How To Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is Federal law, it explains the type of information that can be reported on your credit report and how long it can stay on your credit report. By law, 7 years is the maximum amount of time it can stay on your credit.

The FCRA says that you have the right to an accurate credit report and due to that, you have the right to dispute errors with the credit bureau.

You can submit a dispute with the credit bureau who provided you with the credit report. You can also go to the credit bureaus website and follow the directions to file a dispute.

If you want to dispute it via mail, youll need to write a letter describing the credit report and submit copies of any proof you have.

The credit bureau investigates your dispute with the information youve provided and theyll ultimately make a decision to remove the item or not.

If youre a member of Credit Karma or other credit monitoring platforms, you can file a dispute directly from their platform.

Ways To Scrub A Collections Stain Off A Credit Report

Your credit scores take a hit if you fall behind on payments to a creditor, and again if an account is sent to the creditors collection department or sold to a third-party collector. You may be able to repair some damage to your scores by resolving a collections account on your credit reports.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent. You may want them off sooner than that unpaid collections always hurt your scores. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

There are a few ways to get a collections account off your credit report, depending on your relationship with the creditor and the account status.

First, do your homework

Get information on the debt from two places: your credit reports and your own records.

You can get a free credit report every 12 months from each of the three major credit reporting bureaus by using AnnualCreditReport.com. Some personal finance websites offer free credit report and score information.

Gather your own records for details on the account, including its age and your payment history.

Between the two, verify these details:

- Account number

- Account status

- The date the debt went delinquent and was never again brought up to date

Once you have the details straight, you can decide which approach works for you.

So How Will My Score Change

If youre able to pay or settle a delinquent collection account and you apply for a loan or credit card with a lender thats using a newer credit scoring system, its possible that your scores are going to be higher than if the collection still had a balance. Keep in mind, however, that your score may not change at all, especially if youve got other negative information on your credit report.

In terms of how much you could see your score climb, it could be as little as a few points or as much as several dozen points. If youve recently paid off a delinquent debt or youre planning to in the near future, you can check your free credit score right here at Credit Sesame to see whether youve gained any points. We use the VantageScore 3.0 model, which is one of the scoring systems that ignores zero dollar collections.

Also Check: Unlock My Experian Credit Report

How Can I Check If My Credit Card Bill Is Delinquent

If you want to know whether your credit card bill is delinquent, log into your online account or call the customer service number on the back of your credit card. Youll be able to check your payment history and confirm whether or not you have any overdue bills. Your lender will also contact youby mail, email, text or mobile alertwhen you are late on a payment, so you may already have received notification of a potential credit card delinquency.

If you discover that your credit card bill is delinquent, make a payment as quickly as possible. If this is your first delinquency and you are less than 30 days late, you may even be able to contact your credit card issuer and get your late fee removed.

What Can You Do If You Have Delinquent Debt

If you have delinquent debt or debt in collections, you are not alone. Still, you should act sooner than later to try to address the situation and begin rebuilding your credit and financial footing. Here are some steps to take.

Delinquent debt can have lasting ill effects on your credit, but if you’re proactive about addressing it , you can move past it and rebuild your financial health.

Recommended Reading: How To Get Credit Report Without Social Security Number

What Is A Delinquent Account

Any account that has not been paid past the due date is considered delinquent. Technically, even a one-day delay in repayment can cause your account to be reported as delinquent.

However, your lenders give you some leeway and do not report the incident immediately. They may try to remind you with an email/phone call. Usually, it is only past 2 late payments that an account is termed delinquent on a consumers credit report.

Pay For Delete Letter

Collection agencies and lenders may remove collection accounts if you negotiate with them. One tool is the pay for delete letter, which is a written request to have negative marks removed in exchange for your payment.

A collection agency is contracted to collect payment on a debt for the original creditor or lender. They receive a percentage of the amount collected. This means that in order for it to be an incentive, a pay for delete letter must offer an amount greater than the collection agency paid for your debt.

Your Pay for Delete letter should include relevant information such as:

- Dates

- Payment amounts

- Negotiation terms

Always make sure to receive the creditors agreement in writing first. If you want to learn more or are looking for a letter template to use, read about how to .

Not all creditors will accept Pay for Delete letters. Most banks and mainstream creditors are not open to negotiation, but small utility bills that go to collection might be more receptive to this strategy.

Also Check: Remove Syncb/ppc From Credit Report

What Is Credit Card Delinquency

When using a credit card, you must pay a certain fraction of your balance each month to stay current on your account. By giving you a line of credit, the credit card issuer is basically providing you with a loan that you must pay down little by little each month. By failing to make required monthly minimum payments, you, as the cardholder, are breaking the terms of your agreement with the lender, and the account becomes delinquent.

Delinquency is divided into levels, which are indicative of how many payments the cardholder has missed. These levels are often referred to in terms of days. For example, the day after you miss your first payment, you are one day delinquent. After you miss your second payment, you are 30 days delinquent, and so on.

Technically, a consumer becomes delinquent after missing a single monthly payment. However, delinquency is not generally reported to the major until two consecutive payments have been missed. Consumers are thus provided a buffer zone and are allowed one misstep without suffering significant repercussions.

How Credit Card Delinquency Works

What Are The Consequences Of Delinquency

Late or insufficient payments can have some unfortunate consequences. The loan provider defines the result of delinquent payments in the loan agreement. That being said, delinquency can spur some fairly substantial consequences depending on what type of loan its associated with, how long the delinquency occurred, and the cause of delinquency.

A delinquent loan may include:

- Late fees

- An increased rate of interest

- Your overdue payment may be sent to credit agencies

- You may be continuously contacted by the lender regarding the payment collection

Lets take a deeper look into the effects of delinquent loan payments.

You May Like: Capital One Reporting Date

How Will Collections Accounts Affect Your Credit

When a collection is added to your credit report, it can affect your score by as much as 110 points and take your credit score from fair to poor. The higher your score, the more points you can lose.

Collections tell potential lenders that you failed to pay back a debt and that you pose the same risk to them if they decide to lend you money.

Example Of A Delinquent Account Credit Card

Mark is a client of XYZ Financial, where he holds a credit card. He uses his credit card regularly for a variety of purchases and typically pays only the minimum payment required each month.

One month, however, Mark forgets to make his payment and is contacted 30 days later by XYZ. He is told by XYZ that his account has become delinquent and that he should promptly make up for the lost payment in order to avoid incurring a negative impact on his credit score. Because the missed payment was unintentional, Mark apologizes for the oversight and promptly makes up for the lost payment.

If Mark had refused to make up the lost payment, XYZ may have had to collect on his debt. To do so, they would have first reported the delinquency to one or more credit reporting agencies. Then they would either seek to collect the debt themselves, or they would rely on a third-party debt collection service. If Mark was unable to pay his outstanding debt, this would have impacted his credit score.

Don’t Miss: Opensky Locked Account

How To Correct Mistakes In Your Credit Report

Both the credit bureau and the business that supplied the information to a credit bureau have to correct information thats wrong or incomplete in your report. And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that information on your report. Heres how.

Federal Credit Report Rules

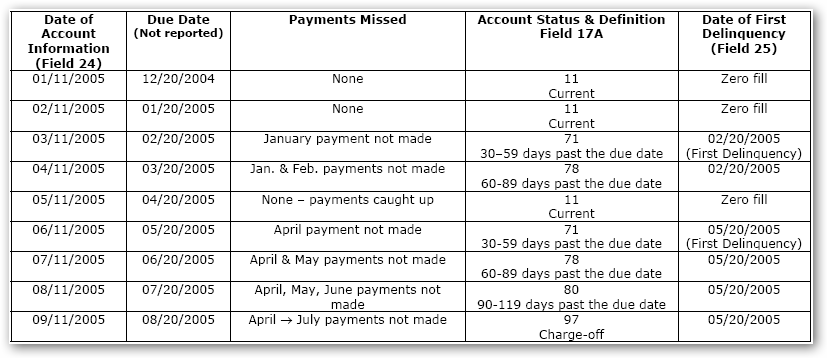

Federal law controls the behavior of credit reporting agencies . The specific law is called the Fair Credit Reporting Act . Under FCRA §605 and , an account in collection will appear on a consumers credit report for up to 7½ years.

To determine when an account will be removed by the CRAs , add 7 years to the date of first delinquency. The date of first delinquency is shown in credit reports. Subsequent activity, such as resolving the debt or one debt collector selling the debt to another collector, is irrelevant to the 7-year rule.

Some debts have a reporting period longer than 7 years, including:

- Tax liens: 10 years if unpaid, or 7 years from the payment date

- Bankruptcy: 10 years from the date of filing

- Perkins student loans: Until paid in full )

- Direct and FFEL loans: 7 years from default or rehabilitation date and 20 U.S.C. §1087e)

- Judgments: 7 years or the debtors state statute of limitations on judgments, whichever is longer

The FCRA 7-year rule is separate from state statutes of limitations for debt issues, which govern how long you are legally responsibly to pay the debt. You can view the statute of limitations for debt for your states, as well as the lifespan of a judgment in your state, at the Bills.com Statute of Limitations Laws by State page.

You May Like: Speedy Cash Change Due Date

Review Your Reports For Mistakes Inaccuracies Items That Shouldn’t Appear

After you get your credit reports, be sure to review them and dispute any inaccurate information you find. If you’re planning to make a big purchase, like a house or a car, or a significant financial commitment, such as refinancing your mortgage, you might want to review information from all three agencies well in advance.

What Will Not Work

A lot of people think filing bankruptcy will remove negative information from your credit report, but thats not true. When your debts are discharged in bankruptcy, the balances will be reported as $0, but the accounts will remain on your credit report.

Also, accounts that were included in your bankruptcy will be noted they belong to it.

It doesnt matter if you closing an account or not, this wont eliminate the delinquency reporting on your credit. If you close an account with a past due balance, your payment will still be reported as delinquent until that payment is caught up.

The only thing closing an account does is keep you from using it.

Paying a delinquent balance doesnt erase the negative entry on your credit report. Once you pay the balance, the account status will change to Current or Ok as long as the account isnt charged off or in collections.

Charge-offs and collection accounts will continue to be reported that way even after you pay the balance.

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Remove Derogatory Remarks From Your Credit Report

You have the right to remove any mistakes from your credit report under the Fair Credit Reporting Act . Under this law, credit bureaus are required to have procedures for investigating mistakes on your report and have a standard for accuracy.

That means you have the right to dispute all incomplete or inaccurate informationon your credit. Dispute forms are available online for each bureau TransUnion, Equifax and Experian. After you dispute an account, creditors have 30-days to respond or it will be removed from your report.

Of course, this doesnt help as much for legitimate derogatoryremarks. If there is a bad mark on your credit report because of late payment ordefault, there are a few things you can try to get it removed.

- Negotiate with the creditor to have it removed or marked as Paid in Satisfaction. This might mean offering to pay the entire balance in full or to get back on a payment plan.

- Ask the original lender to take the account back from collections and mark the account paid if you settle in cash.

- Dispute the derogatory account as a mistake. This can work for old and closed accounts if the lender doesnt take the time to respond to the credit bureau.

A derogatory account on your credit report doesnt have to mean the end of the world but you do need to understand how it affects your credit. Knowing the different types of derogatory remarks can help understand how it will hurt your FICO and how you can get it removed.

Read the Entire Credit Series

What’s In Your Credit Report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

You May Like: Does Paypal Credit Affect Credit

What Is The Fastest Way To Get A Report Of Collection And Late Payments Off A Credit Report

What is the fastest way to get a report of collection and late payments off a credit report?

- Understand that accurate information can’t be removed from your credit report.

- Review the procedures for disputing inaccurate information from your credit report.

- Take the right steps to improve your credit.

There is no reliable way to remove accurate credit information from a credit report. Despite the claims of many organizations offering “,” derogatory items that accurately represent your payment history will stay on your credit report for 7 years. Why? Let us start by looking at the rules for credit reports.

Goodwill Adjustment With Phone Call/letter

You can try for a goodwill adjustment on two fronts: by phone and by mail. Some people try just one or the other, while some try both. Occasionally, people report success from calling and sending multiple letters over time, but we cant verify this.

Whether youre on the phone or writing a letter, remember that youre at fault here and asking forgiveness. Your tone should reflect that. Be polite, thankful, and conscientious. Above all, dont get angry or demanding.

Here are some examples to get you started on the phone or with your goodwill letter. If you get a positive response from the lender, try to also get it in writing.

Phone

You can use this script to start the conversation about removing your late payment. Be sure to have your explanation for why you were late at the ready. If you dont have a perfect payment history, youll have to adjust this slightly to reflect your actual situation.

For credit cards, call the number on the back of your card to speak with the issuer, or check out our listing of backdoor credit card company phone numbers.

Late Payment Goodwill Adjustment Sample Phone Script

Hello, my name is . I recently made a late payment on my account, which was a total accident.

As you can see, my payment history is perfect other than this one mistake. I ended up paying late because . The late payment is also showing up on my credit reports and its done a lot of damage to my credit scores.

That should get the ball rolling in the right direction.

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Know Your Rights With Debt In Collections

Having a debt in collections doesn’t mean you don’t have rights. You shouldn’t suffer harassment as a result of being unable to pay your bill.

The Fair Debt Collection Practices Act outlines your rights, including the following:

- A collection agency cannot contact you at work if you have specifically informed them that your employer will not allow you to receive their calls in the workplace.

- They cannot contact you before 8 a.m. or after 9 p.m.

- Debt collection agencies are strictly prohibited from deceiving you. For example, it would be illegal for them to claim they are a law enforcement agency in order to scare consumers into paying.

Having a debt in collections is overwhelming for anyone, but you should remember that you still have rights. If a debt collection agency violates these rights, you can report them to the Attorney Generals office in your state or the Federal Trade Commission .