An Easy Way To Get Your Credit Report

The three major credit reporting bureaus, TransUnion, Equifax, and Experian, are required to give you a free credit report once a year by federal law. You have to apply for your reports through AnnualCreditReport.com.

While these reports are handy to see what lenders have reported to the credit reporting agencies and find inaccuracies to correct and improve your credit they do not include your actual credit score.

Since you need to know your credit score to get an idea of where you stand when applying for credit, the reports lack of a credit score is problematic. The reporting agency provided a less than an adequate solution offering to sell you your score for a steep price.

In 2007, Credit Karma came on the scene with a better option. They partnered with Equifax and TransUnion to give members ongoing access to their credit reports and credit scores.

Instead of having to wait once a year to check your reports or being price gouged to get your actual credit score, you could sign up for Credit Karma and get what you needed. This is how Credit Karma works and one of its best features.

So, to be crystal clear the company offers a free service where youll have access to your credit profile.

Less About Perfect Accuracy And More About Improving Credit Health Over Time

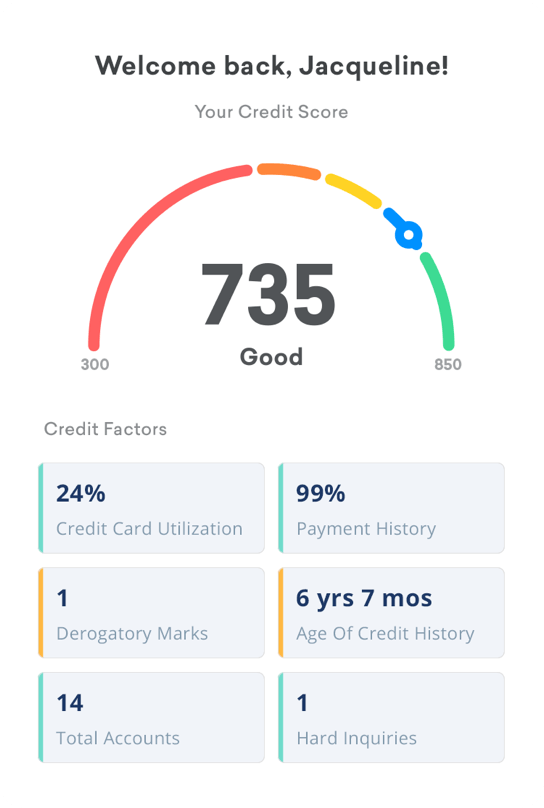

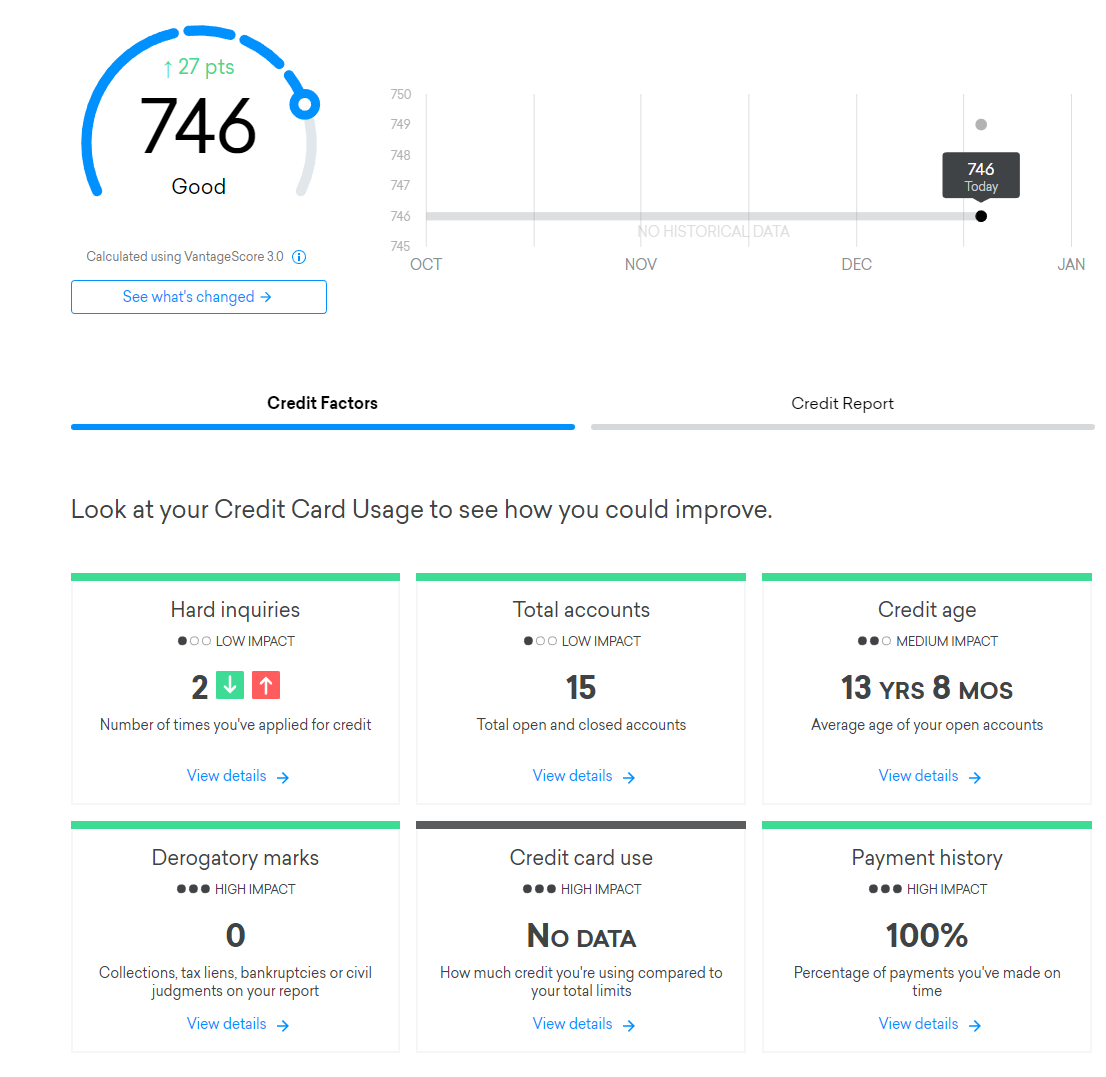

Are there any drawbacks to Credit Karma? Users of the tool notice that the credit score they see on the site can vary slightly from the ratings they see on other websites and from other providers.

The company devotes a whole article to discussing the question of accuracy and variation. They explain that differences in credit scores are typical and expected due to the nature of credit reporting.

The variations are unlikely to be significant. The companys overall goal is to help people track the way their credit score changes over time and offer them ways to improve their score and financial health over time.

There are several reasons why credit scores can vary from those found on Credit Karma, including:

When Does Checking My Credit Score Lower It

Hard inquiries, also called hard pulls, are the kind that can cost you points. They happen when someone pulls your credit for the purpose of deciding whether to extend credit to you. These hard inquiries should not happen without your knowledge or consent.

You can review your hard inquiries on NerdWallets free credit report summary, which updates weekly. You can also check your free credit reports at AnnualCreditReport.com to see who has looked at it in the past two years. Consumers currently have access to those reports weekly.

A hard inquiry might cost you up to five points according to FICO, the creator of the most widely used scoring formulas. With VantageScore, an increasingly popular credit scoring model, a hard inquiry is likely to cost even more.

In contrast, a soft inquiry or soft pull occurs when you or a creditor looking to preapprove you for a loan or credit card checks your score. A soft inquiry has no effect on your credit score.

So, if you apply for several credit cards close together, you might see a significant drop in your credit scores. Before you begin applying, take time to conduct research on the best credit cards for your specific financial needs, while keeping eligibility requirements in mind.

A hard inquiry stays on your credit report for two years, but any effect on your credit score fades sooner than that.

You May Like: Affirm Cricket

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate. This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool. It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained. It shows the key factors affecting your score and how to improve them.

Or alternatively…

Does Checking My Credit Score Lower It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you check your credit score yourself, it doesnt lower it. But if a lender or credit card issuer does, it might.

Either way, youll see an inquiry on your credit report. It means that someone you or a lender pulled your credit.

If you have applied for credit, youre likely to see the lenders or card issuers listed on your report. You may also see collection agencies, lenders to whom you have not applied and records of when you checked your own credit.

Read Also: Comenity Bank Pulls What Credit Bureau

Other Ways To Check Your Credit Score

The three leading credit reporting agencies in the U.S. are the ones that determine your credit score: Equifax, Experian, or TransUnion. These three credit agencies require a monthly subscription fee , but thankfully they each offer one free credit report to consumers per year.

If you really want to see the differences in the reports, you can request all three credit reports simultaneously. However, for most people, it is recommended to spread out the credit reports throughout the year to get a better idea of how your credit score is changing over time.

Check here how to get your free credit report from any of these agencies.

The problem with using the main credit agencies is that you may need more than three credit reports a year to accurately get an idea of how certain events and actions affect your credit score. Thats why Credit Karma is such a good option.

But what if, when you request your credit report, you realize the score is poor?

Access It For Free From Your Bank Or Credit Card Issuer

Many banks offer free access to your credit score as a feature on their app, website or on your monthly statement. This is a major perk and you may even have access to your score monthly or sometimes daily. Some credit card companies and banks offering free access to FICO or VantageScore include:

- Wells Fargo

- Bank of America

Also Check: Paypal Credit Report To Credit Bureau

Why You Could Have Different Credit Scores

Its perfectly normal to have different credit scores from different credit bureaus. Here are a few reasons why your credit scores may differ.

- Theres more than one credit scoring model. As noted above, the credit bureaus may use different credit scoring models to calculate your scores. Since different scoring models have different ranges and factor weightings, this often leads to different scores.

- Some lenders may use different types of credit scores for different types of loans. For example, an auto lender may use an auto industry-specific credit score. These scores tend to differ dramatically from standard consumer credit scores.

- Some lenders may only report to one or two credit bureaus. This means a credit-reporting bureau could be missing information that would raise or lower your score.

- Lenders may report updates to the credit bureaus at different times. If one credit bureau has information thats more current than another, your scores might differ between those bureaus.

With all of these factors at play, youll frequently see minor fluctuations and variations across your scores. Instead of focusing on these small shifts, consider your credit scores a gauge of your overall credit health and think about how you can continue to build your credit over time.

Manage Money And Keep A Budget

Mint offers tools for tracking all your spending and for setting budgets. It suggests budgets in different categories based on your spending history. With Mint, you can carefully classify all transactions. For example, if you have dinner at a hotel restaurant, the charge will likely be categorized automatically as “hotel” or even “travel.” With Mint, you can change it to “restaurant.” When you appropriately classify all your transactions, it becomes really easy to see where and how you spend your money and then set limits on certain categories of spending to meet financial goals.

Recommended Reading: Does Applying For Paypal Credit Affect Score

Why Credit Karma Won’t Hurt Your Score

Credit Karma checks your FICO score on your behalf and therefore conducts soft inquiries. Soft inquiries differ from hard inquiries in that they leave your credit scores untouched. Multiple hard inquiries done in a short period of time can knock off as much as five points per inquiry and can stay on the record for upward of two years.

Credit bureaus tend to deduct points, particularly if the person has a short or only a few accounts. Credit bureaus interpret multiple hard inquiries as showing that the person may be a high-risk borrower. The bureaus suspect that the person may be desperate for credit or was unable to get the credit needed from other creditors. MyFICO reports that people with multiple hard inquiries are eight times more likely to declare bankruptcy than other people with no bankruptcies on their reports.

Is Experian Worth Paying For

Experian offers both free and paid credit monitoring services. … Experian free credit monitoring ranks as our runner-up for the best free credit monitoring service, while Experian IdentityWorks is the best paid service for families. If you’re considering credit monitoring, it may be hard to know if it’s worth the cost.

Don’t Miss: Usaa Credit Monitoring Experian

Factors That Affect Your Credit Scores

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

Sign Up For A Credit Monitoring Service

Whether paid or free, there are many credit monitoring services available to individuals to access their credit report and score. Each credit monitoring service has its own costs and fees. These services are aimed at helping users keep an eye on their credit by alerting them of any different activity on their credit report.

Through a service like this, you can have access to your credit report and detect any acts of fraud or other discrepancies and resolve them before they cause too much damage. This can help you keep track of your credit and keep your credit score in healthy standing.

A few examples of credit monitoring services include Credit Karma, Mint and Credit.com.

Lexington Law offers a paid service that allows you to track your FICO score, as well as other credit information that will help you improve your credit and achieve your credit goals.

However you choose to monitor your credit over time, keeping a close eye on your credit report and score will help you maintain a positive credit history. Checking your credit score often is encouragedand remember, doing so wont lower it. Use the tips in this guide to help you stay on top of your credit and work toward a good credit score.

Reviewed by Kenton Arbon, an Associate Attorney at Lexington Law Firm. by Lexington Law.

You May Like: Credit Score For Comenity Bank

Delayed Reporting From Credit Bureaus

A major credit bureau like Experian and TransUnion may have tens of millions of customers with very complex credit reports and credit scores. As such, it is not very easy for a major credit bureau to constantly update information about your credit. Furthermore, most lenders only report the information about their borrowers to the credit bureaus once a month.

Overall, this means it can take a while for the credit bureaus to report your information. Typically, it can take 30-60 days for the credit bureaus to update your information. Once this information is updated, it can take another seven days for Credit Karma to have access to it and to report it to you.

This means that if you just paid a loan or credit card balance off, it could take up to 9 or so weeks for that information to finally show up on Credit Karmas website. This is very frustrating, but it is the way of the world for credit reporting and it is not likely to change very soon.

You Closed An Account

Closing a credit card account can affect your credit score in a couple ways. If you close one account, maybe one you havent used in a while, but still have a balance on other cards, it can increase your utilization.

Lets say you have two credit cards, both with a $1,000 credit limit. One card has a $500 balance, and the other, a card you never use, has no balance. Your current utilization rate is 25% . Thats below the 30% threshold lenders like you to be at. But if you close the second card that has no balance on it, youll increase your utilization up to 50%! You have to be mindful when closing credit cards for this reason.

Closing a credit card can also impact your score by changing the average age of all your accounts. Lenders like to see that you have accounts with a long history of on-time payments. Generally speaking, the older the average age of your accounts is, the better your score will be. If you close an account thats been open for a long time, it could bring down that average. Think carefully about closing old accounts, especially if you want to limit any negative impact to your score.

Other types of debt can play a role too. Did you recently pay off an installment loan? Those are loans with fixed terms and payment schedules accounts like auto loans, mortgages and student loans. Sometimes, paying off these loans may cause a score to drop slightly, which may seem counterintuitive.

You May Like: Navy Federal Mortgage Approval Odds

The Hidden Costs Of Credit Karma Credit Sesame And Other Credit Score Apps

Most don’t produce reliable scores, and all have unnecessary charges and pose privacy risks, Consumer Reports finds

Janet Ha Andrews, 33, of Redmond, Wash., started using Credit Karma several years ago as a new U.S. citizen to help build and monitor her credit. But when she went to purchase a car earlier this summer, she says she was dismayed when the dealership said her was significantly lower than the one the app showed her.

New York City resident Alfred Bonnabel, 66, says that because hes had poor credit in the past and is trying to get into a better financial position, he planned to sign up for the free Experian Credit Report app. But somehow he accidentally tapped the wrong button and enrolled in a higher tier of service he had to pay for.

Like most consumers, Ha and Bonnabel understand that their credit score mattersa lot. Having a good one means you can get a loan or open a credit card account with a favorable interest rate. And because the scores can also be used by othersfrom phone and utility companies to car insurers and even prospective landlordsto make decisions about you, these scores have money-in-the-bank value if you can get them high and keep them up.

What Credit Scores Do I Need To Get Approved For A Credit Card

Theres no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card.

In general, if you have higher scores, youre more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate.

You May Like: Minimum Credit Score For Care Credit

Whats In A Credit Report

Your credit report shows details of how you have used debt over time. In addition to your credit score, a lender also looks at what is on your credit report. Some of what credit bureaus record on your credit report include:

- Personal information

- Consumer statements

In Canada, credit bureaus are obligated to provide you with one free copy of your credit report per year if you request it.

Companies like Credit Karma and Borrowell provide free monthly or weekly credit report updates when you sign up with them.