score and its moving up, youre definitely on the right track.

According to FICO, the median credit score in the U.S. is in this range, at 723. Borrowers with this good credit score are only delinquent 5% of the time.

You May Like: Does Ginny’s Report To Credit Bureau

Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

What Does Not Count Towards Your 711 Credit Score

There are many things that people assume go into their 711 credit scores but that actually dont. Examples include how much money you earn, your age, your marital status, your child support payments , how much money you have donated to charity, where you work or live, or your employment history.

None of these things or anything like them do anything at all to your credit score, so instead, focus on the five primary factors that we outlined and discussed above.

Now that you know what counts towards your overall credit score and what does not, you should know exactly what you need to pinpoint in order to enhance your score. For example, maybe one reason your credit score is low is because youve opened several new accounts of credit.

Regardless, its important at this stage for you to positively identify what it exactly is that is lowering your credit rating. Once you have identified what that is, you can start to formulate a plan.

You May Like: Open Sky Increase Credit Limit

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

Recommended Reading: How To Report A Death To Experian

Strategies To Raise Your Score Above 700

Whether you have bad credit or a 700 score, improving your credit score is always a worthwhile endeavor.

The single biggest element in the calculation of your FICO score is the timely payment of bills. Payment history makes up 35% of your score.

But, with your 700 FICO score, you probably already know that. So lets assume youll continue doing so.

What else can you do? Well, here are some dos and donts.