Why Your Credit Score Will Affect Your Rental Apartment Application

Get the skinny on how your credit score can impact your chances of getting an apartment, and what you can do to still land the perfect place.

Weve all been there: a late credit card payment, a tough decision between making student loan payments and buying concert tickets, or trying to make a new car payment that exceeds your budget. And then, all of a sudden, your credit score takes a hit. Our credit scores are affected by a number of factors, but we dont always see how our credit, in turn, affects us in our daily lives. Among other things, having poor credit makes it hard to find an apartment. So, just how does your credit score affect your rental application and what can you do about it? Well explain.

What Information Is Needed For A Credit Check

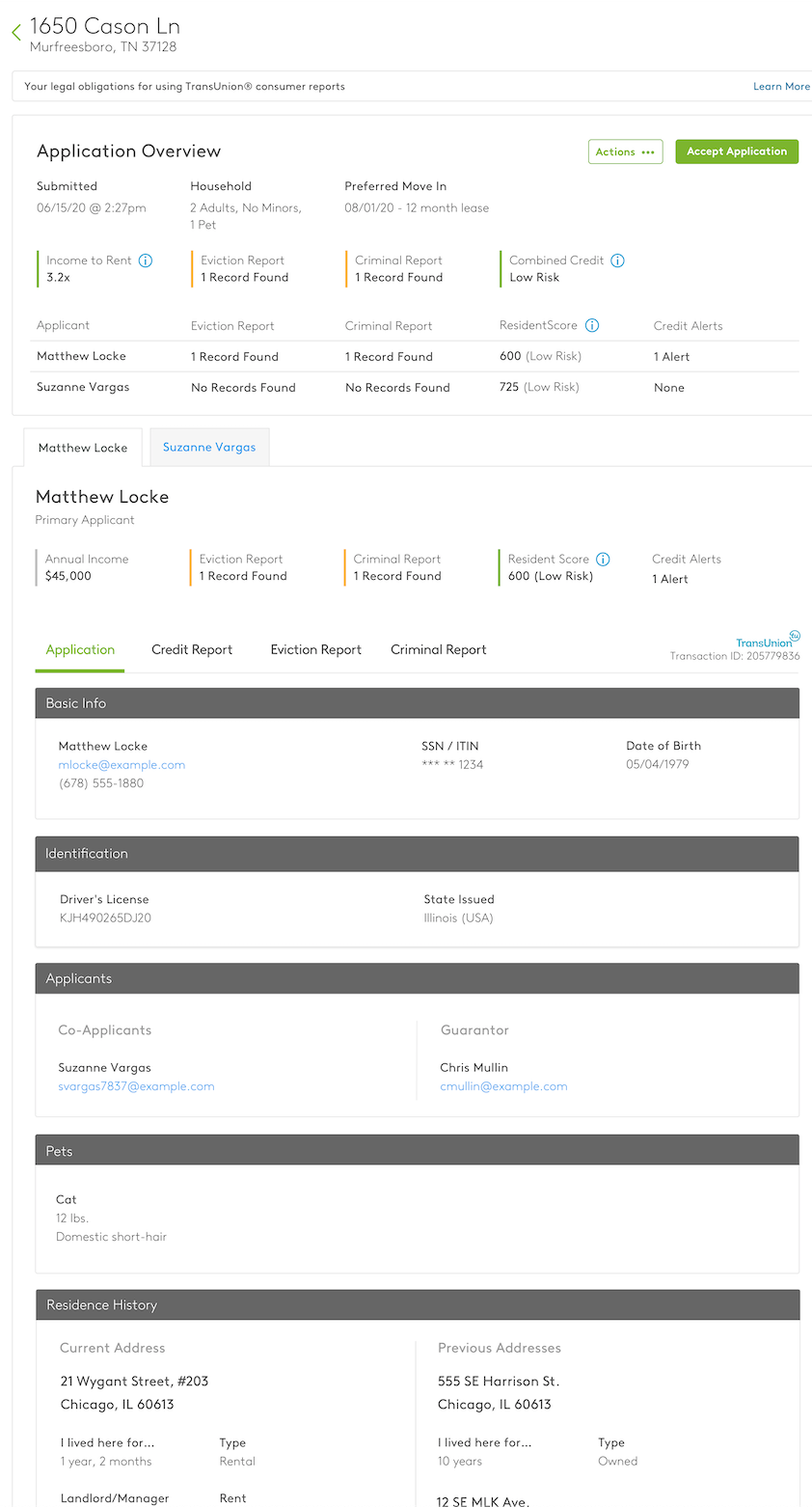

Before you can run a credit check on rental applicants, each applicant over the age of 18 must submit a completed rental application and give the landlord permission to check their credit. As the landlord, you must follow all Fair Credit Reporting Act guidelines and be able to verify that youre the actual landlord. Heres what youll need to prepare for the rental credit check:

What To Do If Your Application Is Rejected Because Of Your Credit Score

If your application was denied due to your credit score, you should receive an official notification; that is actually required by law to be provided. It will be sent by the reporting agency and will show you the score that the landlord saw, as well as instructions on how you can request a copy of your credit report for free.

The reason you have the ability to check your report for free is to ensure you have a chance to review it for errors. That way, if you were rejected due to a mistake, you can reach out to the credit bureau to have the issue corrected.

Unless there was a mistake on your credit report, the landlord isnt required to work from you if you dont meet their minimal cutoff. However, if you have access to a cosigner who can help you cross the threshold, you can certainly ask if theyd be willing to reconsider with a cosigner on the application.

If not, then your best bet is to move on. Luckily, you now know the exact state of your credit score, and that may help you during your search. You can focus on properties where your credit score wont be a disqualifier, or that will let you move forward with a cosigner. You can also choose to work to boost your score before you apply for a place again if you dont have to move right away.

Ultimately, the important part is not to get discouraged. It is possible to recover. Take what you know now and use it to create a new plan. In the end, your diligence will likely pay off.

About

Recommended Reading: Why Is There Aargon Agency On My Credit Report

Pay Your Bills On Time

Missed or late payments can quickly cause your credit score to drop. On-time payments also account for a portion of your credit score breakdown. To avoid missing payments, consider setting up auto-pay so you dont have to worry about remembering to pay your bills on time every month. If youre behind on payments, make sure you do what you can to catch up. Doing this will help show youre a reliable tenant and able to make on-time payments to future landlords.;

Pay More Than The Minimum Payment And Pay Down Outstanding Balances

Paying more than the minimum payment can help you pay off your debts faster and can improve your . If you have multiple lines of credit, try tackling the one with the highest interest rate first. According to FICO, 30 percent of your score is based on the total amount you owe. Your debt amount affects your score because the more you owe, the more it can impact your ability to make payments on time.;

You May Like: Is Klarna A Hard Pull

What Do Apartment Complexes Check On Credit Reports

Apartment complexes use a variety of methods to determine if perspective renters are suitable. Common methods are references, background checks, and credit reports. The criteria an apartment complex uses will vary by the complex. Some may have a minimum credit score that will be accepted while others focus more on references.

Why Do You Need A Good Credit Score To Rent An Apartment

Nick Meyer, a certified financial professional and financial influencer, shared with us the relationship between credit and the apartment applciation process.

“Your credit score acts as your financial report card: it’s a number that tells banks, landlords, and even employers how likely you are to pay off your debts. The lower this number is, the less likely landlords are to approve your rental applications.”

So what should you do if you have a low score?

Recommended Reading: Opensky Billing Cycle

What Exactly Are Landlords Looking For In My Credit Check

Bottom line? Theyre looking to see that you have the right amount of reliable income and dont have enough debt to threaten your ability to pay rent on time. Theyre looking for consistent payments, ideally over a long period of time across multiple accounts.

You dont need perfect credit to be approved, but there are certain negatives on your report that could be deal breakers. Car repossessions, credit cards being charged off, bankruptcies, and previous foreclosures could all give landlords a reason to deny your application. Plus, upscale condos or other high-end properties might require a higher credit score.

What Do Landlords Look For On A Credit Check

Related Articles

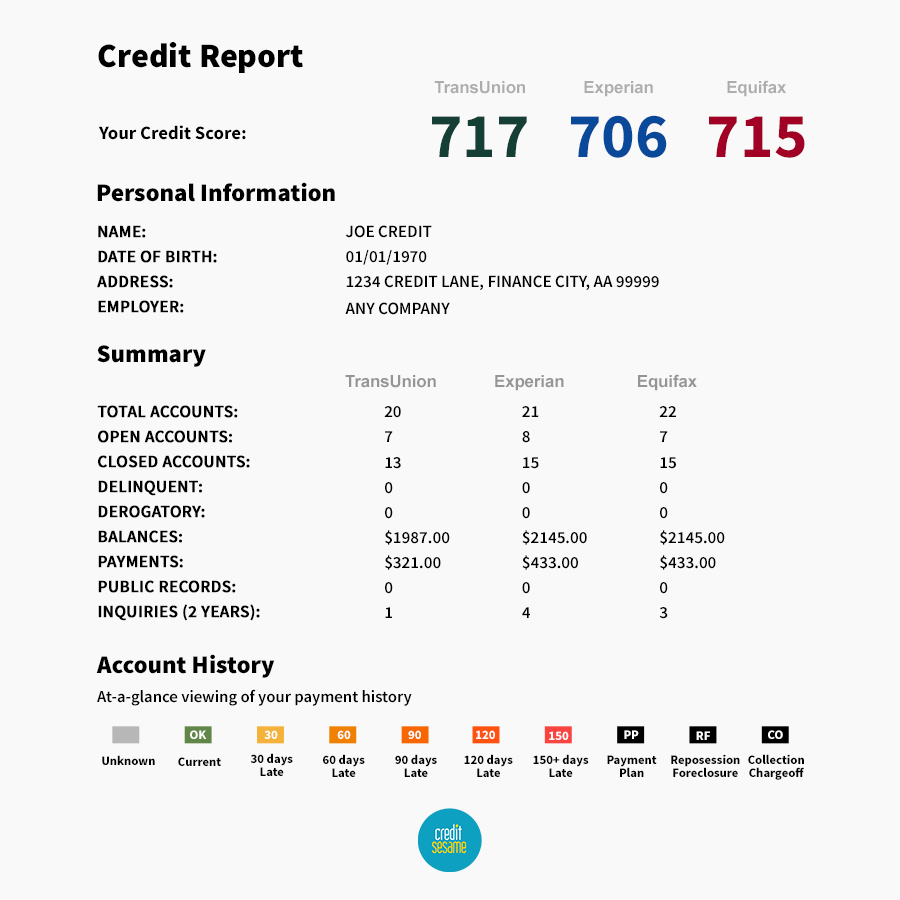

A credit check can give a landlord a reasonable indication of what to expect from you as a renter. They look for prior evictions, your debt load and significant credit mishaps to determine whether you are likely to pay your rent on time each month. There are three different credit bureaus a landlord may use to run a credit check — Equifax, Experian and TransUnion. Credit bureaus may report different information and a landlord can use any or all of the bureaus to get an idea of credit worthiness and financial management.

You May Like: Paypal Working Capital Phone Number

Who Should Pay The Fee

In some states, you can request that prospective tenants pay an application fee to cover the cost of the background and credit checks, or you can absorb the cost yourself. Ultimately, its up to you to decide who ends up paying for the rental credit check. Some areas may impose a limit on how much you can charge an applicant, so be sure to comply with state and municipality laws.

How Do I Find My Rental History

Find your rental history by contacting a credit agency and requesting your free report which is assured under the Fair Credit Reporting Act.;

You can get one free report run for you in any given 12 month period, and they are fairly easy to obtain through one of the big credit agencies. ; TransUnion, Experian, and Equifax are the three biggest credit reporting agencies.;

Keep in mind that when you have them run your report, if it comes back fairly blank and devoid of information, that is a GOOD THING.; Your credit report is ONLY going to have things called inquiries in them.; These are negative things that have happened during the last 7 years that are a stain on your record.; A clean record is an empty report.;

If you dont have anything to show a landlord on a credit report, chances are that they are going to ask for SOME information about where you have been staying for the last couple of years.; In this case, simply write up or type up a list of the last few places you have stayed, along with addresses, the landlords name, and the dates you stayed there.; This will be more than sufficient.;;

Landlords and tenants alike can check their rental history by running a credit report for free under the Fair Credit Reporting Act.; If there is nothing on the report regarding your rental history that is great!; That means there is nothing there to see.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

What Is A Credit Check For Renters

When a potential tenant applies for an apartment and a landlord feels like they could be a good fit, theyre going to run a credit score before starting a tenancy.

This is a normal part of the rental process and typically renters should expect landlords to ask for their information and consent to run a credit check. You can double-check with your local privacy laws to see how youre protected.

A landlord will use a service like Equifax, for example, and using your information they will pull a credit report.

Whats in the credit report will vary, but typically it will show:

- Your credit score

Check Your Credit Report

Take a thorough look at your credit report. Contrary to popular belief, looking at your credit history wont lower your credit score, so dont be afraid to request a credit report. Your credit report may contain errors that could unfairly prevent you from being approved for an apartment. If this is the case, do your due diligence to get these removed from your credit report.;

You May Like: Why Is There Aargon Agency On My Credit Report

What You Can Do

Before going into an apartment tour or meeting with a potential landlord, its good to be upfront about your credit score. Let the landlord know any factors that contributed to your low score, improvements youve made since finding out your score, and show pay stubs to prove you can make monthly rent payments. Be honest and take responsibility; it will show that youre aware of your shortcomings and are ready to make improvements.

Your credit score itself is very important in the rental application process. It could be the one distinguishing factor between another potential renter and you. Keeping up with your payments, working towards improving your credit score, and having an honest conversation with the potential landlord are all important if youre trying to land your dream apartment. Once youre ready to find your next apartment, keep these key points in mind and monitor your credit score so you know what youre working with when youre ready to begin the the apartment application process.

Options For Renting An Apartment When You Have Bad Credit

If your credit score isn’t in good shape or you don’t have a credit history at all, it can be challenging to find a landlord willing to lease an apartment to you. Here are some things you can do to offset your bad credit and hopefully alleviate a landlord’s concerns:

- Pay more upfront, such as a larger security deposit or one or two months’ worth of rent.

- Have a creditworthy cosigner apply with you.

- Find a roommate who has good credit.

- Show documents that prove a responsible rental history, on-time utility payments and consistent income.

- Provide letters of recommendation or references from previous landlords.

- Search for apartments that don’t require a credit check.

Also, consider asking the landlord if they have specific requirements for tenants with bad credit. Depending on your financial situation and rental history, it may take more time to find the right fit, but it is possible.

Read Also: 779 Credit Score

How To Raise Your Credit Score

If you want to raise your credit score before you search for an apartment, here are some quick tips to help you out:

- Pay your bills on time: Consistently paying your bills on time can help improve your payment history, the biggest factor in determining your credit score.

- Pay more than the minimum amount: To improve your credit utilization ratio, aim to pay off the highest amount you can .

- Dont close old cards: Older credit cards can improve your average age of credit, an important factor in your credit score.

- Sign up for a secured credit card: Secured credit cards can help you establish or improve a low credit score for renting an apartment.; Secured credit cards report to all three credit bureaus and your history will be included in your credit report.

- Dont shop around: Each credit inquiry you submit is recorded, and too many in a short period of time can lower your credit score.

- Ask your landlord to report on-time payments: If you’re currently renting, ask your property manager if they can report your on-time rental payments to the bureaus.

You might qualify for lower interest rates for credit cards, a mortgage, car loan or even that charming rental in that cute little tree-lined neighborhood if you have a higher credit score.

Know What’s On Your Credit Report Ahead Of Time

There’s nothing better than turning in a rental application knowing exactly what your prospective landlord will see when they run a credit check. And since you have to act fast when applying for an apartment, be prepared and confident by knowing the ins and outs of your credit report ahead of time.

Terms apply.

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

What Credit Score Do You Need For Renting An Apartment

Generally, youll want a minimum credit score to rent an apartment of 620 to 650. Landlords or property management companies want reassurance that you can pay your rent on time and you’re responsible, and a solid credit history and excellent credit score are two ways to show this. The general range of FICO credit scores are as follows:

- Exceptional: 800850

- Fair: 580669

- Poor: 300579

Although a score of 620 would be considered a fair credit score for renting, it’s definitely not the best score you can get. If your credit falls in this range you may want to work to improve it.

Ask For A Higher Credit Limit

If youre not in the financial position to pay off your debts, you could ask for a increase. If youve had a credit card for a while, have made payments on time and have a low credit utilization, your creditor will likely approve you for an increase.;

While getting a credit increase may seem appealing, you need to be smart about the way you look at it. For example, if you had a $2,000 credit limit and your creditor increases your limit to $4,000, this doubles the amount of credit you have available. You can most benefit from this by making sure not to charge up your card and making sure to avoid spending all of your new credit.;

Though your credit score has an impact on whether landlords will accept you as a tenant, there are certain strategies you can use even if you have a credit score that is lower than the average needed to rent an apartment. If youre on the market for rentals, your best bet is to focus on improving your credit score and getting it as close to 620 as possible to make the process easier.;

Looking for a rental is an exciting process and ensuring youre in a strong financial position can make the process easier and help you get the apartment you want.

Reviewed by Anna Grozdanov, Associate Attorney at Lexington Law Firm. by Lexington Law.

Don’t Miss: Paypal Credit Soft Or Hard Pull

How A Renter’s Credit Score Might Help

Your renters credit score can help to offset past mistakes you may have made credit-wise.

For example, lets say you left an old medical bill unpaid because you didnt have the cash to cover it. The account was sent to collections and its been sitting on your credit report ever since.

If you have a positive history of paying your rent on time, that could take some of the sting out of the black mark caused by the collection account.

Your lender may look more favorably at your application if youve shown that youre able to keep up with your rent.

A renters credit score could also help with establishing your credit history if you dont have any loans or lines of credit in your name.

If youre fresh out of college, for example, and youre hoping to become a homeowner one day, having a positive renters score could make it easier to qualify for a mortgage down the line.

How Do Credit Scores Affect Renting

Your credit scores can influence whether youâll be approved for a rental lease, says Chris Fluegge, director of operations at the National Landlord Association.

âEach landlord is different, but most landlords and property managers look for a credit score above 600,â Fluegge says.;

FICO® and VantageScore® credit scores typically range from 300 to 850. An applicant with a higher credit score might be considered to have shown a pattern of managing their finances responsibly. And a lower credit score might indicate the potential tenant could struggle to pay rent on time.

Keep in mind that you have multiple credit scores and each is calculated using a different scoring model. Scoring companies like FICO and VantageScore even have different versions of their own scores. So you might see slightly different scores depending on what model was used.;

You May Like: Aargon Collection Agency Reviews

What Credit Score Do Landlords Look For

So, what credit score is needed to rent an apartment? There’s no single number, but just to give you an idea, you’re probably going to need a 740 score or higher to rent in a hot rental market.

Landlords in desirable and competitive markets like San Francisco or New York may sometimes even require a minimum credit score to be able to rent in their buildings and generally speaking, the higher the rent, the better credit you’ll need.