Your Childs Credit Report

Parents can place a Protected Consumer security freeze on their childs credit reports to help prevent identity theft. Check a childs credit report before they turn 16.

Youll need to provide the following:

- childs full name

- copy of social security card

- addresses for the past two years

- copy of the parents drivers license

- copy of proof of residence for the parent, such as a utility bill

- guardians should include guardianship papers

Send or submit the information to each of the three major credit reporting bureaus.

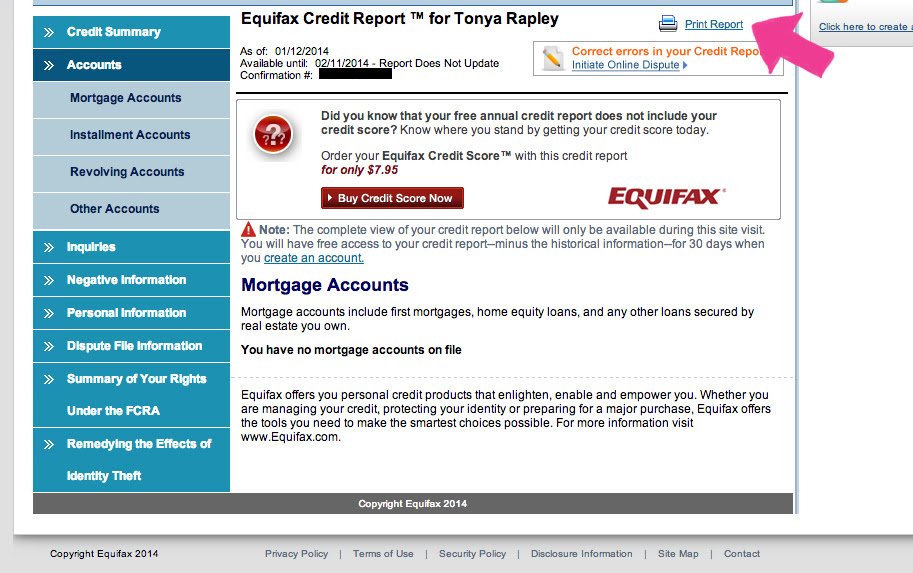

How Can I Find And Dispute Errors On My Credit Reports

If you notice any big discrepancies between your credit reports, there might be an error. There are a number of ways to find and dispute these errors. Lets take a look at a few.

Free credit monitoring from Credit KarmaCredit Karmas free credit monitoring tool can help you stay on top of your credit and catch any errors that might impact your scores.

If we notice any important changes on your Equifax or TransUnion credit report, well send an alert so you can review the changes for suspicious activity. If you dont recognize the information and think it might be associated with an error or identity theft, you can file a dispute.

How to dispute errors on your Equifax credit reportIf you spot an error on your Equifax credit report, youll have to file your dispute directly with Equifax.

Start by reviewing your free report from Equifax on Credit Karma. If you come across an error, scroll down to the bottom of the account in question and click Go to Equifax. Youll have a chance to review your dispute before submitting it to Equifax.

How to dispute errors on your TransUnion credit report with Credit Karmas Direct Dispute featureCredit Karmas Direct Dispute tool makes it easy to file a dispute directly with TransUnion. If you come across an error on your TransUnion report, you can submit a dispute without leaving Credit Karma.

What Are Some Common Warning Signs Of Identity Theft Or Fraud

- Bills that do not arrive as expected

- Unexpected credit cards or account statements

- Denials of credit that you did not apply for

- Charges on your financial statements that you don’t recognize

- Incorrect information on your credit reports – accounts or addresses you don’t recognize or information that is inaccurate

The Federal Trade Commission’s website has additional information regarding the warning signs of identity theft, the Consumer Financial Protection Bureau’s website also provides information on common identity theft warning signs.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

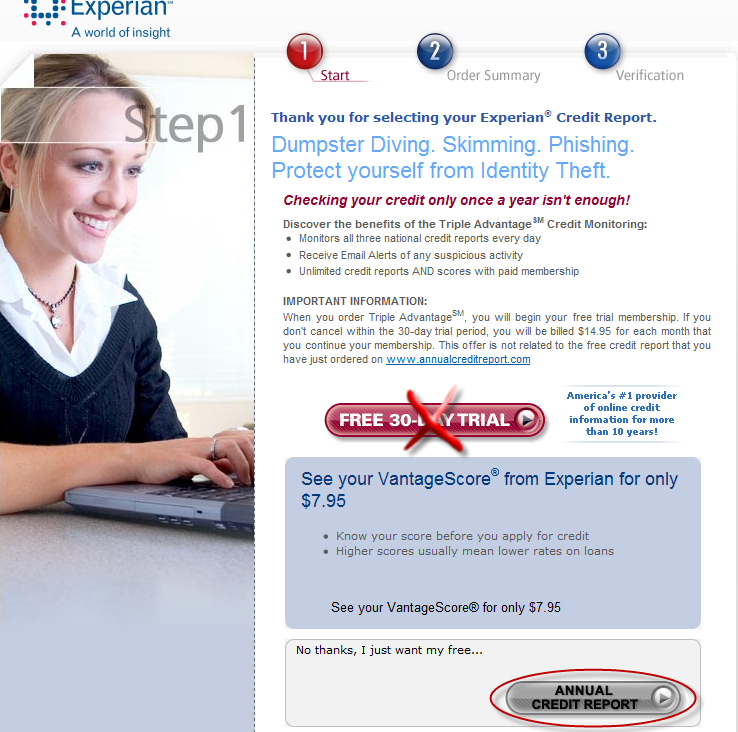

Is The Annual Credit Report Service Really Free

Yes.

There are no fee to get your credit report that way whenever you visit AnnualCreditReport.com.

If you do this online, as part of the process, you will be sent to the sites of the credit reporting agency of your choice.

Heres the tip-off part: once youre on those credit bureau sites, they might try to sell you other things too.

For example, you may see an offer to get your or to register for credit monitoring or identification protection. They can charge you for those other things.

But you dont have to buy those things or sign up for anything to get your credit report.

You can ONLY get the credit report and thats it.

% Collections Foreclosure & Bankruptcy

An account thats in collections can severely damage a credit score, since its reached the point that a borrower has given up paying their bills and now, their lender has asked a collection agency to intervene and get the debt paid. A bankruptcy never has a positive impact on your credit score, but the severity which it affects your numbers depends on your own individual credit profile and situation.

You May Like: How To Remove Repossession From Credit Report

How To Order Your Free Annual Reports From Specialty Consumer Reporting Agencies

All of these reports are ordered through automated telephone systems. The system will ask you for personal information, including your Social Security number, to identify your file. In some cases, you will be sent an order form to fill out and mail in.

- CLUE Personal Property and/or Auto Report

- WorkPlace Solutions Inc. Employment History Report

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free report if a company denies your application for credit, insurance, or employment. Thats known as an adverse action. You must ask for your report within 60 days of getting notice of the action. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them.

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

Outside of these free reports, a credit bureau may charge you a reasonable amount for another copy of your report within a 12-month period.

Also Check: Les Schwab Credit Score Requirement

Warning About Impostor Websites

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,””free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may unwittingly agree to let the company start charging fees to your credit card.

Some “impostor” sites use terms like “free report” in their names others have URLs that purposely misspell Annualcreditreport.com in the hopes that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from Annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam. Ensure you are on the right website by verifying through the Consumer Financial Protection Bureau .

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Read Also: What Is Syncb Ntwk On Credit Report

Get Your Free Credit Report

View your credit report and learn about your credit score – for free!

With MyCredit Guide, you get:

Access to your TransUnion credit report & credit score history

Guidance on how to improve your credit score

Email alerts when a change is posted on your credit report to

help you identify potential fraud

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

Recommended Reading: Is 626 A Good Credit Score

How Many Free Credit Reports Can You Get

So you can get a free credit report from TransUnion, a free one from Equifax, and a free one from Experian every year.

But until April 20, 2022 you are allowed to get a free credit report from each of them each week If you like.

Thats great if you want to keep a close eye on things or are waiting for something to drop or show up.

You can also get free copies of your credit reports after youve been denied credit, insurance, or a job because of whats on it. But you must request them within 60 days of notification. This is true even if you have already received your annual .

How To Order Your Free Credit Reports

One of the best ways to protect yourself from identity theft is to monitor your credit history. Now you can do that for free. Thanks to a new federal law, consumers can get one free credit report a year from each of the three national credit bureaus. Those bureaus are Equifax, Experian, and TransUnion.1 You can also get your reports for free from “specialty” credit bureaus. These companies prepare reports on your employment, insurance claims, rental and other histories.

Checking your credit reports at least once a year is a good way to discover identity theft. And the sooner identity theft is discovered, the easier it is to clear up. You can also identify errors in your credit reports that could be raising your cost of credit

Also Check: What Is Syncb Ntwk On Credit Report

Who Can Pull Your Report

When you are applying for a loan or mortgage, leasing a car, or even renting an apartment a lender will pull your credit report in order to determine your creditworthiness. They will typically do a hard credit inquiry, which can lower your score slightly, compared to a soft credit pull that is usually done to just view your credit report.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: When Does Capital One Report To Credit

Find Out How You Score

A free Credit Sesame account utilizes information from TransUnion, one of the major national credit bureaus. Upgrade to a premium Credit Sesame plan for credit report info from all three bureaus: TransUnion, Experian and Equifax. With full access to your credit history from each bureau, youll have a complete, comprehensive look at your credit activity.

Use Credit Cards Strategically

One of the best ways to build credit is by using credit. Keep your momentum alive by applying for a credit card, one with perks that appeal to you, and terms that you can manage. You might not yet be able to qualify for a traditional credit card, but a secured credit card should be well within your capabilities. Your credit limit will probably be low, but that is ok. The point here is to get into the practice of using a card, and paying it off, on time and at least at the minimum, consistently month to month.

A credit card should work for you in terms of what you get back from it. Not all cards are created equal so definitely shop around before you just randomly pick one. Perks like airline miles and cash back are very popular places to start. If you take out a card and begin to use it and quickly notice that youre not savvy enough to manage this responsibility yet, cut the card up. Closing credit accounts is one of the bad and can negatively impact your score. So you are better off cutting the card up, ceasing to use it, and continuing to pay down the balance without adding to it.

OpenSky® Secured Visa® Credit Card

For Fair, Poor, and Bad Credit

Annual Fee: $35

Please note that our comments are moderated, so it may take a little time before you see them on the page. Thanks for your patience.

Also Check: Which Business Credit Cards Do Not Report Personal Credit

How To Check All Three In One Go

CheckMyFile gives you a 30-day trial to see your Experian, TransUnion and Equifax reports in one place. After that, it’s £14.99 a month. It’s really only for those who want the monitoring, as a combination of Clearscore, Credit Karma and Experian will provide monthly snapshots of these three agencies for free.

To cancel, either call 0800 086 9360 or log into your account, then click through ‘Expert Help’, ‘I need help with my account’ and then ‘I’d like to stop my subscription’.

Tip Email

How To Review Your Credit Reports

To check your reports for errors or possible signs of identity theft, look especially at three areas.

You can view sample credit reports, with the different sections explained, on the Web sites of the three credit bureaus: experian.com, transunion.com, equifax.com/home/en_us.

Also Check: How Accurate Is Creditwise Credit Score

How Does Identity Theft Happen

Identity theft is a serious crime. Identity thieves steal information in several ways, such as:

- Digging through trash cans and other places to find documents that contain credit card numbers, account numbers, Social Security Numbers and other personal information

- Retrieving information from lost or discarded computer equipment, mobile phones and PDAs, or wallets

- Using rogue Radio-Frequency Identification readers stealing checks, credit cards, debit cards, passports, driver’s licenses, Social Security cards or skimming the information from card readers to create new cards

- Stealing information from personal computers using malware or spyware

- Hacking into computer networks and databases to steal large amounts of personal information or infiltrating organizations that store large amounts of valuable information

- Acting as a trusted organization to obtain personal information and/or financial information through the mail, telephone, text messaging and email

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Read Also: How To Remove Repossession From Credit Report

Should I Order Reports From All Three Credit Bureaus At The Same Time

You can order free reports at the same time, or you can stagger your requests throughout the year. Some financial advisors say staggering your requests during a 12-month period may be a good way to keep an eye on the accuracy and completeness of the information in your reports. Because each credit bureau gets its information from different sources, the information in your report from one credit bureau may not reflect all, or the same, information in your reports from the other two credit bureaus.

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Also Check: Paypal Credit Credit Report