What Is A Credit Score

A credit score is a numerical representation of financial health, telling lenders at a glance how responsible you are with credit and debt. Generally speaking, a higher credit score suggests that you borrow and pay back what you owe on time. A lower credit score, on the other hand, may hint that you struggle with managing debt obligations.

So where do credit scores come from? They’re generated by companies like Equifax, Experian, and TransUnion based on information that’s included in your credit reports. A is a collection of information about your financial life, including:

- Your identity

- Existing credit accounts

- Public records, including judgments, liens, or bankruptcy filings

- Inquiries about you from individuals or organizations that have requested a copy of your credit file

Credit reports are maintained by . Equifax, Experian, and TransUnion are the biggest in the U.S. These companies compile credit reports based on information that’s reported to them by creditors as well as information that’s available as part of the public record.

Other Uses For Your Fico Score

Sometimes other people and organizations will check your credit score, including:

- Landlords: To check how responsible youd be as a tenant and decide whether or not to rent to you. 1

- Employers: As part of a background check before hiring or promoting you . 2

- Insurance companies: To determine how much to charge you for an insurance policy. 34

- Utility companies: To check whether youre likely to pay your utility bills on time. If you have a low credit score, you may be required to pay a security deposit before your water, electricity or phone company will provide their services to you.

Why Your Credit Score Matters

Establishing a good credit score isn’t a complex process, but it’s vital for your overall financial picture. When you have a good or excellent credit score, you’ll have an easier time being approved for renting an apartment, you’ll get better rates on car and homeowner’s insurance and it’s cheaper to borrow money when you need it.

Many of the best credit cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets . Terms apply. But you’ll need good or excellent credit to be approved for the Amex Gold, which CNBC Select named the best rewards card of 2020.

The first step to establishing good credit it to know your score. With so many apps and online resources available, it’s easier than ever to stay on top of this important piece of your financial health.

Dont miss:

Read Also: Does Carmax Take Credit Cards

Fico Auto Score Vs Regular Fico Score

FICO auto scores are ultimately derived from your regular FICO score. The main difference is that FICO adjusts the calculation based on auto-industry-specific details. In other words, your auto loan payment history will weigh more heavily on your FICO auto score than your regular FICO score.

However, the same factors that influence your regular FICO score, including credit utilization rate, overall payment history, and more, will still affect your FICO auto score.

Can I Expect The Fico Score Version I Receive From Wells Fargo To Change

FICO® periodically updates its scoring models and Wells Fargo may choose to upgrade to a more updated score version. If this happens, we’ll notify you when a change to the score version change occurs. You can locate the score version on your FICO® Score display. It is listed directly below the score and rating.

Read Also: What Credit Score Do You Need For Affirm

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

You May Like: What Credit Score Do I Need For Ashley Furniture

What Is A Fico Score

A FICO Score is a three-digit number based on the information in your credit reports. It helps lenders determine how likely you are to repay a loan. This, in turn, affects how much you can borrow, how many months you have to repay, and how much it will cost .

When you apply for credit, lenders need a fast and consistent way to decide whether or not to loan you money. In most cases, they’ll look at your FICO Scores.

You can think of a FICO Score as a summary of your credit report. It measures how long you’ve had credit, how much credit you have, how much of your available credit is being used and if you’ve paid on time.

Not only does a FICO Score help lenders make smarter, quicker decisions about who they loan money to, it also helps people like you get fair and fast access to credit when you need it. Because FICO Scores are calculated based on your credit information, you have the ability to influence your score by paying bills on time, not carrying too much debt and making smart credit choices.

Thirty years ago, the Fair Isaac Corporation debuted FICO Scores to provide an industry-standard for scoring creditworthiness that was fair to both lenders and consumers. Before the first FICO Score, there were many different scores, all with different ways of being calculated .

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

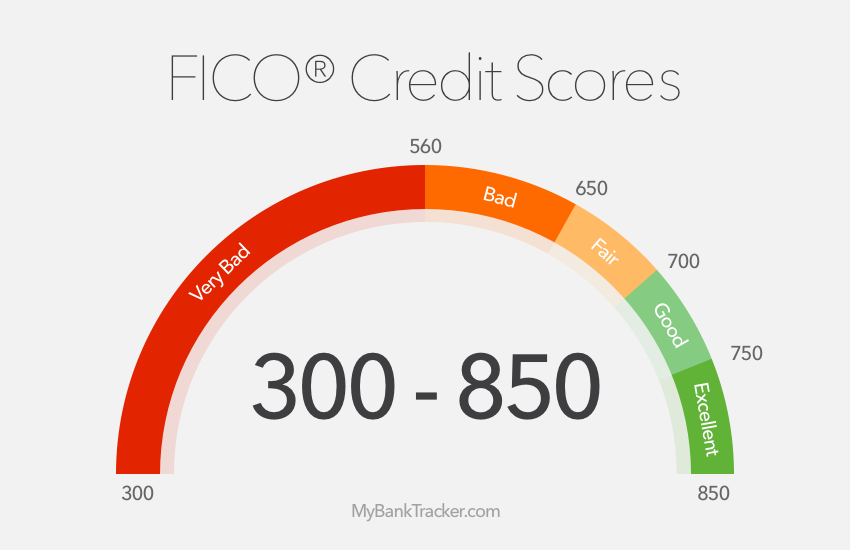

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Recommended Reading: How Long To Increase Credit Score 50 Points

What Is Considered A Good Credit Score Range

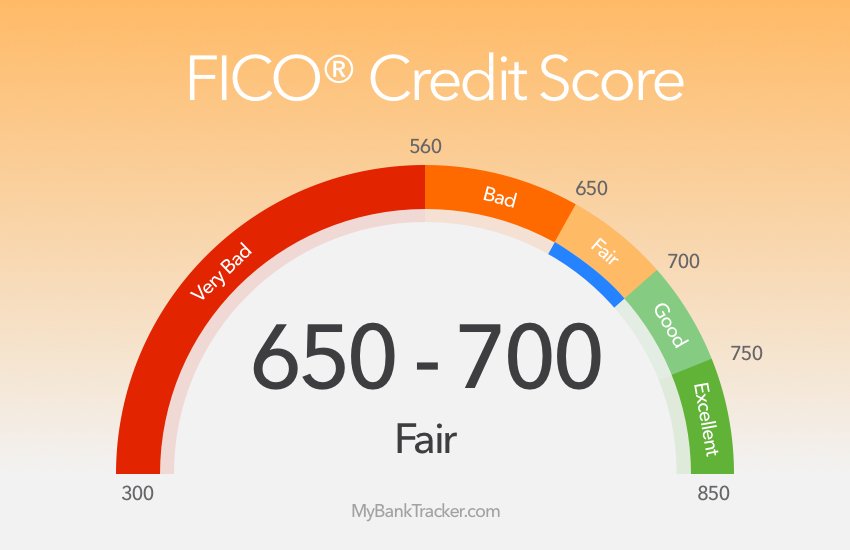

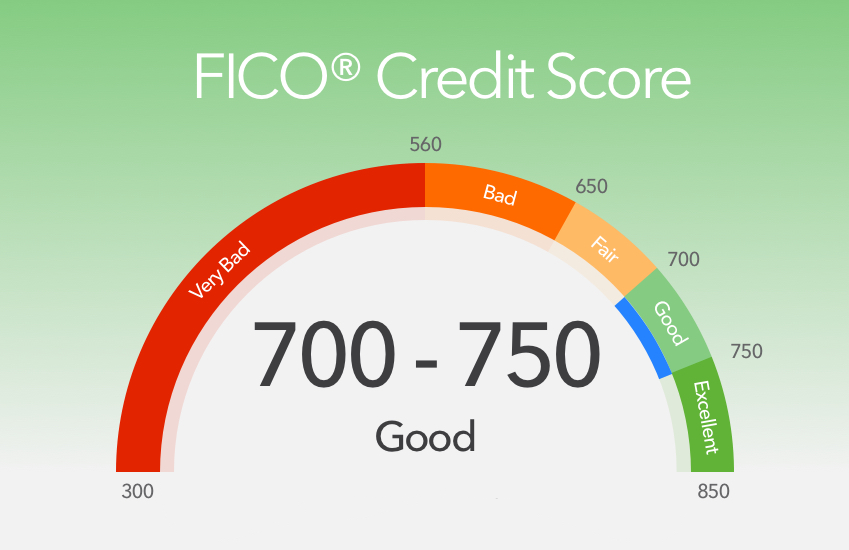

One of the most well-known types of credit scores is the FICO score created by the Fair Isaac Corporation. The FICO score is used by many lenders and often ranges from 300 to 850. Generally, in these models, a FICO score above 670 is considered good credit, while a score above 800 is generally considered exceptional. is considered to.

Why Is Wells Fargo Displaying Your Fico Score

Wells Fargo is displaying your FICO® Score for educational purposes and as a benefit to support your awareness and understanding of FICO® Credit Scores and how they may influence the credit thats available to you. Wells Fargo does not calculate your FICO® Score we are displaying a score that is provided to us by the credit bureau indicated on your score display. Your FICO® Score is provided through Wells Fargo Online® at no additional cost beyond your standard internet/mobile carrier fees.

You May Like: How To Check Credit Score Without Social Security Number

What Factors Matter For A Fico Score

The FICO credit scoring model looks at five key factors and weighs each differently:

Hard And Soft Credit Checks

The majority of Canadian lenders use the FICO Score, including major banks. Consumers arent able to access their FICO Score without going through a major bank. Youve got a soft and hard credit checkoption and your FICO Score is known as a hard credit check. The hard check is where a business runs a credit check but the lender isnt allowed to share this report with you. They can talk about the information they see and provide you with insights however.

A hard check may be necessary, but it does come with risks to you as it can impact your credit score negatively. If you do many hard inquiries in a short amount of time, lenders may end up deeming you as risky. A soft check doesnt impact your credit score however.

What youre going to find is that your hard credit check will give you the true FICO Score where a soft check is less likely to do the same. You may have a lot better credit than a soft check credit score provides. Credit lenders use the FICO Score, which gives a more concise score than a soft credit check. The FICO Score and the percentages that a lender sees is as followed:

Payment history : 35%Length of credit history: 15%New credit: about 10%Types of credit used: about 10%

Also Check: Affirm Credit Score Requirements

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

What Is The Fico Sbss Score

FICO® LiquidCredit® Small Business Scoring Service, is one of the main business credit scores. The FICO® SBSS score ranges between 0 to 300, with 300 being the highest score, and represents your creditworthiness and likelihood to pay back a loan. The U.S. Small Business Administration requires lenders to use this score to pre-screen SBA 7 loans for $350,000 or less, as well as Community Advantage loans. If your score falls below their required threshold of 155 , your loan application must go through a manual approval.

Its the one credit score business owners should know, but many have never heard of it because, until now, its been hard to get your hands on it. Banks arent required to disclose that they use the FICO® SBSS score and very little information exists about it online. More lenders are using it because it helps them make faster, more accurate lending decisions. This means they can make decisions in hours, not days.

You May Like: When Does Hard Inquiries Fall Off

Why Is Your Fico Credit Score Important

Your FICO credit score matters because lenders, landlords and insurance companies use credit scores to help them make decisions. Having a credit score that falls within the very good or exceptional FICO score range, for example, could save you a lot of money on your mortgage. Having a credit score that falls within the fair or poor ranges, on the other hand, could make it more difficult to access new lines of credit. A low FICO credit score might even affect your ability to rent an apartment.

This is why having good credit is so important. Once you build a good FICO score, doors will begin to open for you. If you continue to increase your FICO score, youll have access to better credit cards, higher rewards, lower interest rates and more financial opportunities.

If I Dont Agree With My Fico Score What Should I Do

Your FICO® Score is provided to Wells Fargo by Experian® based on information within your credit report on the calculation date . If you feel this information is inaccurate, your next step should be to request a free credit report from annualcreditreport.com. If theres incorrect information within any of your credit reports, follow each bureaus instructions on how to dispute that information. If theres incorrect information about your Wells Fargo accounts, please call the Wells Fargo phone number in your credit report.

Also Check: How To Unlock Transunion Credit Report

What Is Fico 9

FICO 9 was introduced in 2016 and is available to both lenders and consumers. While not as widely used as FICO 8, this scoring model has some features that could help certain consumers improve their credit scores.

Here are the most noteworthy aspects of FICO 9:

- Third-party collection accounts that have been paid in full no longer have a negative impact for credit scoring.

- Unpaid medical collection accounts have less of a negative impact compared with other types of unpaid collection accounts.

- Rental history can now be factored into FICO 9 credit scores, which may help people with limited credit history.

FICO 9 credit scores are available to consumers for free through lenders that participate in the FICO Score Open Access program. Your credit card company, for example, may offer free FICO 9 credit scores as one of its customer benefits. Otherwise, youll need to purchase your scores from FICO.

Rent payments arent factored into FICO 9 scores automatically. Your landlord has to report your payment history to one or all three of the major credit bureaus for your rent payments to be included.

What Is Fico Score 8

FICO Score 8 is a credit-scoring model released by Fair Isaac Corporation . Released in 2009, its the 8th generation of FICOs credit-scoring model. 1Although FICO was founded in 1956, they released their first modern credit-scoring model in 1989.

FICO has since released two subsequent generations, FICO Score 9 and FICO Score 10. Despite claimed improvements to the model, FICO Score 8 remains the most-used credit score by lenders to determine creditworthiness.

Read Also: How Do I Report A Tenant To The Credit Bureau

Industry Specific Credit Scores

Now that you know what a good credit score is, its time to get more specific.

While traditional FICO scores from the popular scoring company Fair Isaac Corporation range from 300 to 850, there are actually several different models that lenders might use when judging your creditworthiness. These vary depending on what type of credit youre applying for.

A few examples include versions specifically for mortgages, car loans, credit cards, and student loans. Each one will look at slightly different information that is more relevant to the exact type of credit you want.

What Is Fico Score

FICO Score refers to the overwhelmingly most popular and heavily utilized in the United States. The company which created, owns, and manages it to this day is Fair Isaac Corporation.

Financial institutions that loan out money employ this FICO score for an individual to assess any credit risk and decide whether or not they will offer the person credit.

Sometimes they also consider specific information on the of the borrower, but this is increasingly uncommon. The reason for this is that the FICO score contemplates a well-rounded set of risk parameters for the would-be borrowers.

These five areas it considers and draws upon to issue a credit score for credit worthiness include the individuals payment history, present amount of debts, types of credit utilized, amount of , and new credit inquiries and issued accounts.

Ninety percent of financial institutions in the United States that offer loans rely on the FICO score for assessing the creditworthiness of an individual. These scores vary from as low as 300 to as high as 850. Generally speaking, scores over 650 represent desirable credit history.

Individuals who boast less than 620 conversely typically find it hard to get decent financing offers approved at reasonable interest rates. Financial institutions claim that they also consider various other details besides FICO scores. These include history of time at a job, applicants income, and the kind of credit they are seeking.

Also Check: What Credit Score Does Les Schwab Require

How To Check Your Fico Score

Knowing your FICO Score can help you get a handle on your finances and prepare you for the loan or credit card application process. Luckily, there are a number of ways to check your credit score. Start by reviewing your credit card statements and card providers website. Many issuers offer customers free FICO scores each month, while others even offer the service to non-cardholders.

Alternatively, you can visit FICOs website and choose from one of three monthly plans that provide access to FICO scores, credit reports, identity monitoring and other services.