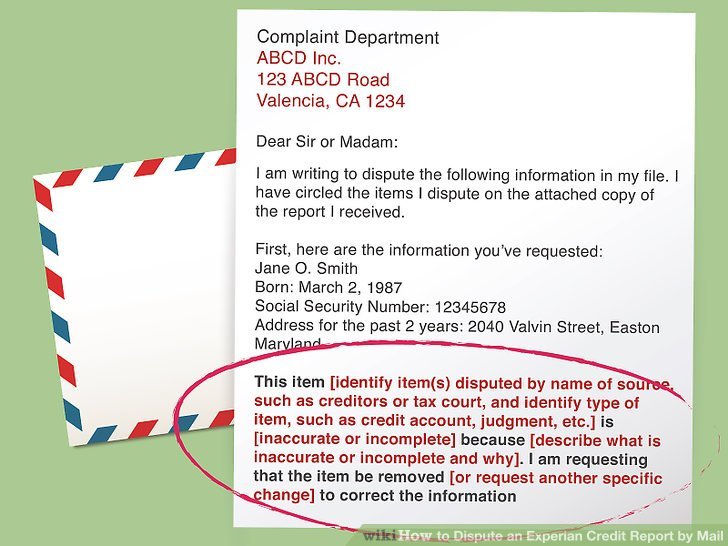

Disputing A Charge With Your Creditor

Sometimes you may also have better luck filing a dispute directly with your creditor, even if your Experian dispute was unsuccessful. The creditor is the one who actually reports your account information to the three major credit bureaus, so they can also remove negative information from your credit report. You can mail them a letter requesting deletion just as you would with Experian.

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Recommended Reading: When Does Paypal Credit Report To Credit Bureau

How To Request Your Report

Request your report online

AnnualCreditReport.com allows you to request a no-cost credit report once every 12 months from each of the nationwide consumer credit reporting companies: Equifax, Experian and TransUnion. If you are eligible for a no-cost credit report, you will be able to view it and print it after your identity is verified.

Request your report by phone

To make your request, call 1-877-FACTACT . You will go through a simple verification process over the phone. Your reports will be mailed to you.

Request your report by mail

Get your credit report by mailing a request form to this address:

Annual Credit Report Request ServiceP.O. Box 105281

What Should I Look For In My Credit Report

When reviewing your credit report, check that all the information listed is up-to-date and accurate. Heres a brief breakdown on the kinds of things to verify within each credit report:

- Personal Information: Social Security number, name and address

- Inquiries: everyone who has reviewed your credit report in the past 2 years

- Public Records: bankruptcies, which can stay on a credit report for up to 10 years

Also Check: Is A 524 Credit Score Good

Ordering Your Credit Report

Free Annual Credit Reports

The Fair Credit Reporting Act requires each of the three nationwide credit reporting agencies to provide you with a free copy of your credit report, at your request, once every twelve months.

How do I order my free credit report?

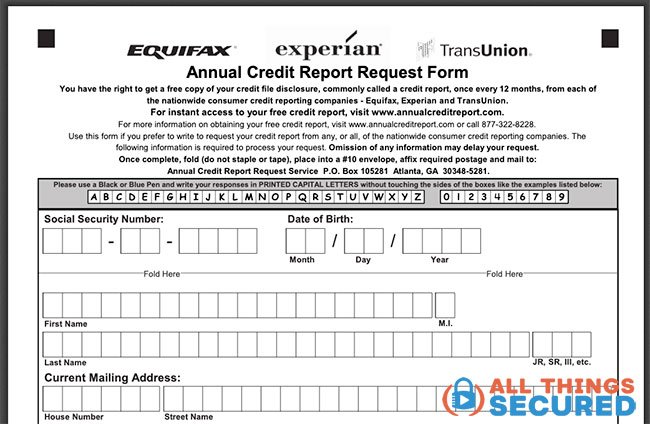

You can order your report online at www.annualcreditreport.com by telephone at 877-322-8228 or by completing the Annual Credit Report Request Form and mailing it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

You can also obtain the request form at www.ftc.gov/credit. Do not contact the three nationwide consumer reporting companies directly.

What information do I have to provide to get my free credit report?

You will need to provide your name, address, Social Security Number, and date of birth. To verify your identity, you may be asked to provide some information only you would know, such as the name of your credit card company.

How long does it take to get my free credit report?

If you request your report online, you should be able to get it immediately. If you request your report by phone or mail, it should be mailed to you within 15 days.

Will the free credit report include my credit score?

No. However, you can purchase your credit score when you order your free report.

Does ordering my credit report lower my credit score?

No. For more information on your credit score, see .

What should I do if I ordered my free credit report, but I never received it?

Experian:

Getting Free Credit Reports Under The Fcra

The three major credit bureaus have set up a central website and a mailing address where you can order your free annual report.

You may get your free reports at the same time or one at a time – the law allows you to order one free copy of your report from each of the credit bureaus every 12 months.

To get your free reports, visit AnnualCreditReport.com. You can also complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281.

Recommended Reading: What Credit Bureau Does Uplift Use

Why Do I Want A Copy Of My Credit Report

Your credit report has information that affects whether you can get a loanand how much you will have to pay to borrow money. You may want a copy of your credit report to:

Free Credit Report In Spanish

Additionally, Equifax is the first and only credit bureau to offer a free, translated credit report in Spanish online and by mail. There are two ways to request your Spanish credit report, online or by phone.

To receive your credit report in Spanish, you can visit: www.equifax.com/micredito or call Equifax customer service 888-EQUIFAX and press option 8 to begin requesting your free credit report in Spanish. Our Customer Care is available between 9:00 AM and 9:00 PM ET, Mon-Fri 9:00 AM and 6:00 PM ET, Sat-Sun. When you request your Equifax credit report in Spanish by phone you will receive it in the mail.

Also Check: Carmax Minimum Credit Score

Can You Get Your Credit Report With An Itin

The Internal Revenue Service assigns an Individual Taxpayer Identification Number, or ITIN, to some individuals for tax processing purposes. It could be assigned to someone who has to report on their taxes to the IRS but isnt eligible to get a Social Security number.

So what if you need a copy of your credit report and only have an ITIN? The law allows you to access a free copy of your annual report every year from the three major credit bureaus through AnnualCreditReport.com. As a result of the financial fallout of the pandemic, you can get a free copy of your credit report every week from each of the three bureaus through April 2022.

However, the site does not provide your free credit report if you use your ITIN as an identifier. It considers your Social Security number to be the most secure number to use, so the site only accepts that number.

Even if you are able to use your ITIN to open a bank account or get a loan, you may still find it difficult to get a credit report using the ITIN. Thats because lenders may not report all your information to the credit bureaus.

And even if lenders do report your information, they may not report it to all the three bureaus or at the same time. Thats why each bureau is likely to have different input about your . Besides, each bureau uses its own system to decide what information about you goes into its credit report.

See related: Why did I get charged for my free credit report?

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Read Also: Syw Mc/cbna

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Read Also: How To Get An Eviction Off Your Credit

Can I Get More Than One Free Credit Report Per Year

If youve already ordered your legally-mandated free credit reports for the year and you dont live in a state where you are entitled to an additional free report, there are still several situations which qualify you for an additional free credit report:

Negative actions as a result of your credit report such as:

- Being denied for credit or a loan

- Being denied for insurance

- Being passed over for employment

- Being denied a government license or benefit, or having an adverse action for either of these

- Being denied or having an unfavorable action happening on another account

Hardships that make it difficult to maintain positive credit such as:

- You are currently unemployed and are planning to seek employment within the next 60 days

- You are receiving or have recently received public welfare assistance

- You believe that your credit file may be inaccurate due to fraud or identity theft

Information You Need To Provide To Get Your Free Yearly Credit Report

To get your free annual credit report, you need to provide:

- Your full name

- Current address

- Social Security Number

- Date of birth

You also may be asked to provide information only you would know. Each credit bureau may ask you different questions, depending on what information of yours they have on file.

You May Like: Report To Credit Bureau Death

Who Can Request A Copy

- lenders and creditors

- insurance companies

- landlords

- potential employers

If a person denies you credit or increases a charge or fee and if you request it within 60 days you must be told:

- the nature and the source of the information

- the name and address of the consumer reporting agency reporting the information

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Also Check: Is Credit Wise Score Accurate

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Recommended Reading: How To Get Evictions Off Your Credit

How Do I Order My Free Credit Reports

If you are getting your annual free credit reports, you can order them online through AnnualCreditReport.com.

This website will let you order all three of your free credit reports at once, with no obligations and no hidden fees. You may have to provide some personal information to confirm your identity before ordering, but you will not be charged if you use this site.

Please note that if you use these free credit reports to file a dispute with the credit reporting agencies, they have 45 days to investigate your dispute instead of the typical 30-day timeframe.

Warning About Impostor Websites

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law: AnnualCreditReport.com. Other websites that claim to offer “free credit reports,””free credit scores,” or “free credit monitoring” are not part of the legally-mandated free annual credit report program.

In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may unwittingly agree to let the company start charging fees to your credit card.

Some “impostor” sites use terms like “free report” in their names others have URLs that purposely misspell Annualcreditreport.com in the hopes that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

Annualcreditreport.com and the nationwide credit reporting companies will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from Annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam. Ensure you are on the right website by verifying through the Consumer Financial Protection Bureau .

You May Like: Is Mrs Bpo Legit

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.