How To Improve Your Credit Score

Here are some methods you can use to fix your credit before applying for your next apartment:

Takeaway: Finding an apartment to rent is harder with a low credit score, but its possible with the right approach.

- Landlords often run credit checks to evaluate whether youll be a reliable tenant and always pay your rent on time.

- Getting approved for a rental is easier if you have a good credit score , but landlords differ in their credit score requirements.

- If you have a low credit score, youre better off applying to rent from individual landlords than property management companies because they usually have more flexibility.

- If you dont meet a landlords credit score requirements, give them references from a previous landlord or employer or show them evidence of your income or savings.

Article Sources

What To Do If You Have A Low Credit Score

Everyone’s financial situation is unique, and your credit score will reflect that fact. Whether you’re recovering from bankruptcy or building credit for the first time in your life, there’s a chance that you may have a sub-650 credit score.

Don’t panic! A score below 650 doesn’t mean that you’ll never be able to rent your dream apartment. However, itll take additional effort on your part to make it happen. Here are some tips that will help you rent with bad credit.

Average Tenant Credit Score Ranges

What is the average number you can expect to see when checking into what should be considered an acceptable credit score for renting?

Here at RentPrep, we run a lot of for the landlords who use our services. This gives us some insight into what you might see from renters. We are not the only ones who have insight into acceptable credit scores, however.

These are some of the most popular numbers used as a measure of what is an average credit score for tenants in America.

649

This is the exact average score we have seen in one year of data among all of the reports weve completed. This means if the score is lower than 649, it should be at least a little concerning. According to Experian, an acceptable credit score to rent an apartment is around 638.

These numbers are based on the data we have here at RentPrep. We run thousands of credit checks every month and this is a result of our findings. Understand that this is not based on all renters, but it is based on renters of landlords who run background checks.

673 699

According to an article from ValuePenguin, the average credit score of Americans in a 2021 report was 688 for the Vantage scoring model and 711 for a FICO model. Keep in mind that this is not industry-specific it takes into account everybody and not just renters. Renters statistically have a lower credit score than homeowners.

662

Recommended Reading: When Does Capital One Report To Credit Bureaus 2020

Why Do You Need A Good Credit Score To Rent An Apartment

Nick Meyer, a certified financial professional and financial influencer, shared with us the relationship between credit and the apartment applciation process.

“Your credit score acts as your financial report card: it’s a number that tells banks, landlords, and even employers how likely you are to pay off your debts. The lower this number is, the less likely landlords are to approve your rental applications.”

So what should you do if you have a low score?

Why Do Landlords And Property Managers Perform Credit Checks

Landlords perform credit checks on potential renters to ensure the renter can meet the financial needs of renting the available unit. Credit checks give landlords an insight into the renters financial history and provide security that the rent will be paid in full and on time. Negative marks on your credit, or a low credit score could impact the landlords decision to accept your rental application.

You May Like: How Often Does Discover Report To Credit Bureaus

Tips For Managing Your Savings

- To rent or to buy? Sometimes its not worth it to jump right into homeownership. Understand whether continuing to rent is the right choice for you using SmartAssets rent vs. buy calculator. No matter what your homeownership status, it might be useful to learn about the ways that the recent Coronavirus Aid, Relief and Economic Stablility Act passed by the government directly and indirectly protects homeowners and renters.

- Consulting an expert could save you time and money in the long run. If youre looking for guidance and are able to do so, it might be useful to enlist the help of an expert advisor. Finding the right financial advisor who fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in five minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

Questions about our study? Contact us at

Be Prepared To Pay More Up Front

Whether you’re able to get around the credit check altogether or you get approved for an apartment despite your credit history, expect to pay more money upfront. You might be required to pay a higher security deposit or between one and three months worth of rent to move into your new apartment.

If you dont have the best credit and expect to move in the near future, start setting some money aside now so you can cover the higher upfront costs.

Also Check: Affirm Credit Score Needed For Approval

How To Rent An Apartment With Bad Credit But High Income

Renting with bad credit is never easy, but its much easier for people with a high income. Youll want to show proof of your salary and a recommendation from your employer. Plus, youll want to have a clear rental history of paying your monthly rent on time. You should also have the extra money in your savings to show you have reserve funds and be able to offer a larger deposit if needed. And you may also want to find a cosigner with good credit.

If you have an issue with debt, try to spend time paying it down before moving if possible. People with high income and high debt, especially credit card debt, will still have some explaining to do. After all, it doesnt matter how much money you make if 75% of it is going toward credit card payments.

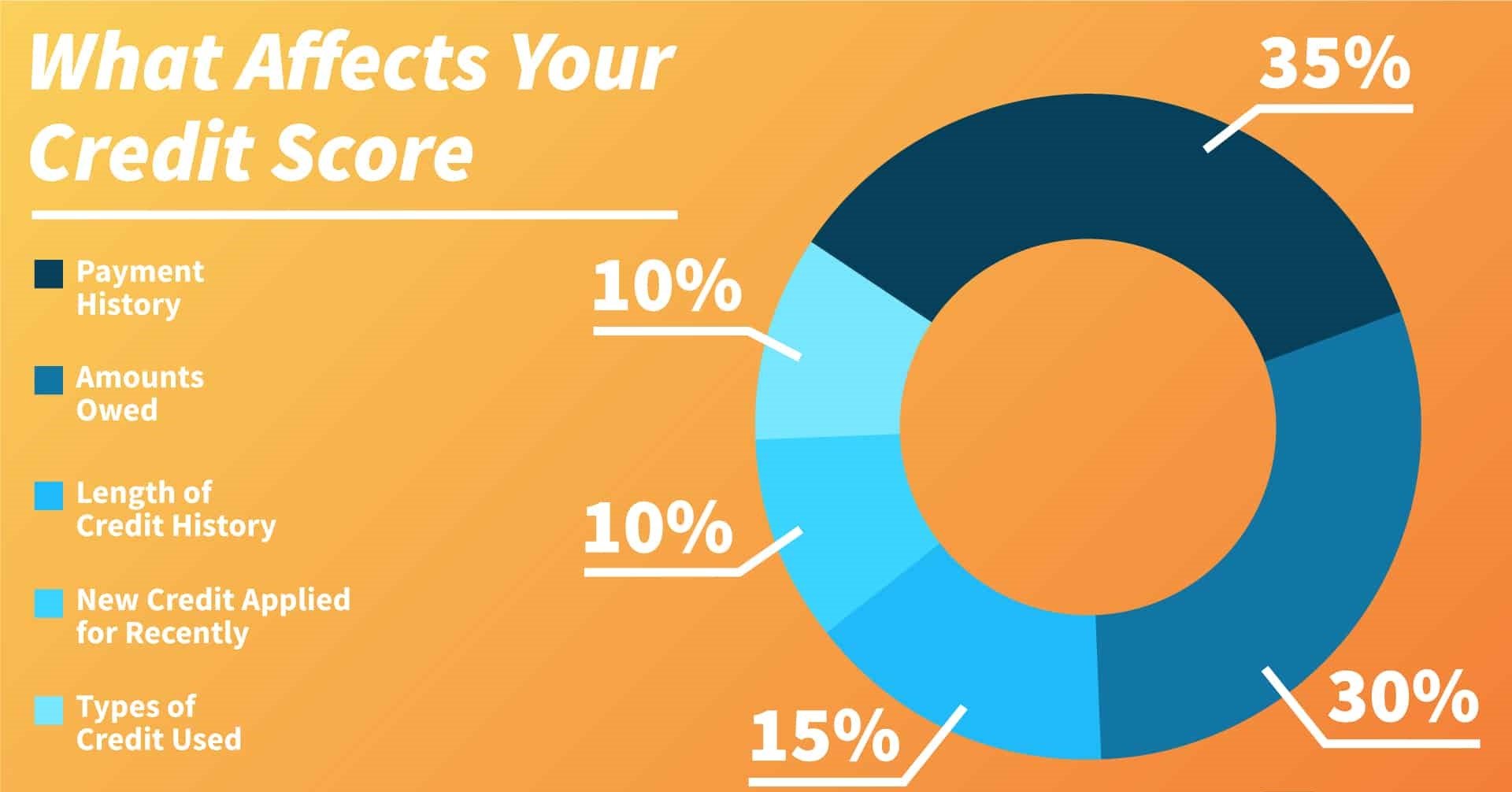

How Do Landlord Hard Inquiries Affect My Credit Score

Hard inquiries can comprise as much as 10 percent of your credit score. This means that with every apartment for which you apply and, therefore, with every landlord who checks your credit score you put your credit score at risk of decreasing by a few points. A negligible change in your credit score isnt in and of itself a cause for concern, but if too many hard inquiries appear on your credit score in a short timeframe, your credit report may deter potential lenders landlords included from working with you. An excess of hard inquiries may suggest that youre seeking out loans left and right because you have no money.

Recommended Reading: Can Someone Check Your Credit Without Permission

What Is The Minimum Credit Score To Rent An Apt

In general, if your credit score is 660 or higher, youll have a good chance of securing a rental. If your credit score is below average, there are still steps you can take to position yourself as a desirable tenant. Below, well dig into how you can bolster your rental application, even when your credit score is low.

What Can A Landlord See On A Credit Check

Your landlord can pull your full credit report and see everything it contains, including unpaid accounts, late payments, collections actions, bankruptcies, and your overall credit score. A landlord will be most interested in things that could make you an unreliable or problematic tenant, such as delinquencies, criminal records, and bankruptcies.

Recommended Reading: What Credit Score Do I Need To Get Care Credit

What Landlords May Look For On Credit Reports

In addition to checking credit scores, landlords also might check a potential tenantâs credit reports. Thatâs because credit reports can provide a more complete picture of the applicantâs financial history.

âMost landlords understand that a comprehensive credit report is more important than a credit score because itâs a better indicator of a tenantâs payment history,â Fluegge says. âOne bad hospital bill or a case of identity theft can send a credit score plummeting. But if thatâs the only blemish in a long credit history, the risk is minimized.â

Here are some of the things landlords might look for on a credit report:

- Payment history: Prospective landlords usually look at your payment history from the past 24 months, according to Fluegge. âIf landlords can see that a tenant has been consistently paying down their debt, itâs a strong sign that they are responsible enough to pay rent on time every month,â he says.

- Rental history: Some credit bureaus may include rental history on their credit reports. That can help landlords predict whether applicants will pay rent on time.

- Collection items and public records: âThe things most likely to be deal breakers are usually evictions, unpaid utilities and bankruptcy,â says real estate investor Gabby Wallace. âMost managers are more understanding of debt like student loans, medical bills or credit card debt.â

Its Not Just When Youre Renting

What credit score do you need to rent an apartment? Consider that even when youre not about to rent or a buy a home.

We tend to think more about credit scores when were facing a big financial event: renting a home or applying for a mortgage, credit card or loan. Its good if you can keep your score front and center whenever you make a purchase or payment.

Thats because a low score can cost you serious amounts of money over your lifetime. One estimate reckons the average cash difference between living a life with excellent credit and one with poor credit is $200,000.

And the effect of low credit can dog you in other ways: by closing off options and opportunities that are open to others. So dont forget your score, even when you dont immediately need it.

Read Also: Does Paypal Report To The Credit Bureaus

What Do Landlords Look For In A Credit Check

Timely rent payment is one of a landlord’s biggest concerns. So, to better evaluate which applicants are most likely to pay on time, landlords may use credit information to screen tenants. If you’re wondering about the credit information you’ll need for your next rental, here’s what you need to know.

Tenant credit checks are different from traditional lending credit checks that measure your creditworthinessor how risky of a borrower you are. Landlords focus more on your actual credit information rather than deciding rental agreements based on your credit score alone.

When credit scores are considered as part of your overall credit information, a score above 670on a FICO® Score range of 300 to 850generally indicates good creditworthiness. However, you shouldn’t focus on a specific credit score number. The cutoff can vary depending on the apartment, your local rental market, your income, and the rent. As a reminder, your FICO Score does not consider your income in its calculation, so that’s something the landlord will factor into their decision separately.

A credit score below 670 doesn’t automatically mean your application will be denied, but a landlord may take a closer look at your credit details if your score is in the mid-600s and below. In a competitive rental market, the higher your credit score, the better.

What Are No Credit Check Apartments

No credit check apartments are rentals that do not require a credit check to be approved for leasing. These types of rentals are usually not offered for upscale or luxury buildings, and are typically listed by private landlords looking to fill a vacancy immediately. No credit check apartments can be more risky to lease and have been known to be indicative of common rental scams. If youre looking at no credit check apartments, be sure to verify the listing through an in-person tour, virtual tour, or verified photos. If you have a low credit score, no credit check apartments are not your only option. Here are some tips for applying for a rental with low credit.

Also Check: Paypal Credit Now Reporting To Credit Bureaus

No One Has Just A Single Credit Score

An applicant’s credit score is not a single number. Depending on where you get the score, an applicant could have three different scores representing their credit. This occurs because all applicants’ financial activity is not always reported to all three credit bureaus. Also, the timing of reporting this information to each bureau may vary. For this reason, an applicant’s score can be different depending on where you got it. Rest assured, all the sources will have moderately similar scores.An excellent credit score for renting is called a ResidentScore, and it comes from TransUnion. The ResidentScore is one of the only credit scores designed exclusively for the rental process and not used for other purposes.

What Goes Into A Rental Credit Check

Landlords look at more than just your credit score to evaluate your rental applicationthat’s if they factor in your credit score at all. Some landlords only look at your actual credit data, focusing on your payment history instead. Regardless of your credit history, landlords consider the ratio of your monthly income to monthly rent to ensure you can afford the rent payments.

Some landlords use tenant screening services or rental-specific credit scores to approve applicants. Landlords may even opt for a service that automatically screens tenants based on certain risk factors like debt-to-income ratio, number of bankruptcies or delinquent accounts, and criminal history.

Your credit doesn’t have to be spotless to get approved for an apartment. A couple of late payments or high credit card balances may not be grounds for rejection. However, having an eviction in your record puts you at a higher risk of having your application rejected, especially if you still have an unpaid balance related to the eviction. You might also find it harder to get approved if you have other serious delinquencies like loan default, bankruptcy, foreclosure, repossession, or charge-offs.

Read Also: Does Wells Fargo Business Credit Card Report To Bureaus

What Else Do Landlords Check

In addition to looking at your numerical credit score, your landlord might also check the individual items in your credit history to obtain a more complete picture of how you manage your finances. In particular, they might check whether you have a history of evictions, unpaid utility bills, or bankruptcies.

Tenant screening services, such as the ones offered by Experian, Equifax, and TransUnion, sometimes also provide the following information:

- Employment history

- Criminal history

Quick Tips For Improving Your Credit Score

A surefire way to increase your chances of renting with a low credit score is to improve it. That said, it’s not something that you can do overnight.

This is especially true for those with a long-standing history of non-payment or late payments of debts. It can take years to fully repair a credit score. However, all hope is not lost.

There are some things that you can do in the short term to improve your credit score. Here are some quick tips to raise your credit score.

- Don’t Close Old Cards: This is often the biggest mistake that people make when trying to improve their credit score. Though you may have older cards that you simply do not use, it’s better to keep them open. Older cards contribute to the average age of your credit. So, the older your accounts are, the better.

- Pay What You Can…Often: It’s unlikely that you’ll be able to pay all your debts off at once. Paying as much as you can in small increments and meeting the minimum monthly payment for each of your cards is essential.

- If youre able to successfully negotiate a higher credit limit with your card issuer, the percentage of credit used can go down significantly. As this is an important factor in your credit score, it can be the one change you need!

- Increase Your Credit: Another counterintuitive method for improving your credit score, diversifying your credit can improve your score. A mix of loans and credit cards are ideal. Even opening another credit card can have a positive impact!

Also Check: Is Opensky Reliable

Living With A Roommate

To reduce your expenses, consider sharing the cost of rent, utilities and other expenses with one or more roommates.

If you decide to live with someone else, discuss your living arrangements and shared financial responsibilities.

For example, figure out the following:

- how youll divide rent

- how youll divide the security deposit

- if youll share bills and expenses or pay for them separately

- what each of you will buy for the rental unit

Make sure you understand what youre responsible for.

If 2 or more tenants sign the same rental agreement, each is equally responsible for payments and damages. If each of you sign separate rental agreements, youre only responsible for whats in your own written agreement.

If your name alone is on the utility bills, you must pay them on time. Missing a payment for your rent or utilities could hurt your credit score.

Tenant and landlord rights and responsibilities vary across the country.

- lawn maintenance

Pay A Larger Initial Deposit Or Prepay Rent

Offering to pay a larger security deposit or paying rent in advance demonstrates to the landlord that you are serious about making a commitment to stay and pay. This ensures the landlord would have cash on hand if you left or it became necessary to evict you. It also shows you are serious about avoiding that predicament.

Also, offering to prepay rent shows a good-faith effort. A landlord would probably prefer a larger deposit first, so you might offer to prepay three months rent in addition. If paying more upfront lands you a good apartment and keeps you independent, it might be worth a temporary financial hardship.

Also Check: How To Get Repos Off Your Credit