Check Your Credit Report From Each Bureau

Free credit reporting services provide information from a single credit bureau. Remember that there are still two other reports you absolutely have to check out. Its possible the information across all three reports could be slightly different.

Most importantly, the credit report youre seeing could be squeaky clean while the one from the other bureaus includes inaccurate or outdated information. These errors could potentially affect your credit health. Its of utmost importance to compare the information across all three reports. Anything that shouldn’t be there can and must be removed.

Keep in mind, though, that information won’t be removed if you can’t provide enough evidence to the bureaus of its inaccuracy.

What Affects Your Credit Scores

Common factors can affect all your credit scores, and these are often split into five categories:

- Payment history: Making on-time payments on your credit accounts can help your scores. But missing payments, having an account sent to collections or filing bankruptcy could hurt your scores.

- : How many of your accounts have balances, how much you owe and the portion of your credit limit that you’re using on revolving accounts all come into play here.

- Length of credit history: This category includes the average age of all your credit accounts, along with the age of your oldest and newest accounts.

- Types of accounts: Also called “credit mix,” this considers whether you’re managing both installment accounts and revolving accounts . Showing that you can manage both types of accounts responsibly generally helps your scores.

- Recent activity: This considers whether you’ve recently applied for or opened new accounts.

FICO® and VantageScore take different approaches to explaining the relative importance of the categories.

Why Credit Scores Differ

Suppose you apply for a loan, line of credit, or credit card from a lender. That lender almost certainly performs a , requesting that a report on you be run from at least one of the three major credit bureaus. However, it does not have to use all three. The lender might have a preferred relationship or value one credit scoring or reporting system over the other two. All are noted on your credit report, but they only show up for the bureaus whose reports are pulled. For example, if a credit inquiry is only sent to Experian, then Equifax and TransUnion do not know about it.

Similarly, not all lenders report credit activity to each credit bureau, so a credit report from one company can differ from another. Lenders that do report to all three agencies may see their data appear on credit reports at different times simply because each bureau compiles data at different times of the month.

Delinquency generally doesnt affect your credit score until at least 45 days have passed.

Most lenders examine just one report from a single credit bureau to determine an applicants creditworthiness. The major exception is a mortgage company. A mortgage lender examines reports from all three credit bureaus because such large amounts of money per consumer are involved. It often bases the approval or denial on the middle score.

You May Like: Does Monroe And Main Report To Credit Bureaus

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

The Credit Reporting Agencies Use Slightly Different Versions Of Each Of Fico Score

The credit reporting agencies also use slightly different models on the newer versions of the FICO score including the general FICO scores and the industry-specific FICO scores. Moreover, the most common scores used will vary according to the credit bureau reporting the score.

The most widely used version by all 3 credit reporting agencies is FICO Score 8.

- For auto lending: FICO Auto Score 8

- Experian: FICO Auto Score 2

- Equifax: FICO Auto Score 5

- TransUnion: FICO Auto Score 4

Note that all 3 credit reporting agencies use the same VantageScores regardless of the type of lending, since they developed the VantageScore. Unlike FICO, VantageScores do not have industry-specific scores.

Home Mortgage Lenders Use Older Versions of FICO Scores

Most home mortgage lenders use older versions of the FICO score, because Fannie Mae and Freddie Mac both require the use of such scores for loans that the lenders sell to these government agencies. These scores are the FICO Scores 2, 4, and 5, depending on the credit bureau that calculates the score. The credit bureaus also use slight modifications of the scores and new names to distinguish themselves from their other 2 competitors:

- FICO Score 2 based on Experian data

- FICO Score 5 based on Equifax data

- FICO Score 4 based on TransUnion data

Don’t Miss: How To Figure Out Your Credit Score

So What Are Credit Scores Then

As weve mentioned previously, a credit score is a three-digit grade credit bureaus give you based on your credit history. Since this grade can determine so many of your lifes big financial decisions – from buying a home to getting the job you want – its important to check your credit history regularly and be aware of whats being taken into account when calculating your score.

Many people arent aware that they dont have just one credit score, just as they dont have one single credit report. FICO, for instance, has over 50 distinct credit score types corresponding to different industries–and there are other, lesser-known and lesser-used scoring models as well .

at least in the two most popular scoring models, FICO and VantageScore usually range from 300 to 850, with 300 considered extremely poor and 850 excellent. The higher the number the more creditworthy youre thought to be. People in the higher end of the scale will not only qualify for most loans and credit cards, but will also be offered the lowest interest rates.

FICO Score

The FICO Score was created by the Fair Isaac Corporation and is considered the most widely used credit score model. In fact, FICO states they are used in more than 90% of lending decisions.

FICO has developed different versions of their score throughout the years. As a result, you have more FICO scores than you probably imagine.

Theres also the FICO Score 3 which is used primarily for credit card lending.

VantageScore

Which Credit Bureau Is Most Important When Buying A House

The most important credit bureau or score when buying a house is the one your lender will utilize to change an underwriting decision for a loan application.

Because of the large loan amounts, mortgage companies typically use all three bureau reports. The outlier, if any, could be the one to change approval to a denial.

Therefore, you should focus on identifying the agency that reports an adverse trade line that does not appear on the files of the other two bureaus.

As you will shortly learn, this one anomaly could impact your Tri-Bureau merged report and make the middle credit score lower than it might otherwise be.

Recommended Reading: Is Fico The Same As Credit Score

Freecreditreportcom: An Alternative Owned By Experian

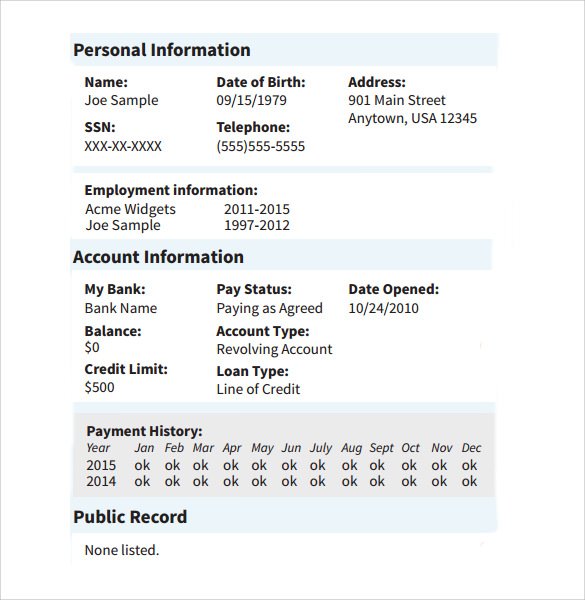

Screenshot freecreditreport.com, August 2019.

FreeCreditReport.com shows up as a separate site from Experian when searching for credit reporting services, but theyre actually owned by the major credit bureau.

Their sign up process does have a difference. While Experian asks for only the last four digits of your social security number, FreeCreditReport.com asks for your full number. If youre someone whos skeptical about giving out their social security number, youre better off simply creating your account with Experian.

We also noticed that if youve already created an account through Experian, you wont be able to create one FreeCreditReport.com using the same login information. If you try, theyll say your email address is already in use. Oddly, even though they say youre already registered, they still wont let you access your credit information because through Experian you only provide the last four digits of your social security number and they continue to ask for your full number.

Best For Single Bureau Access: Credit Sesame

-

Monthly updates of your credit report

-

Only offers access to TransUnion report

-

Sign-up required

In addition to your TransUnion credit report information, youll also have access to your TransUnion credit score online or through the Credit Sesame mobile app. Reviewing your credit report often gives you an idea of where your credit stands and whether you need to improve your score.

Also Check: How Long Does Chapter 7 Bankruptcy Stay On Credit Report

Monitoring & Extra Features

Some services also include credit monitoring alerts, security scans, and identity theft insurance. Alerts are a great way of getting a heads up on any changes in your credit report and may even offer some identity theft protection. Each time theres a change in your credit report, the service sends out an email or push notification alerting you of the change. If these dont relate to your usual credit activity or are otherwise unfamiliar, it could mean someone else is using your personal information.

We also took a look into services that included identity theft insurance or security scans. These features are usually available only for premium members but they could interest people who fear their personal information might have been exposed to hackers.

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Read Also: What Credit Score Does Carmax Use

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Equifax Experian And Transunion Vary In How They Calculate Credit Scores

Pamela Rodriguez is a Certified Financial Planner®, Series 7 and 66 license holder, with 10 years of experience in Financial Planning and Retirement Planning. She is the founder and CEO of Fulfilled Finances LLC, the Social Security Presenter for AARP, and the Treasurer for the Financial Planning Association of NorCal.

People talk a lot about . What do they do? How do they differ? And why are there three of them? Lets take a closer look at these entities, what they do, and how they do it.

You May Like: How Bad Is A 600 Credit Score

Why Are There Different Types Of Credit Scores

First, itâs important to know that itâs normal to have several different credit scores. And as long as youâre getting your score from a legitimate source, no one credit score is necessarily more valid than another is.

In addition to having multiple credit reports, there are two major reasons why you have more than one credit score: multiple credit-scoring companies and multiple credit-scoring models.

Whatâs a Credit-Scoring Model?

Each model might also use information from just one or a combination of different credit reports. Then each credit-scoring model might assign different levels of importance to that information.

And thatâs not all. According to the Consumer Financial Protection Bureau , your score can even change depending on the day it was calculated or the type of credit youâre applying for.

Itâs understandable if this all feels a little complicated.

To put it simply: There are multiple credit bureaus, credit-scoring companies and scoring models. So your credit score can change depending on what information is used to calculate it, what company calculates it and when itâs calculated.

Best For Credit Monitoring: Credit Karma

If you’re interested in viewing your credit performance over time, CreditKarma may fit the bill. It lets you access your Equifax and TransUnion reports quickly and easily.

-

Only offers reports from two credit bureaus

-

Account required

While you will have to create an account to use Credit Karma, you dont have to enter your credit card information or remember to cancel any free trial subscription. You can access your credit reports at any time by logging into your account either directly through your web browser or through their mobile app. Your credit report information is updated to reflect changes in your credit history and activity, giving you continued access to changes in your credit information. Although, changes my require some days to be reflected in what is shown by Credit Karma.

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

You May Like: How To Fight Collections On Credit Report

What’s The Difference Between Base Fico Scores And Industry

Base FICO® Scores, such as FICO Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether it’s a mortgage, credit card, student loan or other credit product.

Industry-specific FICO® Scores incorporate the predictive power of base FICO Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking. For example, auto lenders and credit card issuers may use a FICO Auto Score or a FICO Bankcard Score, respectively, instead of base FICO Scores.

FICO® Auto Scores and FICO Bankcard Scores have these aspects in common:

- Many lenders may use these scores instead of the base FICO® Score.

- It is up to each lender to determine which credit score they will use and what other financial information they will consider in their credit review process.

- The versions range from 250-900 and higher scores continue to equate to lower risk.

Which Credit Score Do Lenders Actually Use

Consumer Financial Protection Bureau Director Richard Cordray speaks during a a hearing in Denver… where he discussed his agency’s proposal on arbitration, in Denver, Colo., on Oct. 7, 2015.

There was some big news in the world of credit scores this week. The Consumer Financial Protection Bureau ordered TransUnion and Equifax to pay more than $23 million in fines and restitutions “for deceiving consumers about the usefulness and actual cost of credit scores they sold to consumers.” I’ve used these and the other credit scoring services described below extensively, and these services are advertisers on my personal finance blog, so I was particularly interested in the CFPB’s orders.

The orders explained that the credit score models most often used by lenders are those developed by Fair Isaac Corporation. You may know these scores by their common name, FICO scores. In contrast, the scores offered by TransUnion and Equifax used proprietary scoring models, sometimes referred to as “educational credit scores.” The name comes from the idea that these scores help educate consumers about their credit scores generally.

The problem, according to the CFPB, was that TransUnion and Equifax misled consumers by suggesting that the educational credit scores they offered were the same scores lenders used to make credit decisions. According to the CFPB, however, these scores were “rarely used by lenders to make credit decisions.”

Many Credit Scores

- Equifax Beacon 5.0

Don’t Miss: Is 717 A Good Credit Score

Reasons Why Your Credit Score Might Differ

If your credit score isnt quite adding up across different sources, heres why:

- Most commonly, this will be your FICO or VantageScore 3.0.

- Score version: Each company uses a different base score. For example, the FICO 9 ranges from 300 to 850. This model puts less weight on things like medical debt and doesnt calculate past accounts in collections. However, it does consider rent payments, if reported, in the overall score.

- Industry-specific scores: These scores focus mainly on things like auto score, mortgage score and other installment loans.

- Not every lender reports the same information to every credit bureau. So, your Experian score might differ from your Equifax or TransUnion score.

- Data provided to the credit bureau: Lenders arent legally obligated to report to all three credit bureaus. Some lenders dont report a consumers activity to any bureaus at all.

- Timing: Scores vary from day to day. This depends on whats been reported recently, whats fallen off the report and the age of an account or remark.

- Errors on your credit report: A persons credit score reflects any errors that appear on their report. If an error only appears on one credit bureaus report, then that bureau might give you a lower score. Always dispute any errors as soon as you find them for an accurate score.