What Is The Difference Between A Hard Inquiry And Soft Inquiry

There are two types of inquiries that lenders may use when running your credit. A hard inquiry results in a permanent record on your credit score. A soft inquiry, on the other hand, does not affect your credit score. Applying for insurance policies counts as a soft inquiry your credit score is reviewed but is not impacted by the act of getting auto insurance quotes.

What Is A Credit

Before we answer this question, it’s important to note that you will never be denied a GEICO policy solely because of your credit-based insurance score.

Like your credit score , a credit-based insurance score is a numerical summary of information on your credit report. However, credit-based insurance scores do not look at the amount of credit you carry or other indicators of income. These scores only consider information that has shown a correlation in predicting possible future claims losses. This information can be things like payment history, collections, length of credit history, and credit utilization.

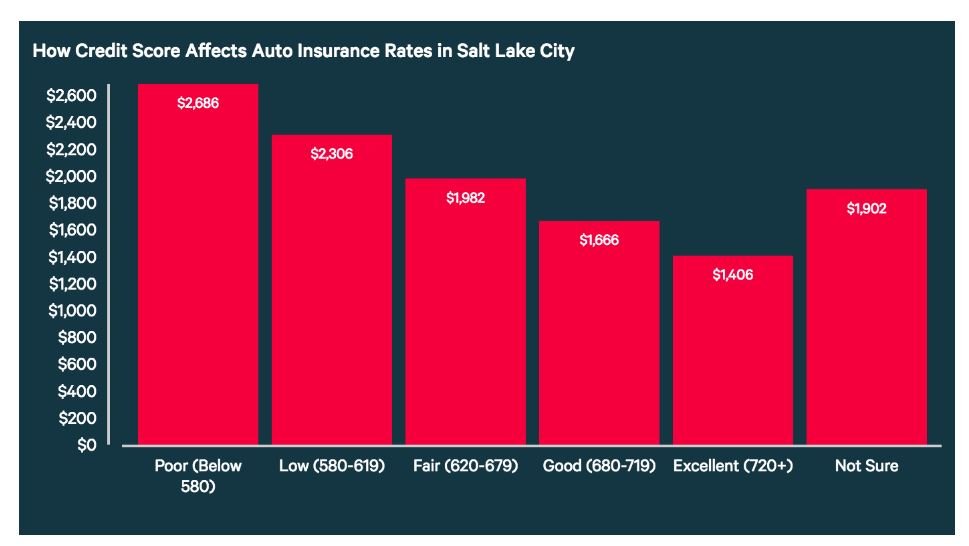

How Does Credit Affect Your Auto Insurance

Did you know that you can save money on auto insurance rates if your credit is excellent or good? Watch this video on how credit scores impact auto insurance rates.

Credit can impact your insurance rates in most states. According to the National Association of Insurance Commissioners , insurers will look at proprietary credit-based insurance scores to determine if a household will file a claim. Those with a lot of debt or a lot of payment defaults will pay a higher premium than people with a better credit history. Not all companies use credit as a rating factor.

Not paying your car insurance can get you in big trouble with law enforcement and the DMV. Make sure you do your best to keep your coverage from lapsing.

If your policy has already lapsed, start shopping around for coverage right away.

Does getting car insurance quotes affect credit score? Not at all. Find a low-cost option by comparing car insurance rates online for free, and then apply for the best product so that you have protection.

Read Also: Does Carmax Work With Poor Credit

Get Your Fico Score For Free

While you can’t check your credit-based insurance scores, Experian offers you free access to your FICO® Score based on your Experian credit report. You can monitor your score to see how your actions help or hurt your credit. And, if you notice a large increase in your score, you may want to see if you can now qualify for lower insurance rates.

How To Improve Your Credit Score Before Applying For Car Insurance

Because credit-based insurance scores are largely based on the same underlying information that as other types of credit scores, similar actions can help you improve all your credit scores. These include:

- Pay bills on time and in full. Missing payments, having accounts sent to collections and filing for bankruptcy can all hurt your credit scores. On the flip side, making on-time payments can help your scores.

- Pay down debts. Having outstanding debts can hurt your credit scores, as can using a large portion of your available credit limit on your credit cards. Having low credit card balances and then paying your bill in full each month could help your score and save you money on interest.

Over time, your credit scores may also improve as the length of your credit history increases. You may also benefit, a little, from having experience with both revolving and installment accounts in your credit history. Additionally, be mindful of applying for new credit as the resulting hard inquiries can temporarily hurt your scores.

Don’t Miss: How To Unlock My Experian Account

How Does Nationwide Protect Customer Information

Nationwide has many safeguards in place to ensure the confidential and responsible handling of your personal information.

- The only employees who see your information are those who need it for legitimate business purposes to provide products or services to you.

No Nationwide associate will ever view your actual credit report

Does Paying Car Insurance Build Your Credit History

Sometimes it can seem like your takes into account pretty much everything you do with money, from your credit usage to the age of your credit, to your types of credit. With all of these factors, it’s worth asking-does paying your car insurance build your credit history?

The short answer is no. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt collection reports. Debt collection reports do appear on your credit report and can be read by future lenders.

Don’t Miss: Does Usaa Do A Hard Pull For Credit Increase

Concerns About The Vulnerable

The Insurance Brokers Association of Ontario issued a statement in February about the possibility of using credit scores in auto policies, noting the use is a source of controversy.

While insurers say it helps them to judge risk because a good credit score indicates someone is more responsible, up to date on repairs and does regular maintenance, reducing the chance of being in an accident, the association has concerns.

“With the use of credit scoring on the auto product, those consumers who are most vulnerable in society could be further disadvantaged,” it said, noting the practice could “negatively impact the availability and price offered to those who can least afford insurance in the first place.”

It identified those as people with low or no credit scores, retired seniors, newcomers to Canada, unemployed single income families and small business owners using lines of credit.

Dean, with the Insurance Bureau of Canada, said a number of insurance companies have agreed to follow the organizations’s code of conduct on using credit information.

It includes the option of a customer with a low credit score asking their insurer to take “extraordinary life circumstances” into account so the person isn’t unduly penalized by a low credit score. It’s up to the customer to make the request and provide documentation backing up their claim. The code identifies an extraordinary life event as “identity theft or a catastrophic event as declared by provincial authorities.”

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

You May Like: Ccb Ppc Credit Inquiry

Does Your Credit Affect Insurance Rates

While your car insurance policy will never impact your credit score, the opposite may be true. According to the National Association of Insurance Commissioners, 95% of auto insurance carriers use what’s called a to calculate premiums in states where the practice is allowed.

The score is based on your credit history but isn’t the same as the traditional FICO® Score that lenders use, though they consider many of the same factors.

States that prohibit or limit the practice of using credit information in insurance include California, Hawaii, Maryland, Michigan and Massachusetts. Additionally, Washington state has banned insurance carriers from using credit scores to set policy premiums through 2024, and Utah and Oregon have prohibited using credit histories for setting rates in certain situations.

Even in states where there aren’t such limitations, insurance companies typically can’t use a credit-based insurance score as the sole basis for increasing rates or for denying, canceling or refusing to renew a policy.

As a result, having good credit can help when you’re shopping for a new insurance policy or when your insurance company renews your policy. The opposite is also true. While a low credit score alone may not be enough to cause a premium hike, it can have that effect if there are other factors at play.

How An Insurance Company Calculates Premiums

Premiums are the amount you pay to buy insurance.

When determining how much you’ll pay for premiums, insurance companies may consider factors such as:

- your age

- how much you use your car

- your driving record

- the type of coverage you choose

- the amount of your deductible

A deductible is the amount of your claim you agree to pay before your insurance company pays the rest.

Don’t Miss: What Is Leasingdesk

Why Does Credit Affect Car Insurance Rates

When you apply for car insurance, the company checks your credit rating, explains John Espenschied, owner of Insurance Brokers Group and an insurance expert with over 20 years in the industry. If your score is low or if there is an indication that you might be living beyond your means, it may affect whether you get coverage at all.

Like your driving record, your credit rating is a helpful tool for car insurance companies to use when assessing your risk as a driver. Yes, most car insurance companies use credit scores as one of many factors affecting car insurance premiums, affirms Adrian Mak, CEO of AdvisorSmith. Other factors considered include driving history, claims history, ZIP code, vehicle type and many other factors.

Analysis of car crash data shows that credit scores can accurately predict the risk that a policyholder will crash or file a claim against a policy, Mak adds. Drivers with higher credit scores tend to get into fewer crashes and file fewer claims than those with lower scores.

Therefore, the drivers who have higher credit scores are generally perceived as lower risk and are offered lower rates than drivers with lower credit scores.

How Does Your Credit Score Affect Your Insurance Rate

The types of credit scores that lenders and credit card issuers use to evaluate your creditworthiness won’t affect your insurance rates. These scores, including many FICO® Scores and VantageScore® credit scores, are created to help creditors predict the likelihood that a credit applicant will miss a payment. They might impact your ability to get a loan or the interest rate you’ll receive, but they’re not used for insurance purposes.

FICO, LexisNexis and other companies also create . Similar to general credit scores, credit-based insurance scores are largely based on your credit report from one of the major credit bureausExperian, TransUnion or Equifax. However, credit-based insurance scores are generally built to help insurance companies understand the likelihood that someone will file insurance claims that cost the company more than it collects in premiums.

Factors that influence your credit scores can also affect your credit-based insurance scores. These include whether you made past payments on time and your current debt balances. If you have poor credit, you may have a harder time getting approved for an auto insurance policy or may have to pay more in premiums.

You May Like: The Lowest Fico Credit Score Is Brainly

If You Don’t Cancel Your Car Insurance Properly It Could Affect Your Credit Score

Cancelling your car insurance policy shouldn’t affect your credit score, whether you pay monthly or annually. As long as you cancel it properly.

If you pay monthly, you can’t just cancel your direct debit. You’ll need to tell your insurer you want to cancel and pay any admin fees.

If you don’t cancel your policy properly, you’ll get a bunch of missed payments on your credit record. And because pay-monthly car insurance is a credit agreement, it could be bad news for your credit score.

The Problem With Uninsured Drivers

You share the road with an estimated 30 million uninsured drivers, according to the Insurance Research Council. Although every state except New Hampshire mandates that drivers have insurance coverage, some slip through the net of state enforcement by buying coverage to register a car, then letting it lapse.

Its easy to demonize those consumers by assuming that they choose not to buy a product they can easily afford. There are individuals out there who like to live on the edge and drive without insurance, says an Allstate Web video.

But insurance credit scoring, which links customers premium prices to their creditworthiness, raises the cost of insurance for some low-income drivers and might make it unaffordable to them. In fact, research by the Consumer Federation of America found a strong correlation between state poverty rates and the percentage of uninsured drivers in a given state, which ranges from 4 percent in Massachusetts to 26 percent in Oklahoma.

Whats worse, our own data show that when the uninsured try to get back on track and buy coverage, insurers tack on an additional price penalty. Our single policyholders who had a 60-day lapse in their coverage got socked with a $207 higher premium on average nationally. The penalty varied by state and ranged from zero in California to $834 per year in Michigan.

Our single policyholders who had a 60-day lapse in their coverage got socked with a $207 higher premium on average nationally.

Highest: Michigan

Recommended Reading: Check Credit Score Without Ssn

We Are Cancelling Your Policy And Not Giving You Any Notice

Required notice will vary by state but your insurer must give you written notice of a cancellation or non-renewal and the reason why. For instance, Texas requires 10 days’ notice, while Massachusetts gives you 20 days. If you feel the cancellation is based on inaccurate information, you have the right to appeal.

If you experience a cancellation, look for a new policy immediately

“A lapse of just one day can result in a penalty, and a lapse will typically cause your rates to go up,” says Penny Gusner, consumer analyst with Insure.com.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Don’t Miss: Wells Fargo Authorized User Credit Report

Ways To Fight Unfair Pricing

Request an extraordinary life circumstances exception if you receive an adverse action. You should get one of those notices if credit scoring causes a higher premium, a reduction in coverage limits, a cancellation or nonrenewal of your policy, or a denial of coverage to begin with.

Shop at the companies that charged our model drivers with good and/or poor credit scores the lowest premiums. Check our state map for details

Monitor your credit reports to make sure theyre accurate, and ask to be rescored if youve found and corrected errors in your file. Thats important, because the information that determines your insurance credit score is plucked from them.Get your free yearly report from all three credit bureaus at annualcreditreport.com.

Use credit that insurer scoring models favor: national bank-issued credit cards .

Keep credit-card balances in check the higher the balance, the more points you lose on your score

Avoid certain types of credit that insurance company credit-scoring models penalize you for: department-store credit cards, instant credit offered by stores to move big-ticket items credit accounts from your local tire dealer, auto-parts store, or service station and finance-company credit, including retailer credit cards.

Try not to add new credit. Scoring systems look askance at those who open new credit accounts frequently, and they can penalize you for just shopping around for credit because credit inquiries appear on your credit report.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: How To Boost My Credit Score 50 Points

Its Not Your Actual Credit Score

Before we get further into this question, its important to note that car insurance companies arent looking at your real credit score. They dont so much care about your numerical FICO or VantageScore.

Instead, theyre using your credit report information to create whats called a credit-based insurance score. It looks at much of the same information. A history of late payments and a high amount of debt correlate with more auto insurance claims. However, your credit-based insurance score is likely weighted a bit differently than your FICO score. And you typically wont see the numerical score an insurance company uses to determine your rates.

What Is A Credit Score

Equifax explains that a credit score is a three-digit number indicating the likelihood that you will pay your bills and do so on time. The three main credit bureaus are Equifax, TransUnion, and Experian. These bureaus calculate your credit score based on your credit report, which includes:

- Your payment history

- Your debt

- The length of your credit history

Different credit scoring models use different sets of data. Some models include your income to calculate credit scores, and others include how much of your available credit you use.

Don’t Miss: Can A Closed Collection Account Be Reopened

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.