What Is A Bad Credit Score Range

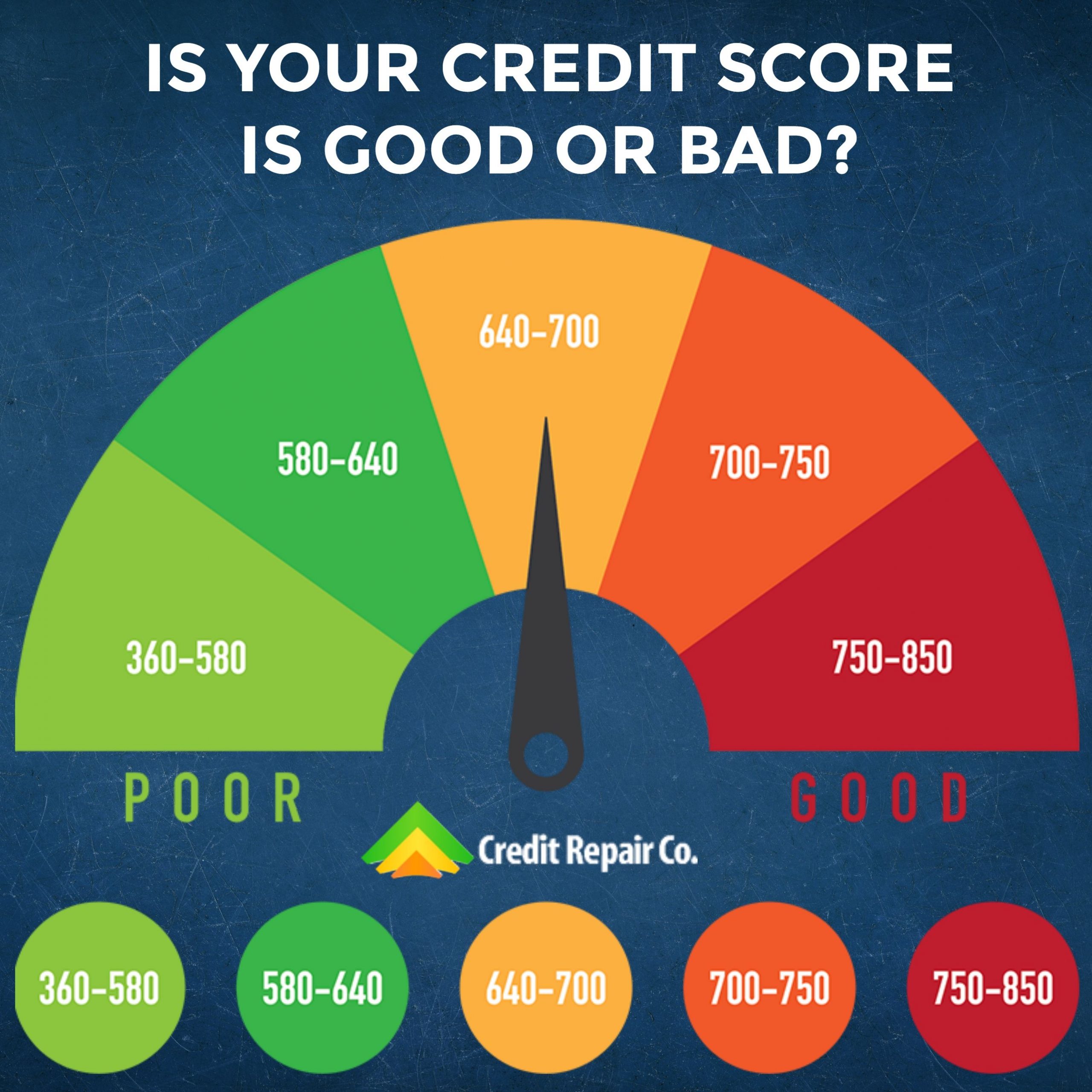

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

How Credit Scoring Works

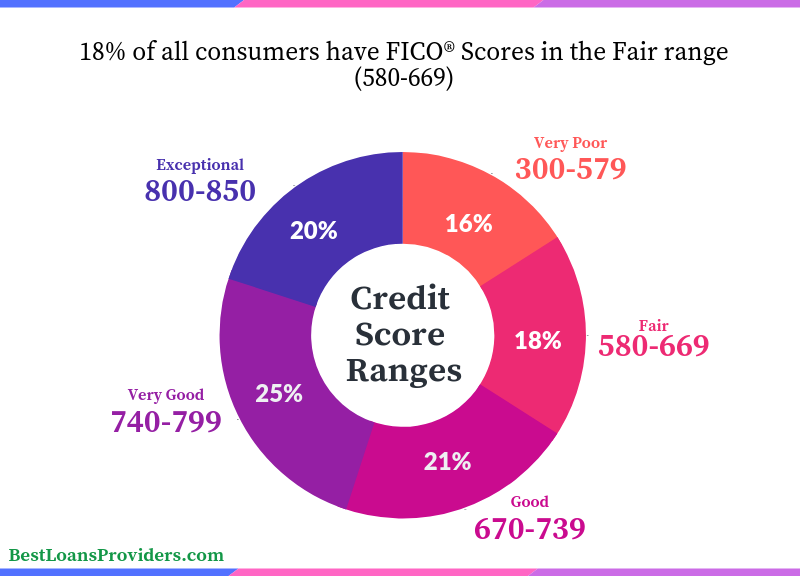

Many creditors use the popular FICO scoring system, which combines financial data collected from major credit bureaus Equifax, Experian and TransUnion. Those credit bureaus also have their own scoring system, VantageScore, which bases ratings on internal financial data.

Your credit score is tied directly to the financial decisions you make, such as paying your loans or on time.

Improving Your 650 Credit Score

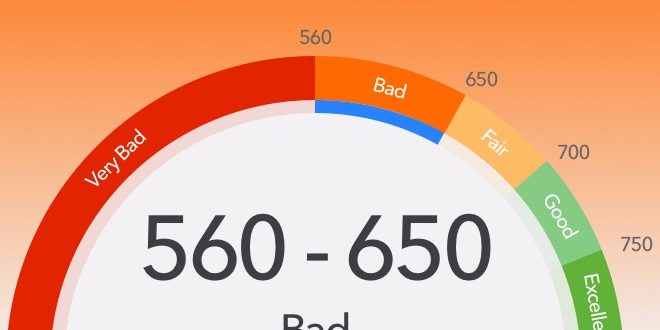

So what can you do to improve your credit score? I asked myself the same question when I was haunted by my persistent 650. First, let me pat you on the back for taking the right steps, you are wise in seeking out information, and you are on the right path! Second, take a deep breath! Its not the end of the world. With some hard work and persistence I raised my score. Below are some tips to rebuilding credit. In the meantime, use this site to inform yourself about the options you currently have for mortgages, auto loans, and credit cards with a credit score of 650.

Steps you can take to improve your credit score:

You May Like: Does Opensky Report To Credit Bureaus

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Also Check: Remove Payday Loans From Credit Report

Personal Loans For Borrowers With A 650 Credit Score

While it can be harder to secure a personal loan if you only have a fair credit score, it isnt impossible. Some lenders offer personal loans for borrowers with a 650 credit score. Besides your credit score, lenders may also take your income and debts into consideration or they may require collateral to secure a loan to lower their risk.

The following Credible partner lenders offer personal loans for borrowers with a 650 credit score:

Tldr What Can You Do With A 650 Credit Score

Time, along with the proper steps and action, can improve even the lowest credit score. The impact of negative factors in your report lessens, and those negative marks will eventually fall off of your report. While youre waiting, good credit habits will help you build positive credit. Embracing these behaviors today means that when the negative reports cycle off of your credit report in the future, youre left with a better score and who doesnt want that?

Recommended Reading: How To Get A Repo Off Credit Report

How To Build Up Your Credit Score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Check your FICO Score® regularly. Tracking your FICO® Score can provide good feedback as you work to build up your score. Recognize that occasional dips in score are par for the course, and watch for steady upward progress as you maintain good credit habits. To automate the process, you may want to consider a credit-monitoring service. You also may want to look into an identity theft-protection service that can flag suspicious activity on your credit reports.

Avoid high credit utilization rates. High , or debt usage. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.7 credit card accounts.

Seek a solid credit mix. No one should take on debt they don’t need, but prudent borrowingin the form of revolving credit and installment loanscan promote good credit scores.

What Can I Do With A 650 Credit Score

Luckily, when you have a 650 credit score, your hands arent tiedyou have options. Most notably, you should be able to get approved for a credit card quite easily. You can then use this credit card to build up your credit and improve your score.

However, you should also be very careful when taking out any new credit. Lenders know you have few options with a 650 score, and some will try to take advantage of you.

For example, you might be approved for loans with an incredibly high interest rate and strict loan terms. Youll want to be careful and thoroughly research any new loans you take on. The last thing you want to do is end up in a situation where you make your credit worse.

For example, lets say you take on a loan with a high interest rate of 25 percent. If you miss one payment and dont realize theres a penalty that increases your interest by 4 percent, your loan will now be sitting at 29 percent. This is just one way that lower credit scores can end up costing you significantly more.

Not sure how your credit compares? Find out with our free credit Assessment

Also Check: How To Get Rid Of Serious Delinquency On Credit Report

Is 669 A Good Credit Score

Your score of 669 is only one point away from the range for Good credit scores. Its also a great starting point to raise your score even higher. Increasing your credit score to the Good range can lead to additional credit possibilities, lower interest rates, and lower fees.

Having a FICO Score of 699 allows you to apply for a wide range of loans and credit cards, but raising your score can enhance your chances of being approved for even more, and under more inexpensive conditions.

What Factors Affect Your Credit Score

Your credit score is comprised of five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. When youre in the average credit score range, your credit score can be affected by any of these five factors. In fact, your payment history may not even be a major issue. Even though your payment history is flawless, your credit score can still fall below 700 if you owe too much on your credit cards, or if you have too much new credit.

Don’t Miss: What Credit Bureau Does Capital One Report To

Personal Loans With A 650 Credit Score

Are you in the market for a personal loan?

While you might qualify for a personal loan with fair credit, you could be charged a higher interest rate and more fees than you would with scores in the good or excellent range.

These higher rates and fees might make the loan a less desirable proposition, depending on what you need it for. For example, if you want to consolidate credit card debt with a personal loan, the interest rate with your new loan may not be low enough to save you money in the long run especially considering all the fees you might be charged upfront.

On the other hand, if youre using a personal loan to finance a major purchase, you should consider whether its something you need now or can wait to buy. If you can wait and spend some time building your credit, you might be able to qualify for a loan with a lower interest rate.

When youre ready to move forward with a personal loan, you can compare personal loan options on Credit Karma.

Is 672 A Good Credit Score

With a 672 credit score, getting a mortgage, vehicle loan, or personal loan is fairly simple. Lenders prefer to work with clients who have Good credit, because it is less risky.

672 is a median score and median scores are classified as Good, so lenders dont consider you a high risk for loans and you shouldnt experience too much trouble qualifying for one. Since a 672 FICO Score is towards the bottom of the Good level, youll want to keep an eye on it to avoid falling into the more restrictive Fair credit score range .

Also Check: Carecredit Minimum Score

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

Measures To Improve Your Credit Score

There are several measures that will help you improve your credit score:

- Get your credit report from Bankbazaar.com.

- Review and analyse your credit report. Make necessary changes and improvements.

- Fix your late payments by paying your dues on a timely basis moving forward.

- Pay off debts instead of transferring it to other accounts.

- A good way to build a credit history is to get a secured credit card.

- Increase the credit limit on your existing credit card.

- Have a good mix of secured and unsecured loans.

- Maintain a low credit utilisation ratio.

You May Like: 524 Credit Score Credit Card

Sure You Can But Holding Onto It Can Be Fleeting

You may have been able to check your credit score lately using a number of free services including from your bank or mortgage lender. But, what good is knowing your FICO score if you dont understand what the number means on the overall reporting scale? Maybe you have a 740 FICO score. If the maximum score is 750, youre pretty much a credit genius. If the max is over 1,000, youre sporting a C averagenot really all that impressive.

So what is the highest credit score possible, and how do you achieve it?

Compare More Recommended Credit Card

Is your credit score not 650, 660, 670, 680, or 690? Find more top credit cards for your credit score range:

Note: According to our research, these credit cards offer the best chance of approval for applicants with credit scores of 650, 651, 652, 653, 654, 655, 656, 657, 658, 659, 660, 661, 662, 663, 664, 665, 666, 667, 668, 669, 670, 671, 672, 673, 674, 675, 676, 677, 678, 679, 680, 681, 682, 683, 684, 685, 686, 687, 688, 689, 690, 691, 692, 693, 694, 695, 696, 697, 698 and 699. This does not mean guaranteed approval as credit decisions take into factors other than FICO score.

Petal credit cards are issued by WebBank, Member FDIC.

Read Also: Credit Score To Qualify For Care Credit

Can I Get A Home Loan With A Credit Score Of 650

The minimum credit score is around 620 for most conventional lenders.

However, for those interested in applying for an FHA loan, applicants are only required to have a minimum FICO score of 500 to qualify for a down payment of around 10%. Those with a credit score of 580 can qualify for a down payment as low as 3.5%.

See also: 9 Best Mortgage Loans for Bad Credit

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Read Also: Syncb Inquiry

Monitor Your Credit Score From Now On

You dont want to become obsessive about this, but you do need to have a general idea where your credit score is at any time. At a minimum, a serious negative change in your credit score can indicate either an error on your report or even fraudulent activity. Only by knowing what your credit score is on a regular basis will you be able to detect and deal with either situation.

Watch Your Credit Utilization Ratio

Your credit utilization ratio is how much credit card debt you have relative to how high your credit limit is. If youve got a good credit score, youve likely managed to keep this ratio low. Dont max out your debts or dramatically increase this ratio credit reporting agencies like to know you have flexibility if something goes wrong.

Don’t Miss: How To Report A Death To Credit Bureaus

How Long Does It Take To Fix A Fair Credit Score

How long it takes to fix a score of 650 will depend on various factors. If you have accurate negative items on your report, such as a collection account, these items can stay on your report for up to seven years. Until these items fall off your report, itll be much more challenging to see significant increases in your credit.

On the other hand, if you dont have anything serious bringing your score down, a few months of on-time payments and responsible financial patterns can result in a relatively quick improvement in your score.

As we mentioned earlier, a fair score is only a few points away from a good credit score. If you take the right actions, your score might improve to the good range within a few months.