How Does Your Credit Score Affect Your Car Insurance Premiums

Car insurance companies use an Auto Insurance Score to determine your insurance premiums and rates. Your AIS is meant to indicate the likelihood of you getting into a car accident and filing a claim. The higher the risk, the higher your insurance rate and premium.

Your AIS is made up of three factors: your driving record, your auto claims history and your credit score. It surprises most people to know that the credit score is given the highest priority in the calculation. However, multiple studies have found that theres a correlation between driving risk and credit history. In particular, insurers are looking to see how much financial liability the consumer has taken on in the past and how theyve managed it.

So, a low credit score can cost you more in buying a car, and it can drive your insurance premium up as well. In fact, some car insurance companies may deny you coverage if your credit score is too low. Note that not all car insurers use AIS, but the majority do.

Not All Credit Reporting Agencies Are Created Equal

The first thing you need to bear in mind is that there are only two credit reporting agencies in Canada, TransUnion, and Equifax.

Each of these companies are private organizations and use different credit scoring models to determine the credit score of a consumer.

You could have a 720 with TransUnion but a 600 with Equifax . So, as a rule, you should sign up for with both agencies it is free, and this way, you know precisely where you stand, at least for the most part.

While you can access your credit score with these credit reporting agencies, different lenders will also use different scoring models, so these scores are only a ballpark figure at best.

Whats The Minimum Credit Score Needed To Buy A Car At Carmax

Carmax hasnt set a universal minimum credit score requirement for car loans. Its not the only company that operates with no such restrictions, too. There are no universally accepted industry standards that stipulate the minimum credit score individuals need to qualify for a car loan. Each auto lender can come up with its own policies for evaluating your creditworthiness.

Does the lack of minimum credit score requirements mean that anyone can qualify for a Carmax Auto Finance Loan? Well, not exactly.

Even though Carmax doesnt have a minimum credit score requirement, your credit score will determine whether you qualify for a loan and the terms you get if you do. The credit score needed to buy a car at Carmax goes through an evaluation. The car retailer evaluates your eligibility for financing based on four factors:

- Your credit history

- How much you can afford to pay upfront as a downpayment

- The car you want .

The better you perform on these four merits, the higher your chances of qualifying for approval, friendly loan terms, and a better interest rate.

If wondering should you get a Carmax pre approval the answer is yes. But since todays discussion is all about credit scores, were only interested in one of these four factors: your credit history. In a nutshell, the higher that you rank on the credit score tiers, the better the deal youll get.

Heres an in-depth look at how CAF financing works for buyers in the various credit tiers:

Recommended Reading: Credit Report Serious Delinquency

Why Are Used Cars Suddenly So Expensive

Now is a very bad time to buy a car, especially if your credit score is low. While Mays Consumer Price Index showed that prices were up 5% overall from a year earlier, about of that increase was due to the price of used cars. Used car prices rose 30% in the 12 months leading up to May.

According to Edmunds, the average used car price hit $26,500 in June, up 27% from a year ago, while the average new car transaction price is $41,000, up 5%, virtually the same as the average sticker price of $41,500.

A Car Loan Will Also Help Your Score

Its worth noting that once you are finally approved for a car loan, you can leverage it to build your score even more.

The biggest influence on your credit score is your payment history. When you make your car payment on time every month, your lender will report it to the three major credit bureaus .

Car loans also boost your score by helping with your credit mix. If the only type of credit you currently have is credit cards , adding an installment loan will help improve your score.

As you continue to strengthen your credit, it may make sense to refinance your auto loan in the future when you qualify for better rates.

Read Also: Does Applying For Paypal Credit Affect Credit Score

Where To Get Financing

While you can accept the financing terms and the interest rate on a car loan from the dealership, you donât have to. It pays to shop around and look at multiple options for auto financing. Getting a car loan approved by a bank or credit union before going into a dealership can help you negotiate more favorable terms and a lower interest rate with a dealer.

If one lender denies your loan application, donât be discouraged. Keep looking around and applying with other lenders. They might approve you for a car loan and offer better terms and a lower interest rate than you thought you could get. Keep track of your credit applications, though. Lenders will perform a hard inquiry on your credit report when you apply for financing. Having too many hard inquiries on your credit reports in a short time can hurt your score. Sometimes tabling your auto financing for a few months while you work on repairing your credit and improving your credit score can help you qualify for better auto financing options.

Shop Around For A Preapproval

Each lender can look at your credit history in slightly different ways and offer you a different loan APR. Thats why its best to shop around for any type of loan you want. Dont rely on a dealership to do this for you. As the middleman, car dealers can raise your APR up to two percentage points. Instead, look at the best auto loans for bad credit and especially consider applying at your local credit union.

| Lender | |

|---|---|

| $7,500 or more | Refinance loans |

It does not hurt your credit to apply to multiple lenders the major credit bureaus allow consumers a two-week window to rate-shop. If you do all loan applications within 14 days, your credit isnt harmed any more than it is when you apply for one loan.

Borrower Beware:

Also Check: Opensky Payment Due Date

Consider Bringing Your Own Financing

While dealerships do provide financing, checking with your local bank or credit union is a good idea, too. You can even compare car loan rates online. Compare quotes from the top potential lenders and, once youve settled on your top choice, you can get preapproved to make the process run smoothly,

Keep in mind that getting financing results in a hard pull on your credit. It helps to cluster applications closely together when rate-shopping for a loan.

If you end up with a loan with a higher rate than you wanted, keep an eye on your scores. You may be able to refinance your auto loan at a lower rate after youve made on-time payments for six to 12 months.

How To Get A Car Loan With Bad Credit

If you have bad credit and don’t have time to wait for it to improve, getting a car loan is still possible. In fact, there are some lenders that work specifically with people with lower credit scores. Once you know your credit score, start speaking with potential lenders to see which ones might have options for someone in your credit range.

In addition to shopping around for deals, make sure to have other aspects of your application well-organized so you can compensate for a lower credit score. Here are a few ways you can prepare for financing a car with bad credit:

Recommended Reading: Credit Score With Itin Number

Demand Gives Car Sellers The Upper Hand

With high demand and low supply, car dealers hold more control over prices and loan rates. Simply put, if you want a car right now, youre going to have to pay more for it no matter where you shop. With the world supply chain still stretched thin and demand remaining high, this trend is likely to continue into 2022.

How Do My Credit Scores Affect My Car Loan

Your credit scores can affect your ability to get a car loan and the interest rate and terms you may be offered.

Before you begin car loan shopping, its generally a good idea to check your credit scores and understand how they can influence the terms you get from auto lenders for a new- or used-car loan. This is also an opportunity to check your credit reports for errors, which could bring your credit scores down.

You May Like: Does Seventh Avenue Report To Credit Bureaus

What Does That Mean For You

It means that although different lenders use different measures, people with exceptional or at least good credit scores may qualify for lower rates, while people with lower credit scores will often qualify only for higher rates.

High Credit Score Low Interest Rate

Average Credit Score Medium Interest Rate

Low Credit Score High Interest Rate

How To Get A Bad Credit Car Loan In 2022

Home MediaUp to 723.99%

- Financing for customers with bad, limited, or no credit

- Offers special military rates

Up to 842.49%Up to 723.99%

- Great for customers with limited/no credit

- Offers special military rates

When you have bad credit, trying to find a car loan to purchase a vehicle can be stressful. Bad credit car loans typically come with higher interest rates and may require large down payments. However, there are options available when it comes to auto loan providers that specialize in bad credit car loans.

In this article, we at the Home Media reviews team will explain the loan application process and provide you with tips to help increase your chances of getting approved. Based on our research, well also recommend several auto lenders that offer services to people with bad credit, including some that offer the best auto loan rates of 2022.

Recommended Reading: Usaa Experian Credit Monitoring

Used Cars Credit Score

Used cars have exploded in popularity over the last several years as automakers make vehicles that last longer and retain value. This has spawned a whole new area of sales for dealers, the certified pre-owned vehicle.

Once a gimmick, many dealers now offer certified pre-owned vehicles as a way to capitalize on the longevity most cars now have. This means that you can get a reliable vehicle, for less money than a new car, and that likely still has a manufacturers warranty.

You can get a used vehicle more easily with a lower credit score because a finance company will not be able to recoup as much value on that vehicle if you fail to pay. To compensate for this, lower credit score individuals will almost always pay a higher interest rate. In fact, subprime borrowers can expect to pay a rate thats about 10% higher than higher credit score buyers.

How Does Your Credit Score Affect Your Auto Loan Rates

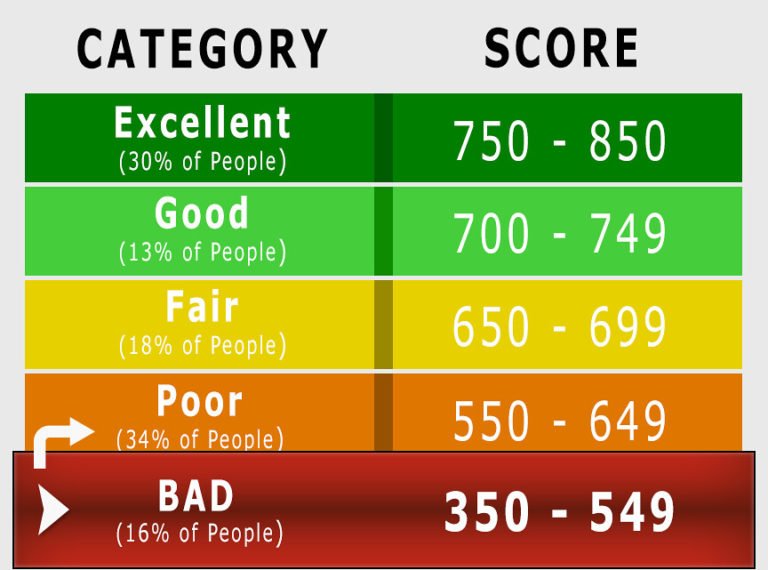

Depending on what credit score you have, youll fall into a credit category ranging from deep subprime to super prime . As you climb up in these categories, you can be granted better interest rates and loan terms.

Lets look at an example. Currently, the interest rate for a new auto loan for someone with a deep subprime credit score is 13.97 percent. In comparison, someone with a super prime credit score can expect an interest rate of 3.24 percent for a new car. If both of these people take out a seven-year car loan on an $18,000 car, the deep subprime lender will pay $10,310 in interest over the life of their loan. However, the super prime consumer will pay only $2,142. In this scenario, having a bad credit score costs the individual more than 4.5 times in interest.

Don’t Miss: When Will A Repo Show On Your Credit

How To Improve Your Credit Score Before Applying For An Auto Loan

As mentioned, the higher your credit score, the better chances you’ll be approved for a loan with a low interest rate and preferable terms. Improving your credit score before applying for an auto loan can help you save money over the life of your loan, and could make a difference in what car you end up being able to buy.

First, figure out where your credit stands. You can get a free from Experian to review. Look for areas where you can improveespecially those that could help you more quickly if you are trying to buy a new car soon.

The following are actions you can take to boost your credit:

Credit Score Tips For Car Buyers

There are certain steps that you can take to prep your credit score for car shopping. And there are ways to overcome a low score once you start. Either method can help you save money as well as get behind the wheel sooner.

Heres what we recommend doing:

The best way to get your credit score in car-buying shape is to sign up for a free WalletHub account. Well perform a personalized credit analysis, telling you what to fix, how to fix it and how long it will take.

Recommended Reading: How Long Repossession Stay On Credit Report

What Is The Lowest Credit Score To Buy A Car

Your credit score is always important when applying for new loans, but when it comes to buying a car, there is no minimum score needed to be approved. Having a higher score may improve your chances of getting a loan with low rates and more favorable terms, but it’s still possible to get an auto loan with a less-than-perfect score.

Read on to learn what scores are used by auto lenders and how you can improve your chances of financing a car even if you don’t have perfect credit.

Car Loan Credit Score Faqs

Can I get a car with a 500 credit score?

You could be able to get a bad credit car loan with a 500 credit score. Having a high down payment, getting a good deal on the car and having a cosigner can all improve your likelihood of being approved.

What is a good credit score to buy a car?

Experian reports that nearly 56% of auto loans go to people with a credit score of 661 and above.

What credit score is needed to buy a car without a cosigner?

People with prime credit scores likely dont need an auto loan cosigner.

What is a good credit score for an auto loan?

The higher your credit score, the better the rate youll get for any loan. A credit score above 660 will typically allow you to qualify for an auto loan without a hassle. A credit score of 760 and above will typically allow you to qualify for auto maker special financing that can offer low-APR loans and rebates.

Will a car loan improve my credit score?

Yes, a car loan will improve your credit score if you make the payments on time and in full until you trade in the car, sell it or pay off the loan.

Read Also: Carvana Down Payment Bounced

Get A Shorter Term Loan

A shorter term loan will mean a higher monthly payment, but that pays off over the length of the loan. Thats because a shorter loan will result in paying less in interest. Also, lenders typically offer lower rates for shorter term loans.

Even if the interest rate is the same, the savings are significant: more than $750!

Shop For Car Insurance

Keeping your monthly payment under 10% of your gross income is the most important thing. Thats whats going to keep you from feeling pinched and stretched. Here are some of the top insurance providers on the market today that are operating in your local area. Find the policy that best suits your needs.

If you prefer to work with an agent, can help you save money. If youre an excellent driver, this insurer may be a great option for you. Sign up for Drivewise and earn as much as 25% back for every six months you go without an accident.

Those who have multiple types of insurance may want to look at . You can save big by bundling your auto policy with your renters, homeowners, or condo insurance. Their website makes it easy to get a quick quote to find out if you can save money by switching to them.

Related: Tips for Saving on Your Car Loan

You May Like: How To Remove A Repossession From Your Credit Report